help

help

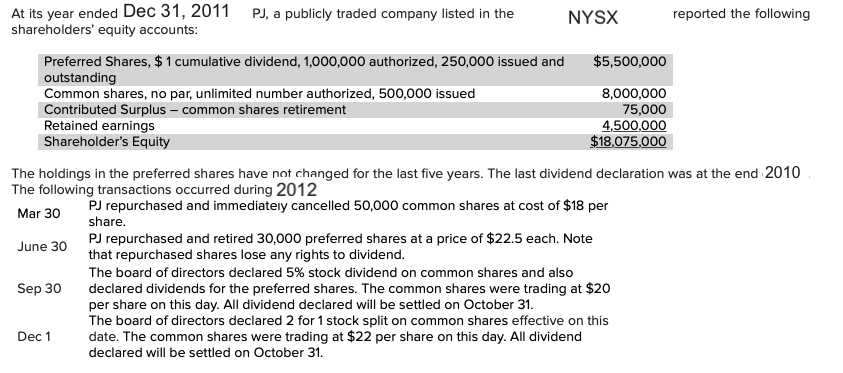

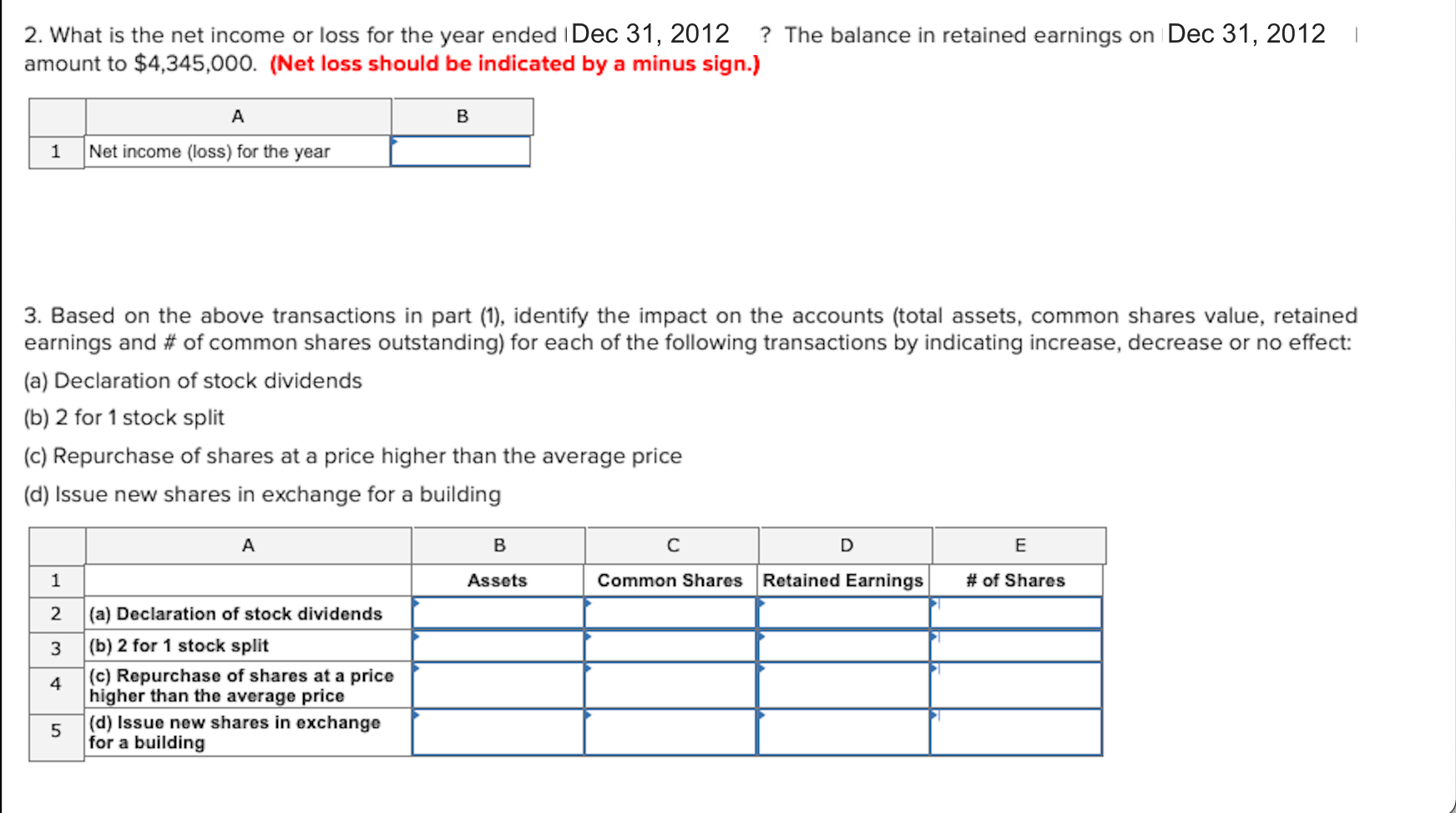

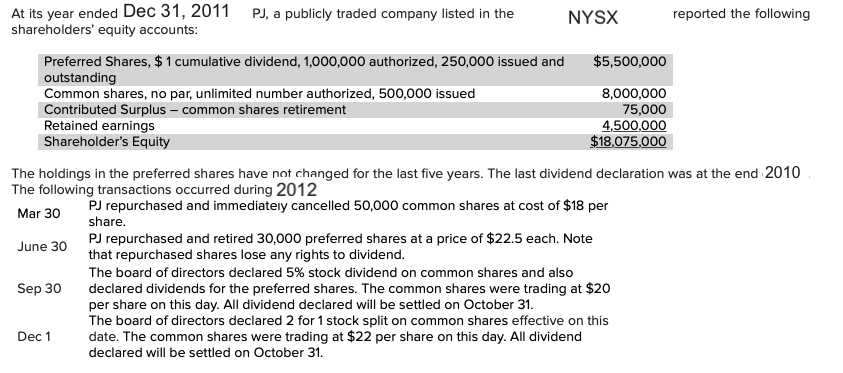

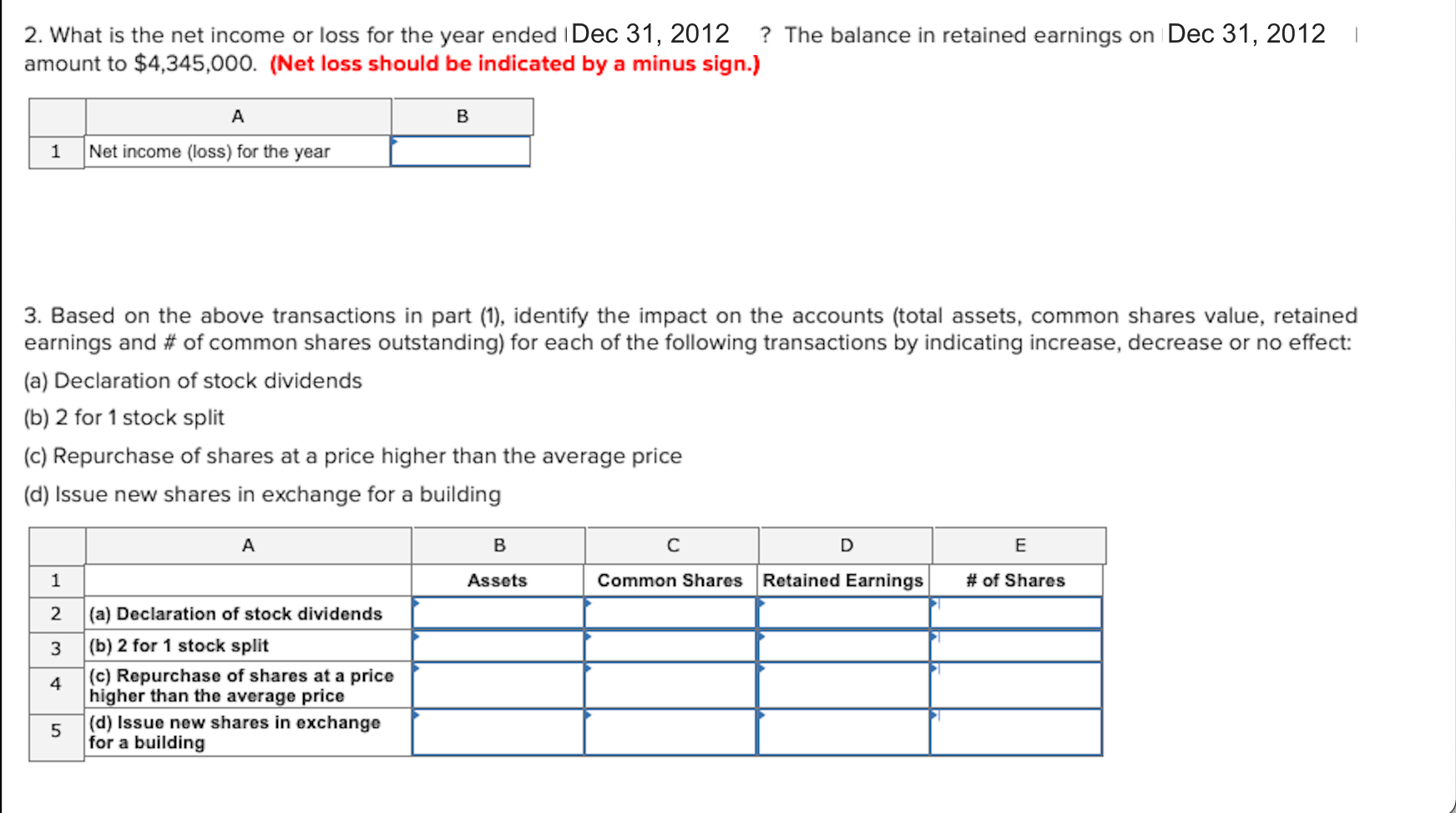

At its year ended Dec 31, 2011 PJ, a publicly traded company listed in the NYSX reported the following shareholders' equity accounts: Preferred Shares, $ 1 cumulative dividend, 1,000,000 authorized, 250,000 issued and $5,500,000 outstanding Common shares, no par, unlimited number authorized, 500,000 issued 8,000,000 Contributed Surplus - common shares retirement 75,000 Retained earnings 4,500,000 Shareholder's Equity $18,075,000 The holdings in the preferred shares have not changed for the last five years. The last dividend declaration was at the end 2010 The following transactions occurred during 2012 Mar 30 PJ repurchased and immediately cancelled 50,000 common shares at cost of $18 per share. June 30 PJ repurchased and retired 30,000 preferred shares at a price of $22.5 each. Note that repurchased shares lose any rights to dividend. The board of directors declared 5% stock dividend on common shares and also Sep 30 declared dividends for the preferred shares. The common shares were trading at $20 per share on this day. All dividend declared will be settled on October 31. The board of directors declared 2 for 1 stock split on common shares effective on this Dec 1 date. The common shares were trading at $22 per share on this day. All dividend declared will be settled on October 31. 2. What is the net income or loss for the year ended Dec 31, 2012 ? The balance in retained earnings on Dec 31, 2012 amount to $4,345,000. (Net loss should be indicated by a minus sign.) A B 1 Net income (loss) for the year 3. Based on the above transactions in part (1), identify the impact on the accounts (total assets, common shares value, retained earnings and # of common shares outstanding) for each of the following transactions by indicating increase, decrease or no effect: (a) Declaration of stock dividends (b) 2 for 1 stock split (c) Repurchase of shares at a price higher than the average price (d) Issue new shares in exchange for a building B D E 1 Assets Common Shares Retained Earnings # of Shares 2 3 PI 4 (a) Declaration of stock dividends (b) 2 for 1 stock split (c) Repurchase of shares at a price higher than the average price (d) Issue new shares in exchange for a building 5

help

help