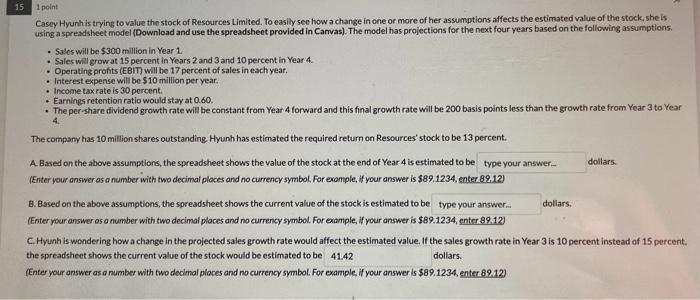

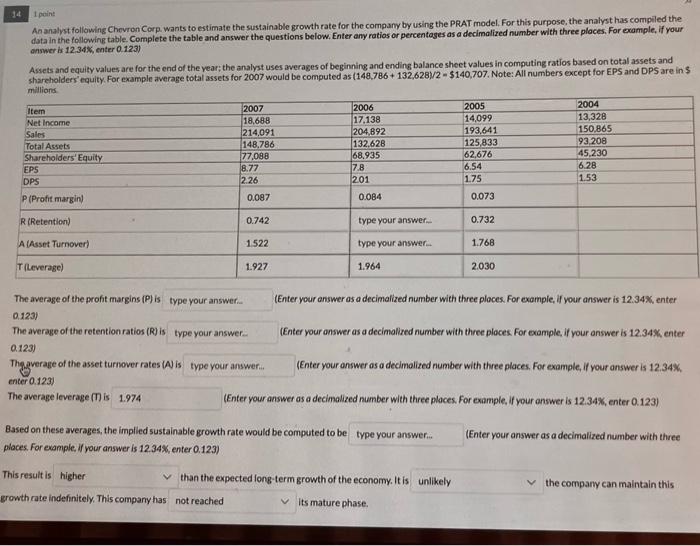

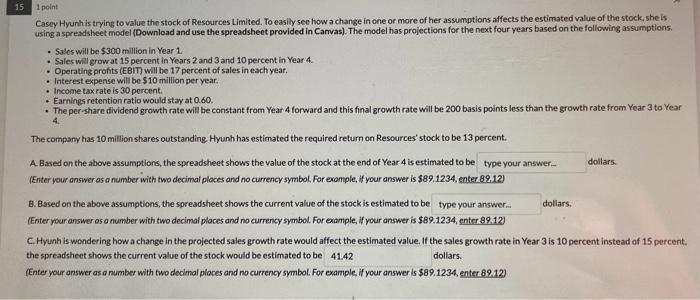

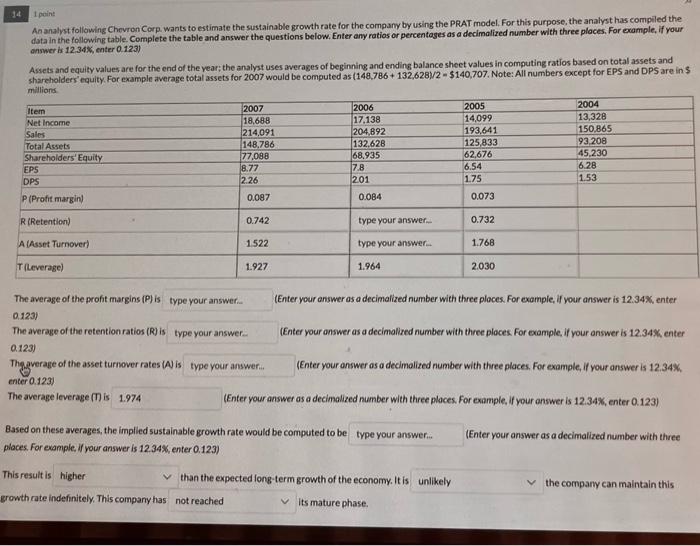

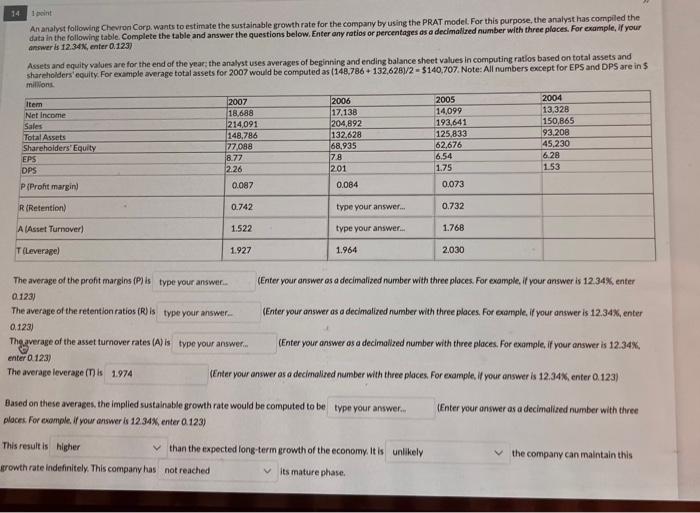

Casey Hyunh is trying to value the stock of Resources Limited. To easily see how a change in one of more of her assumptions affects the estimated value of the stock, she is using a spreadsheet model (Download and use the spreadsheet provided in Canvas). The model has projections for the next four years based on the fallowing assumptions. - Salos will be $300 million in Year 1 . - Saleswill grow at 15 percent in Years 2 and 3 and 10 percent in Year 4. - Operating profits (EBIT) will be 17 percent of sales in each year. - Interest expense will be $10 million per year. - Income tax rate is 30 percent. - Earnings retention ratio would stay at 0.60. - The per-share dividend growth rate will be constant from Year 4 forward and this final growth rate will be 200 basis points less than the growth rate from Year 3 to Year 4. The company has 10 million shares outstanding. Hyunh has estimated the required return on Resources' stock to be 13 percent. A. Based on the above assumptions, the spreadsheet shows the value of the stock at the end of Year 4 is estimated to be (Enter your answer as a number with two decimal places and no currency symbol, For example, if your answer is $89.1234, enter 89.12 ) B. Based on the above assumptions, the spreadsheet shows the current value of the stock is estimated to be dollars. (Enter your answer os a number with two decimal places and no currency symbol. For example, if your answer is $89.1234, enter 89.12) C. Hyunh is wondering how a change in the projected sales growth rate would affect the estimated value. If the sales growth rate in Year 3 is 10 percent instead of 15 percent. the spreadsheet shows the current value of the stock would be estimated to be dollars. (Enter your answer as a number with two decimal ploces and no currency symbol. For example. if your answer is $89,1234, enter. 89.12] An analyst following Chevron Corp. wants to estimate the sustainable growth rate for the company by using the PRAT model. For this purpose, the analyst has compied the data in the following table. Complete the table and answer the questions below. Enter any ratios or percentages as a decimalized number with three places. For ovample, if your onwer is 12.34x, enter 0.123 ) Assets and equity values are for the end of the year; the analyst uses averages of beginning and ending balance sheet values in computing ratios based on total assets and shareholders' equity. For example average total assets for 2007 would be computed as (148,786+132,628)/2=$140,707. Note: All numbers except for EPS and DPS are in $ millions Based on these averages, the implied sustainable growth rate would be computed to be IEnter your answer as a decimalized number with three places. For example, if your answer is 12.34\%, enter 0.123 ) This result is than the expected long-term growth of the economy. It is the company can malntain this rowth rate indefinitely. This company has Its mature phase. An analyst following Chevron Corp. wants to estimate the sustainable growth rate for the company by using the PRAT model. For this purpose, the analyst has compiled the data in the following table. Complete the table and answer the questions below, Enter any ratios or percentages as a decimallzed number with three ploces. For example, If your answer is 12.34N, enter 0.1237 Assets and equity values are for the end of the year; the analyst uses averages of beginning and ending balance sheet values in computing ratios based on total assets and shareholders ecuity. For example average total assets for 2007 would be computed as (148,786+132,628)/2=$140,707. Note: All numbers except for EPS and DPS are in $ millions