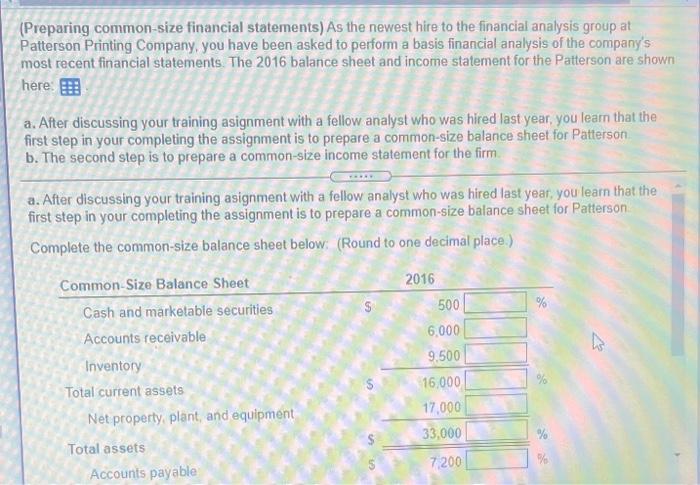

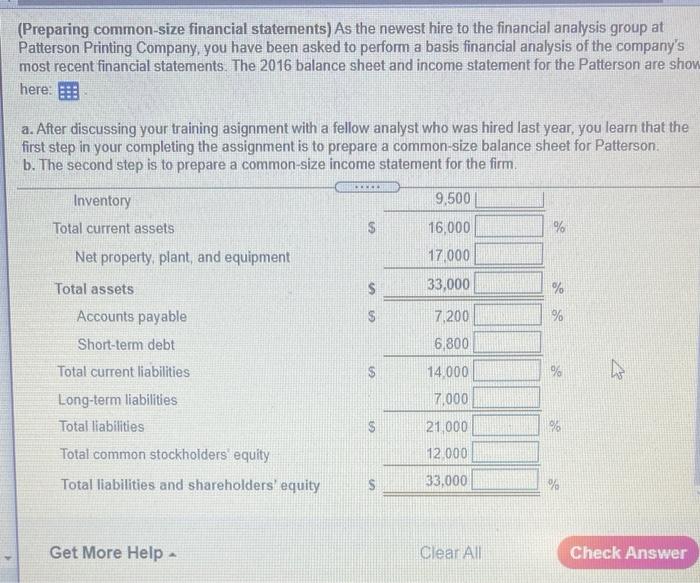

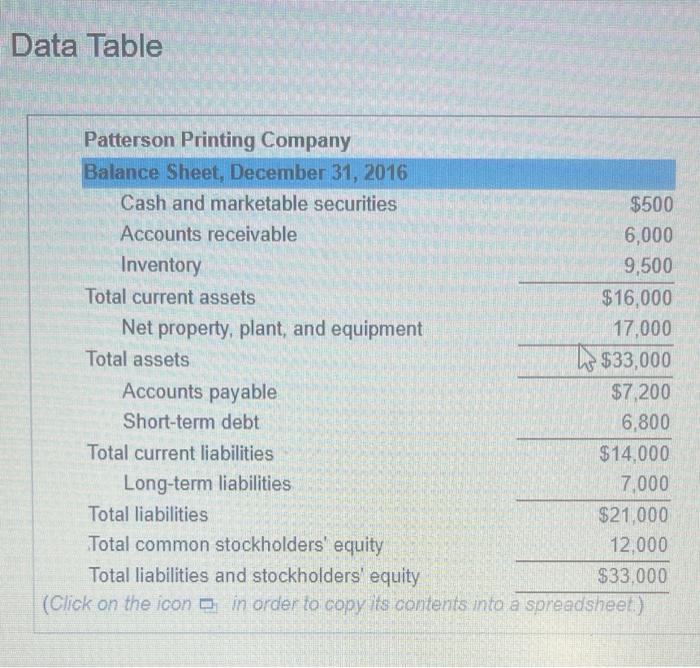

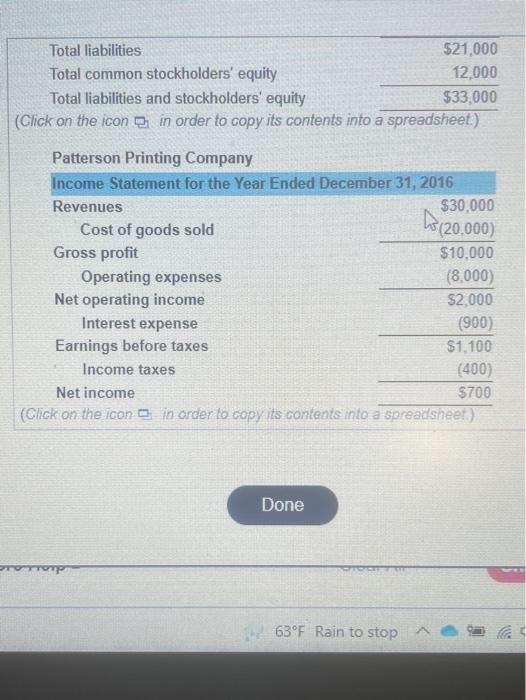

(Preparing common-size financial statements) As the newest hire to the financial analysis group at Patterson Printing Company, you have been asked to perform a basis financial analysis of the company's most recent financial statements. The 2016 balance sheet and income statement for the Patterson are shown here: B a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson b. The second step is to prepare a common-size income statement for the firm a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson Complete the common-size balance sheet below: (Round to one decimal place.) 2016 500 % 6.000 9.500 a Common-Size Balance Sheet Cash and marketable securities Accounts receivable Inventory Total current assets Net property, plant, and equipment Total assets Accounts payable 16,000 17,000 33,000 7200 % (Preparing common-size financial statements) As the newest hire to the financial analysis group at Patterson Printing Company, you have been asked to perform a basis financial analysis of the company's most recent financial statements. The 2016 balance sheet and income statement for the Patterson are show here: a. After discussing your training asignment with a fellow analyst who was hired last year, you learn that the first step in your completing the assignment is to prepare a common-size balance sheet for Patterson. b. The second step is to prepare a common-size income statement for the firm. CM- Inventory Total current assets Net property, plant, and equipment $ % 9.500 16,000 17.000 33,000 Total assets % Accounts payable S 7,200 % Short-term debt 6,800 $ % Total current liabilities Long-term liabilities Total liabilities S 14.000 7,000 21,000 12.000 33,000 90 Total common stockholders equity Total liabilities and shareholders' equity S % Get More Help - Clear All Check Answer Data Table Patterson Printing Company Balance Sheet, December 31, 2016 Cash and marketable securities $500 Accounts receivable 6,000 Inventory 9,500 Total current assets $ 16,000 Net property, plant, and equipment 17,000 Total assets 5 $33,000 Accounts payable $7,200 Short-term debt 6,800 Total current liabilities $14.000 Long-term liabilities 7,000 Total liabilities $21,000 Total common stockholders' equity 12,000 Total liabilities and stockholders' equity $33,000 (Click on the icon o in order to copy its contents into a spreadsheet) Total liabilities $21,000 Total common stockholders' equity 12.000 Total liabilities and stockholders' equity $33,000 (Click on the icon in order to copy its contents into a spreadsheet.) hp(20.000) Patterson Printing Company Income Statement for the Year Ended December 31, 2016 Revenues $30,000 Cost of goods sold Gross profit $10,000 Operating expenses (8,000) Net operating income $2,000 Interest expense (900) Earnings before taxes $1,100 Income taxes (400) Net income $700 (Click on the icon in order to copy its contents into a spreadsheet) Done op 63F Rain to stop A