help experts

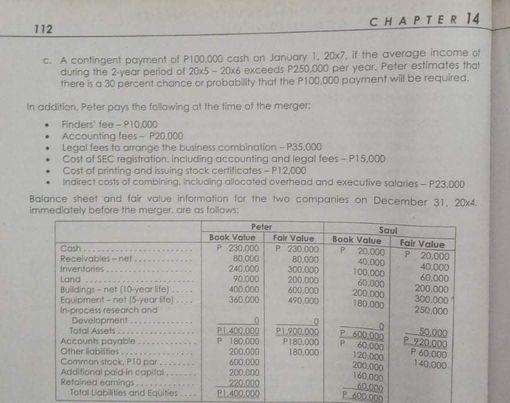

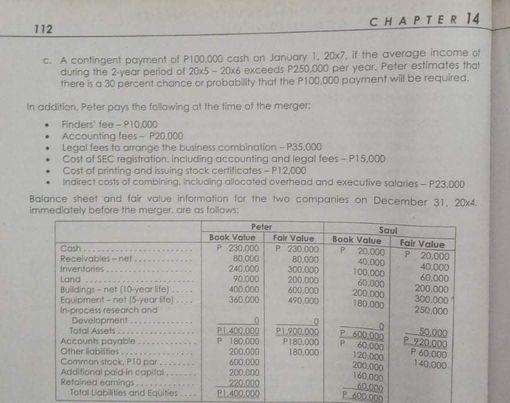

illustration 14-15: Entries in the Acquiree's Records illustration 14-16. Deferred Tax on Business Combinations - Statutory Consolidation .). no ncy is ed for y are mon) The following are the illustrations: llustration 14 -1: Goodwill Computation with Contingent Consideration based on Future Performance - Earnings as a er to dwill on December 31, 20x4, Peter Corporation enters into a business combination by acquiring the assets and assumed the liabilities of Saul Corporation in which Saul Corporation will be dissolved. Peters consideration transferred consists of the following: a 25.000 unissued shares of its P10 par common stock, with a market value of P25 per share: b. P150.000 in long-term 8% notes payable, and to ne VOLUME II Advanced Accounting - (A Comprehensive & Procedural Approach) CHAPTER 14 112 C. A contingent payment of P100.000 cash on January 1, 20x7. if the average income of during the 2-year period of 20x5 - 20x6 exceeds P250.000 per year. Peter estimates that there is a 30 percent chance or probability that the P100.000 payment will be required . . In addition, Peter pays the following at the time of the merger Finders tee-p10.000 Accounting lees- P20,000 Legal fees to arrange the business combination - P35.000 Cost of SEC registration, including accounting and legal fees - P15,000 Cost of printing and issuing stock certificates - P12.000 Indirect costs of combining, including allocated overhead and executive salaries - P23,000 Balance sheet and fair value information for the two companies on December 31, 20x4. immediately before the merger are as follows: Peter Saul Book Value Fair Value Book Value Fair Value Cash P 230,000 P230.000 p 20.000 P20.000 Recevables-not 80.000 B0.000 40.000 40.000 Inventories 240.000 300.000 100.000 80.000 Land 90.000 200.000 60.000 200.000 Buildings - net (to verifo) 400.000 600.000 200.000 Equipment-net year fo) 300.000 360.000 490,000 250.000 In-process research and Development Total Assets P1.400.000 21.900.000 50,000 Accounts payable P180.000 P180.000 P 60.000 Other liabutis 200.000 180,000 Common stock Pro por 600.000 Additional paid in capital 200.000 Rotained emings 220.000 Toto Labtos and Equities PL400.000 180,000 P600.000 2.920.000 P 60.000 140.000 120.000 200.000 160.000 60.000 P200.000 illustration 14-15: Entries in the Acquiree's Records illustration 14-16. Deferred Tax on Business Combinations - Statutory Consolidation .). no ncy is ed for y are mon) The following are the illustrations: llustration 14 -1: Goodwill Computation with Contingent Consideration based on Future Performance - Earnings as a er to dwill on December 31, 20x4, Peter Corporation enters into a business combination by acquiring the assets and assumed the liabilities of Saul Corporation in which Saul Corporation will be dissolved. Peters consideration transferred consists of the following: a 25.000 unissued shares of its P10 par common stock, with a market value of P25 per share: b. P150.000 in long-term 8% notes payable, and to ne VOLUME II Advanced Accounting - (A Comprehensive & Procedural Approach) CHAPTER 14 112 C. A contingent payment of P100.000 cash on January 1, 20x7. if the average income of during the 2-year period of 20x5 - 20x6 exceeds P250.000 per year. Peter estimates that there is a 30 percent chance or probability that the P100.000 payment will be required . . In addition, Peter pays the following at the time of the merger Finders tee-p10.000 Accounting lees- P20,000 Legal fees to arrange the business combination - P35.000 Cost of SEC registration, including accounting and legal fees - P15,000 Cost of printing and issuing stock certificates - P12.000 Indirect costs of combining, including allocated overhead and executive salaries - P23,000 Balance sheet and fair value information for the two companies on December 31, 20x4. immediately before the merger are as follows: Peter Saul Book Value Fair Value Book Value Fair Value Cash P 230,000 P230.000 p 20.000 P20.000 Recevables-not 80.000 B0.000 40.000 40.000 Inventories 240.000 300.000 100.000 80.000 Land 90.000 200.000 60.000 200.000 Buildings - net (to verifo) 400.000 600.000 200.000 Equipment-net year fo) 300.000 360.000 490,000 250.000 In-process research and Development Total Assets P1.400.000 21.900.000 50,000 Accounts payable P180.000 P180.000 P 60.000 Other liabutis 200.000 180,000 Common stock Pro por 600.000 Additional paid in capital 200.000 Rotained emings 220.000 Toto Labtos and Equities PL400.000 180,000 P600.000 2.920.000 P 60.000 140.000 120.000 200.000 160.000 60.000 P200.000