Answered step by step

Verified Expert Solution

Question

1 Approved Answer

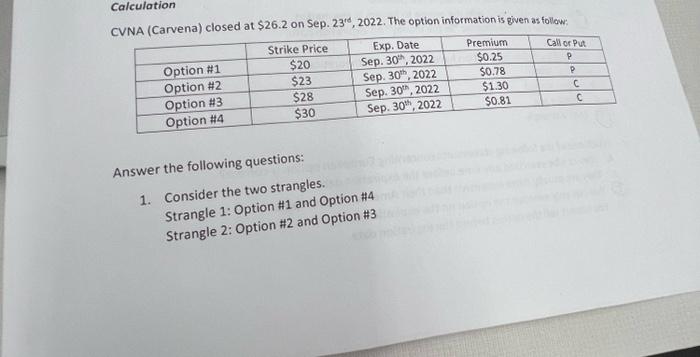

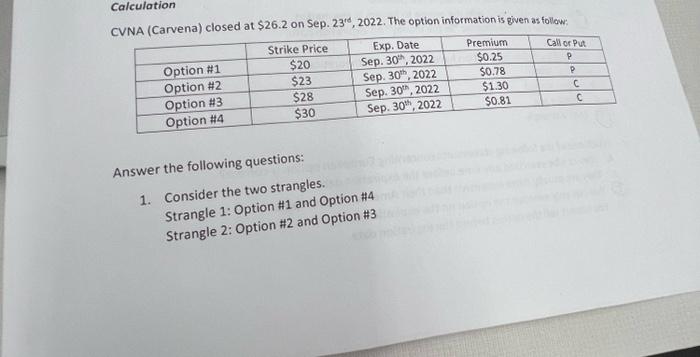

help CVAiA Irarvenal closed at $26.2 on Sep. 2316,2022. The option information is given as follow: Answer the following questions: 1. Consider the two strangles.

help

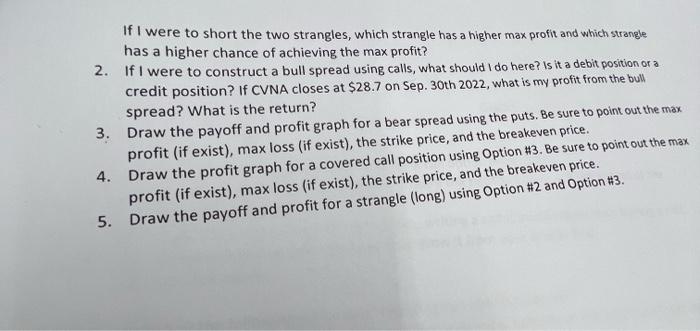

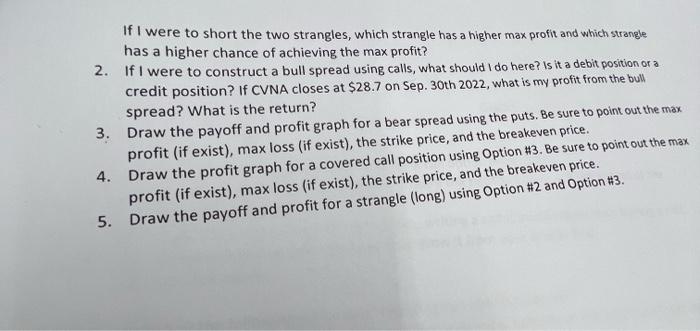

CVAiA Irarvenal closed at $26.2 on Sep. 2316,2022. The option information is given as follow: Answer the following questions: 1. Consider the two strangles. Strangle 1: Option #1 and Option #4 Strangle 2: Option #2 and Option #3 If I were to short the two strangles, which strangle has a higher max profit and which strangle has a higher chance of achieving the max profit? 2. If I were to construct a bull spread using calls, what should I do here? Is it a debit position or a credit position? If CVNA closes at $28.7 on Sep. 30th 2022 , what is my profit from the bull spread? What is the return? 3. Draw the payoff and profit graph for a bear spread using the puts. Be sure to point out the max profit (if exist), max loss (if exist), the strike price, and the breakeven price. 4. Draw the profit graph for a covered call position using Option #3. Be sure to point out the max profit (if exist), max loss (if exist), the strike price, and the breakeven price. 5. Draw the payoff and profit for a strangle (long) using Option #2 and Option #3. CVAiA Irarvenal closed at $26.2 on Sep. 2316,2022. The option information is given as follow: Answer the following questions: 1. Consider the two strangles. Strangle 1: Option #1 and Option #4 Strangle 2: Option #2 and Option #3 If I were to short the two strangles, which strangle has a higher max profit and which strangle has a higher chance of achieving the max profit? 2. If I were to construct a bull spread using calls, what should I do here? Is it a debit position or a credit position? If CVNA closes at $28.7 on Sep. 30th 2022 , what is my profit from the bull spread? What is the return? 3. Draw the payoff and profit graph for a bear spread using the puts. Be sure to point out the max profit (if exist), max loss (if exist), the strike price, and the breakeven price. 4. Draw the profit graph for a covered call position using Option #3. Be sure to point out the max profit (if exist), max loss (if exist), the strike price, and the breakeven price. 5. Draw the payoff and profit for a strangle (long) using Option #2 and Option #3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started