Question: Help! Describe what happens to future value when a. The interest rate increases b. The number of compounding periods increases C. The amount of time

Help!

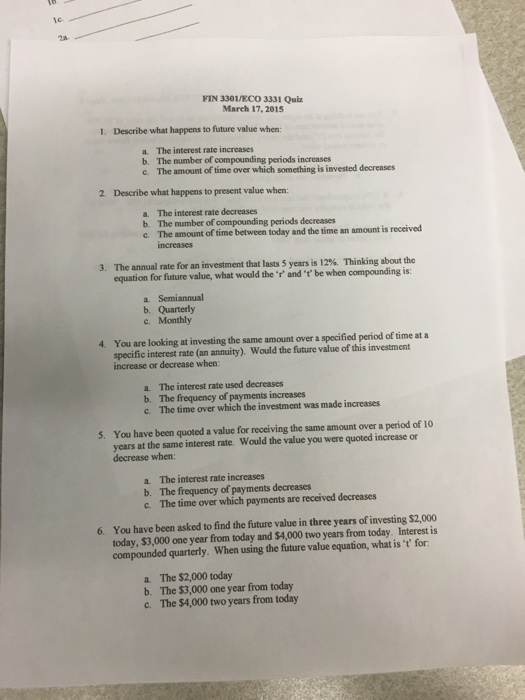

Help!Describe what happens to future value when a. The interest rate increases b. The number of compounding periods increases C. The amount of time over which something is invested decreases 2. Describe what happens to present value when: a. The interest rate decreases b. The number of compounding periods decreares c. The amount of time between today and the time an amount is received increases 3. The annual rate for an investment that lasts 5 years is 12%. Thinking about the equation for future value, what would the "r" and "t" be when compound is: a. Semiannual b. Quarterly c. Monthly 4 You are looking at investing the same amount over a specified period of time at a specific interest rate (an anmuity). Would the future value of this investment increase or decrease when: a. The interest rate used decreases b. The frequency of payments increases c. The time over which the investment was made increases 5. You base been quoted a value for receiving the same amount over a penod of 10 years at the same interest rate Would the value you were quoted increase or decrease when: a. The interest rate increases b. The frequency of payments decreases c. The time over which payments are received decreases 6. You have been asked to find the future value in three years of investing $2,000 today, $3,000 one year from today and $4,000 two years from today Interest is compounded quarterly When using the future value equation, what is 't' for. a. The $2,000 today b. The $3,000 one year from today c. The $4,000 two yean from today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts