Answered step by step

Verified Expert Solution

Question

1 Approved Answer

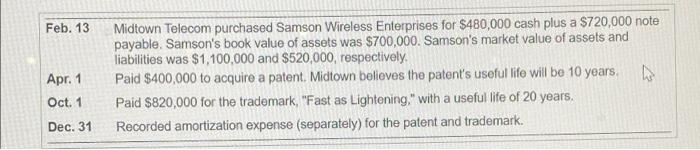

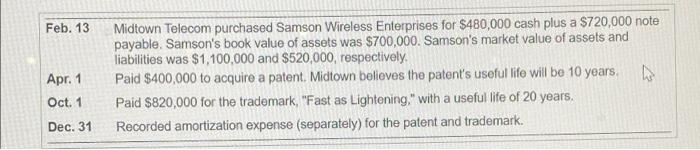

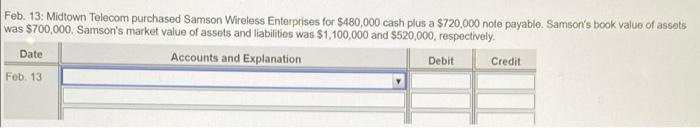

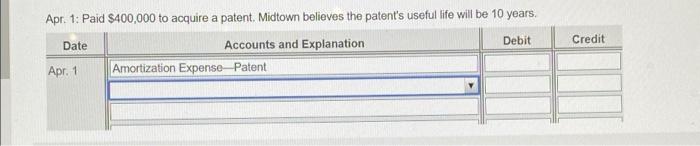

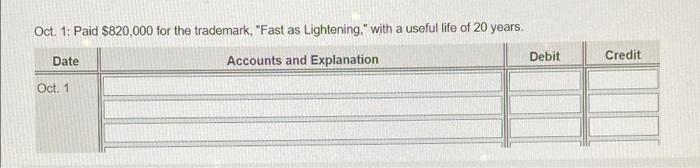

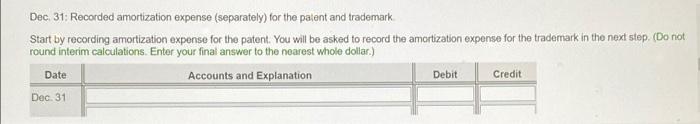

help asap pleass Feb. 13 Apr. 1 Oct. 1 Dec. 31 Midtown Telecom purchased Samson Wireless Enterprises for $480,000 cash plus a $720,000 note payable.

help asap pleass

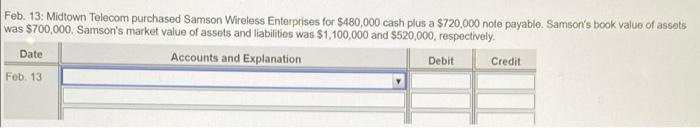

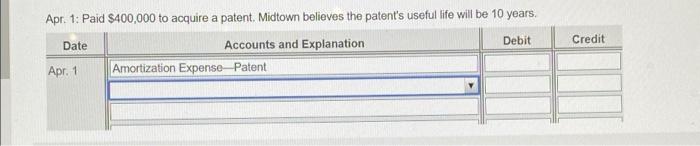

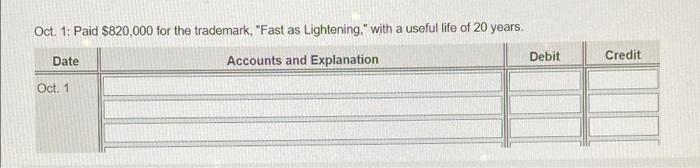

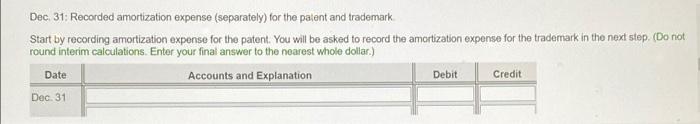

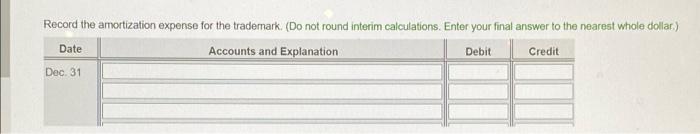

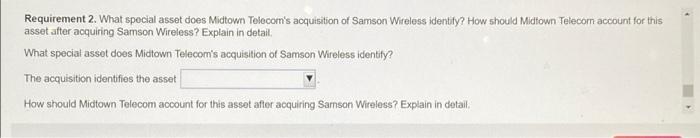

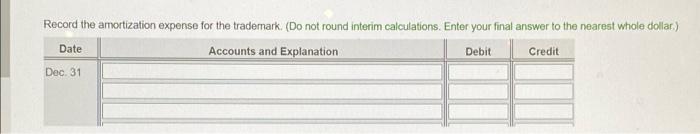

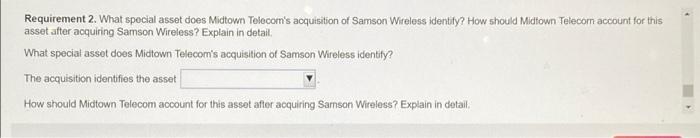

Feb. 13 Apr. 1 Oct. 1 Dec. 31 Midtown Telecom purchased Samson Wireless Enterprises for $480,000 cash plus a $720,000 note payable. Samson's book value of assets was $700,000. Samson's market value of assets and liabilities was $1,100,000 and $520,000, respectively. Paid $400,000 to acquire a patent. Midtown believes the patent's useful life will be 10 years. Paid $820,000 for the trademark, "Fast as Lightening," with a useful life of 20 years, Recorded amortization expense (separately) for the patent and trademark. Feb. 13: Midtown Telecom purchased Samson Wireless Enterprises for $480,000 cash plus a $720,000 note payable. Samson's book value of assets was $700,000. Samson's market value of assets and liabilities was $1,100,000 and $520,000, respectively. Accounts and Explanation Debit Fob 13 Date Credit Apr. 1: Paid $400,000 to acquire a patent. Midtown believes the patent's useful life will be 10 years. Date Accounts and Explanation Debit Apr. 1 Amortization Expense-Patent Credit Oct. 1: Paid $820,000 for the trademark, "Fast as Lightening," with a useful life of 20 years. Date Credit Debit Accounts and Explanation Oct. 1 Dec 31: Recorded amortization expense (separately) for the palent and trademark Start by recording amortization exponse for the patent. You will be asked to record the amortization expense for the trademark in the next step. (Do not round interim calculations. Enter your final answer to the nearest whole dollar.) Date Accounts and Explanation Dec 31 Debit Credit Record the amortization expense for the trademark. (Do not round interim calculations. Enter your final answer to the nearest whole dollar) Date Accounts and Explanation Credit Dec 31 Debit Requirement 2. What special asset does Midtown Telecorn's acquisition of Samson Wireless identity? How should Midtown Telecom account for this asset after acquiring Samson Wireless? Explain in detail, What special asset does Midtown Telecom's acquisition of Samson Wireless identity? The acquisition identifies the asset How should Midtown Telecom account for this asset after acquiring Sarnson Wireless? Explain in detail

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started