Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help asap with circled parts. and depreciation Replacement Analysis 3) Extra CheduT The Everly Equipment Company's flange-lipping machine was purchased 5 years ago for $55,000.

help asap with circled parts.

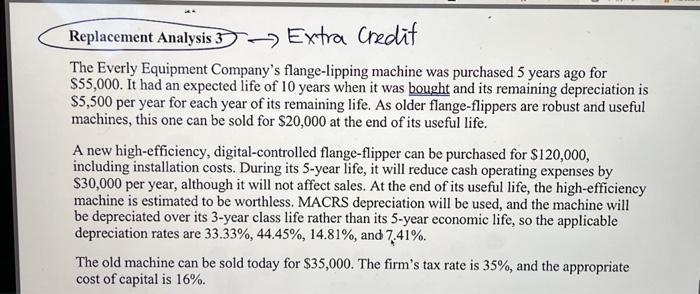

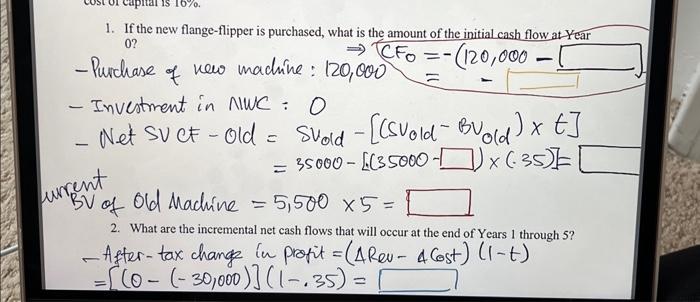

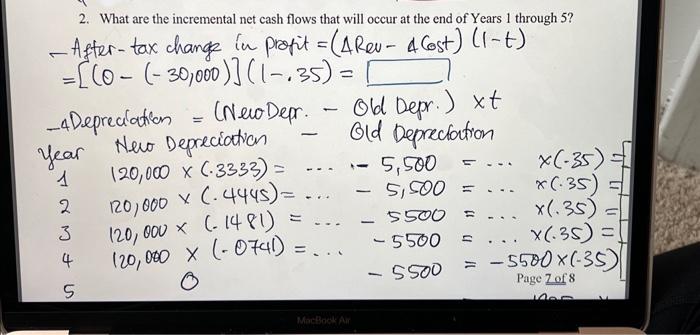

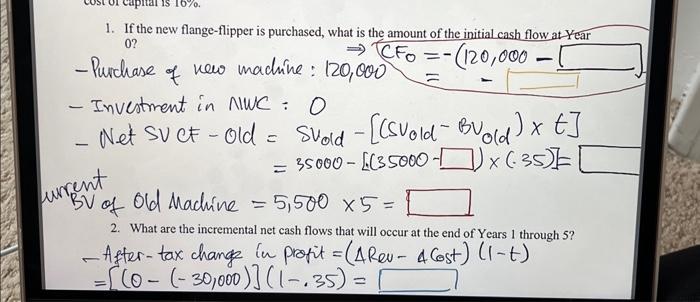

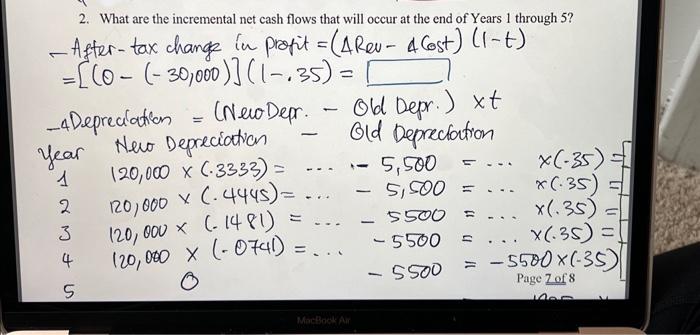

Replacement Analysis 3) Extra CheduT The Everly Equipment Company's flange-lipping machine was purchased 5 years ago for $55,000. It had an expected life of 10 years when it was bought and its remaining depreciation is $5,500 per year for each year of its remaining life. As older flange-flippers are robust and useful machines, this one can be sold for $20,000 at the end of its useful life. A new high-efficiency, digital-controlled flange-flipper can be purchased for $120,000, including installation costs. During its 5 -year life, it will reduce cash operating expenses by $30,000 per year, although it will not affect sales. At the end of its useful life, the high-efficiency machine is estimated to be worthless. MACRS depreciation will be used, and the machine will be depreciated over its 3-year class life rather than its 5-year economic life, so the applicable depreciation rates are 33.33%,44.45%,14.81%, and 7.41%. The old machine can be sold today for $35,000. The firm's tax rate is 35%, and the appropriate cost of capital is 16%. 1. If the new flange-flipper is purchased, what is the amount of the initial cash flow at Y ear 0 ? CF0=(120,000 - Purchase of new madrine: 120,000 = - Investment in NIWC: 0 - Net SUCE-old=SVold[(SVoldBVold)t]=35000[.(35000)(.35)] 2. What are the incremental net cash flows that will occur at the end of Years 1 through 5 ? - After-tax change in profit =(4Rev4Cost)(1t) =[(0(30,000)](1.35)= -4 Depreciation = (NewDDepr. - Old Depr.) xt Year Newo Depreciation - Old Deprectation 12345120,000(.3333)=.5,500=(.35)=120,000(.4445)=5,500=(.35)=120,000(.1481)=5500=(.35)=120,000(.0741)=5500=(.35)=0 and depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started