help filling blanks

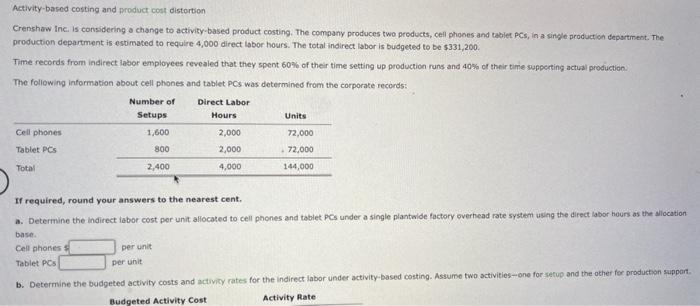

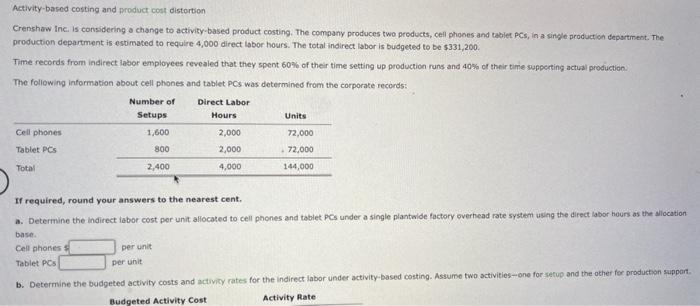

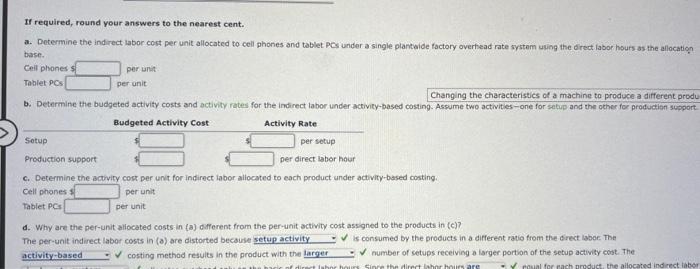

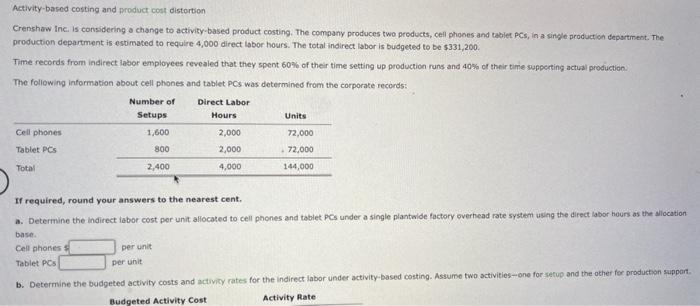

Activity-based costing and product cost distortion Crenshaw inc. is considering a change to activity-based product costing. The company produces two products, cell phooes and tabier pCs, in a single production department. The production department is estimated to require 4,000 direct labor hours. The total indirect labor is budgeted to be $331,200. Time records from indirect labor employees revealed that they spent 60% of their time setting up production runs and 40% of their time wupperting actual production. The following information about cell phones and tablet PCs was determined from the corporate records: If required, round your answers to the nearest cent. a. Determine the indirect labor cost per unit allocated to cell phones and tablet PCS under a single plantalde factory overhead rate system using the direct labor hours as the allocation bast. Cell ahones s per unit Tablet PCS per unit. b. Determine the budgeted activity costs and activity rates for the indirect labor under activity-based costing. Assume two activities-one for setup and the other for production support. Activity Rate If required, round your answers to the nearest cent. a. Dotermine the indirect labor cost per unit allocated to cell phones and tablet PCs under a single plantaide foctory overfead rate system uwing the direct labor hours as the allocation base. Ceil phones 4 per unit Tablet PCs per unit Changing the characteristics of a machine to produce a different produ b. Determine the budgeted activity costs and activity rates for the indirect labor under activity-based costing. Assume two activities-one for satip and the other for production support c. Determine the actwity cost per unit for indirect labor allocated to each product under activity-based costing. cell phones 4 per unit Tablet PCs per unit d. Why are the per-unit aliocated costs in (a) different from the per-unit activity cost assigned to the products in (c)? The per-unit indirect labor costs in (a) are distorted becsuse. is consumed by the products in a different ratio from the drect laboe. The costing methad results in the product with the number of setups receiving a larger portion of the setup activity cost. The