Answered step by step

Verified Expert Solution

Question

1 Approved Answer

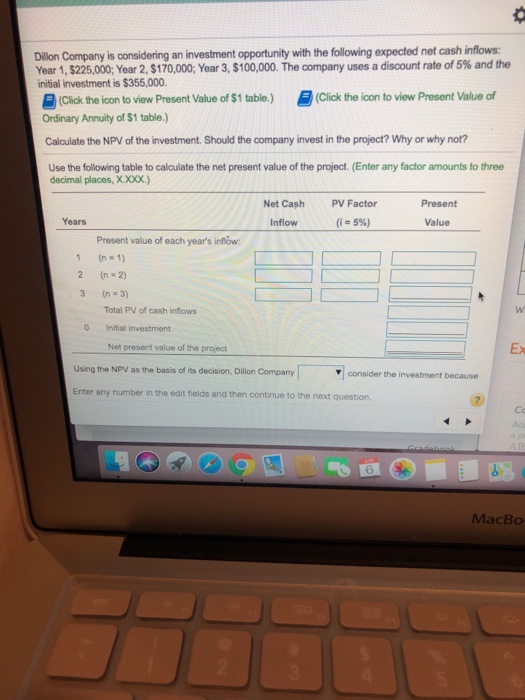

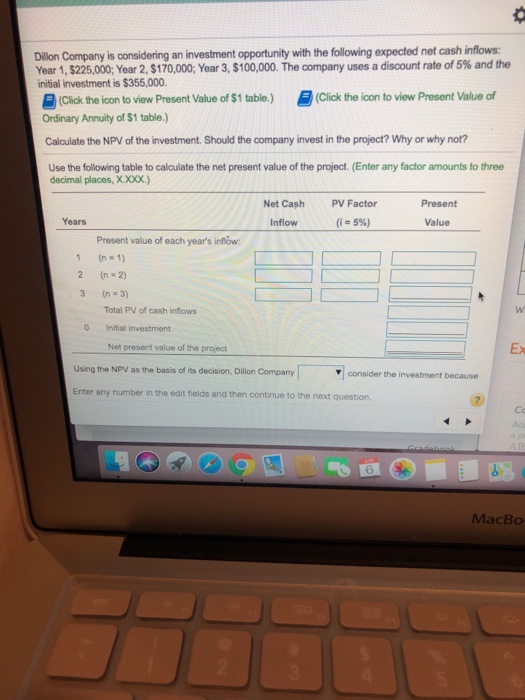

help Dillon Company is oconsidering an investment opportunity with the following expected net cash inflows: Year 1, $225,000; Year 2, $170,000; Year 3, $100,000. The

help

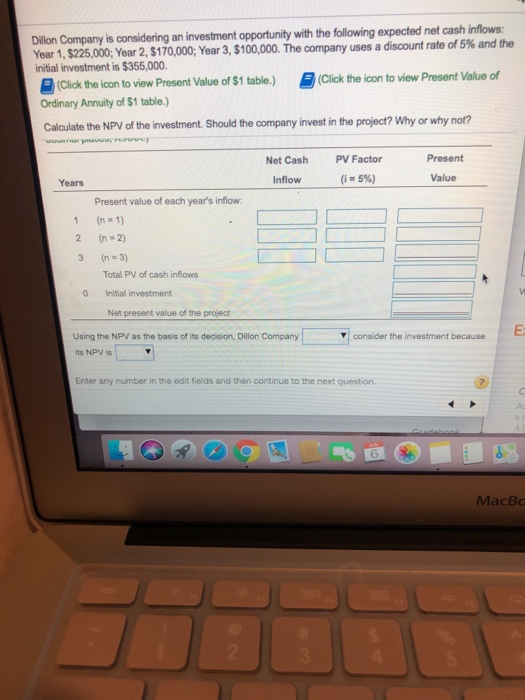

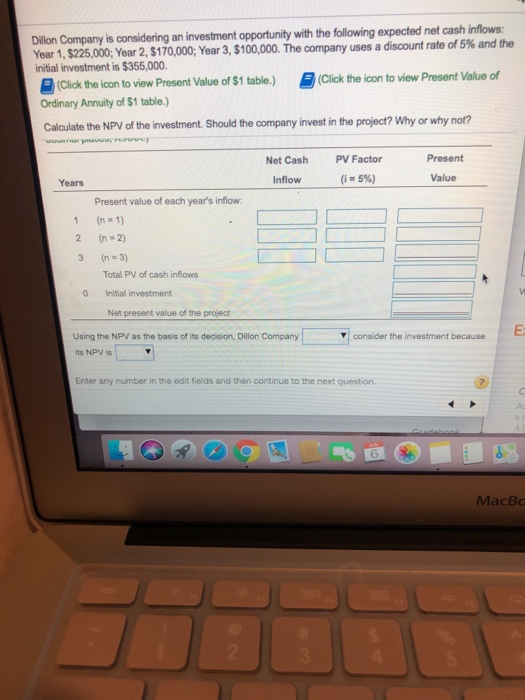

Dillon Company is oconsidering an investment opportunity with the following expected net cash inflows: Year 1, $225,000; Year 2, $170,000; Year 3, $100,000. The company uses a discount rate of 5% and the initial investment is $355,000 (Click the icon to view Present Value of (Click the icon to view Present Value of $1 table.) Ordinary Annuity of $1 table) Calculate the NPV of the investment. Should the company invest in the project? Why or why not? Use the following table to calculate the net present value of the project. (Enter any factor amounts to three decimal places, XXXX.) Present Net Cash PV Factor (i 5 %) Years Inflow Value Present value of each year's inflow: 1 (n 1) 2 (n 2) 3 (n 3) Total PV of cash inflows W Initial investment Net present value of the project Ex Using the NPV as the basis of its decision, Dillon Company consider the investment because Enter any number in the edit fields and then continue to the next question AR Gradabook MacBo Dillon Company is considering an investment opportunity with the following expected net cash inflows: Year 1, $225,000; Year 2, $170,000; Year 3, $100,000. The company uses a discount rate of 5% and the initial investment is $355,000. (Click the icon to view Present Value of (Click the icon to view Present Value of $1 table.) Ordinary Annuity of $1 table.) Calculate the NPV of the investment. Should the company invest in the project? Why or why not? Present Net Cash PV Factor (i5% ) Value Inflow Years Present value of each year's inflow: (n 1) 1 2 (n 2) 3 (n 3) Total PV of cash inflows 0 Initial investment Net present value of the project E Using the NPV as the basis of its decision, Dillon Company consider the investment because its NPV is Enter any number in the edit fields and then continue to the next question. Gadahoal 6 MacBo 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started