Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help asap!! please Vall Book Mart sells books and other supplies to students in a state where the sales tax rate is 6 percent. Vail

help asap!! please

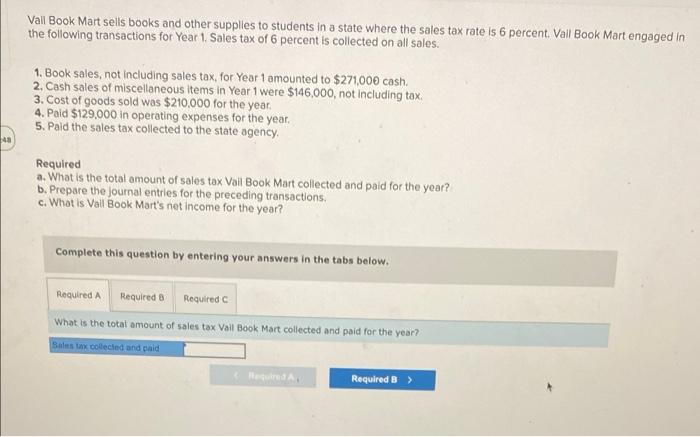

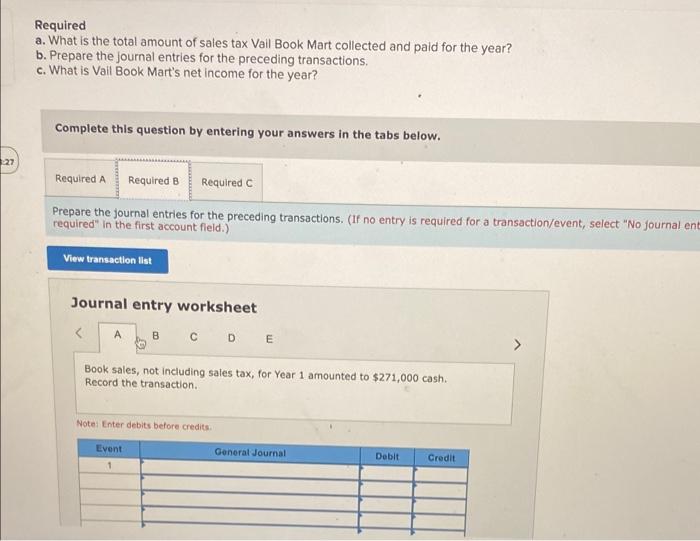

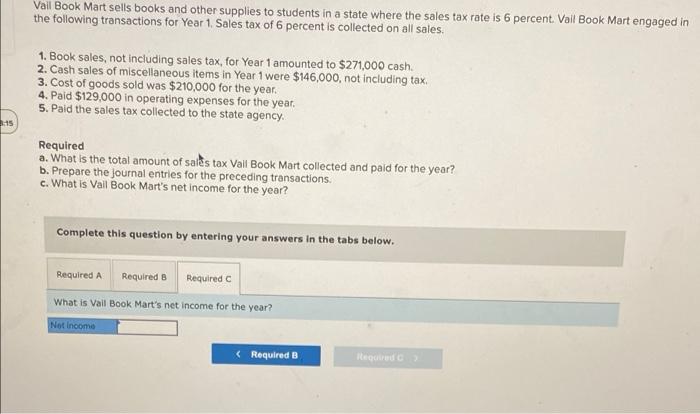

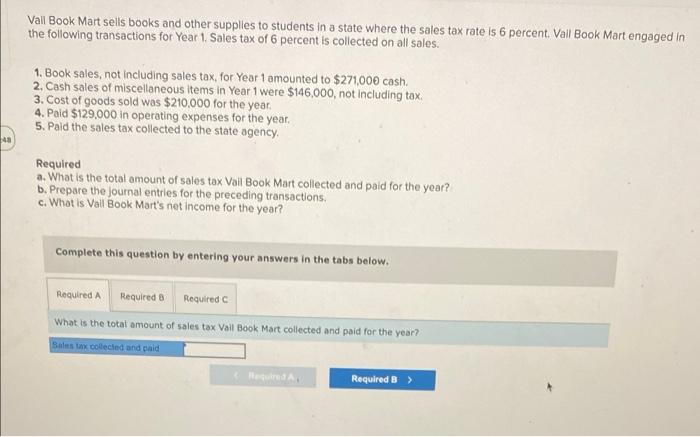

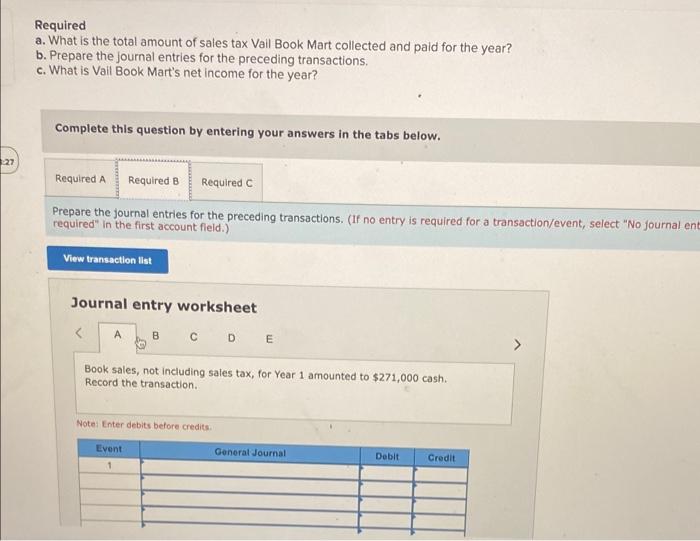

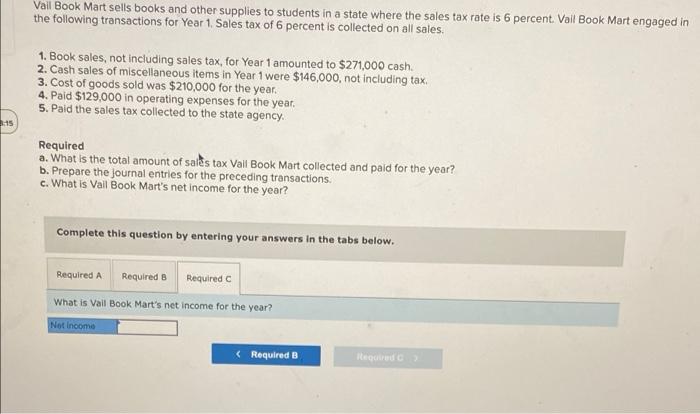

Vall Book Mart sells books and other supplies to students in a state where the sales tax rate is 6 percent. Vail Book Mart engaged in the following transactions for Year 1. Sales tax of 6 percent is collected on all sales. 1. Book sales, not including sales tax, for Year 1 amounted to $271,000 cash. 2. Cash sales of miscellaneous items in Year 1 were $146,000, not including tax. 3. Cost of goods sold was $210.000 for the year. 4. Pald $129,000 in operating expenses for the year. 5. Paid the sales tax collected to the state agency. Required a. What is the total amount of sales tax Vail Book Mart collected and paid for the year? b. Prepare the journal entries for the preceding transactions c. What is Vail Book Mart's net income for the year? Complete this question by entering your answers in the tabs below. Required Required 3 Required What is the total amount of sales tax Vall Book Mart collected and paid for the year? Sales tax collected and paid Required B > Required a. What is the total amount of sales tax Vail Book Mart collected and paid for the year? b. Prepare the journal entries for the preceding transactions, c. What is Vail Book Mart's net income for the year? Complete this question by entering your answers in the tabs below. 27 Required A Required B Required C Prepare the journal entries for the preceding transactions. (If no entry is required for a transaction/event, select "No journal ent required in the first account field.) View transaction list Journal entry worksheet A C D E Book sales, not including sales tax, for Year 1 amounted to $271,000 cash. Record the transaction Note: Enter debits before credits Event General Journal Debit Credit 1 Vail Book Mart sells books and other supplies to students in a state where the sales tax rate is 6 percent Vall Book Mart engaged in the following transactions for Year 1. Sales tax of 6 percent is collected on all sales. 1. Book sales, not including sales tax, for Year 1 amounted to $271,000 cash. 2. Cash sales of miscellaneous items in Year 1 were $146,000, not including tax. 3. Cost of goods sold was $210,000 for the year. 4. Paid $129,000 in operating expenses for the year. 5. Paid the sales tax collected to the state agency. -15 Required a. What is the total amount of sales tax Vail Book Mart collected and paid for the year? b. Prepare the journal entries for the preceding transactions c. What is Vail Book Mart's net income for the year? Complete this question by entering your answers in the tabs below. Required A Required B Required What is Vall Book Mart's net income for the year? Not Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started