Answered step by step

Verified Expert Solution

Question

1 Approved Answer

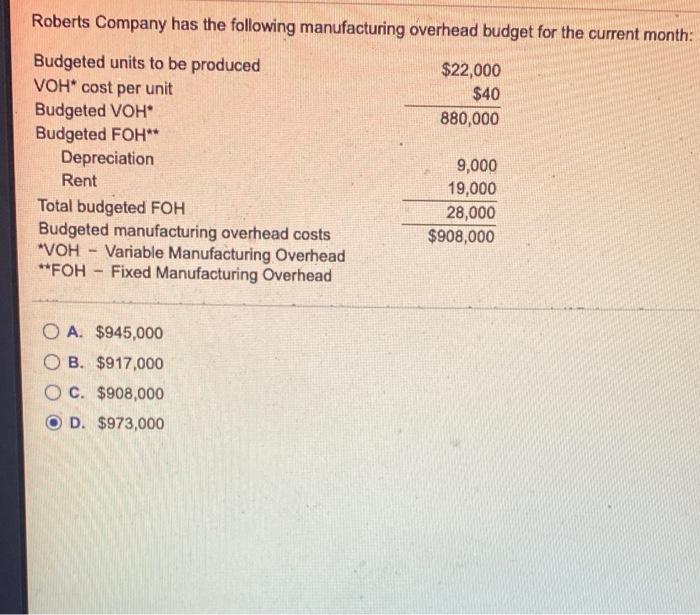

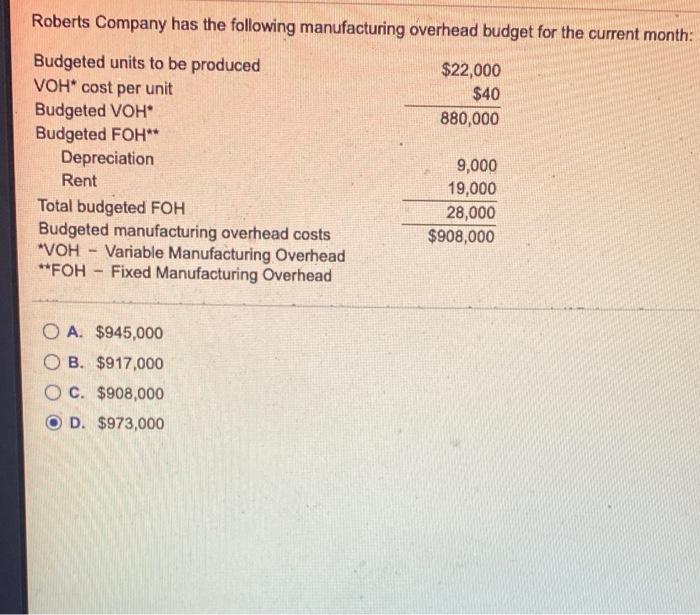

help asap please 1. a. b. c. Roberts Company has the following manufacturing overhead budget for the current month: $22,000 $40 880,000 Budgeted units to

help asap please

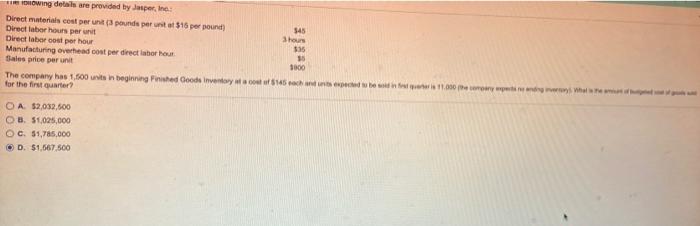

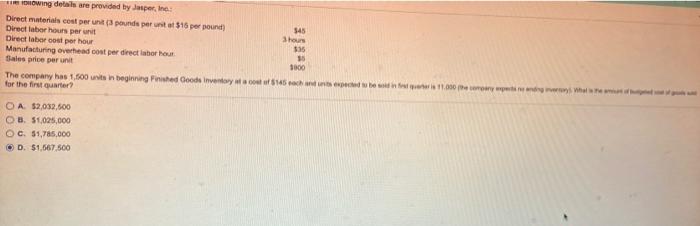

Roberts Company has the following manufacturing overhead budget for the current month: $22,000 $40 880,000 Budgeted units to be produced VOH cost per unit Budgeted VOH Budgeted FOH** Depreciation Rent Total budgeted FOH Budgeted manufacturing overhead costs *VOH Variable Manufacturing Overhead **FOH Fixed Manufacturing Overhead 9,000 19,000 28,000 $908,000 O A. $945,000 O B. $917,000 OC. $908,000 OD. $973,000 Towing details are provided by Jasperine Direct materials cost per unit (pounds per tot 515 per pound 545 Direct labor hours perut Shows Direct labor cost per hour $35 Manufacturing overhead cost per direct labor hour 35 Sales price per unit 3000 The company has 1.600 units in beginning Finished Goods Inventory cost of $5 och deshi 11.000 eura ng mars for the first quarter O A $2,032,500 OB. 51,025,000 OC. 51,785,000 D. $1.667.500 A budget is a financial plan that managers use to coordinate a business's activities with its O A. planning and directing OB. goals and controlling c. planning and controlling O D. goals and strategies 1.

a.

b.

c.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started