Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help figure out line 17 & can you please show your work 1. Irish Himple owns a retail family clothing store. Her store is locat

Help figure out line 17 & can you please show your work

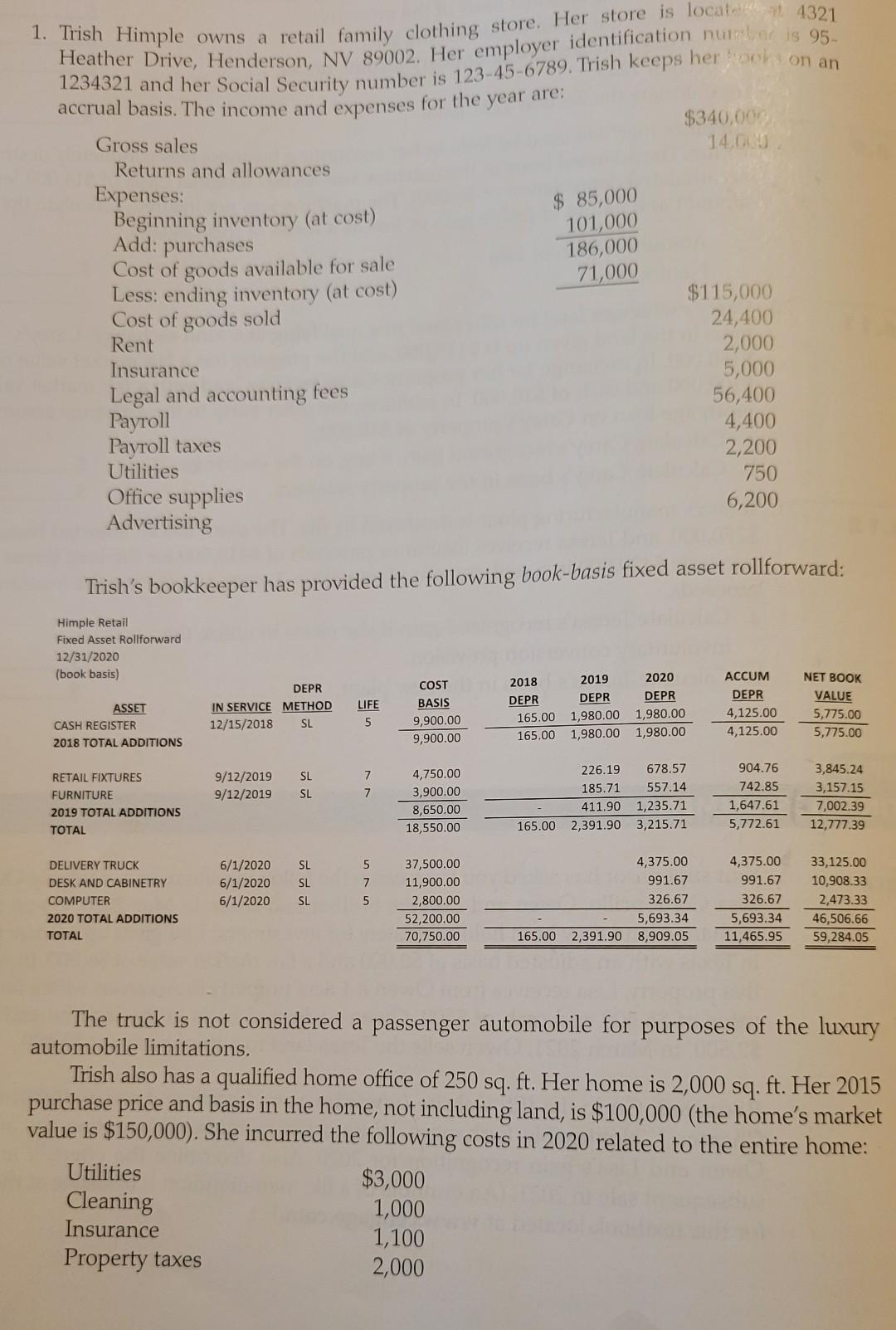

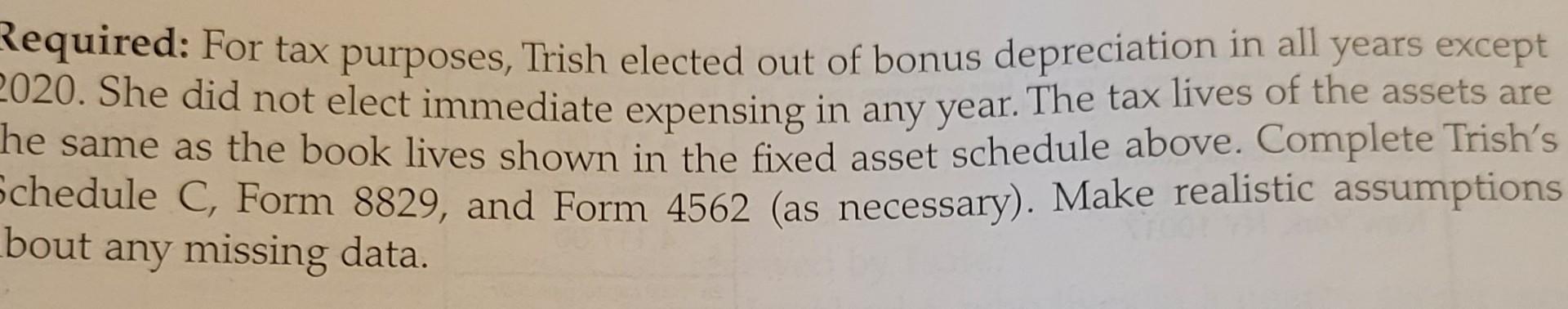

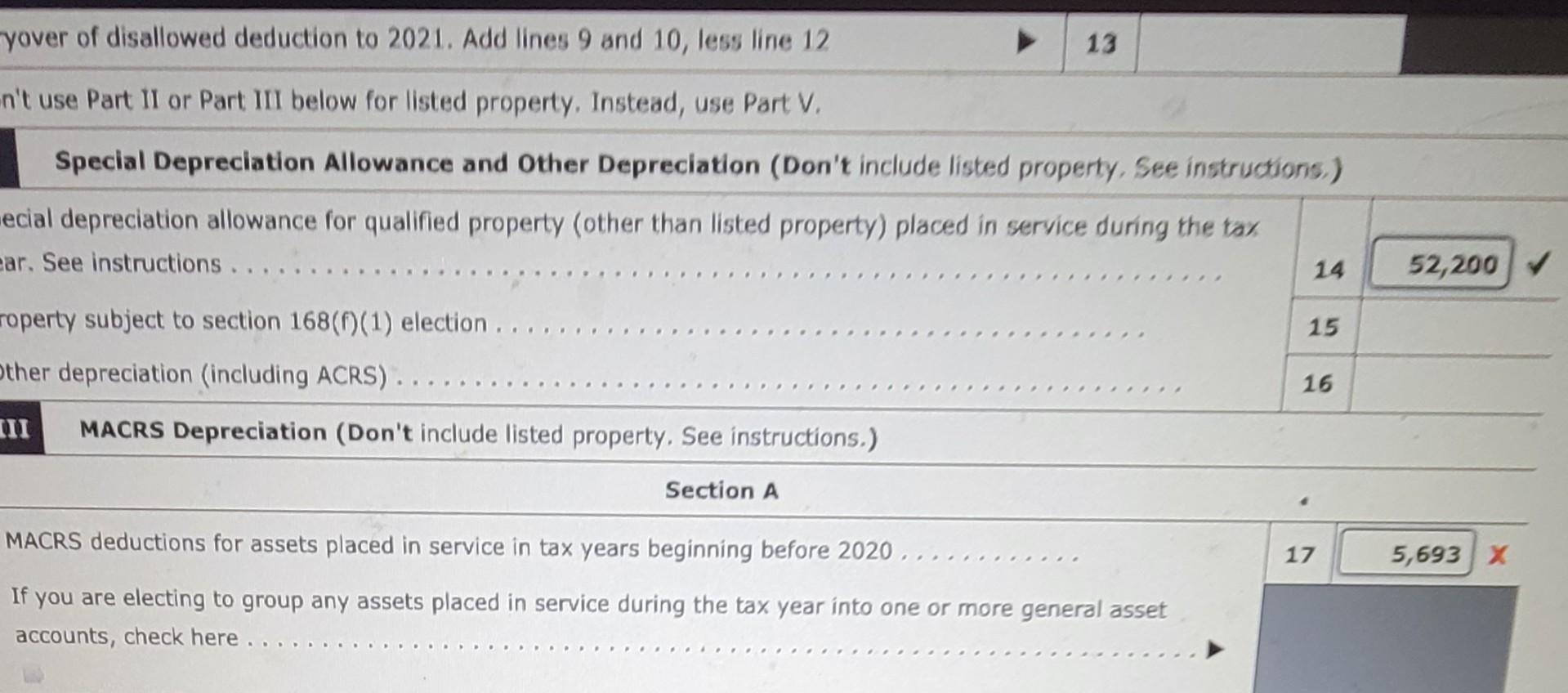

1. Irish Himple owns a retail family clothing store. Her store is locat 4321 Heather Drive, Henderson, NV 89002. Her employer identification nuk is 95 1234321 and her Social Security number is 123-45-6789. Trish keeps her back on an accrual basis. The income and expenses for the year are: $340,000 Gross sales 14.00 Returns and allowances Expenses: Beginning inventory (at cost) Add: purchases Cost of goods available for sale Less: ending inventory (at cost) $115,000 Cost of goods sold 24,400 Rent 2,000 Insurance 5,000 Legal and accounting fees 56,400 Payroll 4,400 Payroll taxes 2,200 Utilities 750 Office supplies 6,200 Advertising $ 85,000 101,000 186,000 71,000 Trish's bookkeeper has provided the following book-basis fixed asset rollforward: Himple Retail Fixed Asset Rollforward 12/31/2020 (book basis) ASSET CASH REGISTER 2018 TOTAL ADDITIONS DEPR IN SERVICE METHOD 12/15/2018 SL LIFE 5 COST BASIS 9,900.00 9,900.00 2018 DEPR 165.00 165.00 2019 2020 DEPR DEPR 1,980.00 1,980.00 1,980.00 1,980.00 ACCUM DEPR 4,125.00 4,125.00 NET BOOK VALUE 5,775.00 5,775.00 7 9/12/2019 9/12/2019 SL SL 7 RETAIL FIXTURES FURNITURE 2019 TOTAL ADDITIONS TOTAL 4,750.00 3,900.00 8,650.00 18,550.00 226.19 185.71 411.90 2,391.90 678.57 557.14 1,235.71 3,215.71 904.76 742.85 1,647.61 5,772.61 3,845.24 3,157.15 7,002.39 12,777.39 165.00 SL 5 DELIVERY TRUCK DESK AND CABINETRY COMPUTER 2020 TOTAL ADDITIONS TOTAL 6/1/2020 6/1/2020 6/1/2020 7 SL SL 5 37,500.00 11,900.00 2,800.00 52,200.00 70,750.00 4,375.00 991.67 326.67 5,693.34 165.00 2,391.90 8,909.05 4,375.00 991.67 326.67 5,693.34 11,465.95 33,125.00 10,908.33 2,473.33 46,506.66 59,284.05 The truck is not considered a passenger automobile for purposes of the luxury automobile limitations. Trish also has a qualified home office of 250 sq. ft. Her home is 2,000 sq. ft. Her 2015 purchase price and basis in the home, not including land, is $100,000 (the home's market value is $150,000). She incurred the following costs in 2020 related to the entire home: Utilities $3,000 Cleaning 1,000 Insurance 1,100 Property taxes 2,000 Required: For tax purposes, Trish elected out of bonus depreciation in all years except 2020. She did not elect immediate expensing in any year. The tax lives of the assets are he same as the book lives shown in the fixed asset schedule above. Complete Trish's Schedule C, Form 8829, and Form 4562 (as necessary). Make realistic assumptions any missing data. bout yover of disallowed deduction to 2021. Add lines 9 and 10, less line 12 13 n't use Part II or Part III below for listed property, Instead, use Part V. Special Depreciation Allowance and Other Depreciation (Don't include listed property, See instructions.) ecial depreciation allowance for qualified property (other than listed property) placed in service during the tal, ar. See instructions .... 14 52,200 15 roperty subject to section 168(0)(1) election... Other depreciation (including ACRS)..... 16 MACRS Depreciation (Don't include listed property. See instructions.) Section A MACRS deductions for assets placed in service in tax years beginning before 2020 17 5,693 x If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check here .. 1. Irish Himple owns a retail family clothing store. Her store is locat 4321 Heather Drive, Henderson, NV 89002. Her employer identification nuk is 95 1234321 and her Social Security number is 123-45-6789. Trish keeps her back on an accrual basis. The income and expenses for the year are: $340,000 Gross sales 14.00 Returns and allowances Expenses: Beginning inventory (at cost) Add: purchases Cost of goods available for sale Less: ending inventory (at cost) $115,000 Cost of goods sold 24,400 Rent 2,000 Insurance 5,000 Legal and accounting fees 56,400 Payroll 4,400 Payroll taxes 2,200 Utilities 750 Office supplies 6,200 Advertising $ 85,000 101,000 186,000 71,000 Trish's bookkeeper has provided the following book-basis fixed asset rollforward: Himple Retail Fixed Asset Rollforward 12/31/2020 (book basis) ASSET CASH REGISTER 2018 TOTAL ADDITIONS DEPR IN SERVICE METHOD 12/15/2018 SL LIFE 5 COST BASIS 9,900.00 9,900.00 2018 DEPR 165.00 165.00 2019 2020 DEPR DEPR 1,980.00 1,980.00 1,980.00 1,980.00 ACCUM DEPR 4,125.00 4,125.00 NET BOOK VALUE 5,775.00 5,775.00 7 9/12/2019 9/12/2019 SL SL 7 RETAIL FIXTURES FURNITURE 2019 TOTAL ADDITIONS TOTAL 4,750.00 3,900.00 8,650.00 18,550.00 226.19 185.71 411.90 2,391.90 678.57 557.14 1,235.71 3,215.71 904.76 742.85 1,647.61 5,772.61 3,845.24 3,157.15 7,002.39 12,777.39 165.00 SL 5 DELIVERY TRUCK DESK AND CABINETRY COMPUTER 2020 TOTAL ADDITIONS TOTAL 6/1/2020 6/1/2020 6/1/2020 7 SL SL 5 37,500.00 11,900.00 2,800.00 52,200.00 70,750.00 4,375.00 991.67 326.67 5,693.34 165.00 2,391.90 8,909.05 4,375.00 991.67 326.67 5,693.34 11,465.95 33,125.00 10,908.33 2,473.33 46,506.66 59,284.05 The truck is not considered a passenger automobile for purposes of the luxury automobile limitations. Trish also has a qualified home office of 250 sq. ft. Her home is 2,000 sq. ft. Her 2015 purchase price and basis in the home, not including land, is $100,000 (the home's market value is $150,000). She incurred the following costs in 2020 related to the entire home: Utilities $3,000 Cleaning 1,000 Insurance 1,100 Property taxes 2,000 Required: For tax purposes, Trish elected out of bonus depreciation in all years except 2020. She did not elect immediate expensing in any year. The tax lives of the assets are he same as the book lives shown in the fixed asset schedule above. Complete Trish's Schedule C, Form 8829, and Form 4562 (as necessary). Make realistic assumptions any missing data. bout yover of disallowed deduction to 2021. Add lines 9 and 10, less line 12 13 n't use Part II or Part III below for listed property, Instead, use Part V. Special Depreciation Allowance and Other Depreciation (Don't include listed property, See instructions.) ecial depreciation allowance for qualified property (other than listed property) placed in service during the tal, ar. See instructions .... 14 52,200 15 roperty subject to section 168(0)(1) election... Other depreciation (including ACRS)..... 16 MACRS Depreciation (Don't include listed property. See instructions.) Section A MACRS deductions for assets placed in service in tax years beginning before 2020 17 5,693 x If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check hereStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started