Question: Thank you so much! (Preparing common-size financial statements) As the newest hire to the financial analysis group at Patterson Printing Company, you have been asked

Thank you so much!

Thank you so much!

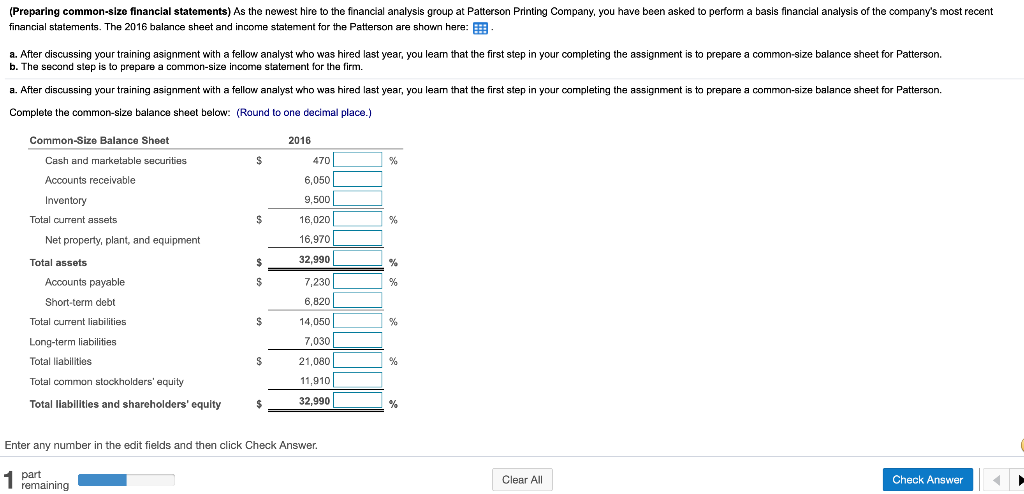

(Preparing common-size financial statements) As the newest hire to the financial analysis group at Patterson Printing Company, you have been asked to perform a basis financial analysis of the company's most recent financial statements. The 2016 balance sheet and income statement for the Patterson are shown here: a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson. b. The second step is to prepare a common-size income statement for the firm. a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson. Complete the common-size balance sheet below: (Round to one decimal place.) Common-Size Balance Sheet 2016 Cash and marketable securities $ % 470 6,050 Accounts receivable Inventory Total current assets 9,500 S 16,020 % Net property, plant, and equipment 16,970 32,990 $ % S 7,230 % 6,820 $ % Total assets Accounts payable Short-term debt Total current liabilities Long-term liabilities Total liabilities Total common stockholders' equity Total liabilities and shareholders' equity 14,050 7.030 $ % 21,080 11,910 $ 32,990 % Enter any number in the edit fields and then click Check Answer. 1 part remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts