Help find the Ke (expected return of stock) and Kr (required rate of return). Please show formulas as well.

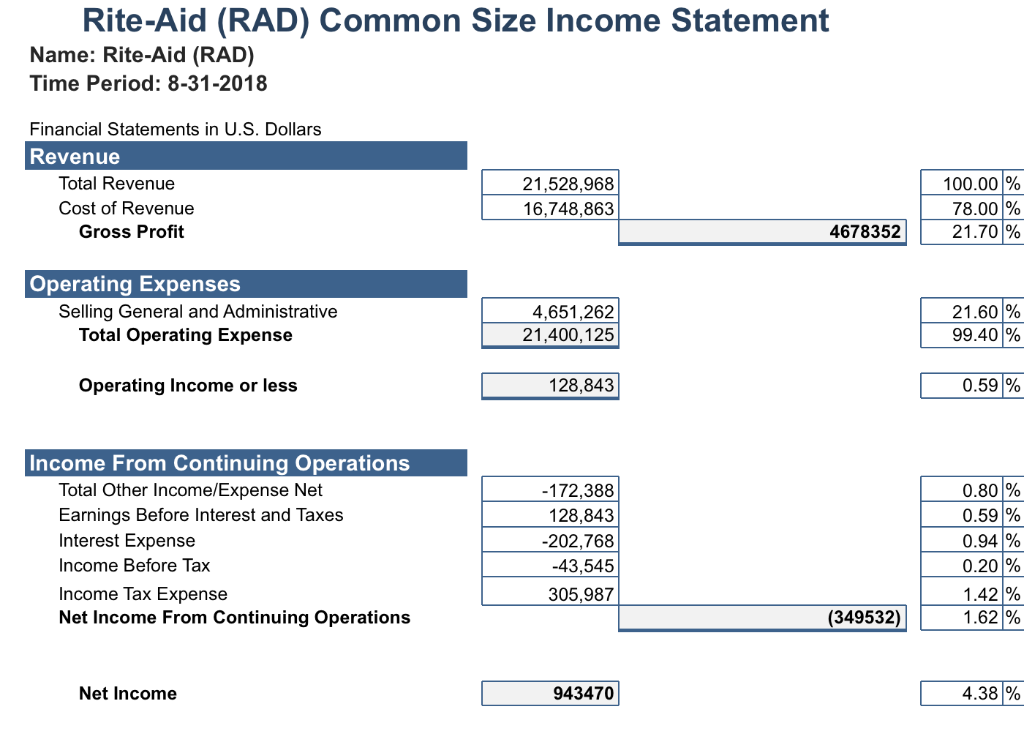

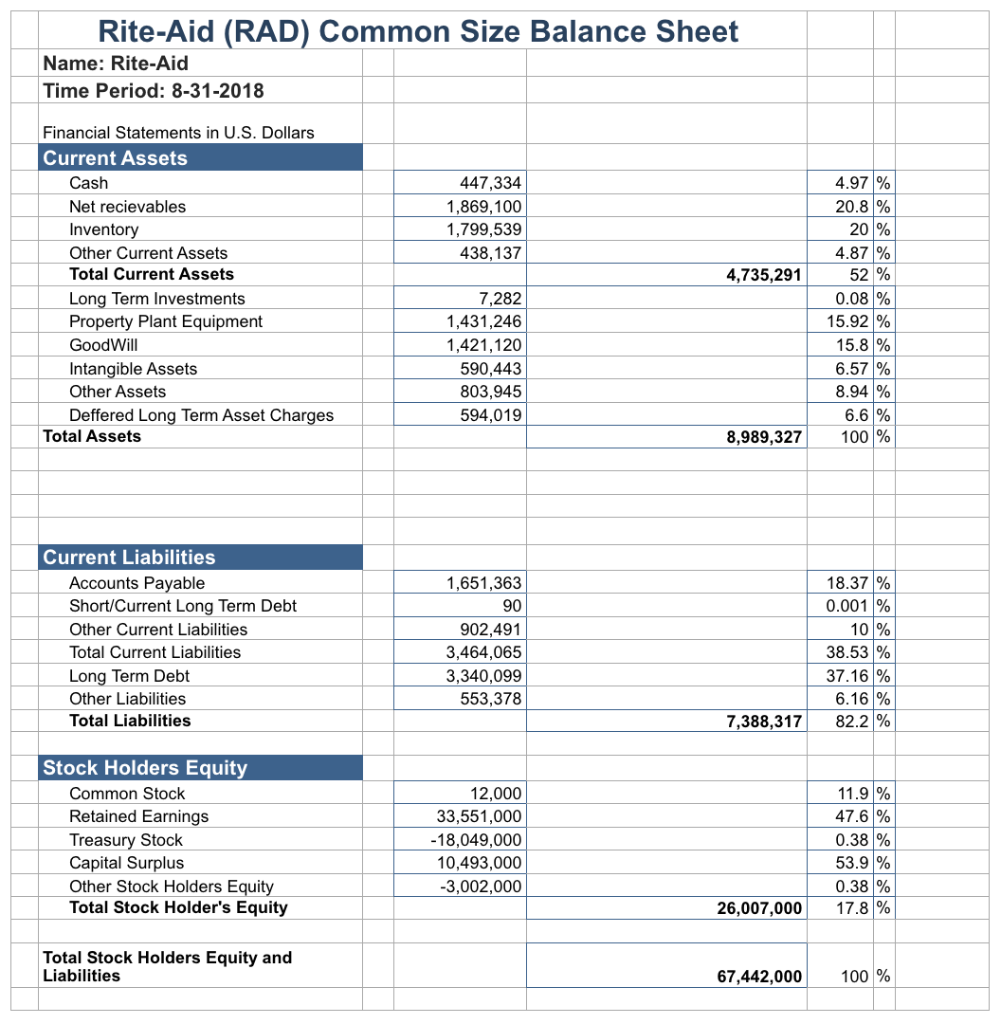

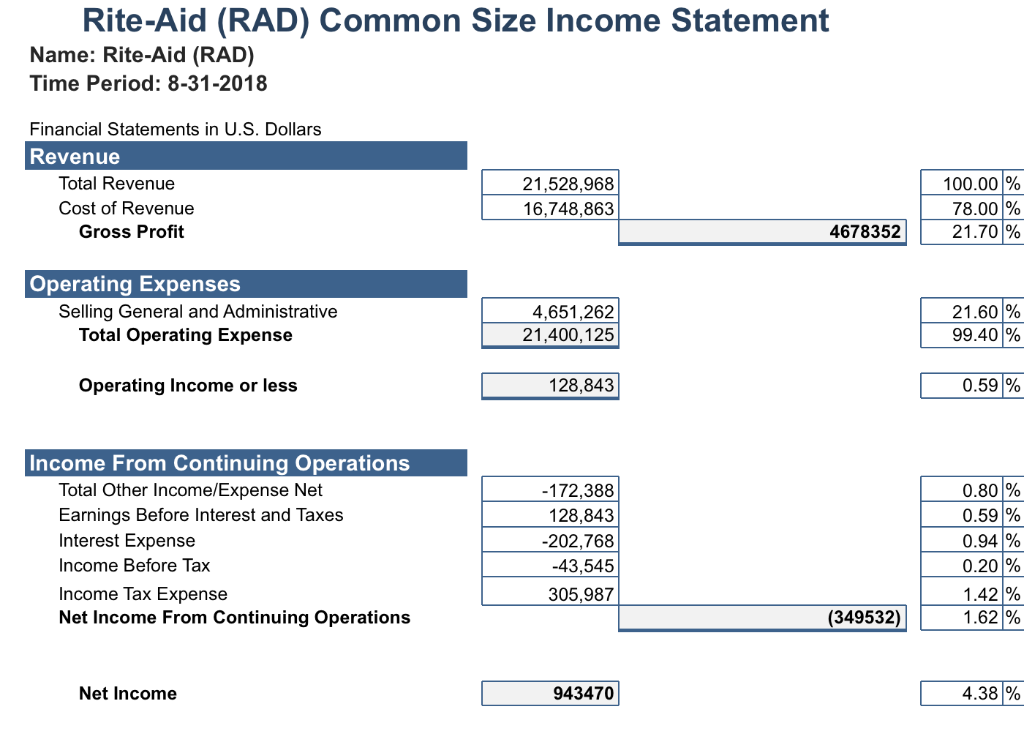

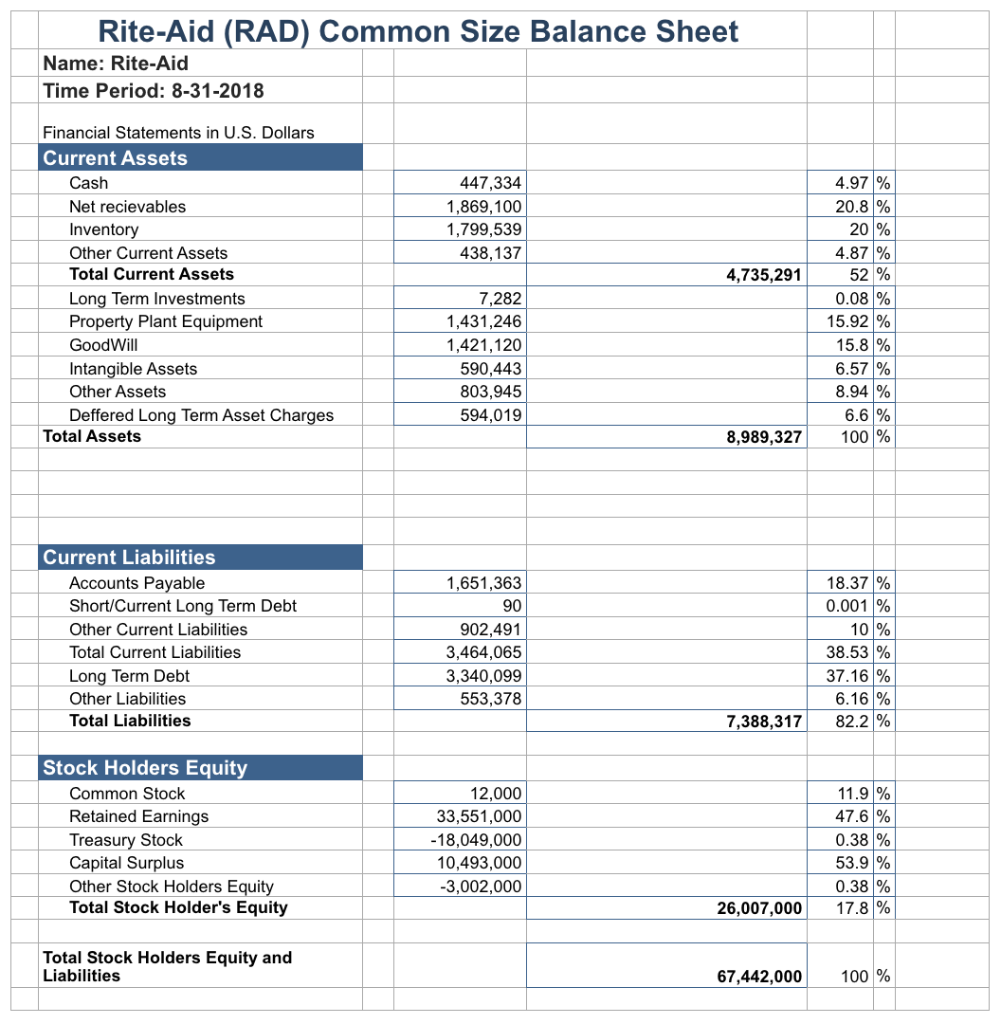

Rite-Aid (RAD) Common Size Income Statement Name: Rite-Aid (RAD) Time Period: 8-31-2018 Financial Statements in U.S. Dollars Revenue Total Revenue Cost of Revenue 21,528,968 16,748,863 100.00 % 78.00% 21.70 % 4678352 Gross Profit Operating Expenses 21.60% 99.40 % Selling General and Administrative 4,651,262 21,400,125 Total Operating Expense Operating Income or less 128,843 0.59% Income From Continuing operations 172,388 128,843 202,768 -43,545 305,987 Total Other Income/Expense Net Earnings Before Interest and Taxes Interest Expense Income Before Tax Income Tax Expense Net Income From Continuing Operations 0.80 % 0.59% 0.94 % 0.20% 1.42% 1.62 % (349532) 943470 4.38% Net Income Rite-Aid (RAD) Common Size Balance Sheet Name: Rite-Aic Time Period: 8-31-2018 Financial Statements in U.S. Dollars Current Assets 447,334 1,869,100 1,799,539 438,137 Cash Net recievables Invento Other Current Assets Total Current Assets Long Term Investments Property Plant Equipment GoodWill ntangible Assets Other Assets Deffered Long Term Asset Charges 4.97 % 20.8% 20 % 4.87 % 52 % 0.08 % 15.92% 15.8% 6.57 % 8.94 % 6.6% 100 % 4,735,291 7,282 1,431,246 1,421,120 590,443 803,945 594,019 Total Assets 8,989,327 Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Total Current Liabilities Long Term Debt Other Liabilities Total Liabilities 1,651,363 90 902,491 3,464,065 3,340,099 553,378 18.37 % 0.001 % 10% 38.53 % 37.16% 6.16% 82.2% 7,388,317 Stock Holders Equity Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stock Holders Equit Total Stock Holder's Equity 12,000 33,551,000 18,049,000 10,493,000 3,002,000 11.9% 47.6 % 0.38 % 53.9% 0.38% 17.8% 26,007,000 Total Stock Holders Equity and Liabilities 67,442,000 100 % Rite-Aid (RAD) Common Size Income Statement Name: Rite-Aid (RAD) Time Period: 8-31-2018 Financial Statements in U.S. Dollars Revenue Total Revenue Cost of Revenue 21,528,968 16,748,863 100.00 % 78.00% 21.70 % 4678352 Gross Profit Operating Expenses 21.60% 99.40 % Selling General and Administrative 4,651,262 21,400,125 Total Operating Expense Operating Income or less 128,843 0.59% Income From Continuing operations 172,388 128,843 202,768 -43,545 305,987 Total Other Income/Expense Net Earnings Before Interest and Taxes Interest Expense Income Before Tax Income Tax Expense Net Income From Continuing Operations 0.80 % 0.59% 0.94 % 0.20% 1.42% 1.62 % (349532) 943470 4.38% Net Income Rite-Aid (RAD) Common Size Balance Sheet Name: Rite-Aic Time Period: 8-31-2018 Financial Statements in U.S. Dollars Current Assets 447,334 1,869,100 1,799,539 438,137 Cash Net recievables Invento Other Current Assets Total Current Assets Long Term Investments Property Plant Equipment GoodWill ntangible Assets Other Assets Deffered Long Term Asset Charges 4.97 % 20.8% 20 % 4.87 % 52 % 0.08 % 15.92% 15.8% 6.57 % 8.94 % 6.6% 100 % 4,735,291 7,282 1,431,246 1,421,120 590,443 803,945 594,019 Total Assets 8,989,327 Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Total Current Liabilities Long Term Debt Other Liabilities Total Liabilities 1,651,363 90 902,491 3,464,065 3,340,099 553,378 18.37 % 0.001 % 10% 38.53 % 37.16% 6.16% 82.2% 7,388,317 Stock Holders Equity Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stock Holders Equit Total Stock Holder's Equity 12,000 33,551,000 18,049,000 10,493,000 3,002,000 11.9% 47.6 % 0.38 % 53.9% 0.38% 17.8% 26,007,000 Total Stock Holders Equity and Liabilities 67,442,000 100 %