Answered step by step

Verified Expert Solution

Question

1 Approved Answer

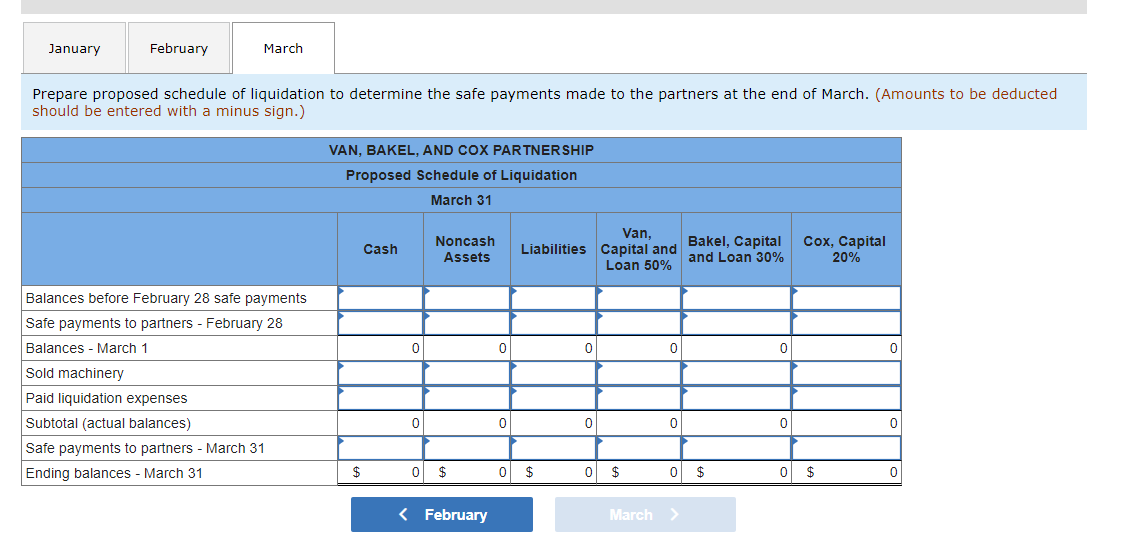

Help Complete this question by entering your answers in the tabs below. January February March Prepare proposed schedule of liquidation to determine the safe payments

Help

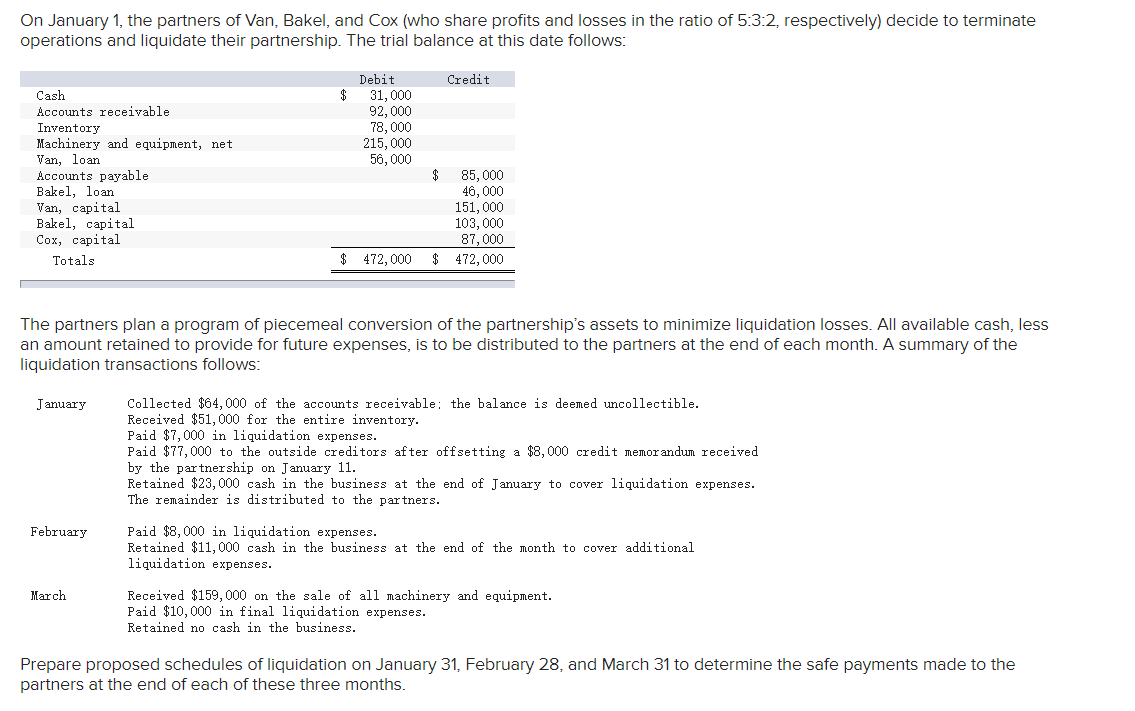

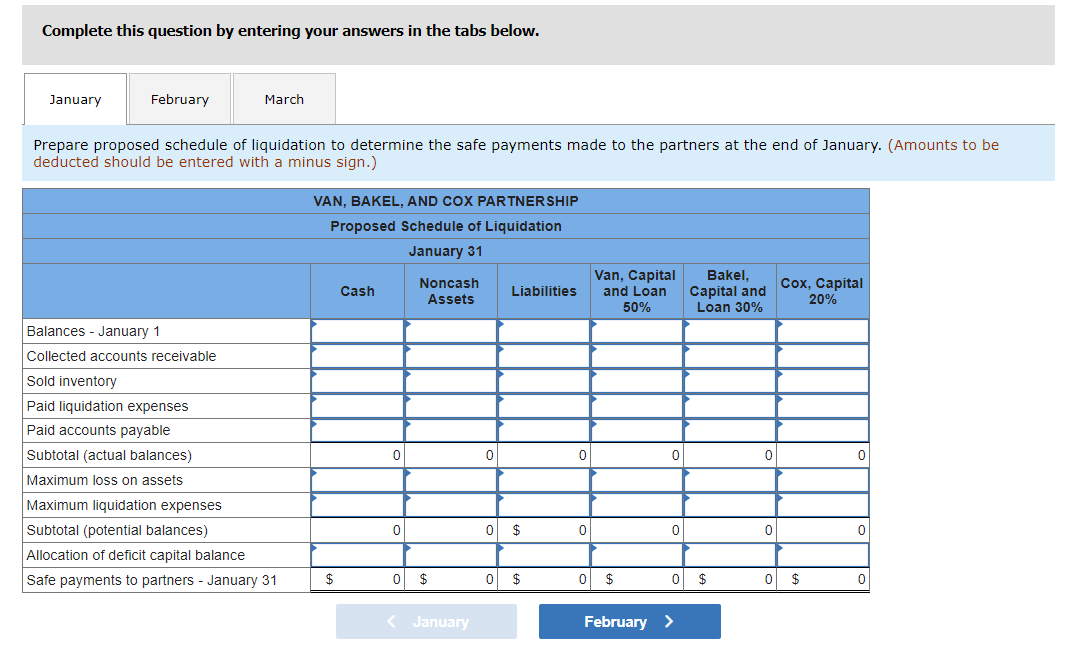

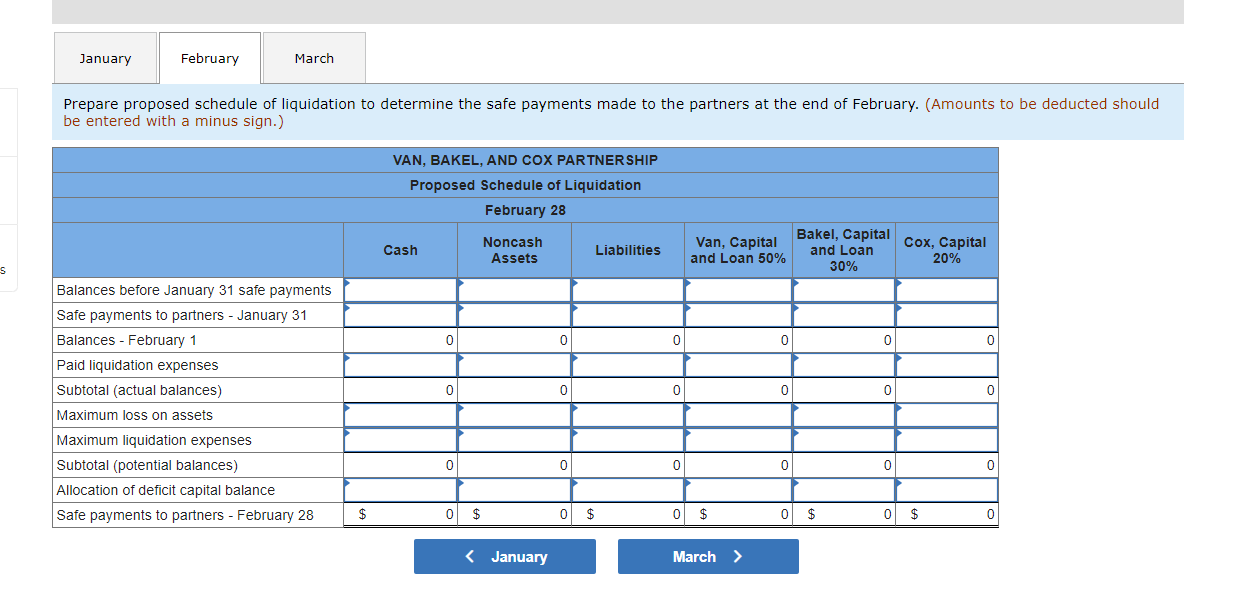

Complete this question by entering your answers in the tabs below. January February March Prepare proposed schedule of liquidation to determine the safe payments made to the partners at the end of January. (Amounts to be deducted should be entered with a minus sign.) VAN, BAKEL, AND COX PARTNERSHIP Proposed Schedule of Liquidation January 31 Cash Noncash Assets Liabilities Van, Capital and Loan 50% Bakel, Capital and Loan 30% Cox, Capital 20% Balances - January 1 Collected accounts receivable Sold inventory 0 0 0 0 0 0 Paid liquidation expenses Paid accounts payable Subtotal (actual balances) Maximum loss on assets Maximum liquidation expenses Subtotal (potential balances) Allocation of deficit capital balance Safe payments to partners - January 31 0 0 $ 0 0 0 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 January February > January February March Prepare proposed schedule of liquidation to determine the safe payments made to the partners at the end of February. (Amounts to be deducted should be entered with a minus sign.) VAN, BAKEL, AND COX PARTNERSHIP Proposed Schedule of Liquidation February 28 Bakel, Capital Cox, Capital Cash Noncash Assets Liabilities Van, Capital and Loan 50% and Loan 30% 20% s 0 0 0 0 0 0 0 0 0 0 0 0 Balances before January 31 safe payments Safe payments to partners - January 31 Balances - February 1 Paid liquidation expenses Subtotal (actual balances) Maximum loss on assets Maximum liquidation expenses Subtotal (potential balances) Allocation of deficit capital balance Safe payments to partners - February 28 0 0 0 0 0 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 January February March Prepare proposed schedule of liquidation to determine the safe payments made to the partners at the end of March. (Amounts to be deducted should be entered with a minus sign.) VAN, BAKEL, AND COX PARTNERSHIP Proposed Schedule of Liquidation March 31 Cash Noncash Assets Van, Liabilities Capital and and Loan 30% Bakel, Capital Loan 50% Cox, Capital 20% 0 0 0 0 0 0 Balances before February 28 safe payments Safe payments to partners - February 28 Balances - March 1 Sold machinery Paid liquidation expenses Subtotal (actual balances) Safe payments to partners - March 31 Ending balances - March 31 0 0 0 0 0 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 January February March Prepare proposed schedule of liquidation to determine the safe payments made to the partners at the end of February. (Amounts to be deducted should be entered with a minus sign.) VAN, BAKEL, AND COX PARTNERSHIP Proposed Schedule of Liquidation February 28 Bakel, Capital Cox, Capital Cash Noncash Assets Liabilities Van, Capital and Loan 50% and Loan 30% 20% s 0 0 0 0 0 0 0 0 0 0 0 0 Balances before January 31 safe payments Safe payments to partners - January 31 Balances - February 1 Paid liquidation expenses Subtotal (actual balances) Maximum loss on assets Maximum liquidation expenses Subtotal (potential balances) Allocation of deficit capital balance Safe payments to partners - February 28 0 0 0 0 0 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 January February March Prepare proposed schedule of liquidation to determine the safe payments made to the partners at the end of March. (Amounts to be deducted should be entered with a minus sign.) VAN, BAKEL, AND COX PARTNERSHIP Proposed Schedule of Liquidation March 31 Cash Noncash Assets Van, Liabilities Capital and and Loan 30% Bakel, Capital Loan 50% Cox, Capital 20% 0 0 0 0 0 0 Balances before February 28 safe payments Safe payments to partners - February 28 Balances - March 1 Sold machinery Paid liquidation expenses Subtotal (actual balances) Safe payments to partners - March 31 Ending balances - March 31 0 0 0 0 0 0 $ 0 $ 0 $ 0 $ 0 $ 0 $ 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started