Answered step by step

Verified Expert Solution

Question

1 Approved Answer

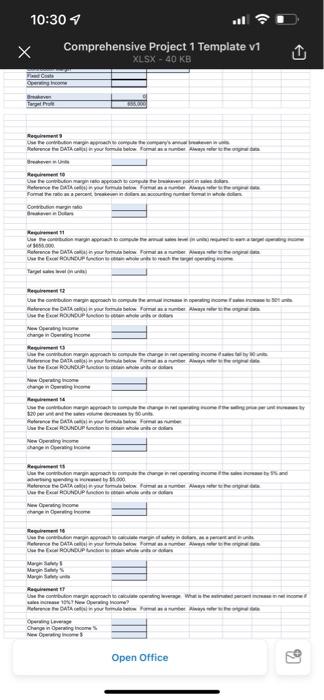

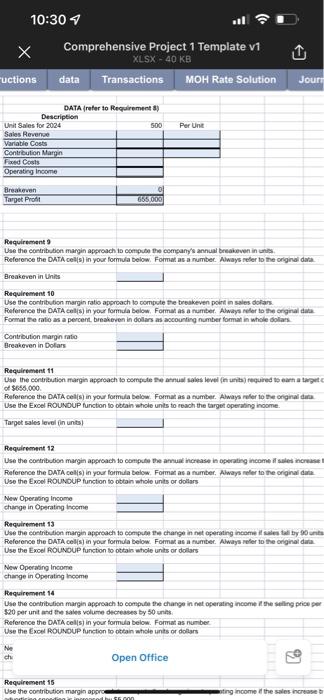

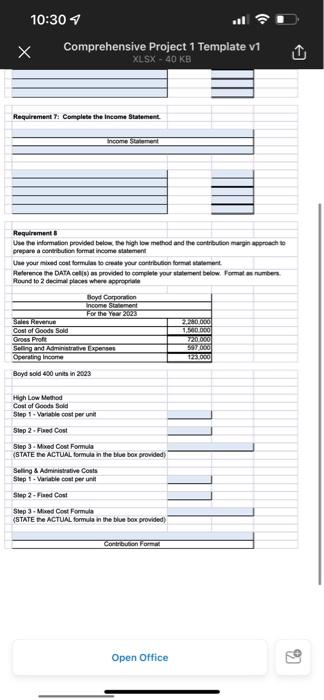

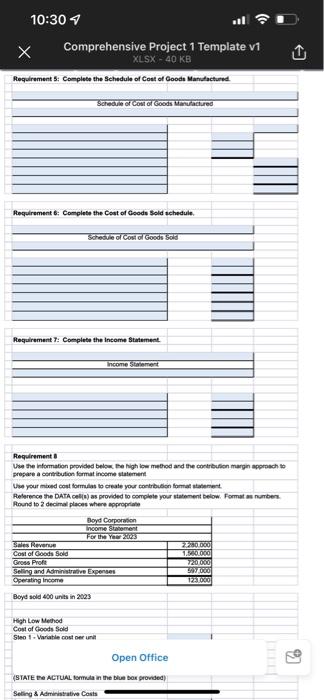

help asap need formulas woth excel layout 10:30 X Comprehensive Project 1 Template v1 XLSX - 40 KB Photo Once ve Breve Net Use the

help asap need formulas woth excel layout

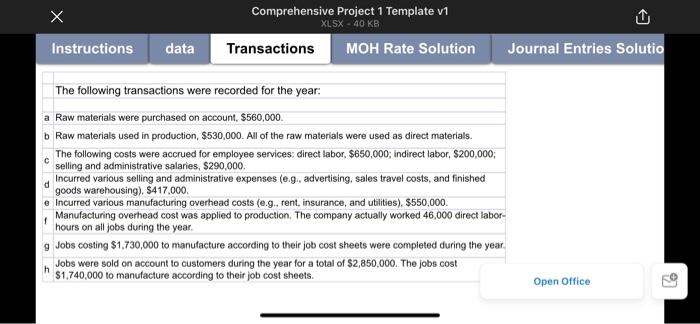

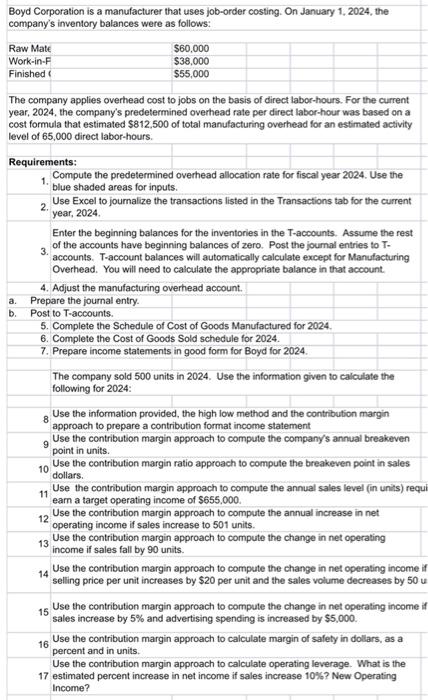

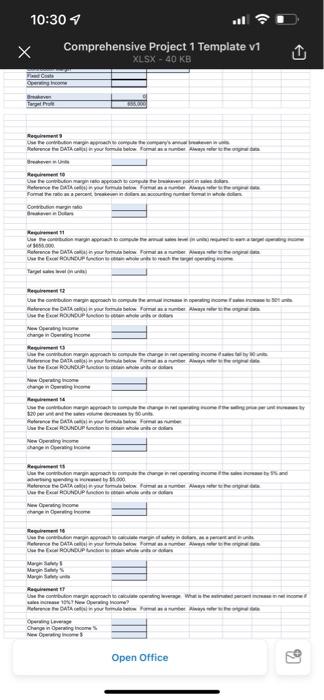

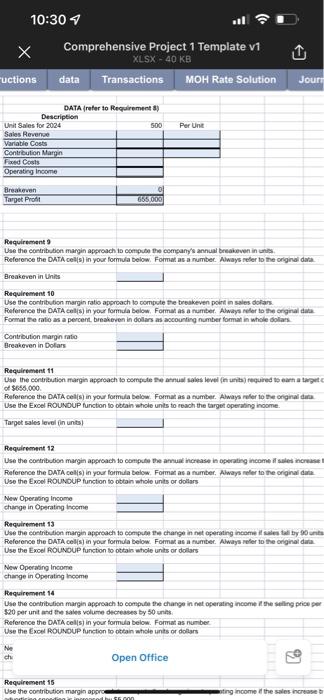

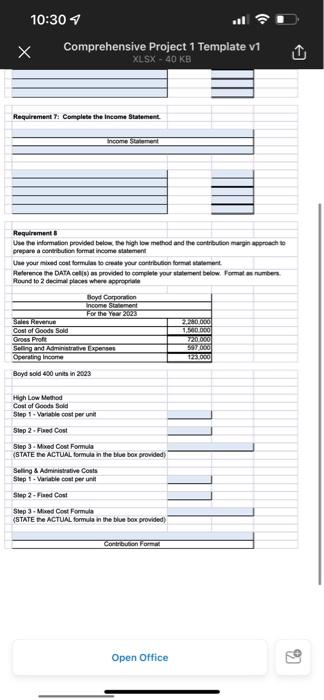

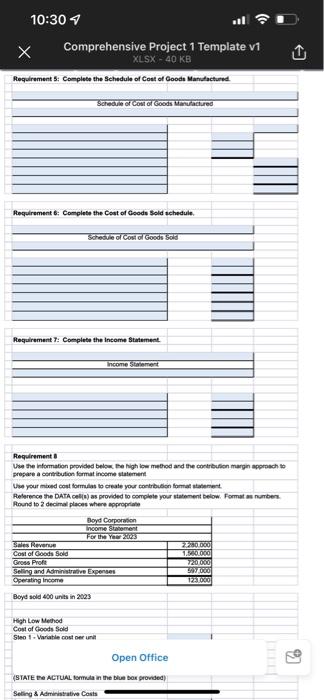

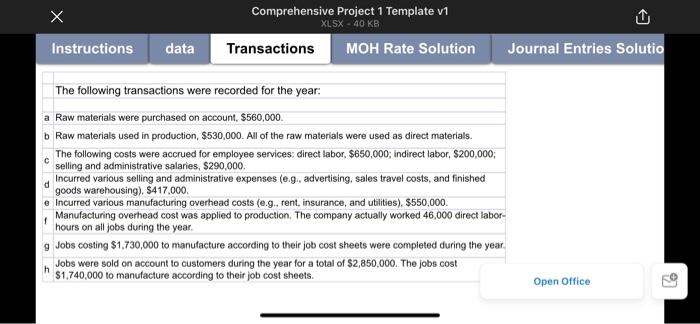

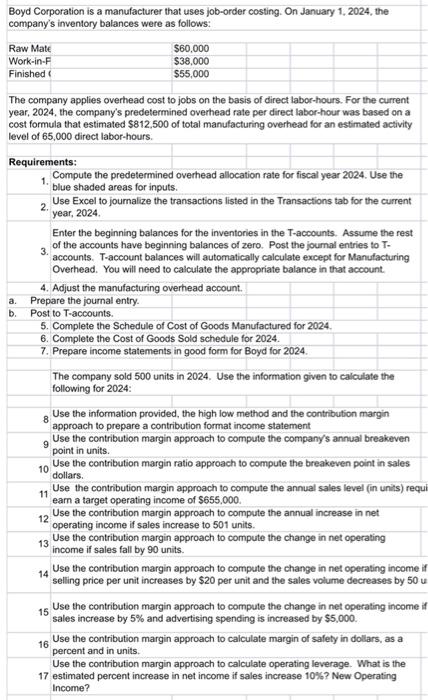

10:30 X Comprehensive Project 1 Template v1 XLSX - 40 KB Photo Once ve Breve Net Use the combuden waren eto poche con poetsen DATA malam per Format percent, treeningute Com Lowoche . Porunce the Dhyourform below for Away ROND Target Uw the contribution margin rochie congue perting.com Walorence the DATA your famillow Format Anaya New ping change in one Requiremen see on marginhecerem Reborn DATA your formelon Woman Almere Uwe ROUNDUP consors New Operating com change Real She was 20 peritone DATA the ROUNDUP non- New Operating com hangen The contin marginwone meting come. where y000 Meherence the DATA your form below formats Almayer the Nine Operating income tharging ein pan Make the DATA your frien oma l Marge Mary More Use the contention mayor aa? Warene Atelyem Change in one come Nie Open Office 92 10:307 Comprehensive Project 1 Template v1 XLSX - 40 KB ructions Transactions MOH Rate Solution data Jour Per Unt DATA (refer to Requirements Description Unit Sales for 2024 500 Sales Revenue Variable costs Contribution Margin Fed Costs Operating Income Breakeven Tarpet Profit 635.000 Requirement Use the contribution marginapproach to compute the company's annual breakeven in ni Reference the DATA cells) in your formula below. Format as a number. Always refer to the original data Breakeven in Units Requirement 10 Use the contribution margin ratio approach to compute the breakeven point in sales doiars. Reference the DATA cells in your formula below. Format as a number. Always refer to the original data Format e ralio as a percent, breakeven in dollars as accounting number format in whole dollars Contribution margin ratio Breakeven in Dofors Requirement 11 Use the contribution marginapproach to computer sales level in its required to cart of $665.000 Reference the DATA cells in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to obtain whole unts to reach the target operating income. Tarpet sales level in uns! Requirement 12 Use the contribution margin approach to compute the annual increase in operating income sales increase Reference the DATA cells) in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to obtain whole units or dollars New Operating Income change in Operating income Requirement 13 Use the contribution margin approach to compute the changin at operating income sales tai by units Reference the DATA cells in your formula below. Format as a number. Always refer to the orginal dari Use the Excel ROUNDUP function to obtais whole units or dollars Now Operating Income change in Operating income Requirement 14 Use the contribution marginapproach to compute the change in net operating income the selling price per $20 per unit and the sales volume decreases by 50 units Reference the DATA cells in your formula below. Format as number Use the EXO ROUNDUP function to ottain whole unts or dollars Ne ch Open Office Lo Requirement 15 Use the contribution marginappro nown sting income the sales increase 10:30 Comprehensive Project 1 Template v1 XLSX - 40 KB Requirement: Complete the income Statement Income Samen Requirements Use the information provided below the high low method and the contribution marginapproach to prepare a contribution format income statement Use your mind cost formules to create your contribution format dement Reference the DATA) as provided to complete your statement below. Formatas rumb Round to 2 decimal places where appropriate Boyd Corporation income sumont For the Year 20 Sales Revue 2200 Cost of Goods Sold 1340 Gross Profit 7201000 Seling and Administrative Expenses Operating Income 123.000 Boyd sold 400 units in 2023 High Low Method Cost of Goods Sold Step 1 - Variable cost per un Step 2 - Fund Cost Step 3. Mored Cost Formula (STATE the ACTUAL formula in the blue box provided) Seling & Administrative Costa Step 1 - Variable cont per un Step 2 - Fed Cost Step 3 - Mixed Cost Form (STATE the ACTUAL formula in the blue box provided) Contribution Format Open Office 92 10:307 X Comprehensive Project 1 Template v1 XLSX - 40 KB Requirement: Complete the schedule of Cost of Goods Manufactured Schedule of Cont of Goods Mandatured Requirement 6: Complete the cost of Goods Sold schedule Schedule of Cost Goods Solid Requirement: Complete the income Statement Income Smart Requirement Use the information provided below the high low method and the contribution marginapproach to prepare a contribution format income statement Use your mixed cost formules to create your contribution format teen Reference the DATA coin) as provided to complete your statement below. Format number Round to 2 decimal places where appropriate Boyd Corporation Income Statement For the Year 2003 Sales Reverse 2280.000 Cost of Goods Sold Gross Proff 720020 Selling and Administrative Expenses E000 Operating Income 123000 Boyd sold 400 units in 2003 High Low Method Cost of Goods Sold Sto. Variable costruit Open Office 92 (STATE ACTUAL for in the blue box provided) Seting & Administrative Costa U Comprehensive Project 1 Template v1 XLSX-40 KB Transactions MOH Rate Solution Instructions data Journal Entries Solutio d The following transactions were recorded for the year: a Raw materials were purchased on account, S560,000 b Raw materials used in production, $530,000. All of the raw materials were used as direct materials. The following costs were accrued for employee services: direct labor. $650,000; indirect labor, $200,000; selling and administrative salaries, $290,000. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), S417,000 e incurred various manufacturing overhead costs (e.g. rent, insurance, and utilities). $550,000. Manufacturing overhead cost was applied to production. The company actually worked 46,000 direct labor- hours on all jobs during the year. 9 Jobs costing $1,730,000 to manufacture according to their job cost sheets were completed during the year Jobs were sold on account to customers during the year for a total of $2,850,000. The jobs cost $1,740,000 to manufacture according to their job cost sheets. 1 h Open Office 2. a Boyd Corporation is a manufacturer that uses job-order costing. On January 1, 2024, the company's inventory balances were as follows: Raw Mate $60,000 Work-in-F $38,000 Finished $55,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, 2024, the company's predetermined overhead rate per direct labor-hour was based on a cost formula that estimated $812,500 of total manufacturing overhead for an estimated activity level of 65,000 direct labor-hours. Requirements: 1. Compute the predetermined overhead allocation rate for fiscal year 2024. Use the blue shaded areas for inputs. Use Excel to journalize the transactions listed in the Transactions tab for the current year, 2024 Enter the beginning balances for the inventories in the T-accounts. Assume the rest of the accounts have beginning balances of zero. Post the journal entries to T- 3. accounts. T-account balances will automatically calculate except for Manufacturing Overhead. You will need to calculate the appropriate balance in that account. 4. Adjust the manufacturing overhead account. Prepare the journal entry. b. Post to T-accounts. 5. Complete the Schedule of Cost of Goods Manufactured for 2024. 6. Complete the cost of Goods Sold schedule for 2024. 7. Prepare income statements in good form for Boyd for 2024 The company sold 500 units in 2024. Use the information given to calculate the following for 2024: Use the information provided the high low method and the contribution margin approach to prepare a contribution format income statement 9 Use the contribution margin approach to compute the company's annual breakeven point in units. 10 Use the contribution margin ratio approach to compute the breakeven point in sales dollars. 11 Use the contribution margin approach to compute the annual sales level (in units) requi earn a target operating income of $655,000 Use the contribution margin approach to compute the annual increase in net 12 operating income il sales increase to 501 units. 13 Use the contribution margin approach to compute the change in net operating income if sales fall by 90 units. Use the contribution margin approach to compute the change in net operating income if selling price per unit increases by $20 per unit and the sales volume decreases by 50 u Use the contribution margin approach to compute the change in net operating income if sales increase by 5% and advertising spending is increased by $5,000. Use the contribution margin approach to calculate margin of safety in dollars, as a 16 percent and in units. Use the contribution margin approach to calculate operating leverage. What is the 17 estimated percent increase in net income if sales increase 10%? New Operating Income? 8 14 15 10:30 X Comprehensive Project 1 Template v1 XLSX - 40 KB Photo Once ve Breve Net Use the combuden waren eto poche con poetsen DATA malam per Format percent, treeningute Com Lowoche . Porunce the Dhyourform below for Away ROND Target Uw the contribution margin rochie congue perting.com Walorence the DATA your famillow Format Anaya New ping change in one Requiremen see on marginhecerem Reborn DATA your formelon Woman Almere Uwe ROUNDUP consors New Operating com change Real She was 20 peritone DATA the ROUNDUP non- New Operating com hangen The contin marginwone meting come. where y000 Meherence the DATA your form below formats Almayer the Nine Operating income tharging ein pan Make the DATA your frien oma l Marge Mary More Use the contention mayor aa? Warene Atelyem Change in one come Nie Open Office 92 10:307 Comprehensive Project 1 Template v1 XLSX - 40 KB ructions Transactions MOH Rate Solution data Jour Per Unt DATA (refer to Requirements Description Unit Sales for 2024 500 Sales Revenue Variable costs Contribution Margin Fed Costs Operating Income Breakeven Tarpet Profit 635.000 Requirement Use the contribution marginapproach to compute the company's annual breakeven in ni Reference the DATA cells) in your formula below. Format as a number. Always refer to the original data Breakeven in Units Requirement 10 Use the contribution margin ratio approach to compute the breakeven point in sales doiars. Reference the DATA cells in your formula below. Format as a number. Always refer to the original data Format e ralio as a percent, breakeven in dollars as accounting number format in whole dollars Contribution margin ratio Breakeven in Dofors Requirement 11 Use the contribution marginapproach to computer sales level in its required to cart of $665.000 Reference the DATA cells in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to obtain whole unts to reach the target operating income. Tarpet sales level in uns! Requirement 12 Use the contribution margin approach to compute the annual increase in operating income sales increase Reference the DATA cells) in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to obtain whole units or dollars New Operating Income change in Operating income Requirement 13 Use the contribution margin approach to compute the changin at operating income sales tai by units Reference the DATA cells in your formula below. Format as a number. Always refer to the orginal dari Use the Excel ROUNDUP function to obtais whole units or dollars Now Operating Income change in Operating income Requirement 14 Use the contribution marginapproach to compute the change in net operating income the selling price per $20 per unit and the sales volume decreases by 50 units Reference the DATA cells in your formula below. Format as number Use the EXO ROUNDUP function to ottain whole unts or dollars Ne ch Open Office Lo Requirement 15 Use the contribution marginappro nown sting income the sales increase 10:30 Comprehensive Project 1 Template v1 XLSX - 40 KB Requirement: Complete the income Statement Income Samen Requirements Use the information provided below the high low method and the contribution marginapproach to prepare a contribution format income statement Use your mind cost formules to create your contribution format dement Reference the DATA) as provided to complete your statement below. Formatas rumb Round to 2 decimal places where appropriate Boyd Corporation income sumont For the Year 20 Sales Revue 2200 Cost of Goods Sold 1340 Gross Profit 7201000 Seling and Administrative Expenses Operating Income 123.000 Boyd sold 400 units in 2023 High Low Method Cost of Goods Sold Step 1 - Variable cost per un Step 2 - Fund Cost Step 3. Mored Cost Formula (STATE the ACTUAL formula in the blue box provided) Seling & Administrative Costa Step 1 - Variable cont per un Step 2 - Fed Cost Step 3 - Mixed Cost Form (STATE the ACTUAL formula in the blue box provided) Contribution Format Open Office 92 10:307 X Comprehensive Project 1 Template v1 XLSX - 40 KB Requirement: Complete the schedule of Cost of Goods Manufactured Schedule of Cont of Goods Mandatured Requirement 6: Complete the cost of Goods Sold schedule Schedule of Cost Goods Solid Requirement: Complete the income Statement Income Smart Requirement Use the information provided below the high low method and the contribution marginapproach to prepare a contribution format income statement Use your mixed cost formules to create your contribution format teen Reference the DATA coin) as provided to complete your statement below. Format number Round to 2 decimal places where appropriate Boyd Corporation Income Statement For the Year 2003 Sales Reverse 2280.000 Cost of Goods Sold Gross Proff 720020 Selling and Administrative Expenses E000 Operating Income 123000 Boyd sold 400 units in 2003 High Low Method Cost of Goods Sold Sto. Variable costruit Open Office 92 (STATE ACTUAL for in the blue box provided) Seting & Administrative Costa U Comprehensive Project 1 Template v1 XLSX-40 KB Transactions MOH Rate Solution Instructions data Journal Entries Solutio d The following transactions were recorded for the year: a Raw materials were purchased on account, S560,000 b Raw materials used in production, $530,000. All of the raw materials were used as direct materials. The following costs were accrued for employee services: direct labor. $650,000; indirect labor, $200,000; selling and administrative salaries, $290,000. Incurred various selling and administrative expenses (e.g., advertising, sales travel costs, and finished goods warehousing), S417,000 e incurred various manufacturing overhead costs (e.g. rent, insurance, and utilities). $550,000. Manufacturing overhead cost was applied to production. The company actually worked 46,000 direct labor- hours on all jobs during the year. 9 Jobs costing $1,730,000 to manufacture according to their job cost sheets were completed during the year Jobs were sold on account to customers during the year for a total of $2,850,000. The jobs cost $1,740,000 to manufacture according to their job cost sheets. 1 h Open Office 2. a Boyd Corporation is a manufacturer that uses job-order costing. On January 1, 2024, the company's inventory balances were as follows: Raw Mate $60,000 Work-in-F $38,000 Finished $55,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, 2024, the company's predetermined overhead rate per direct labor-hour was based on a cost formula that estimated $812,500 of total manufacturing overhead for an estimated activity level of 65,000 direct labor-hours. Requirements: 1. Compute the predetermined overhead allocation rate for fiscal year 2024. Use the blue shaded areas for inputs. Use Excel to journalize the transactions listed in the Transactions tab for the current year, 2024 Enter the beginning balances for the inventories in the T-accounts. Assume the rest of the accounts have beginning balances of zero. Post the journal entries to T- 3. accounts. T-account balances will automatically calculate except for Manufacturing Overhead. You will need to calculate the appropriate balance in that account. 4. Adjust the manufacturing overhead account. Prepare the journal entry. b. Post to T-accounts. 5. Complete the Schedule of Cost of Goods Manufactured for 2024. 6. Complete the cost of Goods Sold schedule for 2024. 7. Prepare income statements in good form for Boyd for 2024 The company sold 500 units in 2024. Use the information given to calculate the following for 2024: Use the information provided the high low method and the contribution margin approach to prepare a contribution format income statement 9 Use the contribution margin approach to compute the company's annual breakeven point in units. 10 Use the contribution margin ratio approach to compute the breakeven point in sales dollars. 11 Use the contribution margin approach to compute the annual sales level (in units) requi earn a target operating income of $655,000 Use the contribution margin approach to compute the annual increase in net 12 operating income il sales increase to 501 units. 13 Use the contribution margin approach to compute the change in net operating income if sales fall by 90 units. Use the contribution margin approach to compute the change in net operating income if selling price per unit increases by $20 per unit and the sales volume decreases by 50 u Use the contribution margin approach to compute the change in net operating income if sales increase by 5% and advertising spending is increased by $5,000. Use the contribution margin approach to calculate margin of safety in dollars, as a 16 percent and in units. Use the contribution margin approach to calculate operating leverage. What is the 17 estimated percent increase in net income if sales increase 10%? New Operating Income? 8 14 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started