help

help

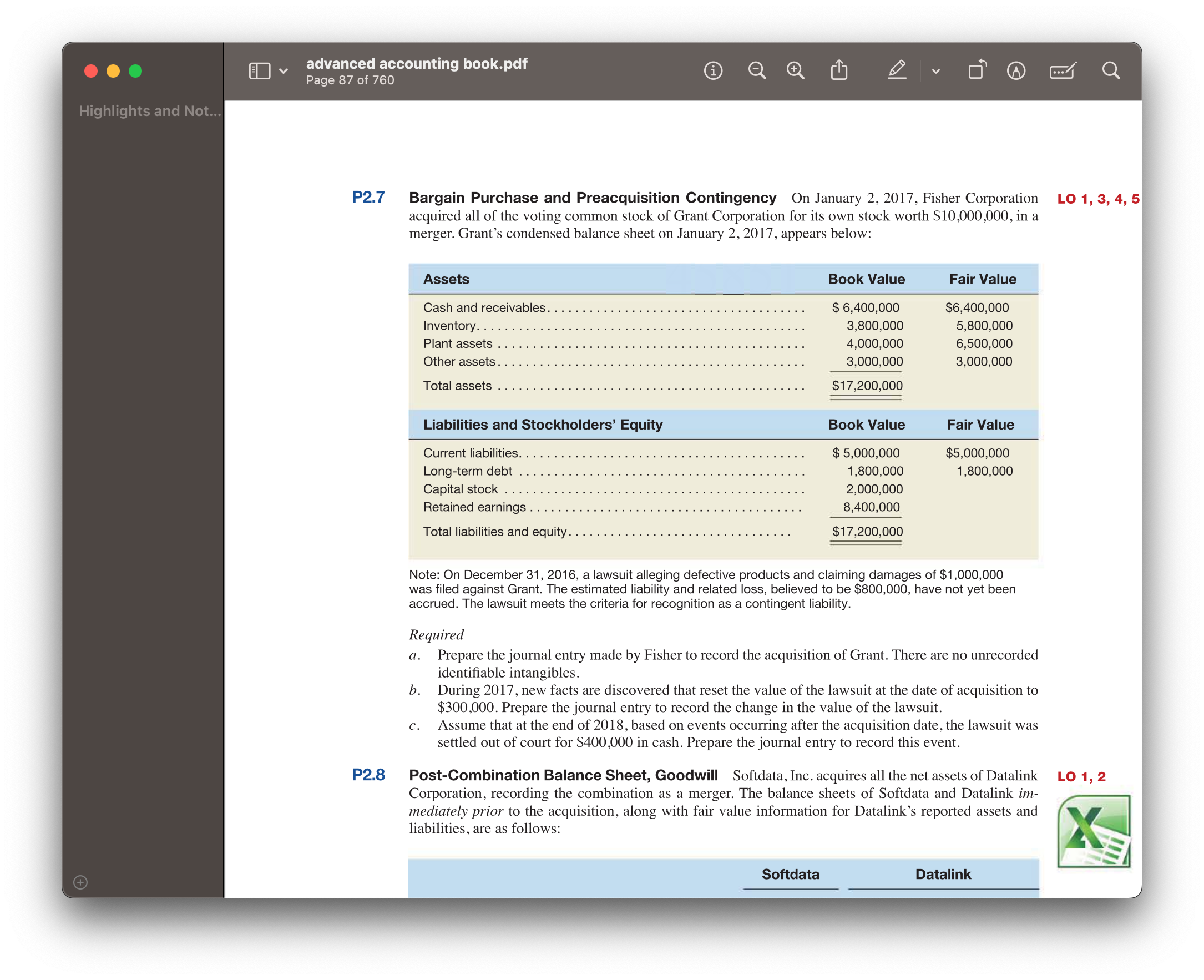

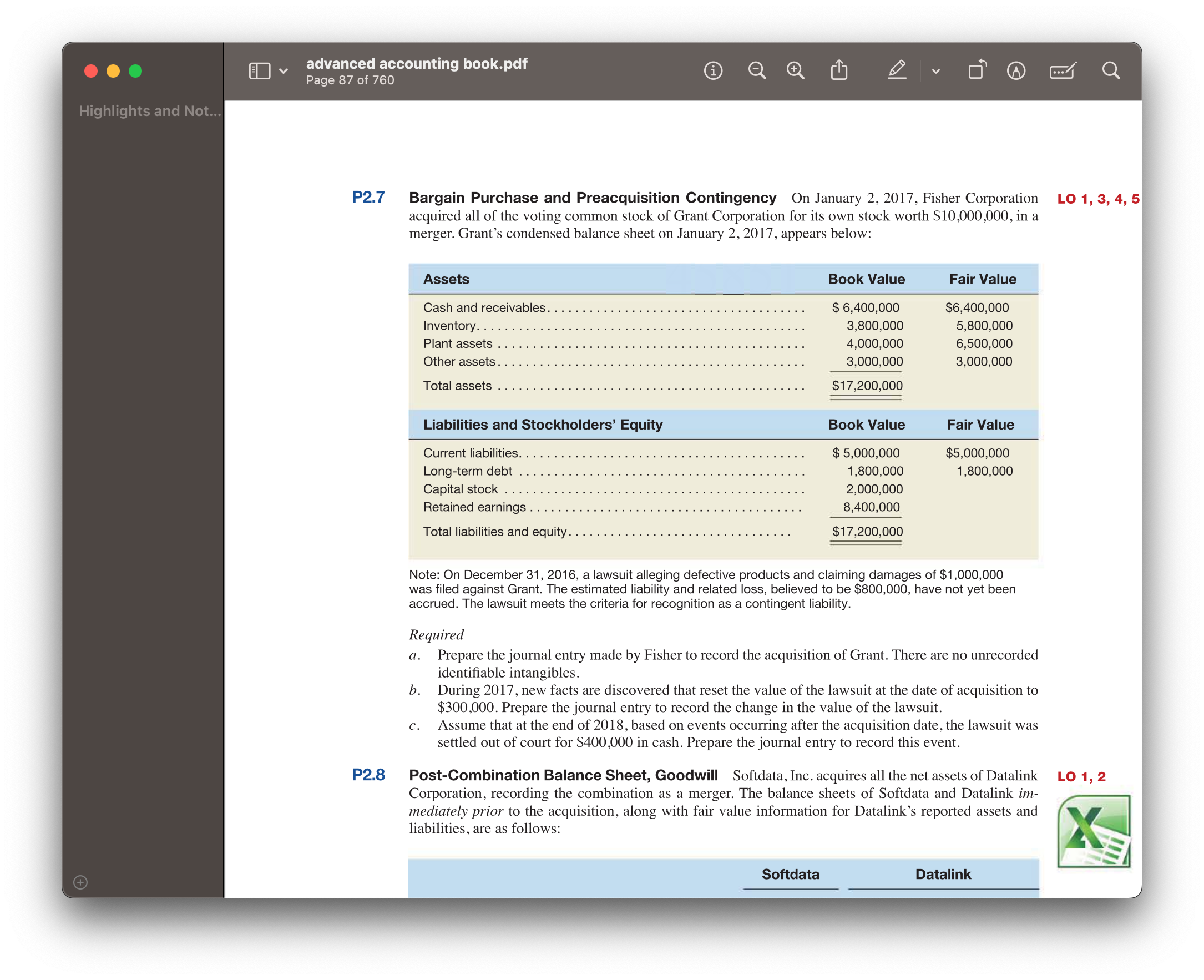

Bargain Purchase and Preacquisition Contingency On January 2, 2017, Fisher Corporation LO 1 acquired all of the voting common stock of Grant Corporation for its own stock worth $10,000,000, in a merger. Grant's condensed balance sheet on January 2, 2017, appears below: Note: On December 31, 2016, a lawsuit alleging defective products and claiming damages of $1,000,000 was filed against Grant. The estimated liability and related loss, believed to be $800,000, have not yet been accrued. The lawsuit meets the criteria for recognition as a contingent liability. Required a. Prepare the journal entry made by Fisher to record the acquisition of Grant. There are no unrecorded identifiable intangibles. b. During 2017, new facts are discovered that reset the value of the lawsuit at the date of acquisition to $300,000. Prepare the journal entry to record the change in the value of the lawsuit. c. Assume that at the end of 2018 , based on events occurring after the acquisition date, the lawsuit was settled out of court for $400,000 in cash. Prepare the journal entry to record this event. Post-Combination Balance Sheet, Goodwill Softdata, Inc. acquires all the net assets of Datalink LO 1 Corporation, recording the combination as a merger. The balance sheets of Softdata and Datalink immediately prior to the acquisition, along with fair value information for Datalink's reported assets and liabilities, are as follows: Bargain Purchase and Preacquisition Contingency On January 2, 2017, Fisher Corporation LO 1 acquired all of the voting common stock of Grant Corporation for its own stock worth $10,000,000, in a merger. Grant's condensed balance sheet on January 2, 2017, appears below: Note: On December 31, 2016, a lawsuit alleging defective products and claiming damages of $1,000,000 was filed against Grant. The estimated liability and related loss, believed to be $800,000, have not yet been accrued. The lawsuit meets the criteria for recognition as a contingent liability. Required a. Prepare the journal entry made by Fisher to record the acquisition of Grant. There are no unrecorded identifiable intangibles. b. During 2017, new facts are discovered that reset the value of the lawsuit at the date of acquisition to $300,000. Prepare the journal entry to record the change in the value of the lawsuit. c. Assume that at the end of 2018 , based on events occurring after the acquisition date, the lawsuit was settled out of court for $400,000 in cash. Prepare the journal entry to record this event. Post-Combination Balance Sheet, Goodwill Softdata, Inc. acquires all the net assets of Datalink LO 1 Corporation, recording the combination as a merger. The balance sheets of Softdata and Datalink immediately prior to the acquisition, along with fair value information for Datalink's reported assets and liabilities, are as follows

help

help