Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help!!! Homework Chapter 12 2. The Palestinian Art Museum, a not-for-profit entity specializing in art items created by natives of the Pacific Northwest, has a

help!!!

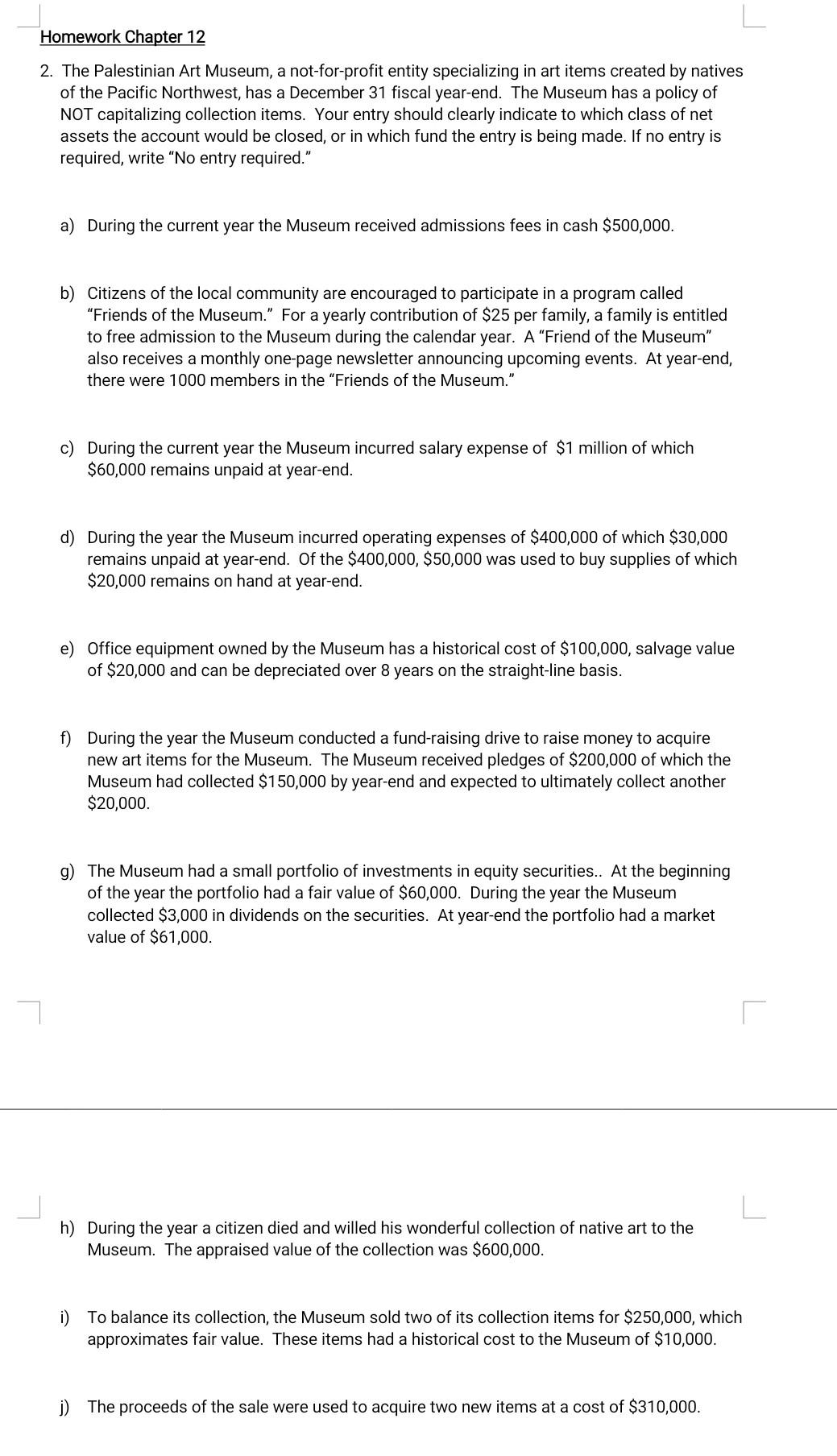

Homework Chapter 12 2. The Palestinian Art Museum, a not-for-profit entity specializing in art items created by natives of the Pacific Northwest, has a December 31 fiscal year-end. The Museum has a policy of NOT capitalizing collection items. Your entry should clearly indicate to which class of net assets the account would be closed, or in which fund the entry is being made. If no entry is required, write No entry required." a) During the current year the Museum received admissions fees in cash $500,000. b) Citizens of the local community are encouraged to participate in a program called "Friends of the Museum." For a yearly contribution of $25 per family, a family is entitled to free admission to the Museum during the calendar year. A "Friend of the Museum also receives a monthly one-page newsletter announcing upcoming events. At year-end, there were 1000 members in the "Friends of the Museum." c) During the current year the Museum incurred salary expense of $1 million of which $60,000 remains unpaid at year-end. d) During the year the Museum incurred operating expenses of $400,000 of which $30,000 remains unpaid at year-end. Of the $400,000, $50,000 was used to buy supplies of which $20,000 remains on hand at year-end. e) Office equipment owned by the Museum has a historical cost of $100,000, salvage value of $20,000 and can be depreciated over 8 years on the straight-line basis. f) During the year the Museum conducted a fund-raising drive to raise money to acquire new art items for the Museum. The Museum received pledges of $200,000 of which the Museum had collected $150,000 by year-end and expected to ultimately collect another $20,000. g) The Museum had a small portfolio of investments in equity securities.. At the beginning of the year the portfolio had a fair value of $60,000. During the year the Museum collected $3,000 in dividends on the securities. At year-end the portfolio had a market value of $61,000. h) During the year a citizen died and willed his wonderful collection of native art to the Museum. The appraised value of the collection was $600,000. i) To balance its collection, the Museum sold two of its collection items for $250,000, which approximates fair value. These items had a historical cost to the Museum of $10,000. j) The proceeds of the sale were used to acquire two new items at a cost of $310,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started