help?

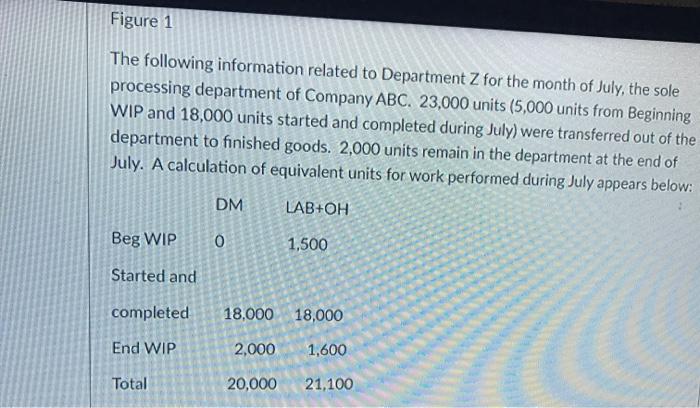

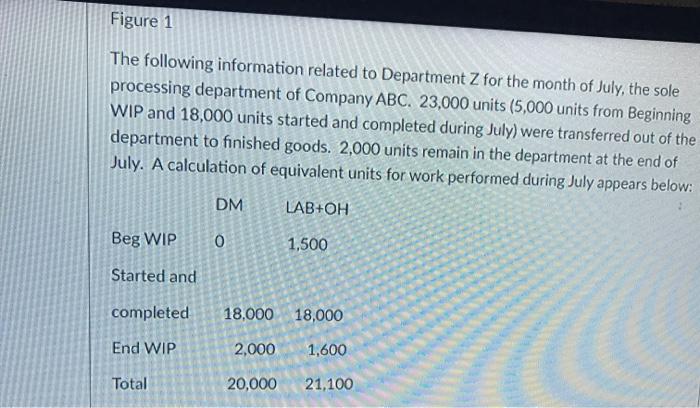

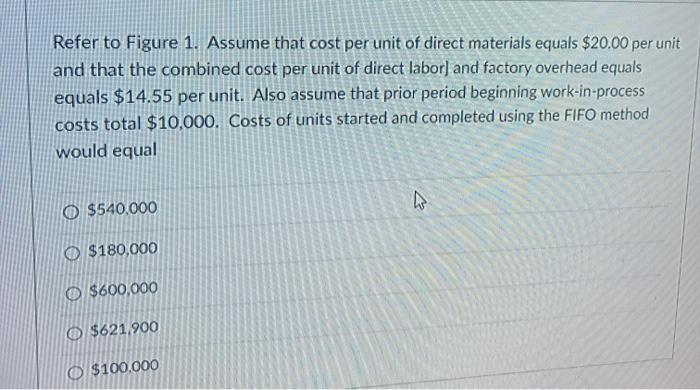

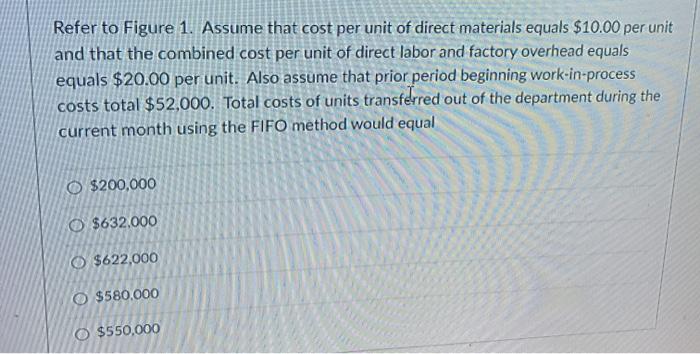

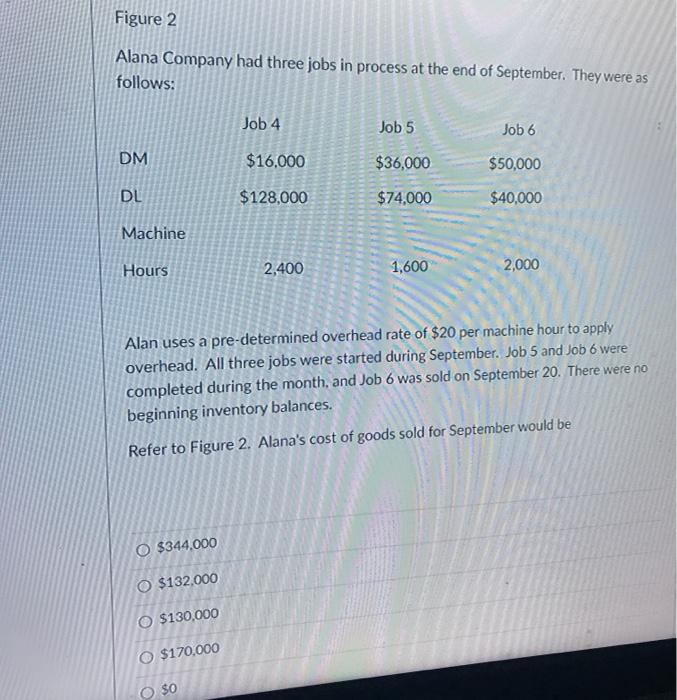

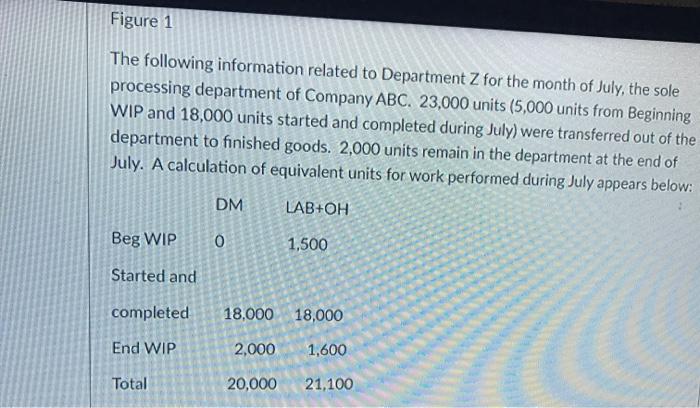

Figure 1 The following information related to Department Z for the month of July, the sole processing department of Company ABC. 23,000 units (5,000 units from Beginning WIP and 18,000 units started and completed during July) were transferred out of the department to finished goods. 2,000 units remain in the department at the end of July. A calculation of equivalent units for work performed during July appears below: DM LAB+OH Beg WIP 0 1,500 Started and completed 18,000 18,000 End WIP 2,000 1,600 Total 20,000 21,100 Refer to Figure 1. Assume that cost per unit of direct materials equals $20.00 per unit and that the combined cost per unit of direct labor) and factory overhead equals equals $14.55 per unit. Also assume that prior period beginning work-in-process costs total $10,000. Costs of units started and completed using the FIFO method would equal O $540,000 $180,000 O $600,000 0 $621.900 $100,000 Refer to Figure 1. Assume that cost per unit of direct materials equals $5.00 per unit and that the combined cost per unit of direct labor and factory overhead equals equals $20.00 per unit. Also assume that prior period beginning work-in-process costs total $10,000. Costs of ending work-in-process using the FIFO method would equal O $60,000 O $42,000 O $16,000 O $20,000 $52,000 Refer to Figure 1. Assume that cost per unit of direct materials equals $10.00 per unit and that the combined cost per unit of direct labor and factory overhead equals equals $20.00 per unit. Also assume that prior period beginning work-in-process costs total $52,000. Total costs of units transferred out of the department during the current month using the FIFO method would equal $200,000 O $632.000 $622,000 O $580.000 O $550.000 Figure 2 Alana Company had three jobs in process at the end of September. They were as follows: Job 4 Job 5 Job 6 DM $16.000 $36,000 $50,000 DL $128.000 $74,000 $40,000 Machine Hours 2,400 1,600 2,000 Alan uses a pre-determined overhead rate of $20 per machine hour to apply overhead. All three jobs were started during September. Job 5 and Job 6 were completed during the month, and Job 6 was sold on September 20. There were no beginning inventory balances. Refer to Figure 2. Alana's cost of goods sold for September would be O $344,000 O $132.000 O $130,000 O $170,000 O $0