Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help asap please. i will upvote. Required Note: For each account category, indicate the appropriate account name. Enter N/A for any account category that is

help asap please. i will upvote.

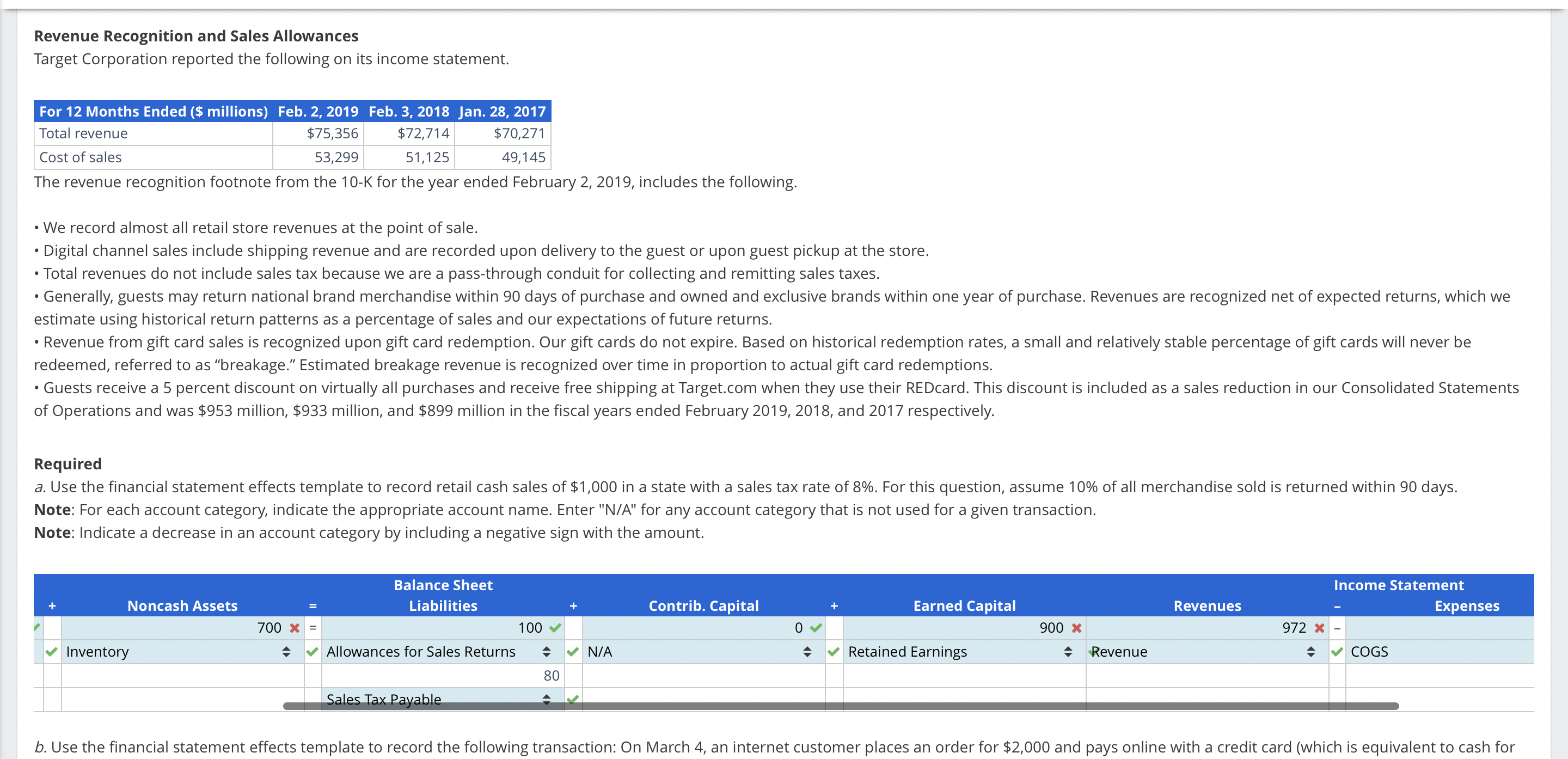

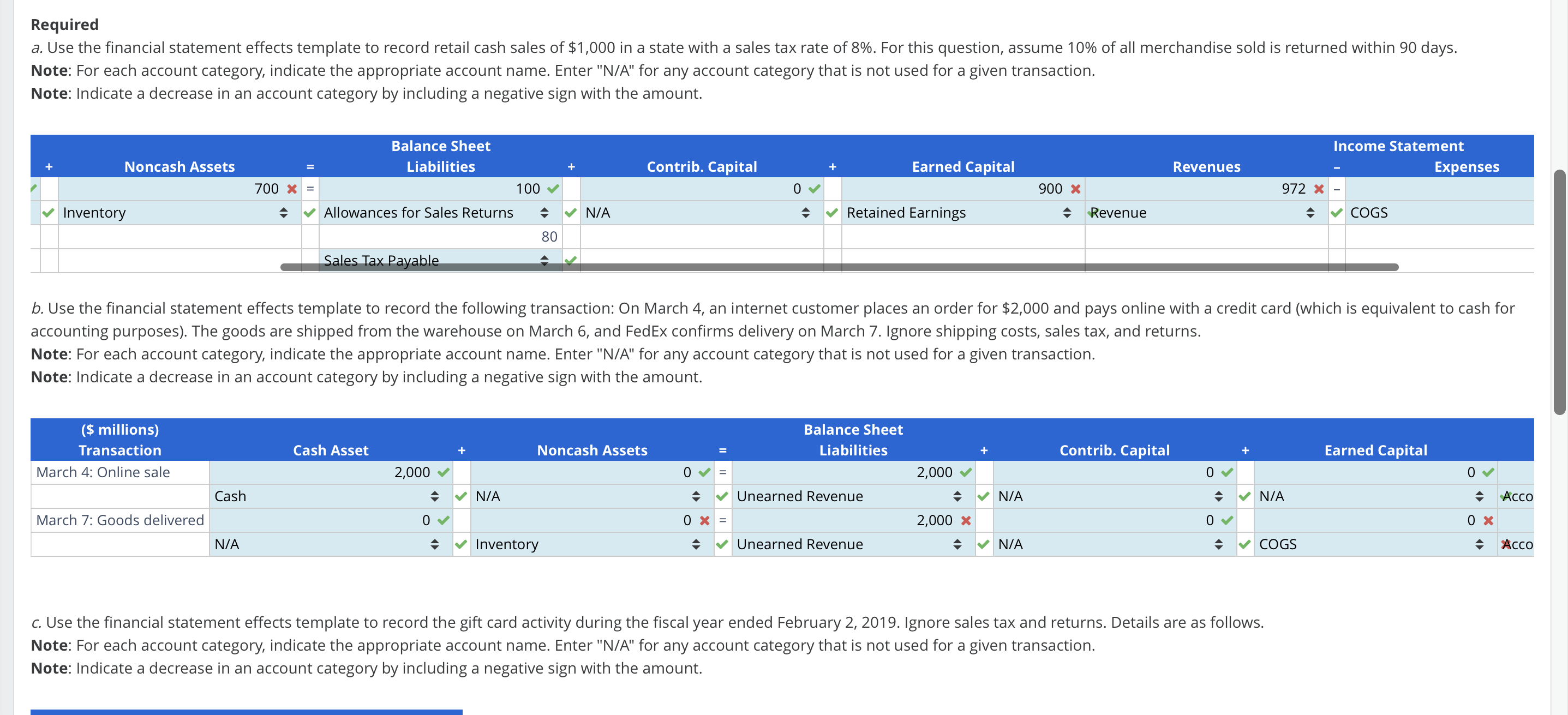

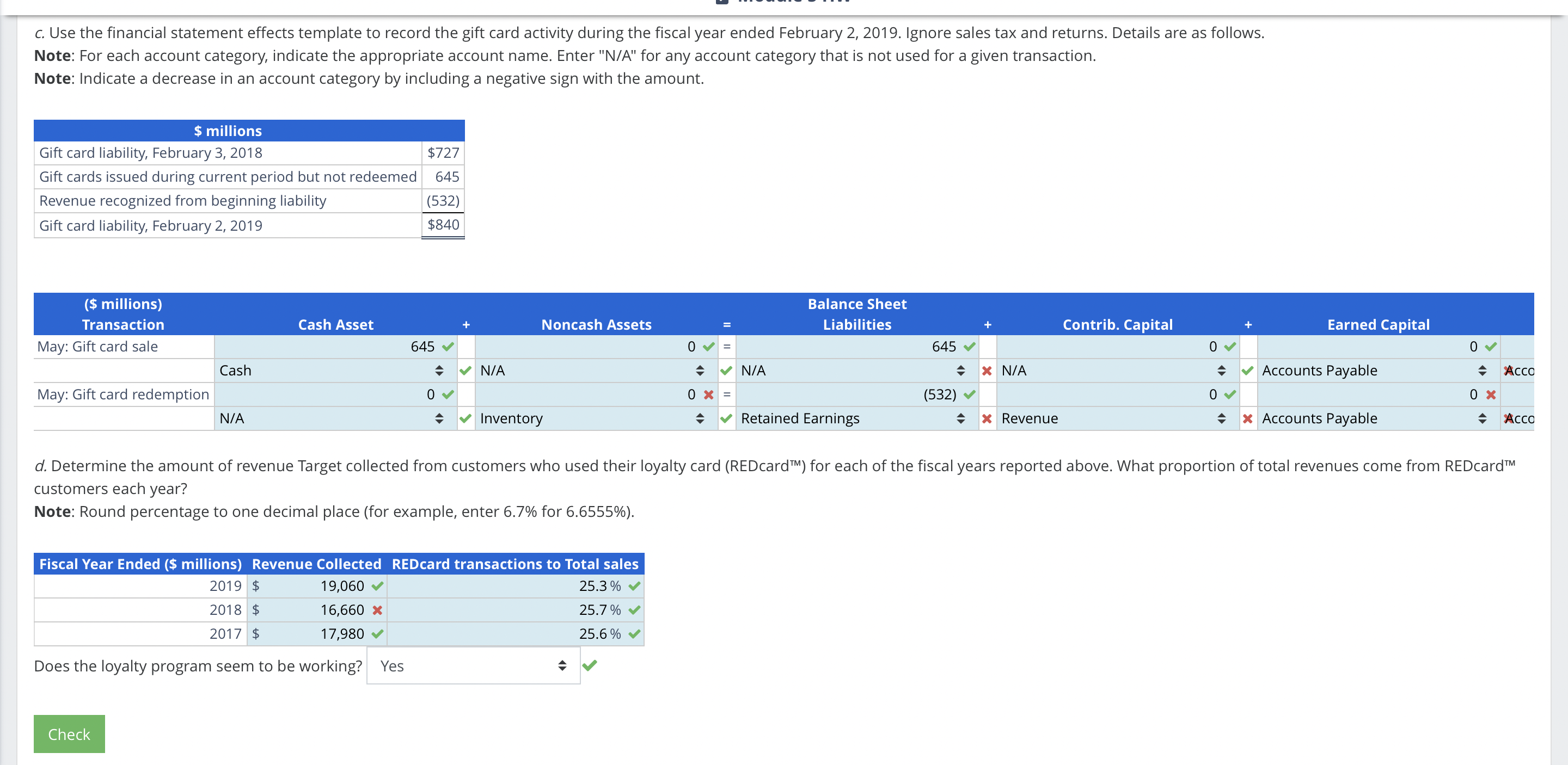

Required Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. accounting purposes). The goods are shipped from the warehouse on March 6, and FedEx confirms delivery on March 7. Ignore shipping costs, sales tax, and returns. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. c. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2, 2019. Ignore sales tax and returns. Details are as follows. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. Revenue Recognition and Sales Allowances Target Corporation reported the following on its income statement. The revenue recognition footnote from the 10-K for the year ended February 2, 2019, includes the following. - We record almost all retail store revenues at the point of sale. - Digital channel sales include shipping revenue and are recorded upon delivery to the guest or upon guest pickup at the store. - Total revenues do not include sales tax because we are a pass-through conduit for collecting and remitting sales taxes. estimate using historical return patterns as a percentage of sales and our expectations of future returns. redeemed, referred to as "breakage." Estimated breakage revenue is recognized over time in proportion to actual gift card redemptions. of Operations and was $953 million, \$933 million, and \$899 million in the fiscal years ended February 2019, 2018, and 2017 respectively. Required Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. c. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2, 2019. Ignore sales tax and returns. Details are as follows. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. customers each year? Note: Round percentage to one decimal place (for example, enter 6.7% for 6.6555% ). Required Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. accounting purposes). The goods are shipped from the warehouse on March 6, and FedEx confirms delivery on March 7. Ignore shipping costs, sales tax, and returns. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. c. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2, 2019. Ignore sales tax and returns. Details are as follows. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. Revenue Recognition and Sales Allowances Target Corporation reported the following on its income statement. The revenue recognition footnote from the 10-K for the year ended February 2, 2019, includes the following. - We record almost all retail store revenues at the point of sale. - Digital channel sales include shipping revenue and are recorded upon delivery to the guest or upon guest pickup at the store. - Total revenues do not include sales tax because we are a pass-through conduit for collecting and remitting sales taxes. estimate using historical return patterns as a percentage of sales and our expectations of future returns. redeemed, referred to as "breakage." Estimated breakage revenue is recognized over time in proportion to actual gift card redemptions. of Operations and was $953 million, \$933 million, and \$899 million in the fiscal years ended February 2019, 2018, and 2017 respectively. Required Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. c. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2, 2019. Ignore sales tax and returns. Details are as follows. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. customers each year? Note: Round percentage to one decimal place (for example, enter 6.7% for 6.6555% )

Required Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. accounting purposes). The goods are shipped from the warehouse on March 6, and FedEx confirms delivery on March 7. Ignore shipping costs, sales tax, and returns. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. c. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2, 2019. Ignore sales tax and returns. Details are as follows. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. Revenue Recognition and Sales Allowances Target Corporation reported the following on its income statement. The revenue recognition footnote from the 10-K for the year ended February 2, 2019, includes the following. - We record almost all retail store revenues at the point of sale. - Digital channel sales include shipping revenue and are recorded upon delivery to the guest or upon guest pickup at the store. - Total revenues do not include sales tax because we are a pass-through conduit for collecting and remitting sales taxes. estimate using historical return patterns as a percentage of sales and our expectations of future returns. redeemed, referred to as "breakage." Estimated breakage revenue is recognized over time in proportion to actual gift card redemptions. of Operations and was $953 million, \$933 million, and \$899 million in the fiscal years ended February 2019, 2018, and 2017 respectively. Required Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. c. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2, 2019. Ignore sales tax and returns. Details are as follows. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. customers each year? Note: Round percentage to one decimal place (for example, enter 6.7% for 6.6555% ). Required Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. accounting purposes). The goods are shipped from the warehouse on March 6, and FedEx confirms delivery on March 7. Ignore shipping costs, sales tax, and returns. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. c. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2, 2019. Ignore sales tax and returns. Details are as follows. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. Revenue Recognition and Sales Allowances Target Corporation reported the following on its income statement. The revenue recognition footnote from the 10-K for the year ended February 2, 2019, includes the following. - We record almost all retail store revenues at the point of sale. - Digital channel sales include shipping revenue and are recorded upon delivery to the guest or upon guest pickup at the store. - Total revenues do not include sales tax because we are a pass-through conduit for collecting and remitting sales taxes. estimate using historical return patterns as a percentage of sales and our expectations of future returns. redeemed, referred to as "breakage." Estimated breakage revenue is recognized over time in proportion to actual gift card redemptions. of Operations and was $953 million, \$933 million, and \$899 million in the fiscal years ended February 2019, 2018, and 2017 respectively. Required Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. c. Use the financial statement effects template to record the gift card activity during the fiscal year ended February 2, 2019. Ignore sales tax and returns. Details are as follows. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. customers each year? Note: Round percentage to one decimal place (for example, enter 6.7% for 6.6555% ) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started