Answered step by step

Verified Expert Solution

Question

1 Approved Answer

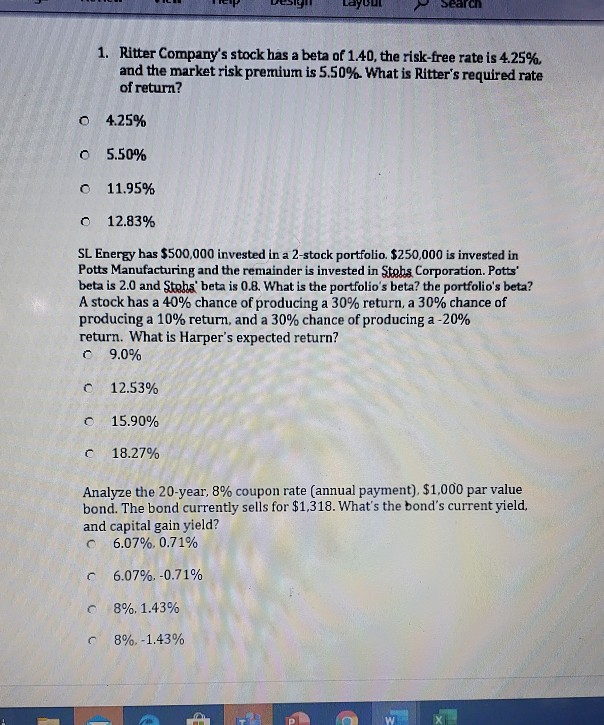

Help Design Layout Search 1. Ritter Company's stock has a beta of 1.40, the risk-free rate is 4.25%. and the market risk premium is 5.50%

Help Design Layout Search 1. Ritter Company's stock has a beta of 1.40, the risk-free rate is 4.25%. and the market risk premium is 5.50% What is Ritter's required rate of return? o 4.25% o 5.50% o 11.95% o 12.83% SL Energy has $500,000 invested in a 2-stock portfolio $250,000 is invested in Potts Manufacturing and the remainder is invested in Stoba Corporation. Potts' beta is 2.0 and Stoha' beta is 0.8. What is the portfolio's beta? the portfolio's beta? A stock has a 40% chance of producing a 30% return, a 30% chance of producing a 10% return, and a 30% chance of producing a -20% return. What is Harper's expected return? 09.0% 12.53% O 15.90% C 18.27% Analyze the 20-year, 8% coupon rate (annual payment) $1,000 par value bond. The bond currently sells for $1,318. What's the bond's current yield, and capital gain yield? o 6.07% 0.71% 6.07%. -0.71% o 8%. 1.43% 8% -1.43%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started