Answered step by step

Verified Expert Solution

Question

1 Approved Answer

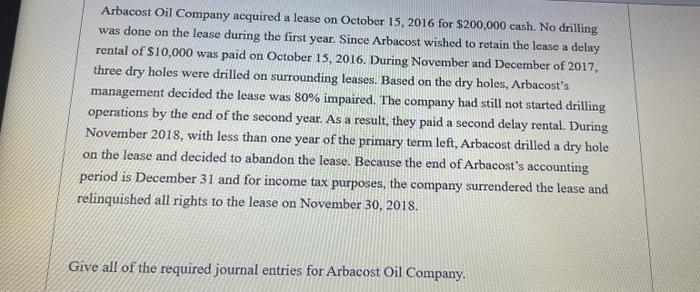

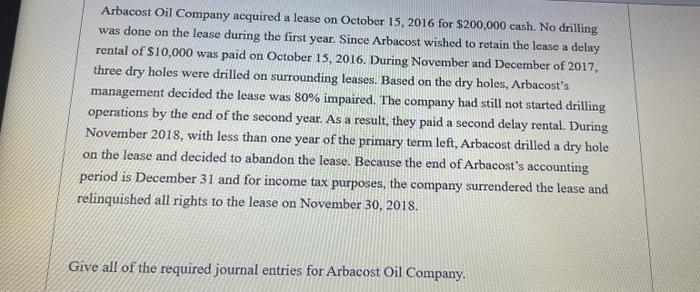

help asp! Arbacost Oil Company acquired a lease on October 15,2016 for $200,000 cash. No drilling was done on the lease during the first year.

help asp!

Arbacost Oil Company acquired a lease on October 15,2016 for $200,000 cash. No drilling was done on the lease during the first year. Since Arbacost wished to retain the lease a delay rental of $10,000 was paid on October 15, 2016. During November and December of 2017 , three dry holes were drilled on surrounding leases. Based on the dry holes, Arbacost's management decided the lease was 80% impaired. The company had still not started drilling operations by the end of the second year. As a result, they paid a second delay rental. During November 2018, with less than one year of the primary term left, Arbacost drilled a dry hole on the lease and decided to abandon the lease. Because the end of Arbacost's accounting period is December 31 and for income tax purposes, the company surrendered the lease and relinquished all rights to the lease on November 30,2018 . Give all of the required journal entries for Arbacost Oil Company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started