Answered step by step

Verified Expert Solution

Question

1 Approved Answer

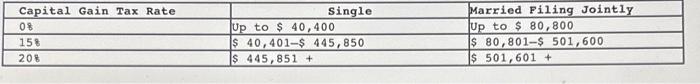

help begin{tabular}{|l|l|l|} hline Capital Gain Tax Rate & multicolumn{1}{|c|}{ Single } & Married Filing Jointly hline 08 & Up to $40,400 & Up to

help

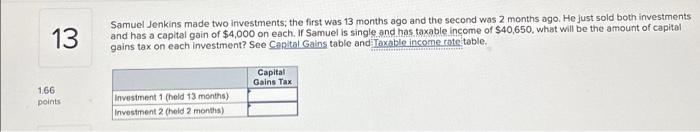

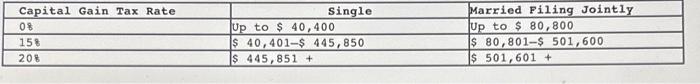

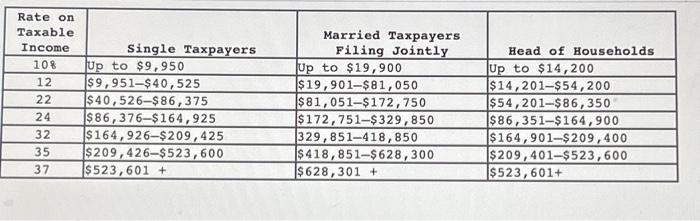

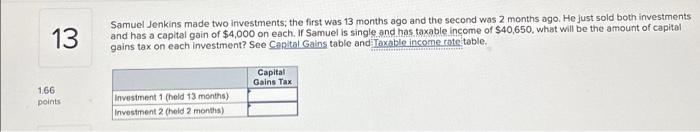

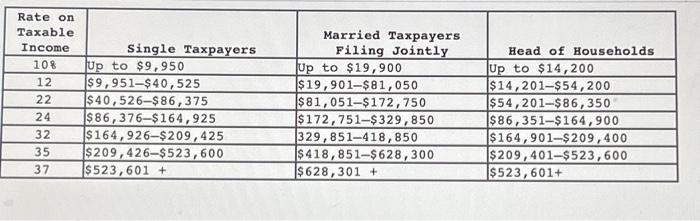

\begin{tabular}{|l|l|l|} \hline Capital Gain Tax Rate & \multicolumn{1}{|c|}{ Single } & Married Filing Jointly \\ \hline 08 & Up to $40,400 & Up to $80,800 \\ \hline 158 & $40,401$445,850 & $80,801$501,600 \\ \hline 208 & $445,851+ & $501,601+ \\ \hline \end{tabular} \begin{tabular}{|c|l|l|l|} \hline RateonTaxableIncome & \multicolumn{1}{|c|}{ Single Taxpayers } & \multicolumn{1}{|c|}{MarriedTaxpayersFilingJointly} & \multicolumn{1}{|c|}{ Head of Households } \\ \hline 108 & Up to $9,950 & Up to $19,900 & Up to $14,200 \\ \hline 12 & $9,951$40,525 & $19,901$81,050 & $14,201$54,200 \\ \hline 22 & $40,526$86,375 & $81,051$172,750 & $54,201$86,350 \\ \hline 24 & $86,376$164,925 & $172,751$329,850 & $86,351$164,900 \\ \hline 32 & $164,926$209,425 & 329,851418,850 & $164,901$209,400 \\ \hline 35 & $209,426$523,600 & $418,851$628,300 & $209,401$523,600 \\ \hline 37 & $523,601+ & $628,301+ & $523,601+ \\ \hline \end{tabular} Samuel Jenkins made two investments; the first was 13 months ago and the second was 2 months ago. He just sold both investments and has a capital gain of $4,000 on each. If Samuel is single and has taxable income of $40,650, what will be the amount of capital gains tax on each investment? See Capital Gains table and Iaxable income rate table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started