Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help for questions 2 and 3 please! Your Company acquired a mineral deposit at a cost of $7,950,000 on january 1 of Year one. It

help for questions 2 and 3 please!

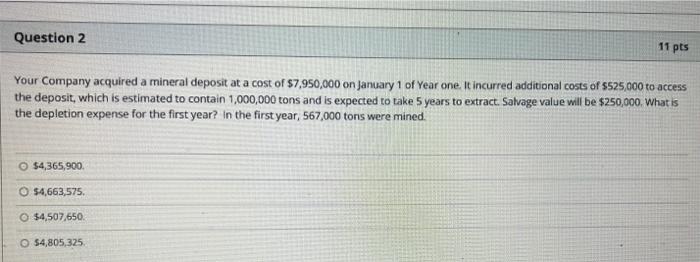

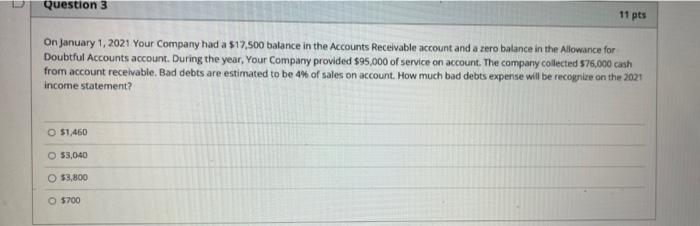

Your Company acquired a mineral deposit at a cost of $7,950,000 on january 1 of Year one. It incurred additional costs of $525,000 to access the deposit, which is estimated to contain 1,000,000 tons and is expected to take 5 years to extract. Salvage value will be $250,000. What is the depletion expense for the first year? In the firstyear, 567,000 tons were mined. 54,365,900 54,663,575 $4,507,650 54,805,325 On january 1,2021 Your Company had a $17,500 balance in the Accounts Recelvable account and a zero balance in the Allowance for Doubtful Accounts account. During the year, Your Company provided $95,000 of service on account. The company collected $76,000 cash from account recelvable. Bad debts are estimated to be 4%6 of sales on account. How much bad debts expense will be recognize on the 2021 income statement? 51,460 53,040 53,800 5700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started