Answered step by step

Verified Expert Solution

Question

1 Approved Answer

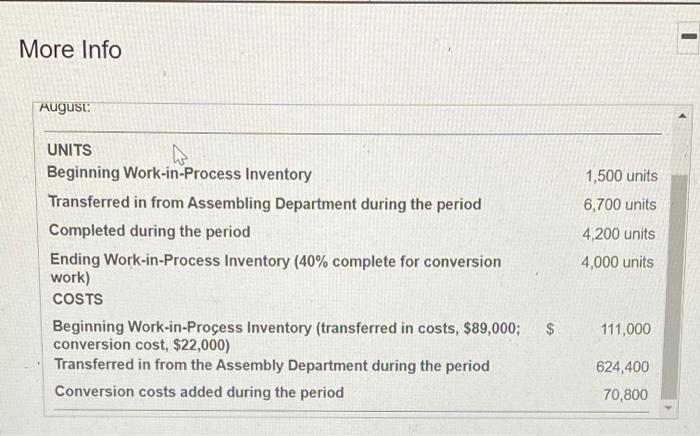

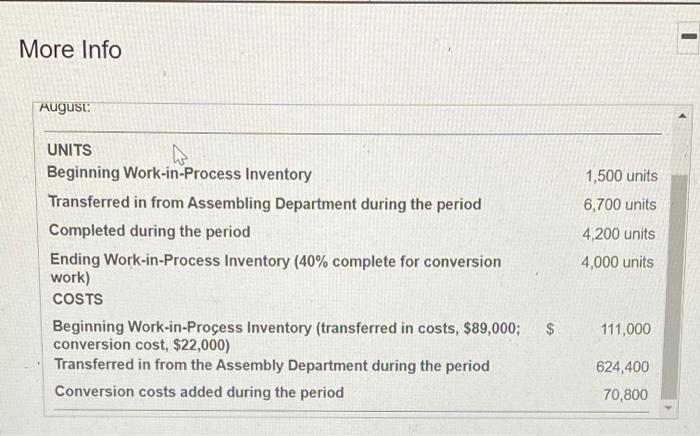

help asap please More Info August UNITS ho Beginning Work-in-Process Inventory Transferred in from Assembling Department during the period Completed during the period Ending Work-in-Process

help asap please

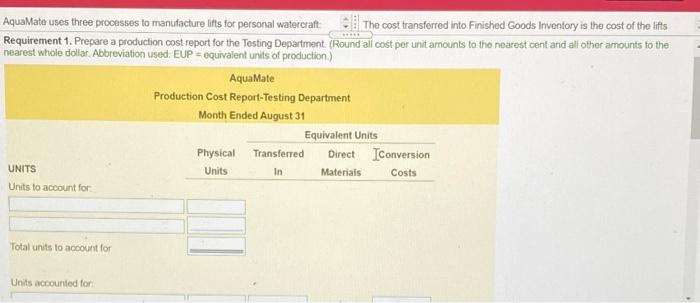

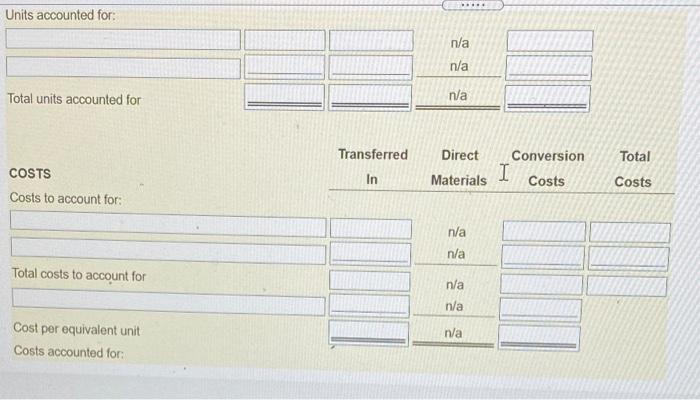

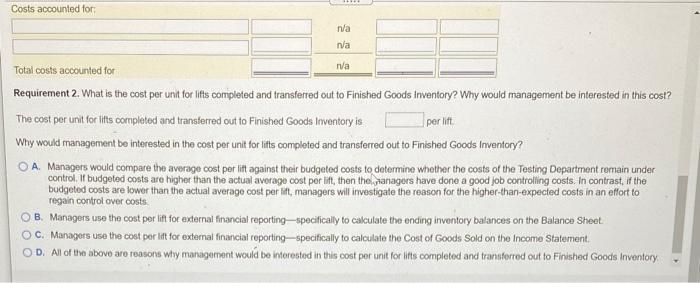

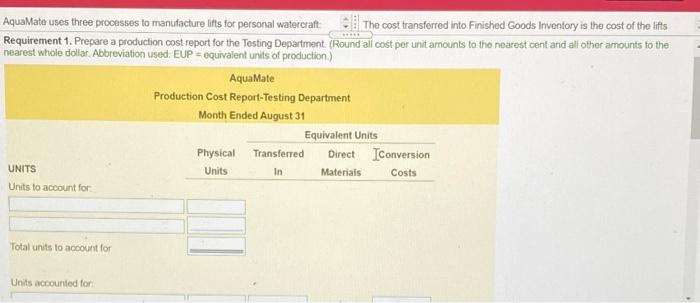

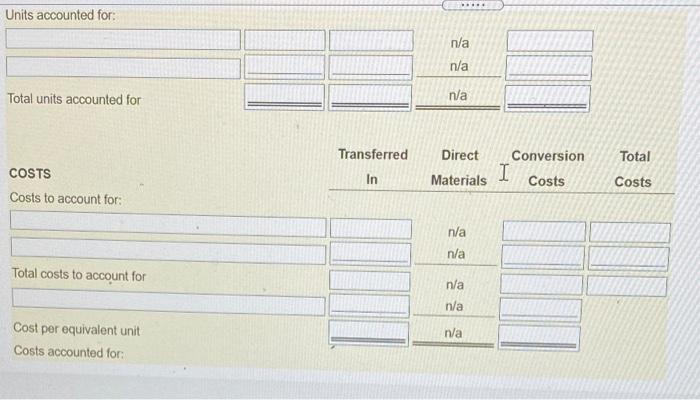

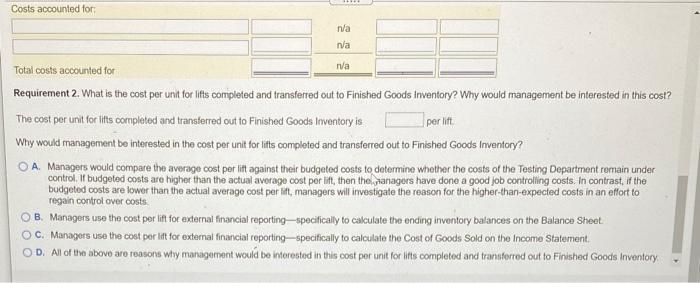

More Info August UNITS ho Beginning Work-in-Process Inventory Transferred in from Assembling Department during the period Completed during the period Ending Work-in-Process Inventory (40% complete for conversion work) COSTS Beginning Work-in-Process Inventory (transferred in costs, $89,000; conversion cost, $22,000) Transferred in from the Assembly Department during the period Conversion costs added during the period 1,500 units 6,700 units 4,200 units 4,000 units $ 111,000 624,400 70,800 AquaMate uses three processes to manufacture lifts for personal watercraft. The cost transferred into Finished Goods Inventory is the cost of the lifts Requirement 1. Prepare a production cost report for the Testing Department (Round all cost per unit amounts to the nearest cent and all other amounts to the nearont whole dollar. Abbreviation used. EUP - equivalent units of production) AquaMate Production Cost Report-Testing Department Month Ended August 31 Equivalent Units Physical Transferred Direct Conversion UNITS Materials Costs Units In Units to account for Total units to account for Units accounted for Units accounted for: n/a n/a Total units accounted for n/a Transferred In COSTS Direct Materials Conversion I Costs Total Costs Costs to account for: n/a n/a Total costs to account for n/a n/a n/a Cost per equivalent unit Costs accounted for: Costs accounted for n/a na Total costs accounted for ra per lift Requirement 2. What is the cost per unit for lifts completed and transferred out to Finished Goods Inventory? Why would management be interested in this cost? The cost per unit for its completed and transferred out to Finished Goods Inventory is Why would management be interested in the cost per unit for lifts completed and transferred out to Finished Goods Inventory? A. Managers would compare the average cost per lift against their budgeted costs to determine whether the costs of the Testing Department remain under control. If budgeted costs are higher than the actual average cost per lift, then the managers have done a good job controlling costs. In contrast, if the budgeted costs are lower than the actual average cost per ift, managers will investigate the reason for the higher than-expected costs in an effort to regain control over costs OB. Managers use the cont per lin for external financial reporting-specifically to calculate the ending inventory balances on the Balance Sheet Oc. Managers use the cost per litt for external financial reporting specifically to calculate the cost of Goods Sold on the Income Statement OD. All of the above are reasons why management would be interested in this cost per unit for its completed and transferred out to Finished Goods Inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started