Answered step by step

Verified Expert Solution

Question

1 Approved Answer

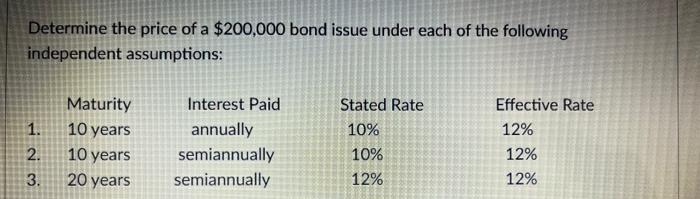

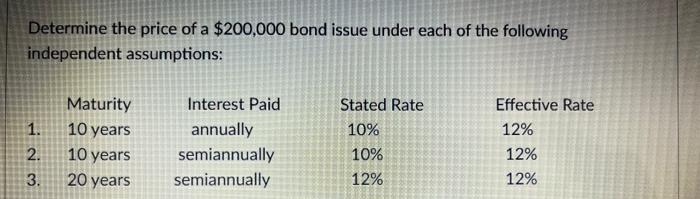

Help ASP! Determine the price of a $200,000 bond issue under each of the following independent assumptions: 1. 2. 3. Maturity 10 years 10 years

Help ASP!

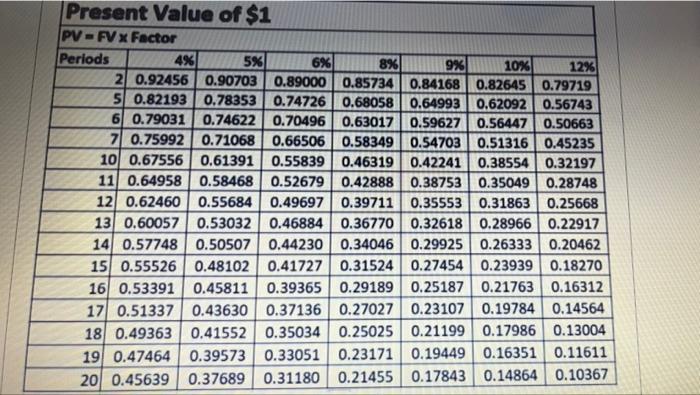

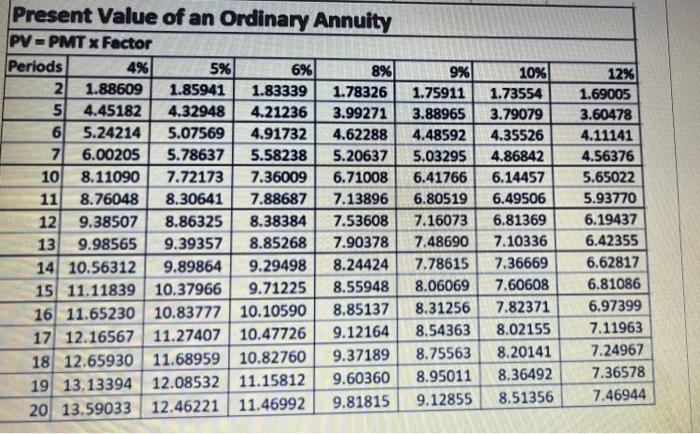

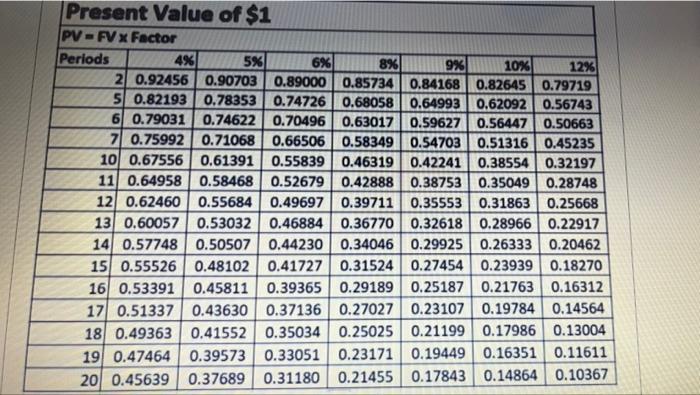

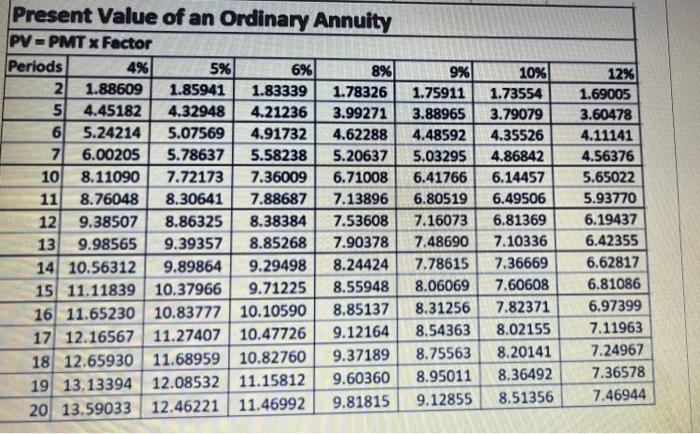

Determine the price of a $200,000 bond issue under each of the following independent assumptions: 1. 2. 3. Maturity 10 years 10 years 20 years Interest Paid annually semiannually semiannually Stated Rate 10% 10% 12% Effective Rate 12% 12% 12% Present Value of $1 PV-FV X Factor Periods 4% 5%) 6% 8% 9% 10% 12% 2 0.92456 0.90703 0.89000 0.85734 0.84168 0.82645 0.79719 5 0.821930.78353 0.74726 0.68058 0.64993 0.62092 0.56743 6 0.79031 0.74622 0.70496 0.63017 0.59627 0.56447 0.50663 71 0.75992 0.71068 0.66506 0.58349 0.54703 0.51316 0.45235 101 0.67556 0.61391 0.55839 0.46319 0.42241 0.38554 0.32197 11 0.64958 0.58468 0.52679 0.42888 0.38753 0.35049 0.28748 12 0.62460 0.55684 0.49697 0.397110.35553 0.31863 0.25668 13 0.60057 0.53032 0.46884 0.36770 0.32618 0.28966 0.22917 14 0.57748 0.50507 0.44230 0.340460.29925 0.26333 0.20462 15 0.55526 0.48102 0.41727 0.31524 0.27454 0.23939 0.18270 16 0.53391 0.45811 0.39365 0.291890.25187 0.21763 0.16312 17 0.51337 0.43630 0.37136 0.27027 0.231070.19784 0.14564 18 0.49363 0.41552 0.35034 0.25025 0.21199 0.17986 0.13004 19 0.47464 0.39573 0.33051 0.23171 0.19449 0.16351 0.11611 20 0.45639 0.37689 0.31180 0.21455 0.17843 0.14864 0.10367 Present Value of an Ordinary Annuity PV = PMT X Factor Periods 4% 5% 6% 8% 2 1.88609 1.85941 1.83339 1.78326 5 4.45182 4.32948 4.21236 3.99271 6 5.24214 5.07569 4.91732 4.62288 7 6.00205 5.78637 5.58238 5.20637 10 8.11090 7.72173 7.36009 6.71008 11 8.76048 8.30641 7.88687 7.13896 12 9.38507 8.86325 8.38384 7.53608 13 9.98565 9.39357 8.85268 7.90378 14 10.56312 9.89864 9.29498 8.24424 15 11.11839 10.37966 9.71225 8.55948 16 11.65230 10.83777 10.10590 8.85137 17 12.16567 11.27407 10.47726 9.12164 18 12.65930 11.68959 10.82760 9.37189 19 13.13394 12.08532 11.15812 9.60360 20 13.59033 12.46221 11.46992 9.81815 9% 1.75911 3.88965 4.48592 5.03295 6.41766 6.80519 7.16073 7.48690 7.78615 8.06069 8.31256 8.54363 8.75563 8.95011 9.12855 10% 1.73554 3.79079 4.35526 4.86842 6.14457 6.49506 6.81369 7.10336 7.36669 7.60608 7.82371 8.02155 8.20141 8.36492 8.51356 12% 1.69005 3.60478 4.11141 4.56376 5.65022 5.93770 6.19437 6.42355 6.62817 6.81086 6.97399 7.11963 7.24967 7.36578 7.46944

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started