Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help asap Knowledge Check 01 On December 1, after making a concerted effort, management determines that it will be unable to collect $1,200 owed to

help asap

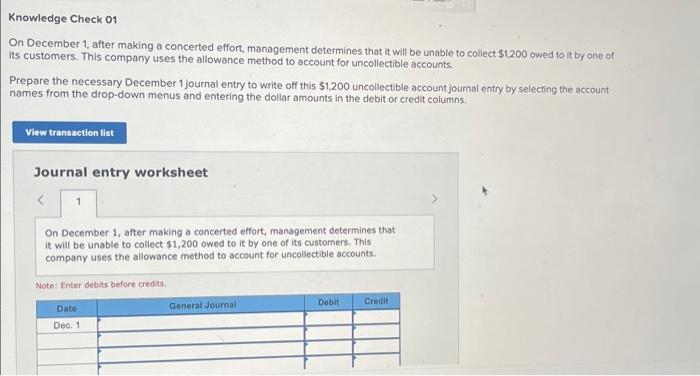

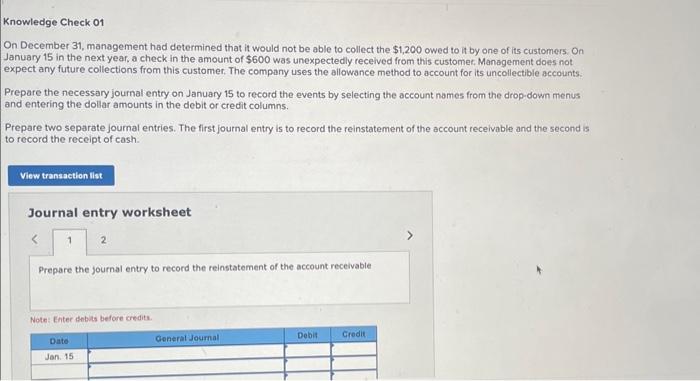

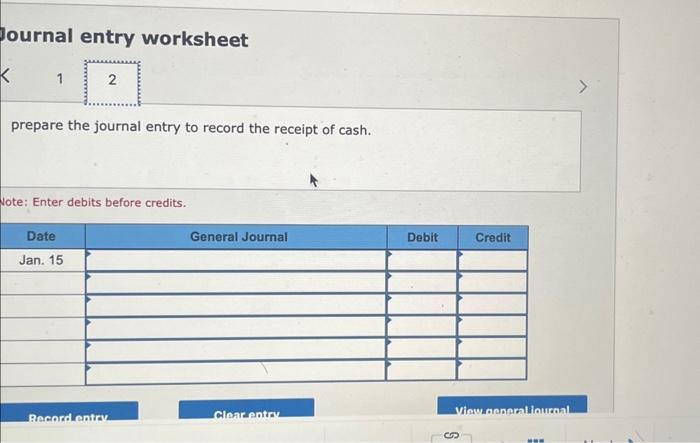

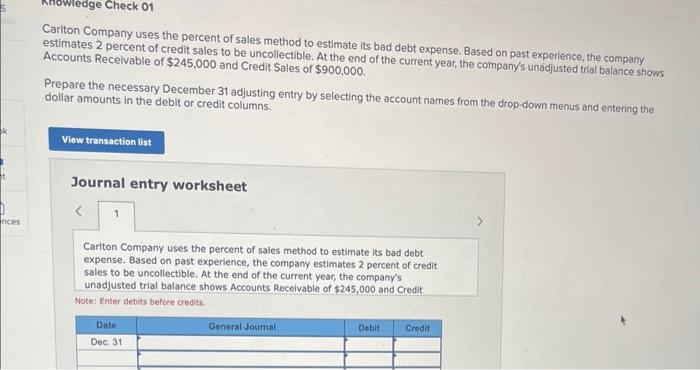

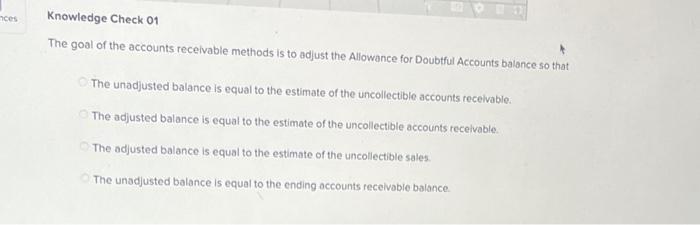

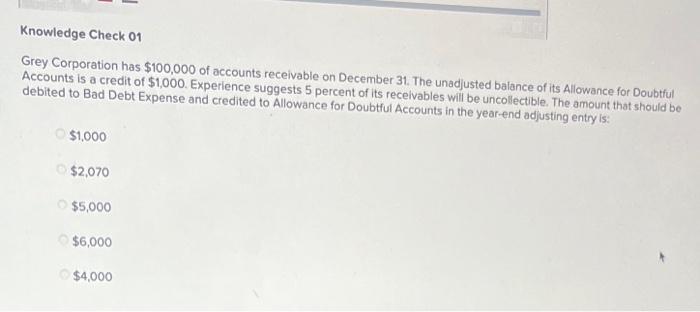

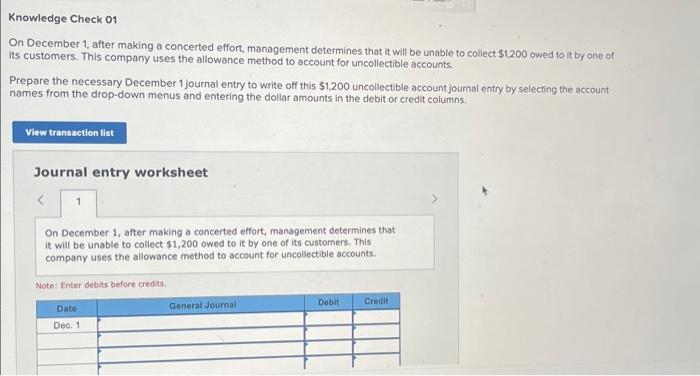

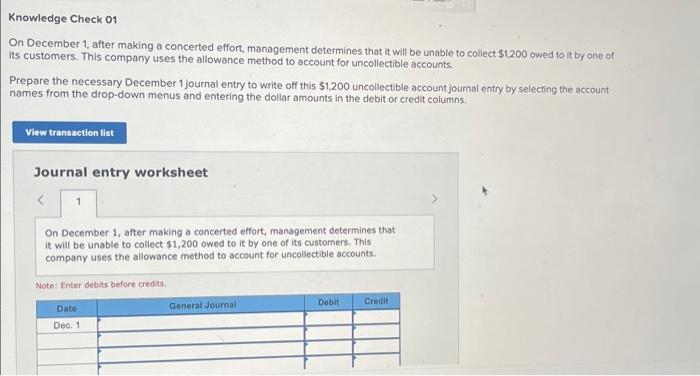

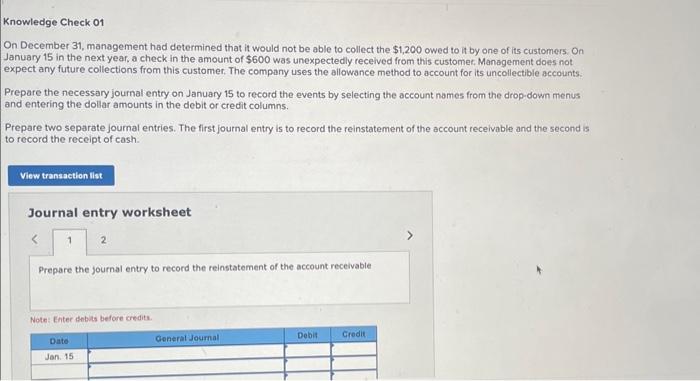

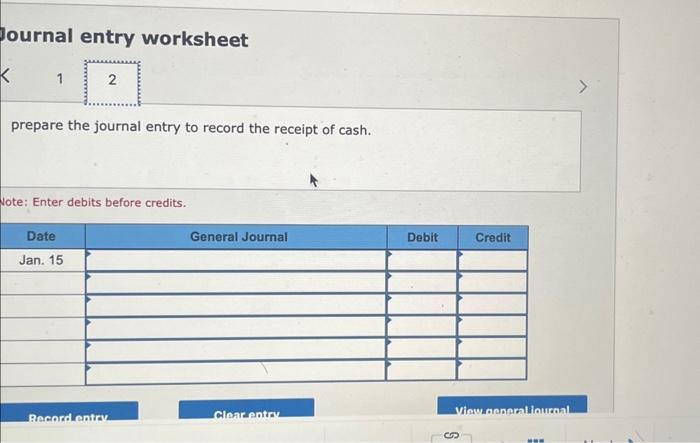

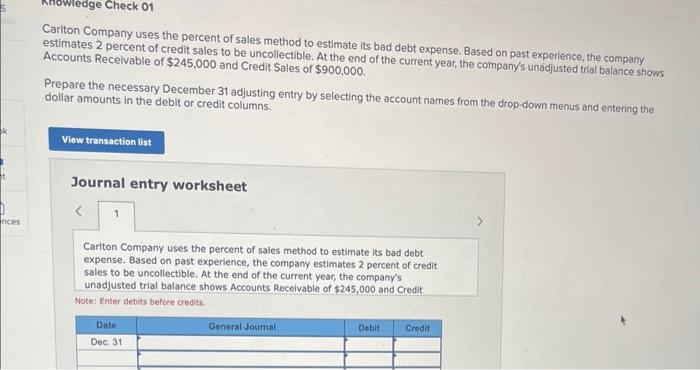

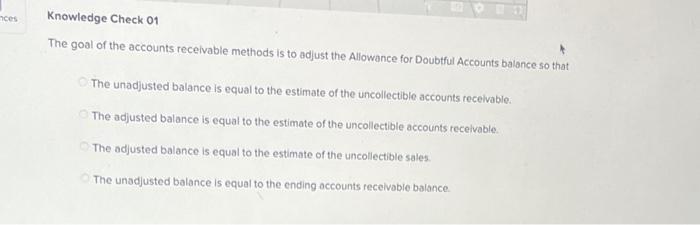

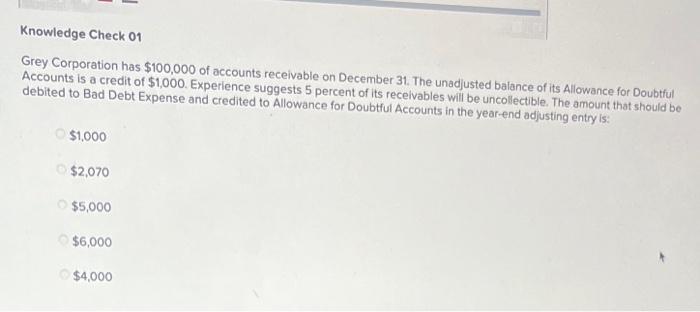

Knowledge Check 01 On December 1, after making a concerted effort, management determines that it will be unable to collect $1,200 owed to it by one of ts customers. This company uses the allowance method to account for uncollectible accounts. Prepare the necessary December 1 journal entry to write off this $1,200 uncoliectible account journal entry by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns: Journal entry worksheet On December 1, after making a concerted effort, management determines that it will be unable to collect $1,200 owed to it by one of its customers. This company uses the allowance method to account for uncollectible accounts. Note: Enter debits before credits. On December 31, management had determined that it would not be able to collect the $1,200 owed to it by one of its customers. On January 15 in the next year, a check in the amount of $600 was unexpectedly recelved from this customec. Management does not expect any future collections from this customer. The company uses the allowance method to account for its uncollectible accounts Prepare the necessary journal entry on January 15 to record the events by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. Prepare two separate joumal entries. The first journal entry is to record the reinstatement of the account receivable and the second is to record the receipt of cash. Journal entry worksheet 2 Prepare the journal entry to record the reinstatement of the account receivable Note: Enter denbits before crediti. Journal entry worksheet prepare the journal entry to record the receipt of cash. Note: Enter debits before credits. Cariton Company uses the percent of sales method to estimate its bad debt expense. Based on past experience, the company Accounts Recelvable of $245,000 and Credit Sales of $900,000. Prepare the necessary December 31 adjusting entry by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. Journal entry worksheet Cariton Company uses the percent of sales method to estimate its bad debt expense. Based on past experience, the company estimates 2 percent of credit sales to be uncollectible. At the end of the current year, the company's unadjusted trial balance shows Accounts Receivable of $245,000 and Credit Note: Enter debits before credits. Knowledge Check 01 The goal of the accounts receivable methods is to adjust the Allowance for Doubtful Accounts balance so that The unadjusted balance is equal to the estimate of the uncollectible accounts recelvable. The adjusted balance is equal to the estimate of the uncollectible accounts recelvable The adjusted balance is equal to the estimate of the uncollectible sales The unadjusted balance is equal to the ending accounts recelvable balance Grey Corporation has $100,000 of accounts receivable on December 31 . The unadjusted balance of its Allowance for Doubtful Accounts is a credit of $1,000. Experience suggests 5 percent of its recelvables will be uncollectible. The amount that should be debited to Bad Debt Expense and credited to Allowance for Doubtful Accounts in the year-end adjusting entry is: $1,000$2,070$5,000$6,000$4,000

Knowledge Check 01 On December 1, after making a concerted effort, management determines that it will be unable to collect $1,200 owed to it by one of ts customers. This company uses the allowance method to account for uncollectible accounts. Prepare the necessary December 1 journal entry to write off this $1,200 uncoliectible account journal entry by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns: Journal entry worksheet On December 1, after making a concerted effort, management determines that it will be unable to collect $1,200 owed to it by one of its customers. This company uses the allowance method to account for uncollectible accounts. Note: Enter debits before credits. On December 31, management had determined that it would not be able to collect the $1,200 owed to it by one of its customers. On January 15 in the next year, a check in the amount of $600 was unexpectedly recelved from this customec. Management does not expect any future collections from this customer. The company uses the allowance method to account for its uncollectible accounts Prepare the necessary journal entry on January 15 to record the events by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. Prepare two separate joumal entries. The first journal entry is to record the reinstatement of the account receivable and the second is to record the receipt of cash. Journal entry worksheet 2 Prepare the journal entry to record the reinstatement of the account receivable Note: Enter denbits before crediti. Journal entry worksheet prepare the journal entry to record the receipt of cash. Note: Enter debits before credits. Cariton Company uses the percent of sales method to estimate its bad debt expense. Based on past experience, the company Accounts Recelvable of $245,000 and Credit Sales of $900,000. Prepare the necessary December 31 adjusting entry by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. Journal entry worksheet Cariton Company uses the percent of sales method to estimate its bad debt expense. Based on past experience, the company estimates 2 percent of credit sales to be uncollectible. At the end of the current year, the company's unadjusted trial balance shows Accounts Receivable of $245,000 and Credit Note: Enter debits before credits. Knowledge Check 01 The goal of the accounts receivable methods is to adjust the Allowance for Doubtful Accounts balance so that The unadjusted balance is equal to the estimate of the uncollectible accounts recelvable. The adjusted balance is equal to the estimate of the uncollectible accounts recelvable The adjusted balance is equal to the estimate of the uncollectible sales The unadjusted balance is equal to the ending accounts recelvable balance Grey Corporation has $100,000 of accounts receivable on December 31 . The unadjusted balance of its Allowance for Doubtful Accounts is a credit of $1,000. Experience suggests 5 percent of its recelvables will be uncollectible. The amount that should be debited to Bad Debt Expense and credited to Allowance for Doubtful Accounts in the year-end adjusting entry is: $1,000$2,070$5,000$6,000$4,000

help asap

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started