Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help from 20-1 to 20-3 Chapter 20 Hybrid Financing. Preented Stock, Wattams, and Convertibles PROBLEMS 519 Answers Appear in Appendir B Easy Problems 1-2 20-1

help from 20-1 to 20-3

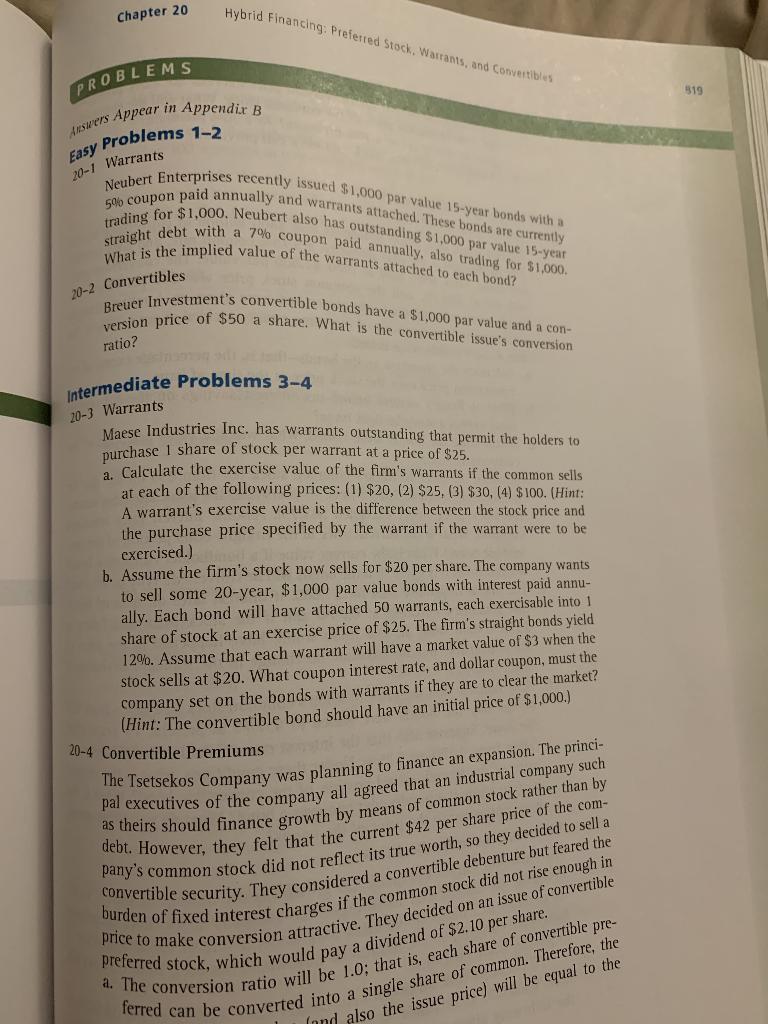

Chapter 20 Hybrid Financing. Preented Stock, Wattams, and Convertibles PROBLEMS 519 Answers Appear in Appendir B Easy Problems 1-2 20-1 Warrants Neubert Enterprises recently issued $1,000 par value 15-year bonds with a 59 coupon paid annually and warrants attached. These bonds are currently trading for $1,000. Neubert also has outstanding $1,000 par value 15-year straight debt with a 7% coupon paid annually, also trading for $1,000. What is the implied value of the warrants attached to each bond? 20-2 Convertibles Breuer Investment's convertible bonds have a $1,000 par value and a con- version price of $50 a share. What is the convertible issue's conversion ratio? Intermediate Problems 3-4 20-3 Warrants Maese Industries Inc. has warrants outstanding that permit the holders to purchase 1 share of stock per warrant at a price of $25. Calculate the exercise value of the firm's warrants if the common sells at each of the following prices: (1) $20, (2) $25, (3) $30, (4) $100. (Hint: A warrant's exercise value is the difference between the stock price and the purchase price specified by the warrant if the warrant were to be cxercised.) b. Assume the firm's stock now sells for $20 per share. The company wants to sell some 20-year, $1,000 par value bonds with interest paid annu- ally. Each bond will have attached 50 warrants, each exercisable into 1 share of stock at an exercise price of $25. The firm's straight bonds yield 12%. Assume that each warrant will have a market value of $3 when the stock sells at $20. What coupon interest rate, and dollar coupon, must the company set on the bonds with warrants if they are to clear the market? (Hint: The convertible bond should have an initial price of $1,000.) 20-4 Convertible Premiums The Tsetsekos Company was planning to finance an expansion. The princi- pal executives of the company all agreed that an industrial company such Is theirs should finance growth by means of common stock rather than by debt. However, they felt that the current $42 per share price of the com- pany's common stock did not reflect its true worth, so they decided to sell a convertible security. They considered a convertible debenture but feared the burden of fixed interest charges if the common stock did not rise enough in price to make conversion attractive. They decided on an issue of convertible preferred stock, which would pay a dividend of $2.10 per share. a. The conversion ratio will be 1.0; that is, each share of convertible pre- ferred can be converted into a single share of common. Therefore, the Innd also the issue price) will be equal to theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started