Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help :D Absorption and Variable Costing Income Statements for the Months and Analysis During the first month of operations ended July 31, Head Gear Inc.

help :D

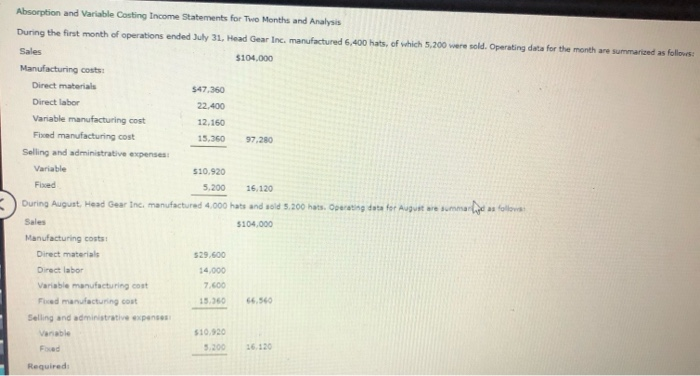

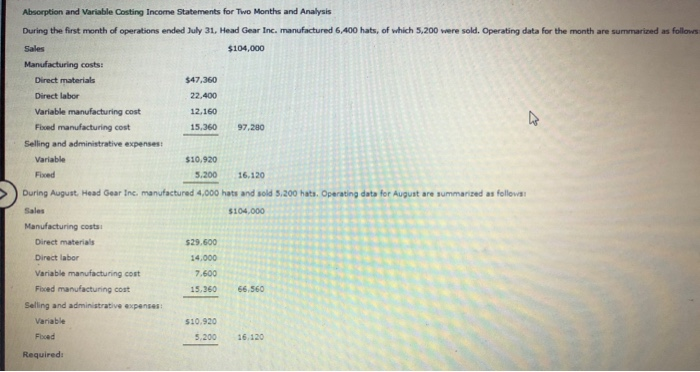

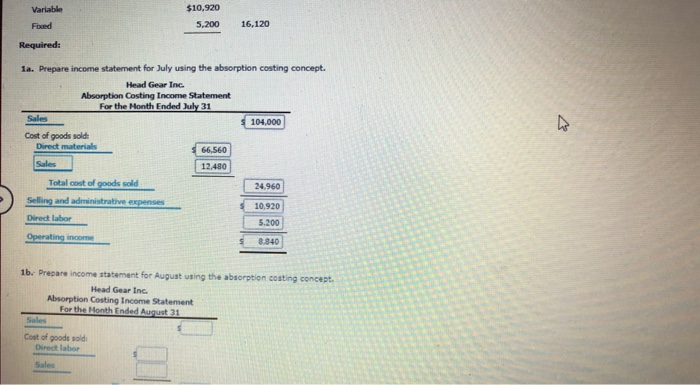

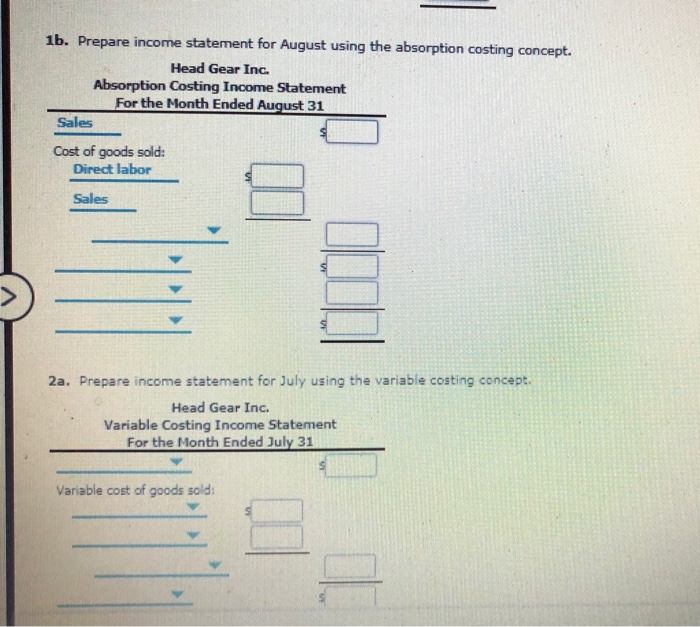

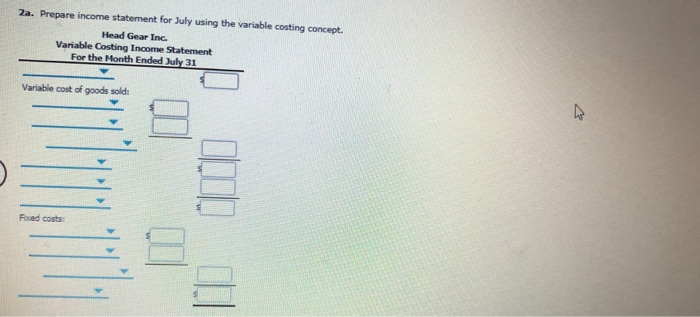

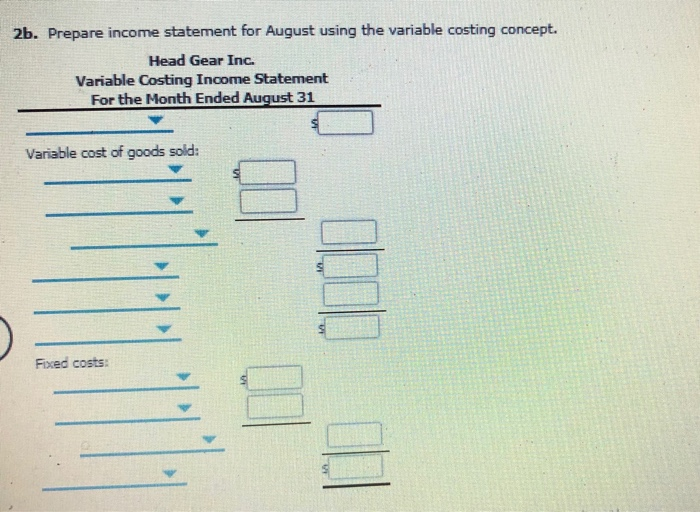

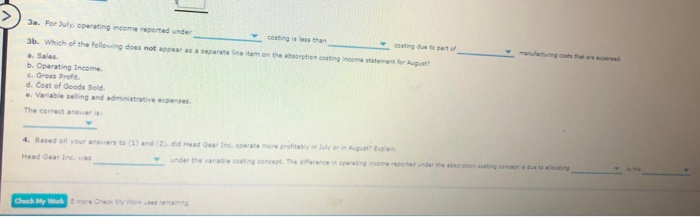

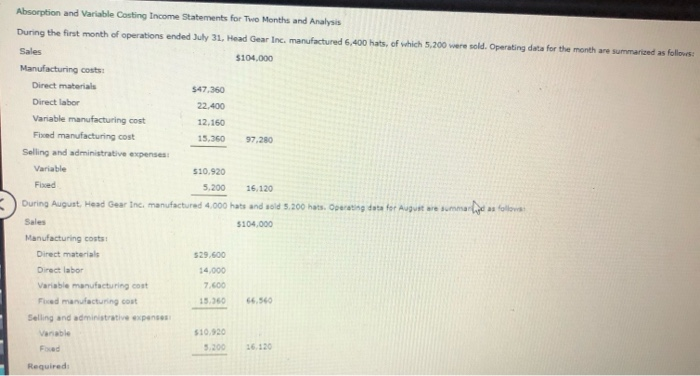

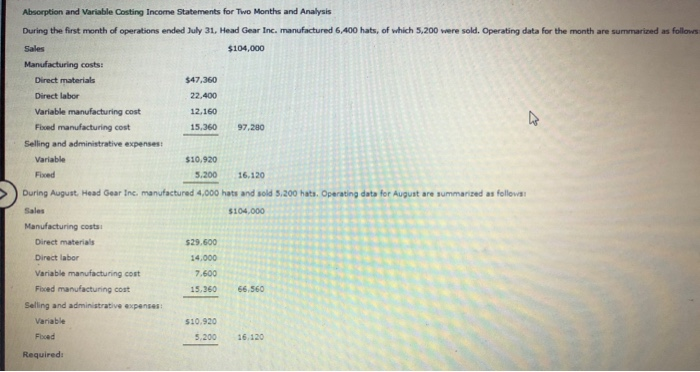

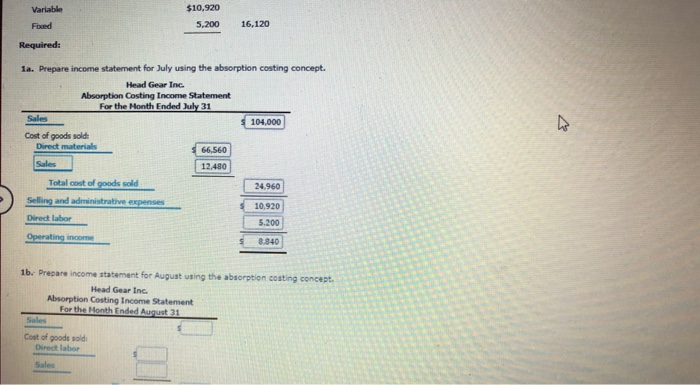

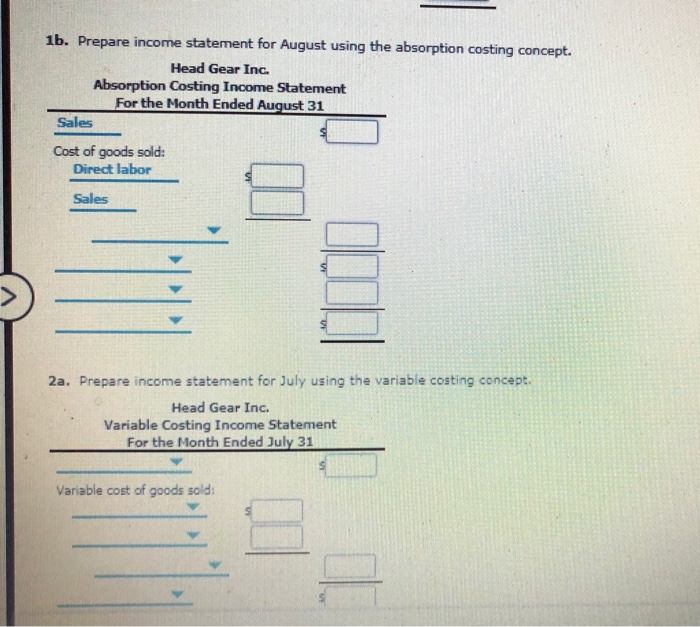

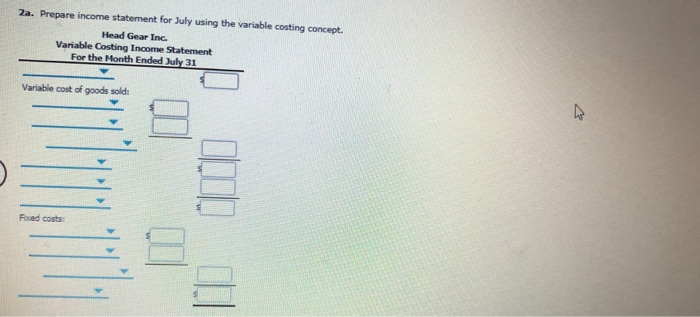

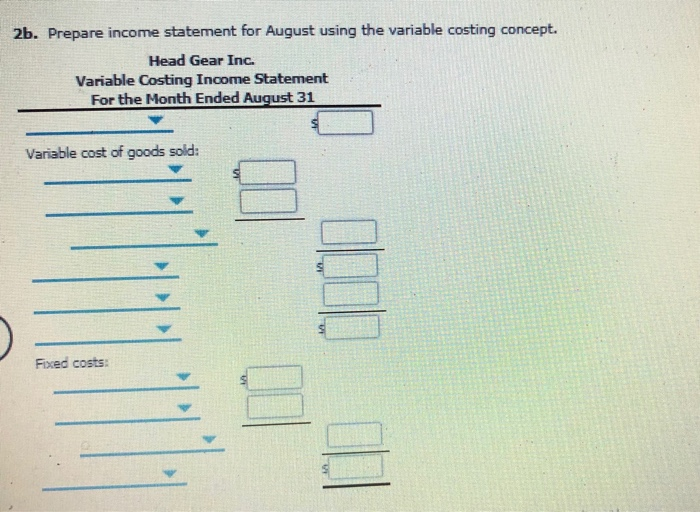

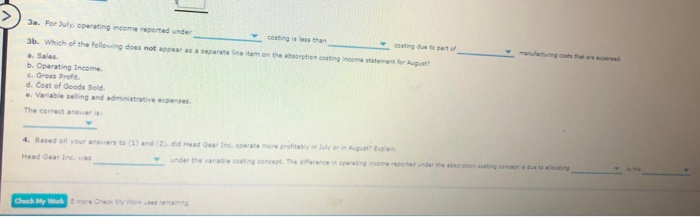

Absorption and Variable Costing Income Statements for the Months and Analysis During the first month of operations ended July 31, Head Gear Inc. manufactured 6.400 hats, of which 5,200 were sold. Operating data for the month are summarized as follows: Sales $104.000 Manufacturing costs Direct materials 547,360 Direct labor 22.400 Variable manufacturing cost 12.160 Fixed manufacturing cost 15.360 97.280 Selling and administrative expenses Variable $10.920 Fored 5.200 16.120 During August, Head Gear Inc, manufactured 4,000 hats and sold 5.200 hats. Operating data for August are summare as follower Sales 5104,000 Manufacturing costs Direct materials 529.600 Direct labor 14,000 Variable manufacturing cost 7.600 Fred manufacturing cout 15.360 66.560 Selling and administrative expenses Variable $10.920 Fixed 5.200 16120 Required Absorption and Variable Costing Income Statements for Two Months and Analysis During the first month of operations ended July 31, Head Gear Inc. manufactured 6,400 hats, of which 5,200 were sold. Operating data for the month are summarized as follows Sales $104,000 Manufacturing costs: Direct materials $47,360 Direct labor 22,400 Variable manufacturing cost 12,160 Fixed manufacturing cost 15,360 97.280 Selling and administrative expenses: Variable $10.920 Fixed 5.200 16.120 During August Head Gear Inc. manufactured 4,000 hats and sold 5,200 hats. Operating data for August are summarized as follows: Sales $104.000 Manufacturing costs Direct materials $29.600 Direct labor 14.000 Variable manufacturing cost 7.600 Forced manufacturing cost 15,360 66,560 Selling and administrative expenses: Variable 510.920 Forced 5.200 16.120 Required: Variable $10.920 5,200 Fored 16,120 Required: 1a. Prepare income statement for July using the absorption costing concept. Head Gear Inc Absorption Costing Income Statement For the Month Ended July 31 Sales 104,000 Cost of goods solde Direct materials 66,560 Sales 12480 Total cost of goods sold 24.960 Selling and administrative expenses 10.920 Direct labor 5.200 Operating income 8.840 1b. Prepare income statement for August using the absorption costing concept Head Gear Inc. Absorption Costing Income Statement For the Month Ended August 31 Sales Cost of goods sold Direct labor Sales 1b. Prepare income statement for August using the absorption costing concept. Head Gear Inc. Absorption Costing Income Statement For the Month Ended August 31 Sales Cost of goods sold: Direct labor Sales 2a. Prepare income statement for July using the variable costing concept. Head Gear Inc. Variable Costing Income Statement For the Month Ended July 31 Variable cost of goods sold: 2a. Prepare income statement for July using the variable costing concept. Head Gear Inc Variable Costing Income Statement For the Month Ended July 31 Variable cost of goods sold: Foxed costs 2b. Prepare income statement for August using the variable costing concept. Head Gear Inc. Variable Costing Income Statement For the Month Ended August 31 Variable cost of goods sold: Fixed costs: Ja. For July. perting comported under coating due to part of 3b. Which of the following does not per separateline on the brorption conting income statement for lupat a. Sales b. Operating Income c. Gross Profit d. Cost of Goods Sold .. Variable selling and diverse The correcta 4. Based on your answers to (1) and (2) did Head Gear Inc. water profitably July or in Austin under the variable con concept the recented under the word Check My Wank more CW

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started