Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help!! For the next 4 questions, you have been tasked with building a stand-alone DCF valuation for Graham Holdings ( GHC ), a publicly-traded company,

help!!

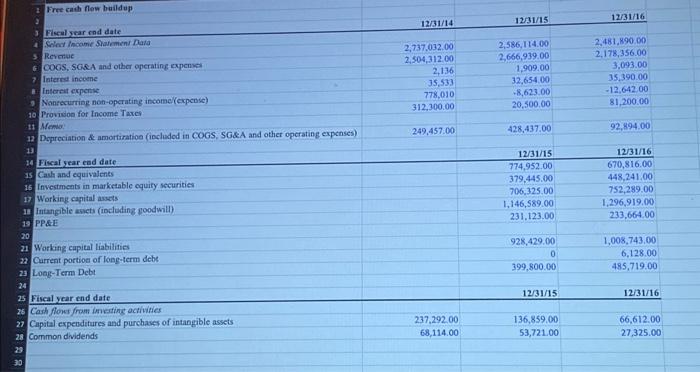

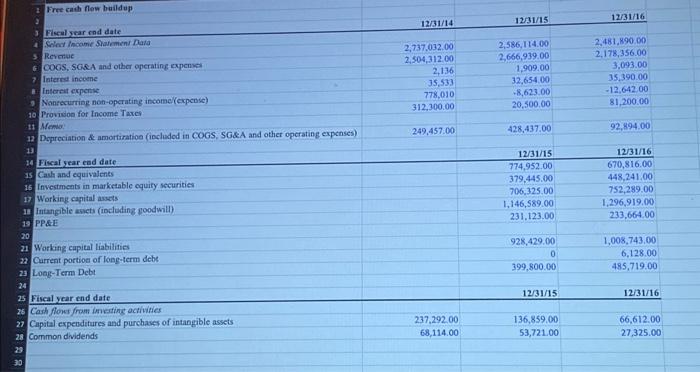

For the next 4 questions, you have been tasked with building a stand-alone DCF valuation for Graham Holdings ( GHC ), a publicly-traded company, using the unlevered (two-stage) approach. You have collected the data found in this file: GHC Free Cashflow Buildup. Using the data from the "GHC Free Cashflow Buildup" workbook, calculate 2016 normalized, unlevered free cash flows. Assume the tax rate =2016 tax expense / pretax income. 241,530.00 268,855.00 270,976.70 282,966.00 333,379.00 Free cach flow buildup Fiscal year end date 12/31/14 12/31/15 1231116 Silet hecame Siatement Data Reverae Coos, sosed and other operating expenes Interned inceene Intcreat expense Nonrecurring non-operating income/(expense) Provision for Income Taxes Meno. Dopreciation \& amortiration (included in COGS, SGEA and other operating expenses) \begin{tabular}{r} 2,737,032,00 \\ 2,504,312,00 \\ 2,136 \\ 35,533 \\ 778,010 \\ 312,300.00 \\ \hline \end{tabular} 2,586,114.00 2,481,890.00 2,666,939.00 2,178,356.00 1,909.00 3.093 .00 35,390.00 32,654,00 +8,623,00 12,642,00 20,500,00 81,200.00 Fiscal year end date Cadi and equivalents Investments in marketable equiry securities Working capital assets Intangible ancts (incleding goodwill) PPEE 428,437.00 92,894,00 Working cupital liabilities Current portion of long-term debs Loag-Term Debt \begin{tabular}{|r|r|} \hline 12/31/15 & 12/31/16 \\ \hline 774,952.00 & 670,816.00 \\ \hline 379,445.00 & 448,241.00 \\ \hline 706,325.00 & 752,289.00 \\ \hline 1,146,589.00 & 1,296,919.00 \\ \hline 231,123.00 & 233,664.00 \\ \hline \end{tabular} 249.457 .00 928,429.00 1,008,743.00 6,128.00 485,719.00 Fiscal year end date. 399,800.00 12/31/16 Cash flows from inceting activities 12/31/15 66,612.00 27,325.00 Capital expenditures and purchases of intangible assets Common dividends 237,292,00 136,859.00 68,114.00 53,721.00 For the next 4 questions, you have been tasked with building a stand-alone DCF valuation for Graham Holdings ( GHC ), a publicly-traded company, using the unlevered (two-stage) approach. You have collected the data found in this file: GHC Free Cashflow Buildup. Using the data from the "GHC Free Cashflow Buildup" workbook, calculate 2016 normalized, unlevered free cash flows. Assume the tax rate =2016 tax expense / pretax income. 241,530.00 268,855.00 270,976.70 282,966.00 333,379.00 Free cach flow buildup Fiscal year end date 12/31/14 12/31/15 1231116 Silet hecame Siatement Data Reverae Coos, sosed and other operating expenes Interned inceene Intcreat expense Nonrecurring non-operating income/(expense) Provision for Income Taxes Meno. Dopreciation \& amortiration (included in COGS, SGEA and other operating expenses) \begin{tabular}{r} 2,737,032,00 \\ 2,504,312,00 \\ 2,136 \\ 35,533 \\ 778,010 \\ 312,300.00 \\ \hline \end{tabular} 2,586,114.00 2,481,890.00 2,666,939.00 2,178,356.00 1,909.00 3.093 .00 35,390.00 32,654,00 +8,623,00 12,642,00 20,500,00 81,200.00 Fiscal year end date Cadi and equivalents Investments in marketable equiry securities Working capital assets Intangible ancts (incleding goodwill) PPEE 428,437.00 92,894,00 Working cupital liabilities Current portion of long-term debs Loag-Term Debt \begin{tabular}{|r|r|} \hline 12/31/15 & 12/31/16 \\ \hline 774,952.00 & 670,816.00 \\ \hline 379,445.00 & 448,241.00 \\ \hline 706,325.00 & 752,289.00 \\ \hline 1,146,589.00 & 1,296,919.00 \\ \hline 231,123.00 & 233,664.00 \\ \hline \end{tabular} 249.457 .00 928,429.00 1,008,743.00 6,128.00 485,719.00 Fiscal year end date. 399,800.00 12/31/16 Cash flows from inceting activities 12/31/15 66,612.00 27,325.00 Capital expenditures and purchases of intangible assets Common dividends 237,292,00 136,859.00 68,114.00 53,721.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started