Answered step by step

Verified Expert Solution

Question

1 Approved Answer

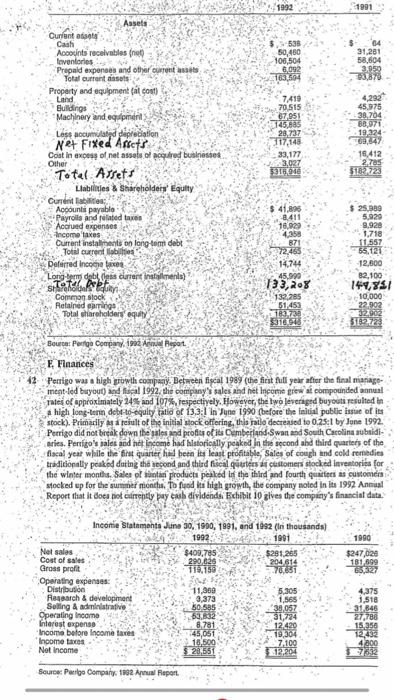

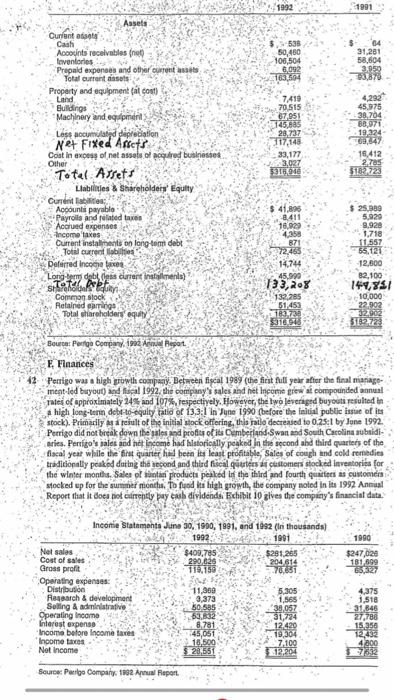

help find all ratios, industry averages, analyze trends, and report interpertuation for each ratios 1992 1991 538 50,480 106,504 6092 163,504 04 31.261 58,604 3.950

help find all ratios, industry averages, analyze trends, and report interpertuation for each ratios

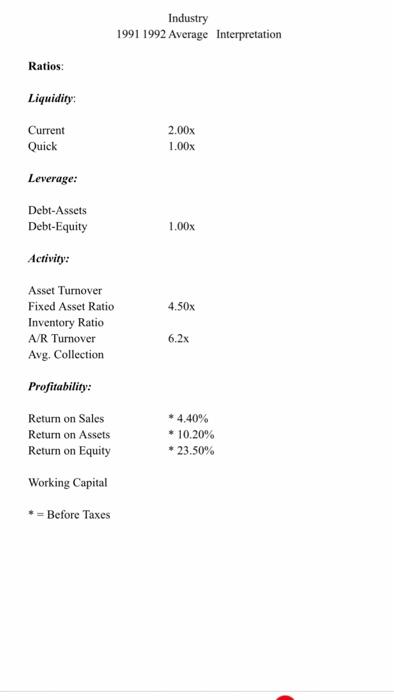

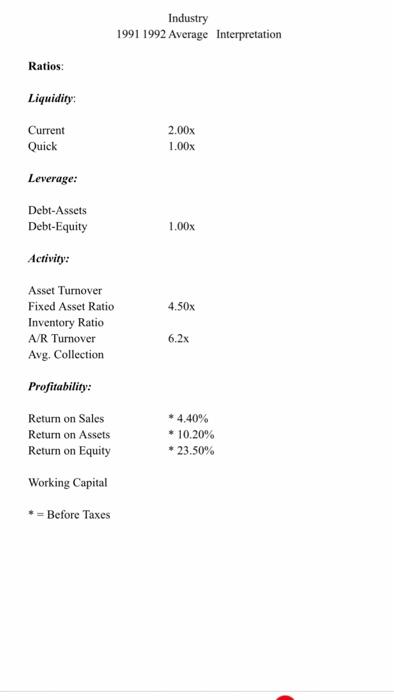

1992 1991 538 50,480 106,504 6092 163,504 04 31.261 58,604 3.950 870 - Assets Current Cash Accounts receivables (not Sevenleries Prepaid expenses and other current Total current anses Property and equipment al cost) Land Buildings Machinery and equipment Less accumulated papreciation net Fixed Anett Coat in excess of net assets of red businesses Other Total Assets Liabiles & Shareholders' Equity Current liabilities Accounts payable Payrolls and related to Accrued expenses Income taxes Current installments on long-tom debt Total current bites Deferred Incoches Long debts current installments) 7410 70.515 67951 145,883 28,737 3117,148 33,177 3,027 160 4,292 45.975 38,704 30.071 19.324 69647 18,412 2.785 $1822723 $ 41.896 8.411 16.929 4.95 871 7245 14,744 45.990 133,208 132.285 51,453 10.732 $310.94 25.380 5.920 9,928 1,718 11 557 55.121 12.500 82,100 144,837 10,000 22.900 3290 316272 Tey skin Common stock Retained garlige Total shareholders equy Source: Perga Company, 1992. An epot. E Finances 42 Perrigo was a high prowth company. Between fiscal 1989 (the first full year after the final manage- ment-led buyout) and Racal 1992, the company sales and het Income grew al compounded anal rates of approximately 24 and 197%, respectiyely. However, the two leveraged buyouts resulted in a high long-term debt-to-equlty ratio of 13,3:1 in June 1990 (before the initial public isste of its stock). Primarily as a result of the initial stock offering, this ratio decreased to 0.25:1 by June 1992 Perrigo did not break down the sales and profits of its Cumberland-Swart and South Carolina subsidi aries. Perrigo's sales and net incoms had historically peaked in the second and third quarters of the fiscal yeat while the first quarter hw been least profitable, Sales of cough and cold remedies tradicionally peaked dating the second and third fiscal quarters of customers stocked inventories for the winter months. Sales of satan product peaked in the third and fourth qualities as customis stocked up for the sur months to find a high growth, the company noted in its 1992 Annual Report that it does not currently bay cash dividends Exhibit 10 gives the company's financial data. 1990 190,438 $247,020 181,699 6527 Income Statements June 30, 1990, 1991, and 1982 (in thousands) 1992 1991 Net sales $409,785 $281.265 Cost of sales 204 614 Gross profit Yi Operating expenses Distribution 11,869 5.305 Research & development 3,373 1,565 Selling & administrative 50 585 38057 Operating Income Interest expenso 8,781 12.420 Income before Income taxe 45,051 19,304 Income taxes 18.500 2,100 Net Income $ 23,551 12,204 4,375 1 518 31.846 27,786 15.350 12,432 4 800 Source: Parige Company. 1992 Anual Report Industry 1991 1992 Average Interpretation Ratios: Liquidity Current Quick 2.00x 1.00x Leverage: Debt-Assets Debt-Equity 1.00x Activity: 4.50x Asset Turnover Fixed Asset Ratio Inventory Ratio A/R Turnover Avg. Collection 6.2x Profitability: Return on Sales Return on Assets Return on Equity 4.40% * 10.20% * 23.50% Working Capital * Before Taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started