Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help! dont understand! Journal entry worksheet 6 Record the entry to accrue revenue not yet billed. Note: Enter debits before credits. Journal entry worksheet 1234567

help! dont understand!

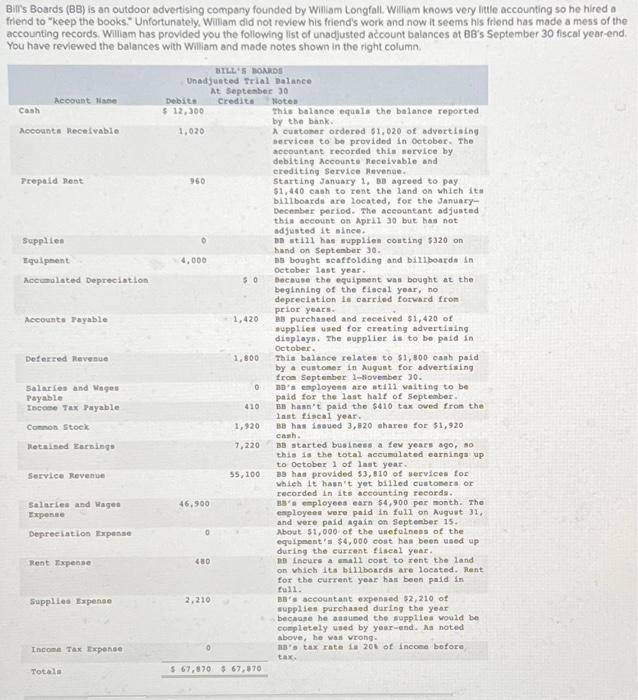

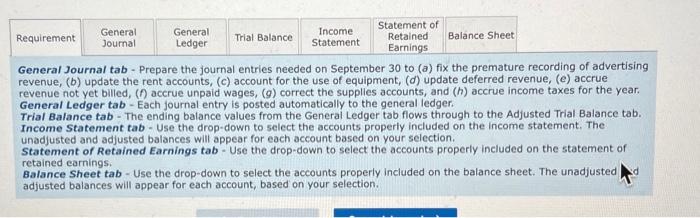

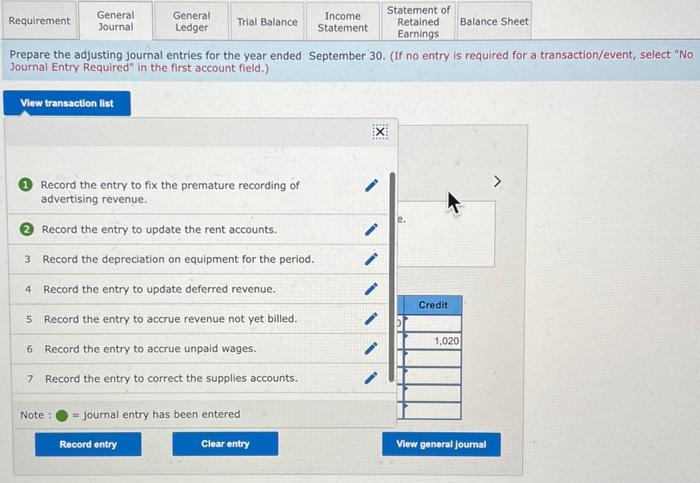

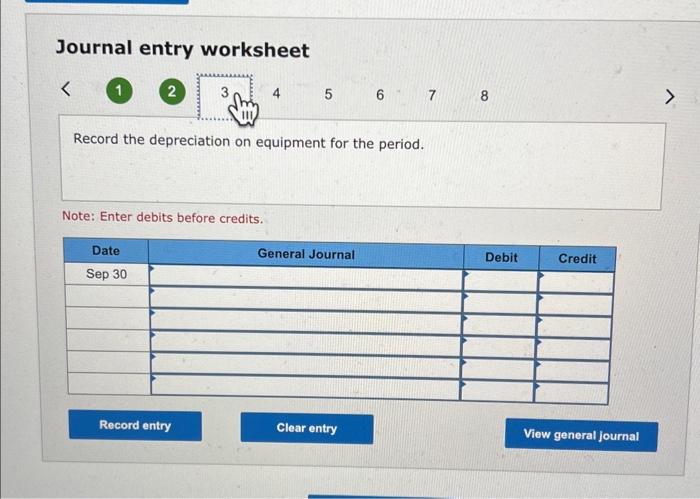

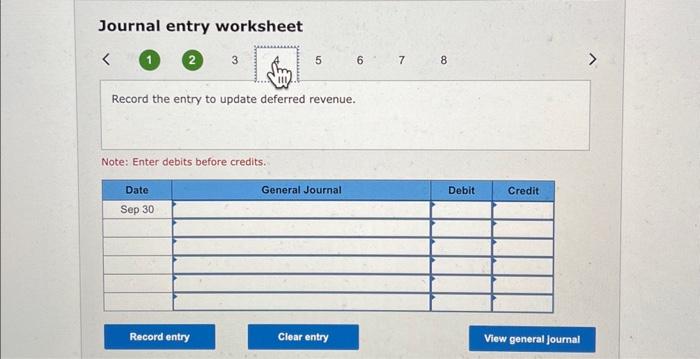

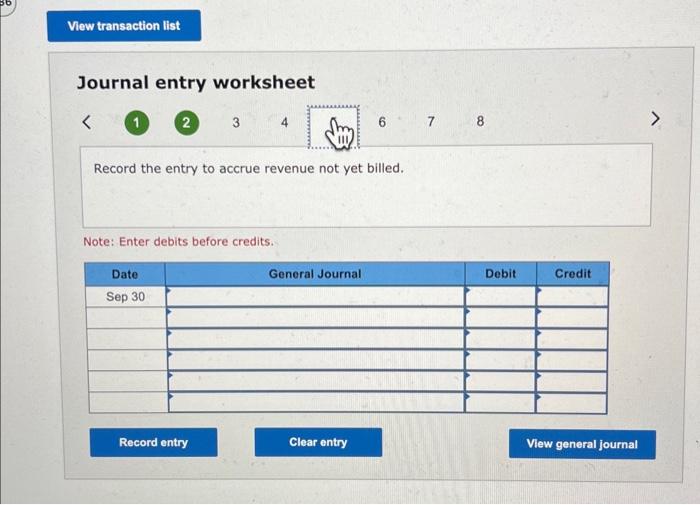

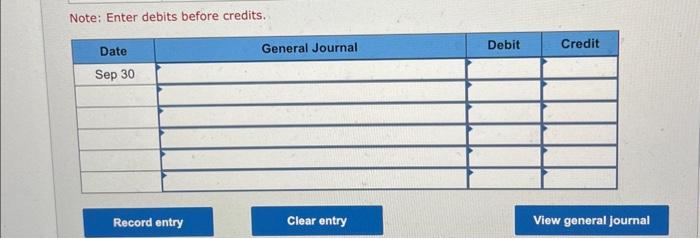

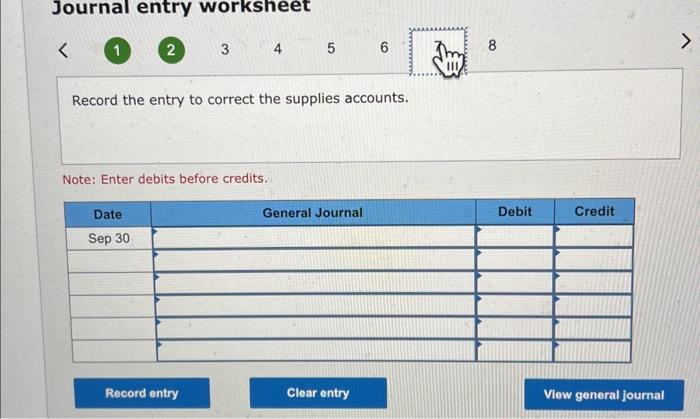

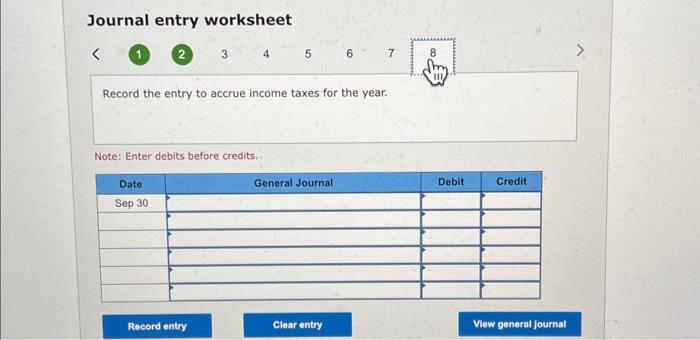

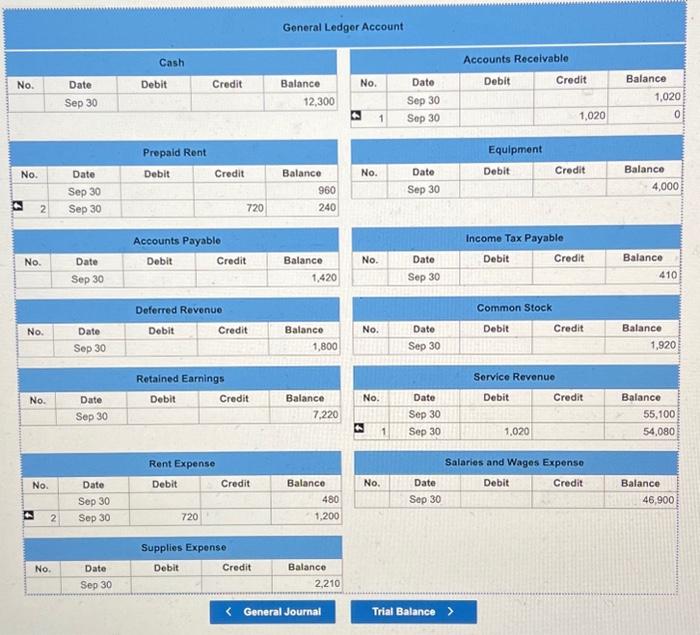

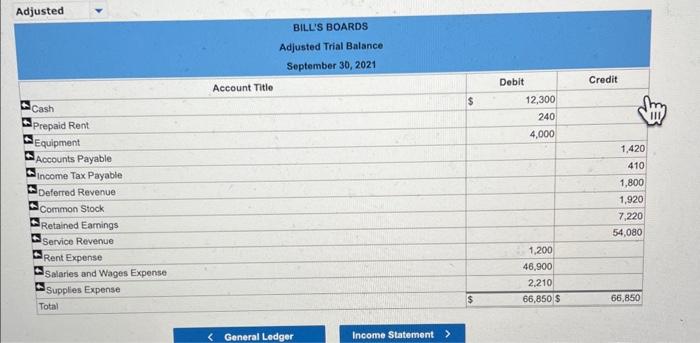

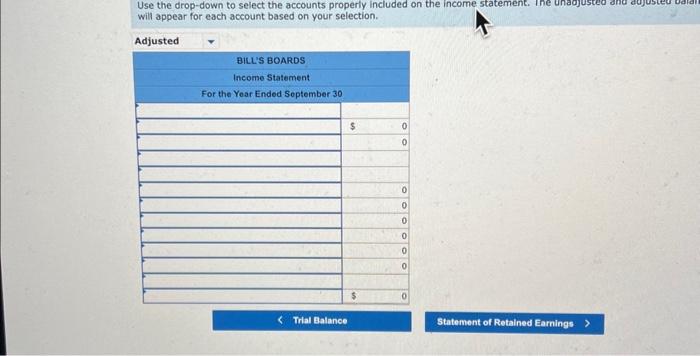

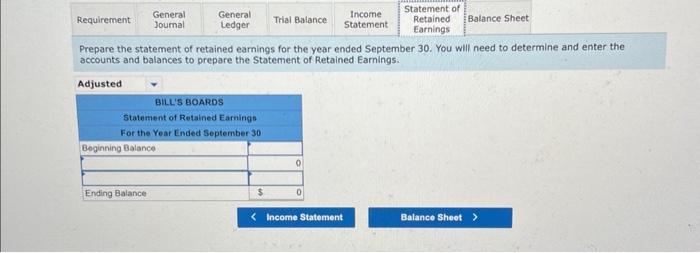

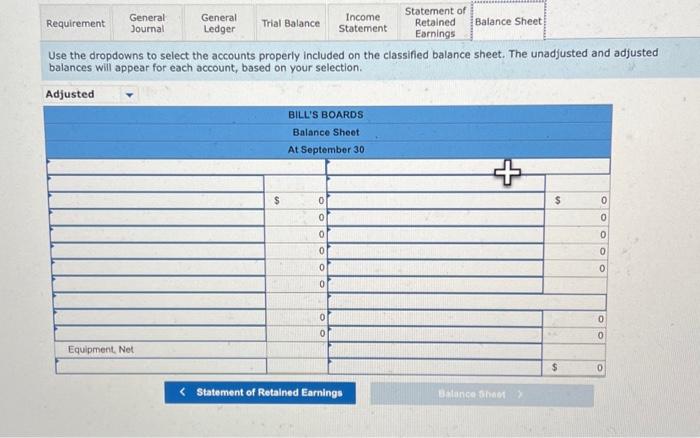

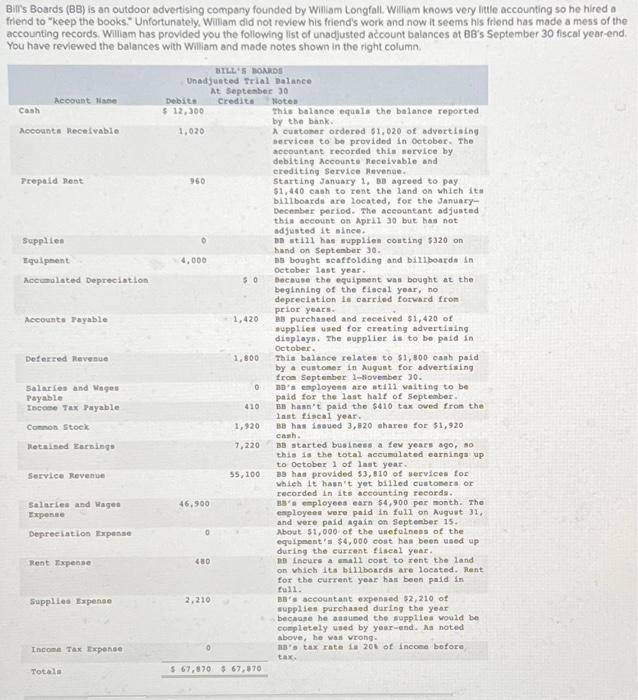

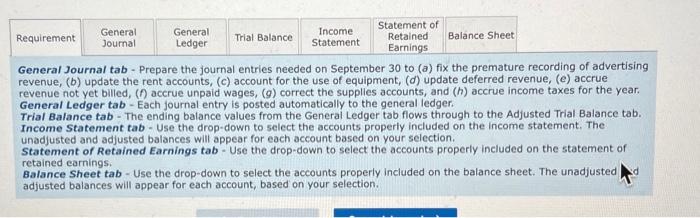

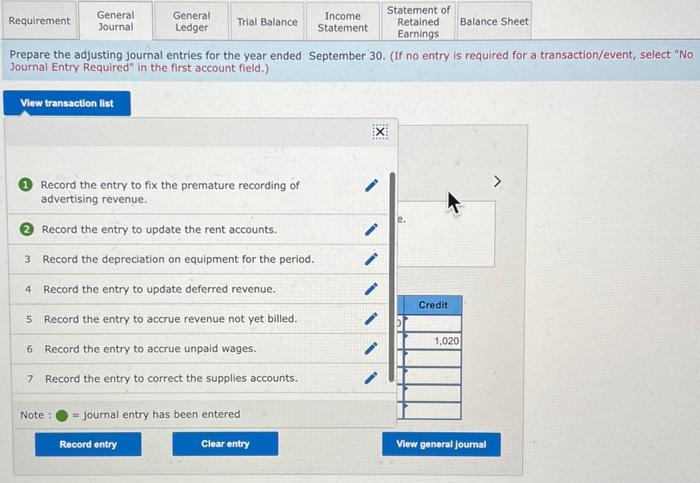

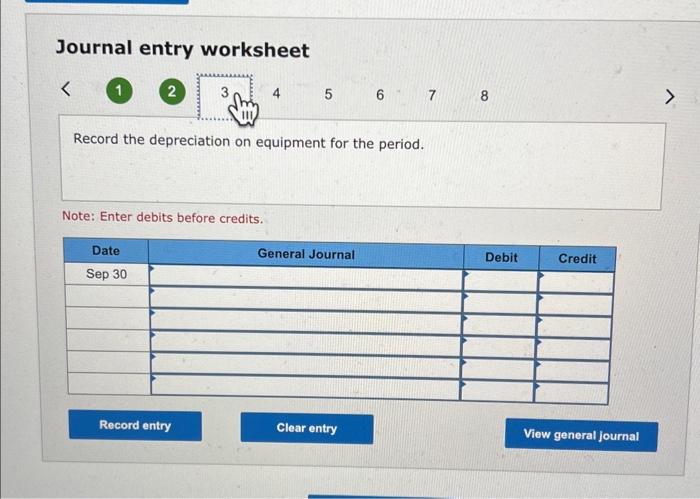

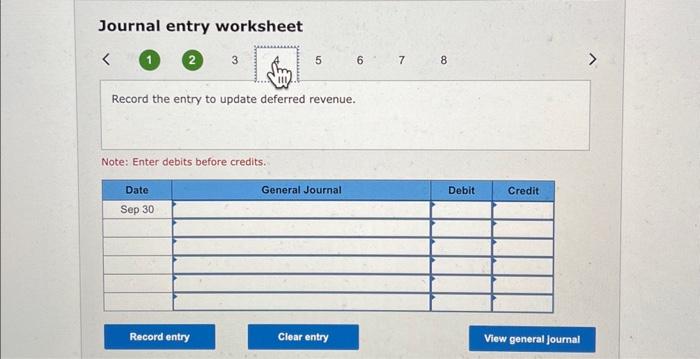

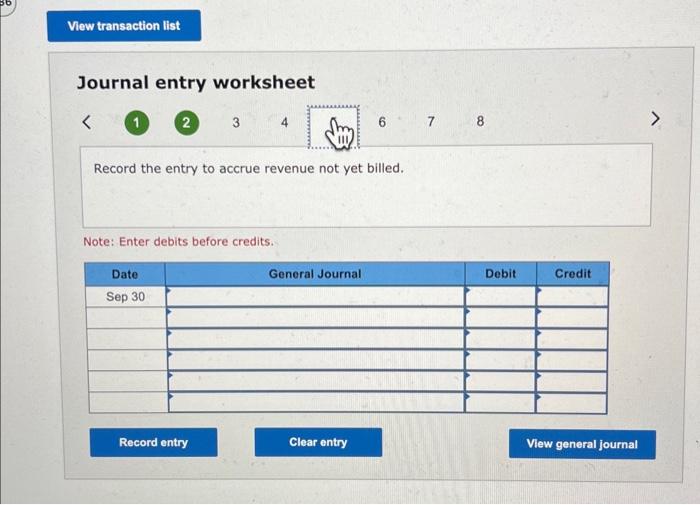

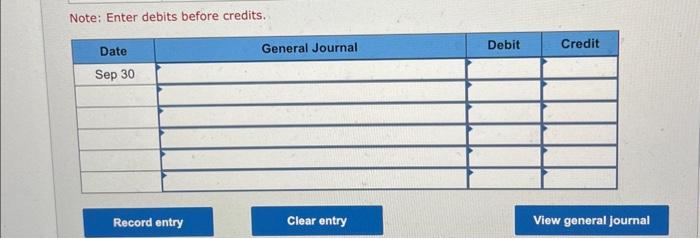

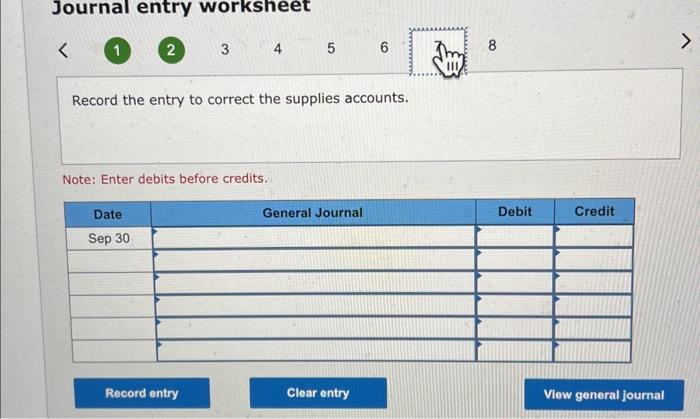

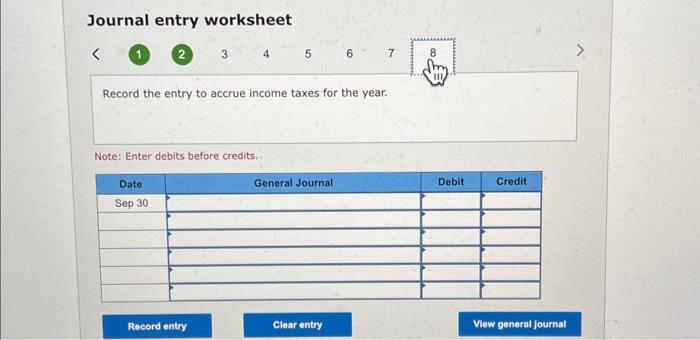

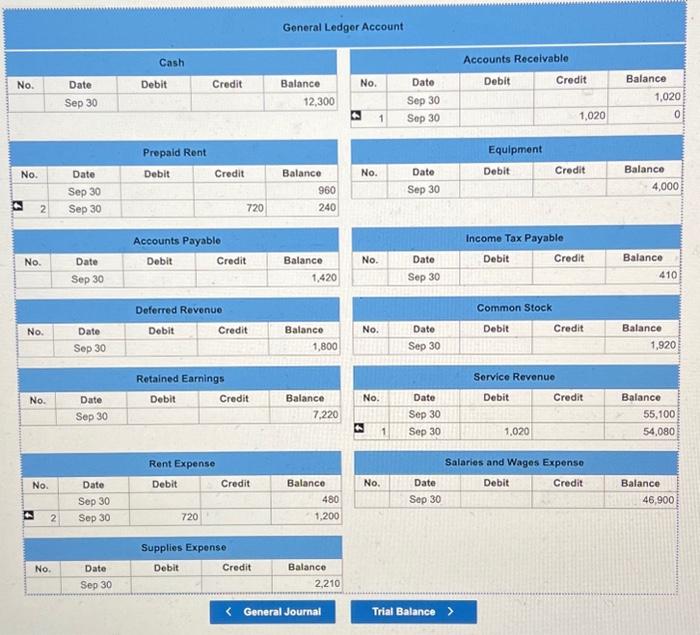

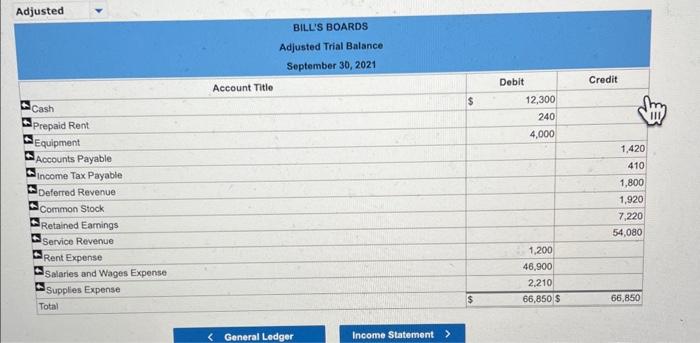

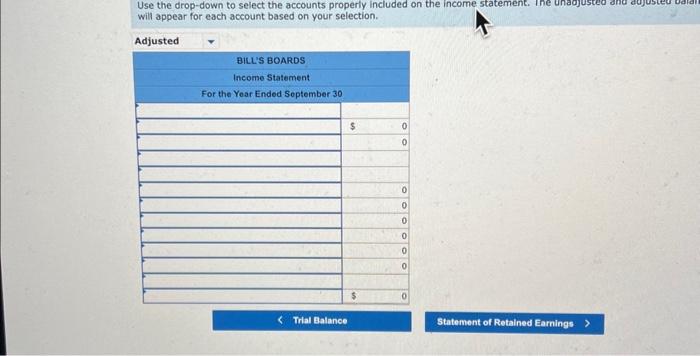

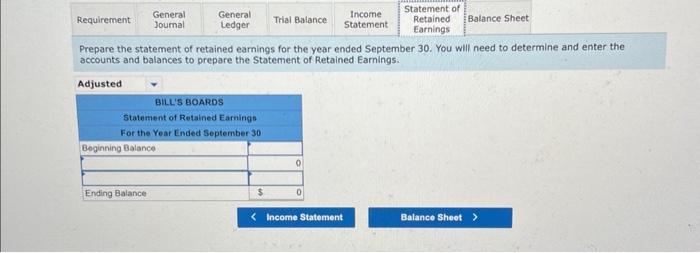

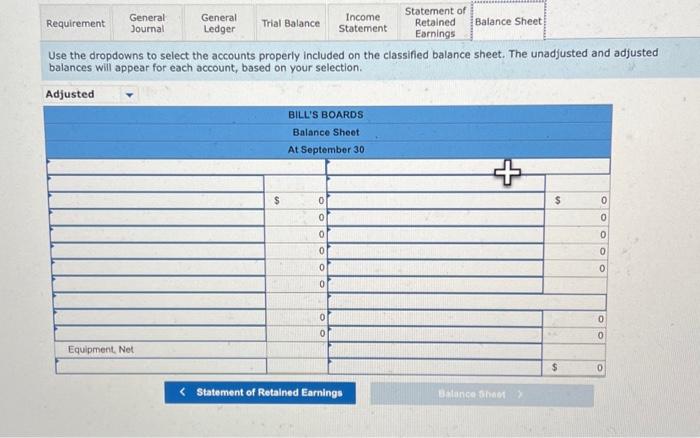

Journal entry worksheet 6 Record the entry to accrue revenue not yet billed. Note: Enter debits before credits. Journal entry worksheet 1234567 Record the entry to accrue income taxes for the year. Note: Enter debits before credits. Journal entry worksheet 1 4 5 6 7 Record the depreciation on equipment for the period. Note: Enter debits before credits. Use the drop-down to select the accounts properly included on the income statement. Ine unadjusted and dujusteu uala will appear for each account based on your selection. General Ledger Account \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Cash } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 12,300 \\ \hline \multicolumn{5}{|c|}{ Prepaid Rent } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 960 \\ \hline D 2 & Sep 30 & & 720 & 240 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts Receivable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & = & 1,020 \\ \hline D 1 & Sep30 & & 1,020 & 0 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 4,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,420 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Income Tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 410 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Deferred Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,800 \\ \hline \end{tabular} \begin{tabular}{|r|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep30 & & & 1,920 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Retained Earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 7,220 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Service Revenue } \\ \hline No. & Date & Debit & Credit & & ince \\ \hline & Sep 30 & & & & 55,100 \\ \hline D 1 & Sep 30 & 1.020 & & & 54,080 \\ \hline \end{tabular} \begin{tabular}{|r|c|r|r|r|} \hline \multicolumn{5}{|c|}{ Rent Expense } \\ \hline No. & Date & Debit & Credit & \multicolumn{1}{|c|}{ Balance } \\ \hline & Sep 30 & & & 480 \\ \hline 2 & Sep 30 & 720 & & 1,200 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Salaries and Wages Expenso } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 46,900 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Supplies Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,210 \\ \hline \end{tabular} General Journal Trial Balance > Prepare the statement of retained eamings for the year ended September 30. You will need to determine and enter the accounts and balances to prepare the Statement of Retained Earnings. Journal entry worksheet 1 5 Record the entry to correct the supplies accounts. Note: Enter debits before credits. Use the dropdowns to select the accounts properly included on the classified balance sheet. The unadjusted and adjusted balances will appear for each account, based on your selection. Prepare the adjusting journal entries for the year ended September 30. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Record the entry to fix the premature recording of advertising revenue. Record the entry to update the rent accounts. 3 Record the depreciation on equipment for the period. 4 Record the entry to update deferred revenue. 5 Record the entry to accrue revenue not yet billed. 6 Record the entry to accrue unpaid wages. 7 Record the entry to correct the supplies accounts. Note : = journal entry has been entered Journal entry worksheet 1 (2) 5 6 Record the entry to update deferred revenue. Note: Enter debits before credits. General Journal tab - Prepare the journal entries needed on September 30 to (a) fix the premature recording of advertising revenue, (b) update the rent accounts, (c) account for the use of equipment, (d) update deferred revenue, (e) accrue revenue not yet billed, (f) accrue unpaid wages, (g) correct the supplies accounts, and (h) accrue income taxes for the year. General Ledger tab - Each journal entry is posted automatically to the general ledger. Trial Balance tab - The ending balance values from the General Ledger tab flows through to the Adjusted Trial Balance tab. Income Statement tab - Use the drop-down to select the accounts properly included on the income statement. The unadjusted and adjusted balances will appear for each account based on your selection. Statement of Retained Earnings tab - Use the drop-down to select the accounts properly included on the statement of retained earnings. Balance Sheet tab - Use the drop-down to select the accounts properly included on the balance sheet. The unadjusted adjusted balances will appear for each account, based on your selection. Note: Enter debits before credits. Adjusted Bilrs Boards (BB) is an outdoor advertising company founded by Wiliam Longfall. William knows very little accounting so he hired a Buirs Boards (BB) is an outdoor advertising company founded by Win... ber 30 fiscal year-end

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started