Help, I can't figure out how I messed up with my variances. If you make corrections, please show work so that I can understand what I did wrong!

Answers

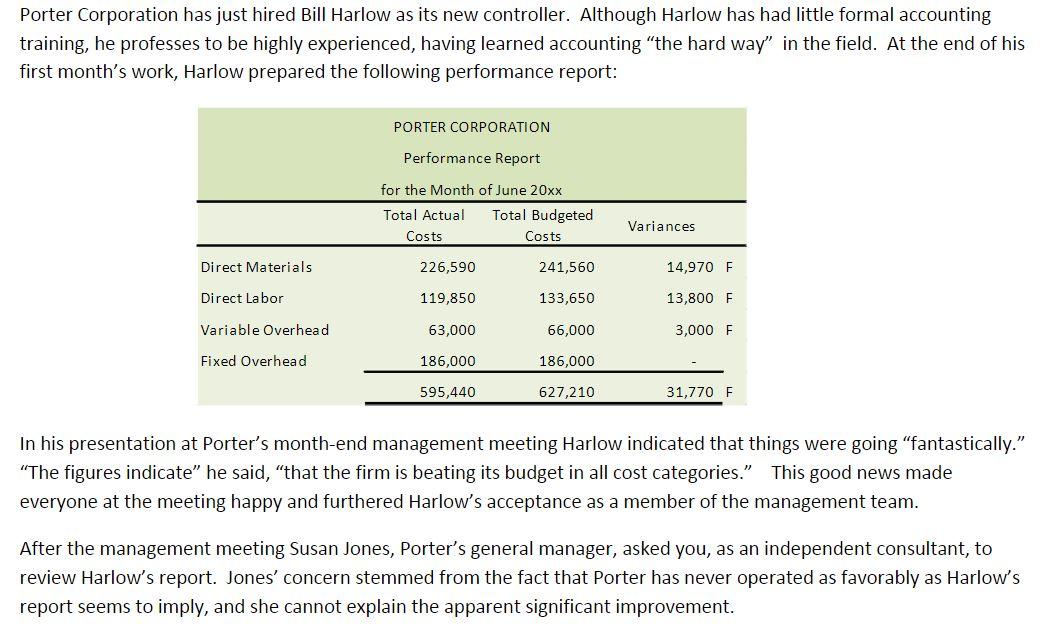

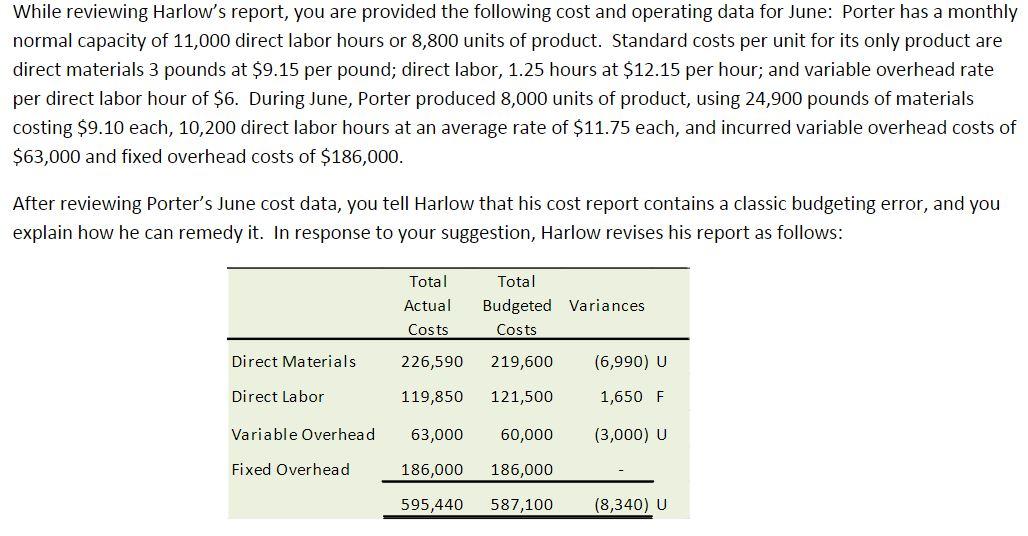

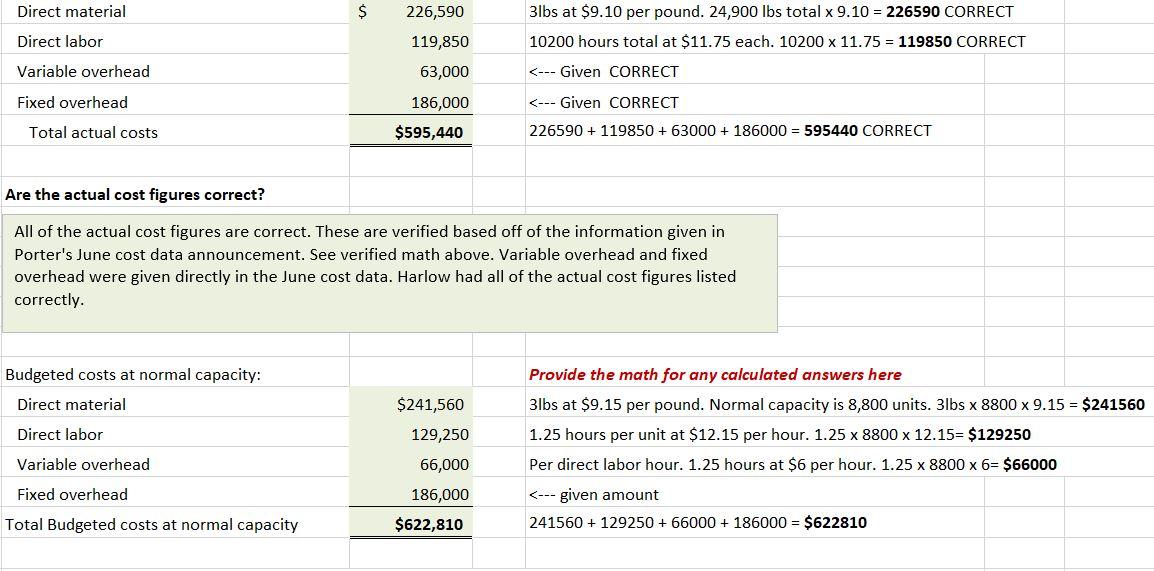

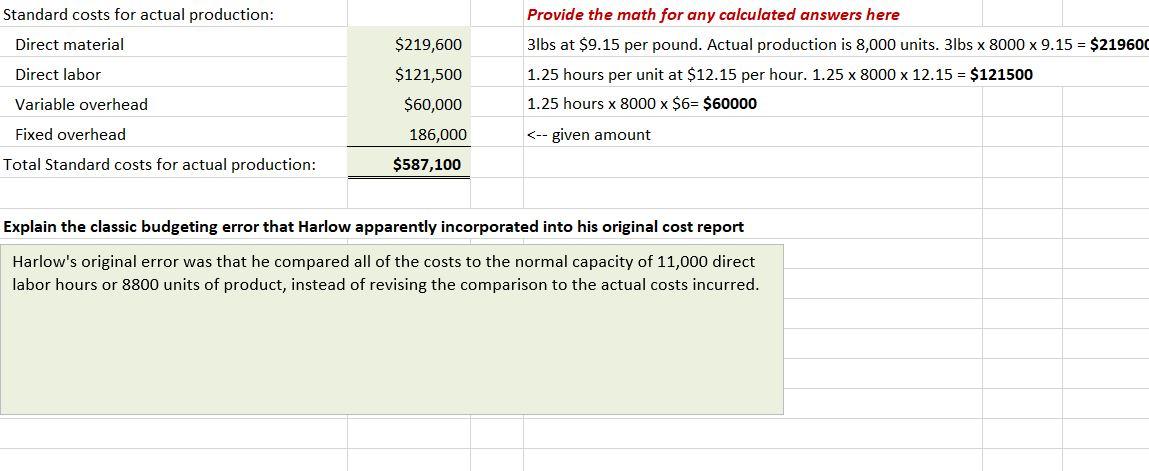

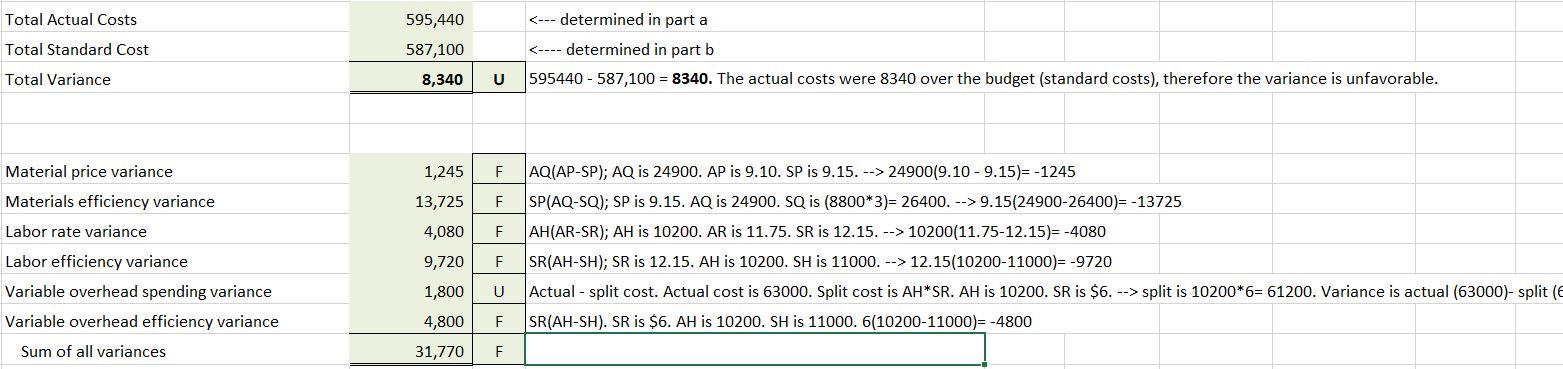

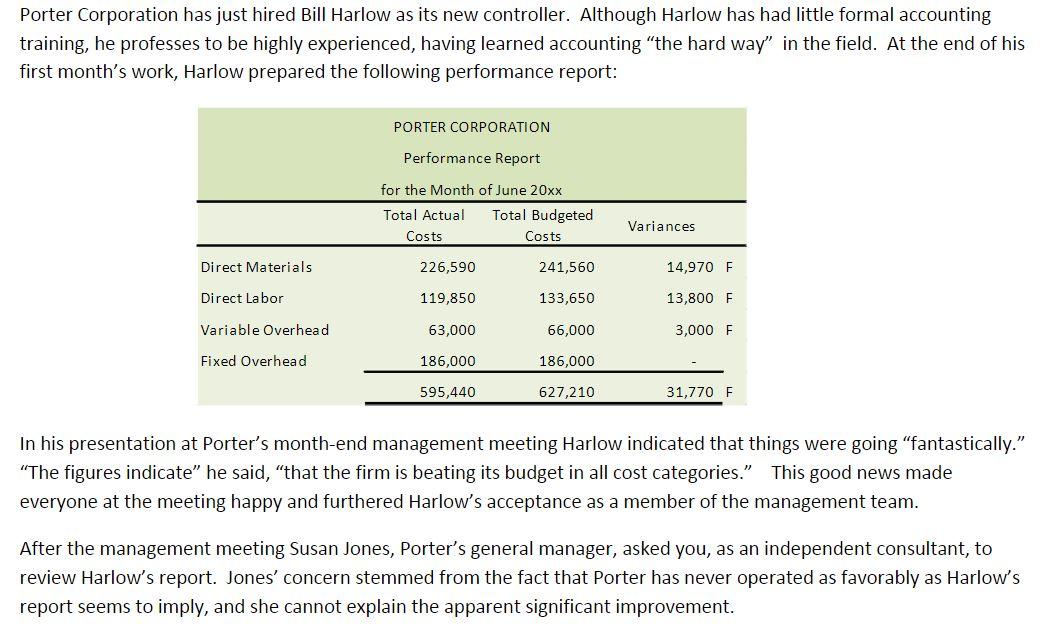

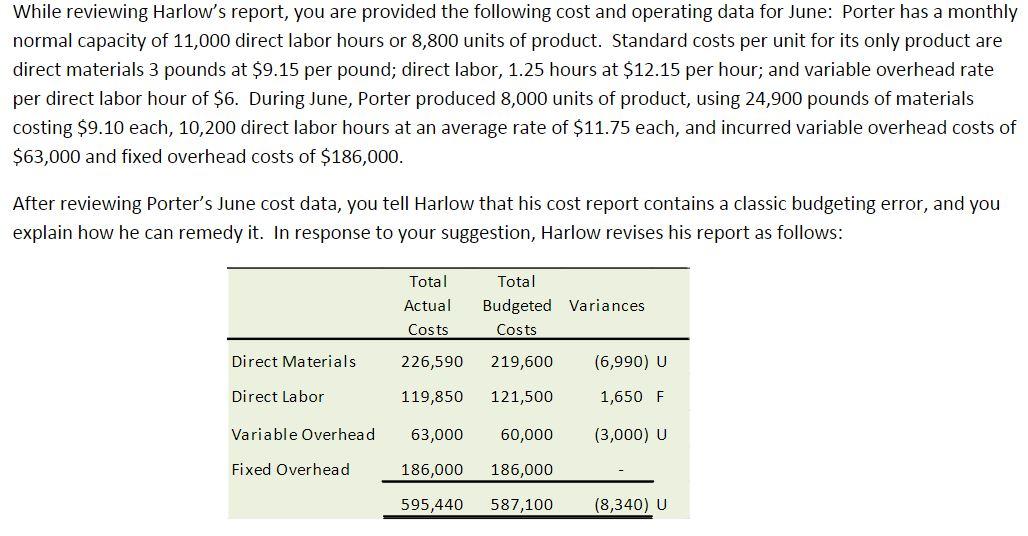

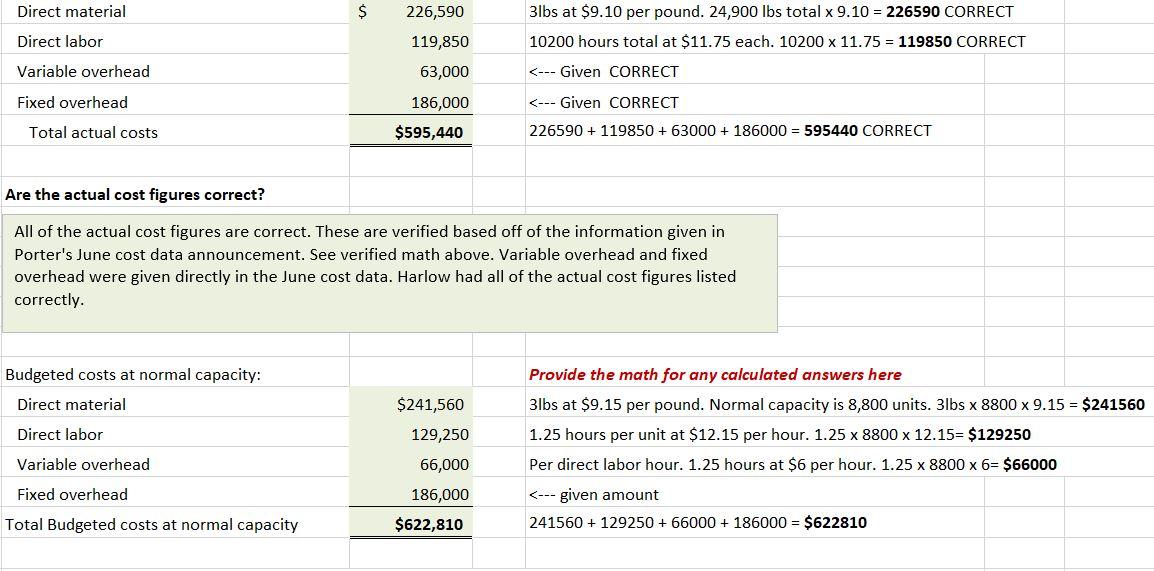

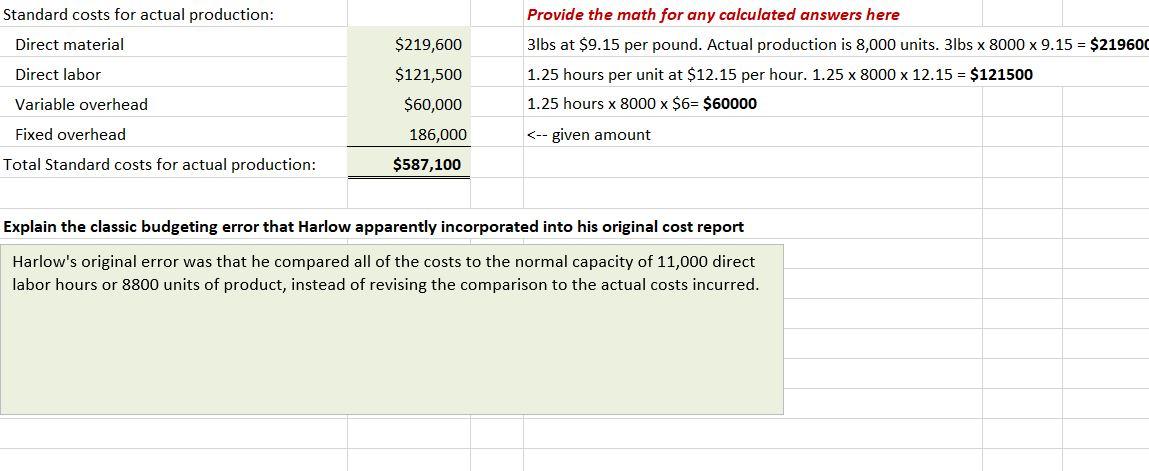

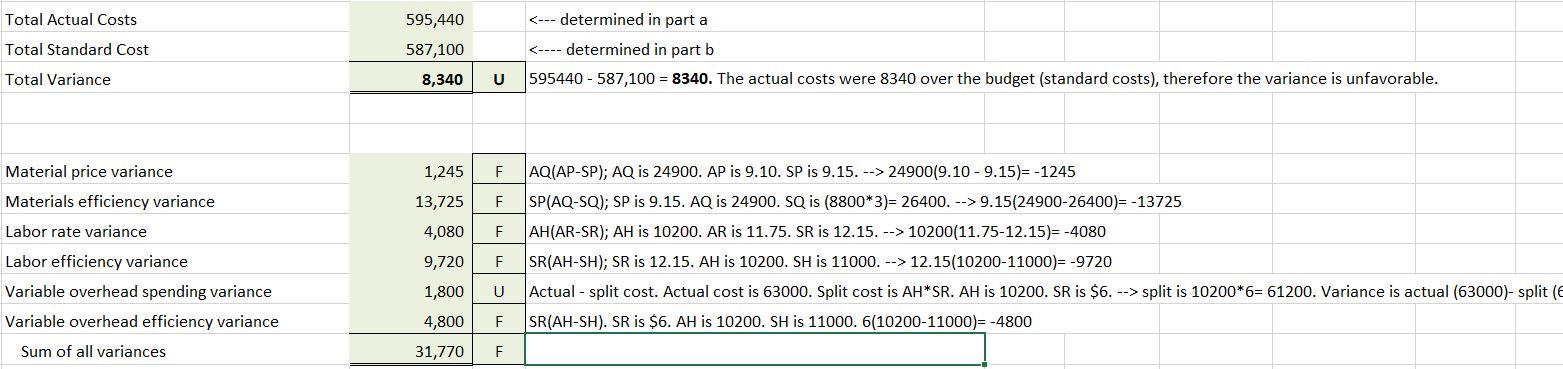

Porter Corporation has just hired Bill Harlow as its new controller. Although Harlow has had little formal accounting training, he professes to be highly experienced, having learned accounting "the hard way" in the field. At the end of his first month's work, Harlow prepared the following performance report: Direct Materials Direct Labor Variable Overhead Fixed Overhead PORTER CORPORATION Performance Report for the Month of June 20xx Total Actual Costs 226,590 119,850 63,000 186,000 595,440 Total Budgeted Costs 241,560 133,650 66,000 186,000 627,210 Variances 14,970 F 13,800 F 3,000 F 31,770 F In his presentation at Porter's month-end management meeting Harlow indicated that things were going "fantastically." "The figures indicate" he said, "that the firm is beating its budget in all cost categories." This good news made everyone at the meeting happy and furthered Harlow's acceptance as a member of the management team. After the management meeting Susan Jones, Porter's general manager, asked you, as an independent consultant, to review Harlow's report. Jones' concern stemmed from the fact that Porter has never operated as favorably as Harlow's report seems to imply, and she cannot explain the apparent significant improvement. While reviewing Harlow's report, you are provided the following cost and operating data for June: Porter has a monthly normal capacity of 11,000 direct labor hours or 8,800 units of product. Standard costs per unit for its only product are direct materials 3 pounds at $9.15 per pound; direct labor, 1.25 hours at $12.15 per hour; and variable overhead rate per direct labor hour of $6. During June, Porter produced 8,000 units of product, using 24,900 pounds of materials costing $9.10 each, 10,200 direct labor hours at an average rate of $11.75 each, and incurred variable overhead costs of $63,000 and fixed overhead costs of $186,000. After reviewing Porter's June cost data, you tell Harlow that his cost report contains a classic budgeting error, and you explain how he can remedy it. In response to your suggestion, Harlow revises his report as follows: Direct Materials Direct Labor Variable Overhead Fixed Overhead Total Actual Costs 226,590 119,850 Total Budgeted Variances Costs 219,600 121,500 63,000 60,000 186,000 186,000 595,440 587,100 (6,990) U 1,650 F (3,000) U (8,340) U Direct material Direct labor Variable overhead Fixed overhead Total actual costs $ Budgeted costs at normal capacity: Direct material Direct labor Variable overhead Fixed overhead Total Budgeted costs at normal capacity 226,590 119,850 63,000 186,000 $595,440 Are the actual cost figures correct? All of the actual cost figures are correct. These are verified based off of the information given in Porter's June cost data announcement. See verified math above. Variable overhead and fixed overhead were given directly in the June cost data. Harlow had all of the actual cost figures listed correctly. 3lbs at $9.10 per pound. 24,900 lbs total x 9.10 = 226590 CORRECT 10200 hours total at $11.75 each. 10200 x 11.75 = 119850 CORRECT 24900(9.10 - 9.15)= -1245 SP(AQ-SQ); SP is 9.15. AQ is 24900. SQ is (8800*3)= 26400. --> 9.15 (24900-26400)= -13725 AH(AR-SR); AH is 10200. AR is 11.75. SR is 12.15. --> 10200(11.75-12.15)=-4080 SR(AH-SH); SR is 12.15. AH is 10200. SH is 11000. --> 12.15(10200-11000)= -9720 Actual - split cost. Actual cost is 63000. Split cost is AH*SR. AH is 10200. SR is $6. --> split is 10200*6= 61200. Variance is actual (63000)- split (6 SR(AH-SH). SR is $6. AH is 10200. SH is 11000. 6(10200-11000)= -4800