help asap, thank you.

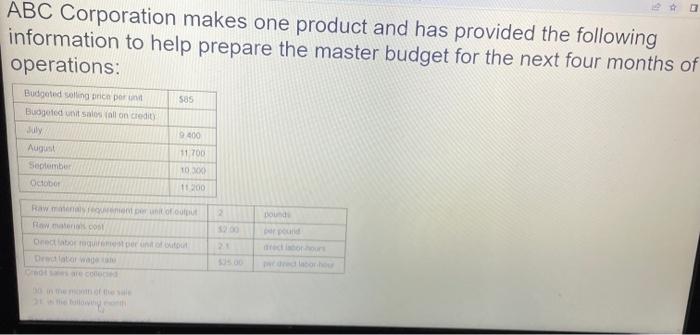

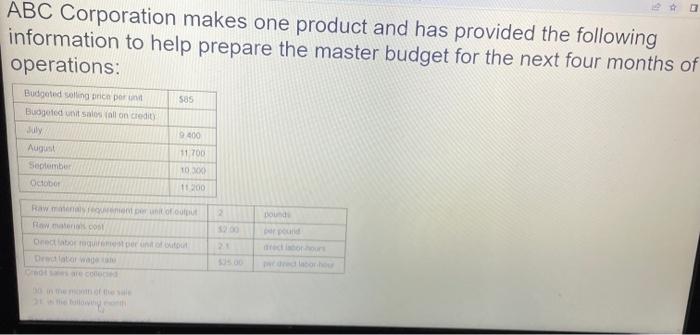

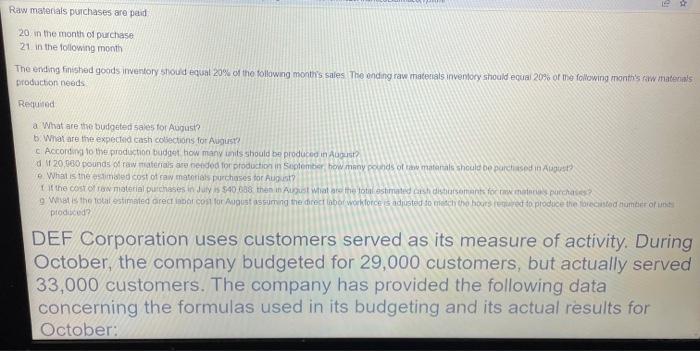

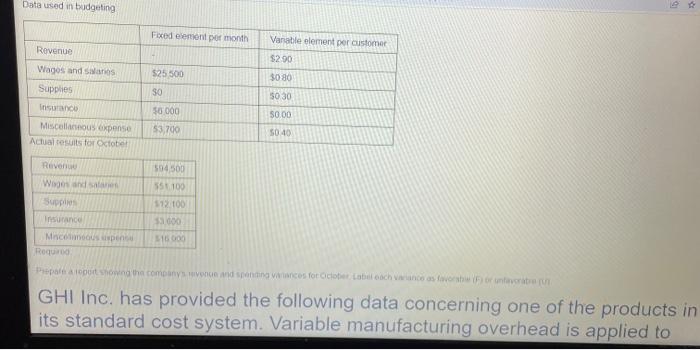

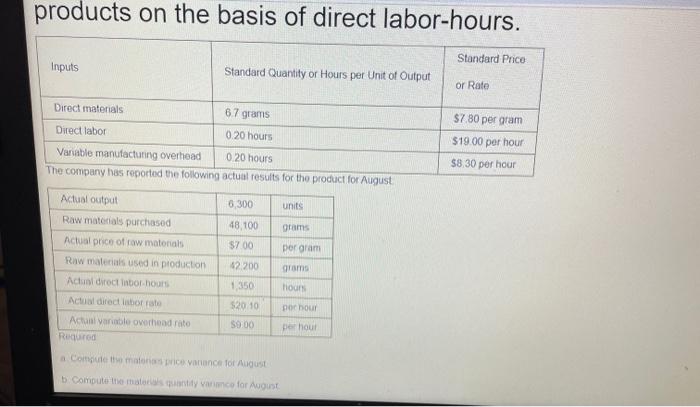

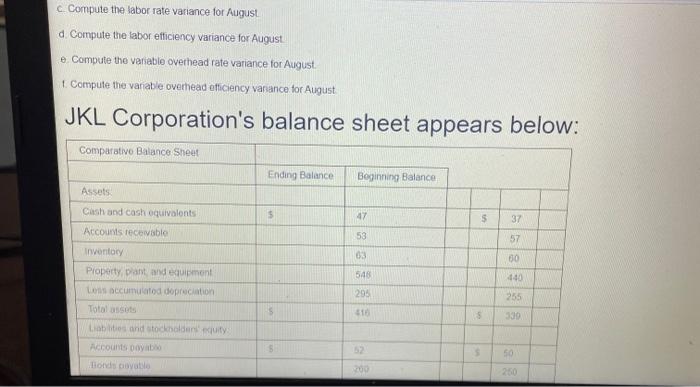

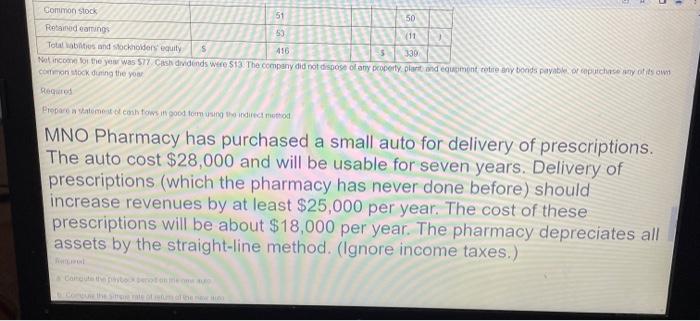

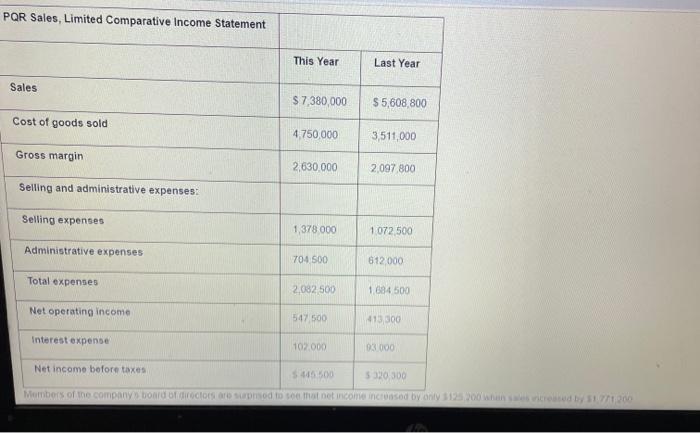

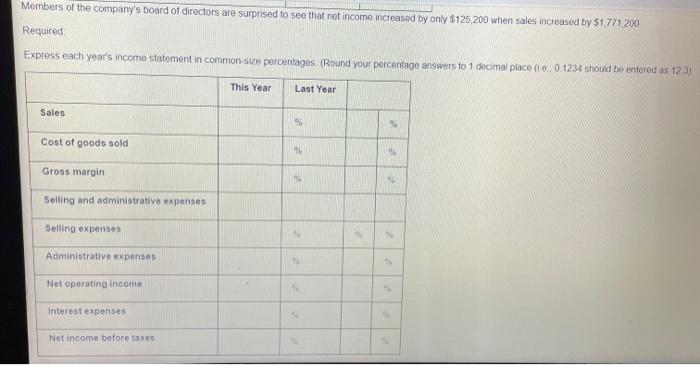

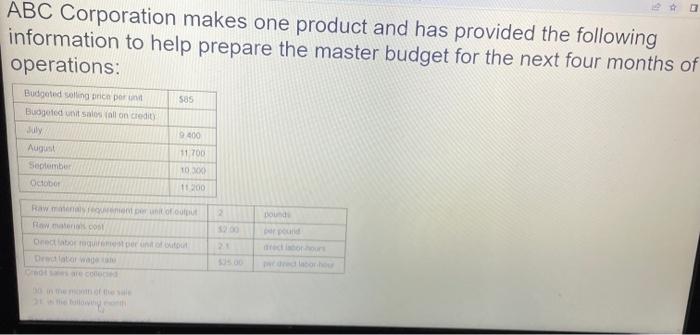

ABC Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations: 585 Budgeted selling priceperunt Budgeted unitates all on credity July August September October 9000 11 700 10X 11200 doud Rawler unit of cott Romano Onedator requirement par under output 500 Core CD news Raw materials purchases are paid 20 in the month of purchase 21. in the following month The ending finished goods inventory Shoud equal 20% of the following month's sales The ending raw materials inventory should equal 20% or se following month's raw materials production noods Required a What are the budgeted sales for August? 6. What are the expected cash collections for August According to the production budget how many units should be produced in Aust? d 20.000 pounds of raw materials are needed for production in September how many pounds of matanals should be purchased in Aust What is the estimated cost of raw materials purchases for August it the cost of material purchases in July is 540 638 then in August Wat the total estimated cash disusons for the purchases 9. What the outostimated Grect inbor cost for August assuming the direct labor workforce is adjusted to match the housed to produce the custod numero produced DEF Corporation uses customers served as its measure of activity. During October, the company budgeted for 29,000 customers, but actually served 33,000 customers. The company has provided the following data concerning the formulas used in its budgeting and its actual results for October: Data used in budgeting Fixed element per month Vanable element per customer $2.90 525 500 3080 Revenue Wagos and anos Supplies Insurance Miscellaneous expense Actual results for October SO 5030 50 000 $0.00 53.700 50 40 Revenu 594500 Woons and 551100 Supplies $12.00 Insurance 351000 Mhcocos en $16000 Roquroo Prepare out how the company once and spaces for cote Label och cash or unava GHI Inc. has provided the following data concerning one of the products in its standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labor-hours. Standard Price Inputs Standard Quantity or Hours per Unit of Output or Rate Direct materials 6.7 grams $780 per gram Direct labor 020 hours $19.00 per hour Variable manufacturing overhead 0 20 hours The company has reported the following actual results for the product for August $8.30 per hour 6,300 units 48,100 grams Actual output Raw materials purchased Actual price of raw materials Raw materials used in production Actual direct inbor hours $700 per gram 42.200 grams 1,350 hours Actual direct laborate por hour Actual variable overhead rate Required 520 10 S9 00 per hour Computers matica vanance for August b. Compute the many varice for August c Compute the labor rate variance for August a Compute the labor efficiency variance for August e Compute the variable overhead rate variance for August Compute the vanable overhead efficiency vanance for August JKL Corporation's balance sheet appears below: Comparative Balance Sheet Ending Balance Beginning Balance Assets Cash and cash equivalents Accounts recewable $ 47 $ 37 53 57 03 60 545 440 295 Inventory Property, plant and equipment Les accumulated dopreciation Total asset Liabilities and stockholdenecity Accounts 255 10 $ 330 50 onds tovallo 250 Common stock 51 50 Read earrings 50 (11 Total abits and stockholders equity 456 -5 339 Not income for the yow was 577 Cash dividends were $13. The company did not dispose of any property plant and equmont retire any bonds payable purchase any of its own monok during the your Round Proparen atomoen fows it good for using the indirect metod MNO Pharmacy has purchased a small auto for delivery of prescriptions. The auto cost $28,000 and will be usable for seven years. Delivery of prescriptions (which the pharmacy has never done before) should increase revenues by at least $25,000 per year. The cost of these prescriptions will be about $18,000 per year. The pharmacy depreciates all assets by the straight-line method. (Ignore income taxes.) PQR Sales, Limited Comparative Income Statement This Year Last Year Sales $7,380,000 $5,608,800 Cost of goods sold 4,750,000 3,511,000 Gross margin 2,630.000 2,097 800 Selling and administrative expenses: Selling expenses 1,378 000 1072 50 Administrative expenses 704 500 612 000 Total expenses 2.082 500 1684 500 Net operating income 547 500 413 300 Interest expense 102.000 03.000 Net income before taxes 5445500 $320.300 Members of the company board of directors are used to see that net income increased by only $125 200 whics200 Members of the company's board of directors are surprised to see that net income increased by only $125 200 when sales increased by 51 771200 Required Express each year's income statement in common size percentages (Round your percentage answers to 1 decimal place de 0 1234 should be entered as 123) This Year Last Year Sales Cost of goods sold Gross margin Selling and administrative expenses Selling expenses Administrative expenses Net operating income interest expenses Net income before taxes