Help for 13 parts/requeriments

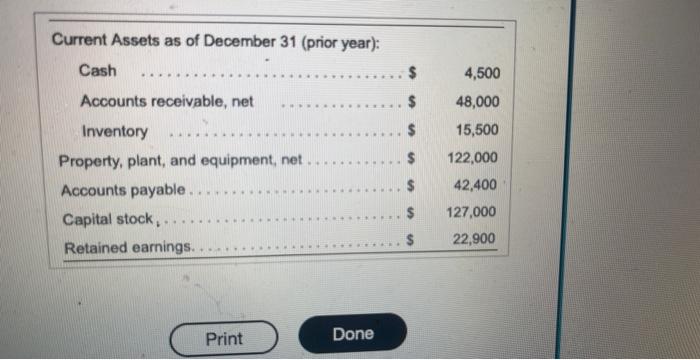

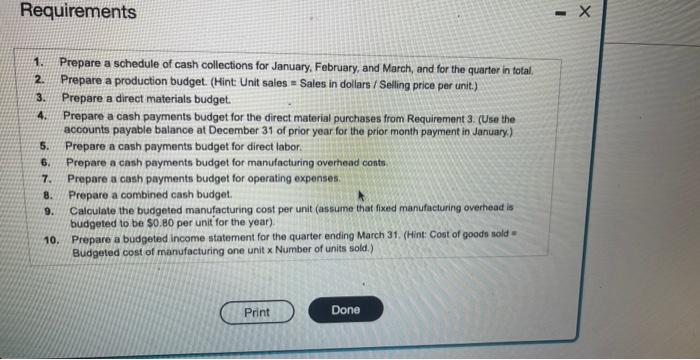

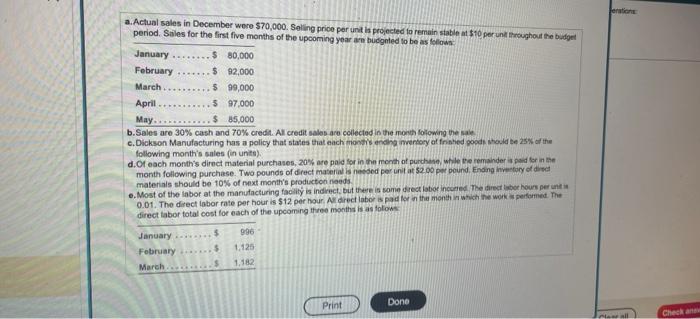

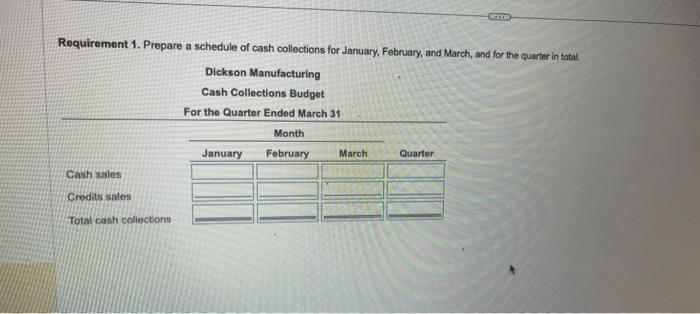

Dickson Manulacturing is preparing its master budget for the firnt quarter of the upeocming year. The fallowing data pertain to Dickson Manufacturing's operations: (Click the ioon to view the data.) (1. \{Click the icen to view addeional data.) Read the mogurementr. Current Assets as of December 31 (prior year): Print Done Requirements 1. Prepare a schedule of cash collections for January, February, and March, and for the quarter in fotal. 2. Prepare a production budget. (Hint. Unit sales = Sales in dollars / Selling price per unit.) 3. Prepare a direct materials budget. 4. Prepare a cash payments budget for the direct material purchases from Requirement 3. (Use the accounts payable balance at December 31 of prior year for the prior month payment in January.) 5. Prepare a cash payments budget for direct labor: 6. Prepare a cash payments budget for manufacturing overhead conts. 7. Prepare a cash payments budget for operating expenses. 8. Prepare a combined cash budget. 9. Calculate the budgeted manufacturing cost per unit (assume that fixed manufacturing overhead is budgeted to be $0.80 per unit for the year). 10. Prepare a budgeted income statement for the quarter ending March 31. (Hint: Cost of goods sold = Budgeted cost of manufacturing one unit x Number of units sold.) a. Actual sales in December wose $70,000. Selling price per unit is projected fo remain stable at $10 per unl hroughout the budpet period. Siles for the first five months of the upcoming year am budgnted to be as folown: b.Sales are 30% cash and 70% credit. All credit sales are collected in the monh folowing the sale c. Dickson Manulacturing has a policy that states that each moopis endine merfory ot fnohed poode should te 25% of the following month's sales (in units) d.Or each month's direct material purchases, 20\%, are pad for in the month of punchase, wille tre remander it poid for in sen month following purchase. Two pounds of direct materia ls netsod per init at 52.00 pee pound, Ending hivertry of di wet materials should be 10% of next month's producton noeds e. Most of the labor at the manudacturing faclity is indrect. but there is tame dreot laboe incueded. The darect lubor hous per unt in 0.01. The direct labor rate per hour is 512 per hour. Aldrect labor is pad for in tha mienth in which he work in performed. Phe direct tabor total cest for each of the upcoming tfree montha is as folons: Requirement 1. Propare a schedule of cash collections for January, February, and March, and for the quarter in total. Dickson Manulacturing is preparing its master budget for the firnt quarter of the upeocming year. The fallowing data pertain to Dickson Manufacturing's operations: (Click the ioon to view the data.) (1. \{Click the icen to view addeional data.) Read the mogurementr. Current Assets as of December 31 (prior year): Print Done Requirements 1. Prepare a schedule of cash collections for January, February, and March, and for the quarter in fotal. 2. Prepare a production budget. (Hint. Unit sales = Sales in dollars / Selling price per unit.) 3. Prepare a direct materials budget. 4. Prepare a cash payments budget for the direct material purchases from Requirement 3. (Use the accounts payable balance at December 31 of prior year for the prior month payment in January.) 5. Prepare a cash payments budget for direct labor: 6. Prepare a cash payments budget for manufacturing overhead conts. 7. Prepare a cash payments budget for operating expenses. 8. Prepare a combined cash budget. 9. Calculate the budgeted manufacturing cost per unit (assume that fixed manufacturing overhead is budgeted to be $0.80 per unit for the year). 10. Prepare a budgeted income statement for the quarter ending March 31. (Hint: Cost of goods sold = Budgeted cost of manufacturing one unit x Number of units sold.) a. Actual sales in December wose $70,000. Selling price per unit is projected fo remain stable at $10 per unl hroughout the budpet period. Siles for the first five months of the upcoming year am budgnted to be as folown: b.Sales are 30% cash and 70% credit. All credit sales are collected in the monh folowing the sale c. Dickson Manulacturing has a policy that states that each moopis endine merfory ot fnohed poode should te 25% of the following month's sales (in units) d.Or each month's direct material purchases, 20\%, are pad for in the month of punchase, wille tre remander it poid for in sen month following purchase. Two pounds of direct materia ls netsod per init at 52.00 pee pound, Ending hivertry of di wet materials should be 10% of next month's producton noeds e. Most of the labor at the manudacturing faclity is indrect. but there is tame dreot laboe incueded. The darect lubor hous per unt in 0.01. The direct labor rate per hour is 512 per hour. Aldrect labor is pad for in tha mienth in which he work in performed. Phe direct tabor total cest for each of the upcoming tfree montha is as folons: Requirement 1. Propare a schedule of cash collections for January, February, and March, and for the quarter in total