Help. I have no idea what I'm doing wrong. After checking my answer twice, I can no longer check my answer, so I really want to know where I messed up.

EDIT: After trying to see if I made any calculation errors, I discovered that I did one tiny error and got the following answers for the 2017 Dollar-Value LIFO retail method: *Ending Inventory (Retail): $564,100 *Ending Inventory (Cost): $311,790 *Cost of Goods Sold: $605,950 ..did anyone happen to get the same answers..?

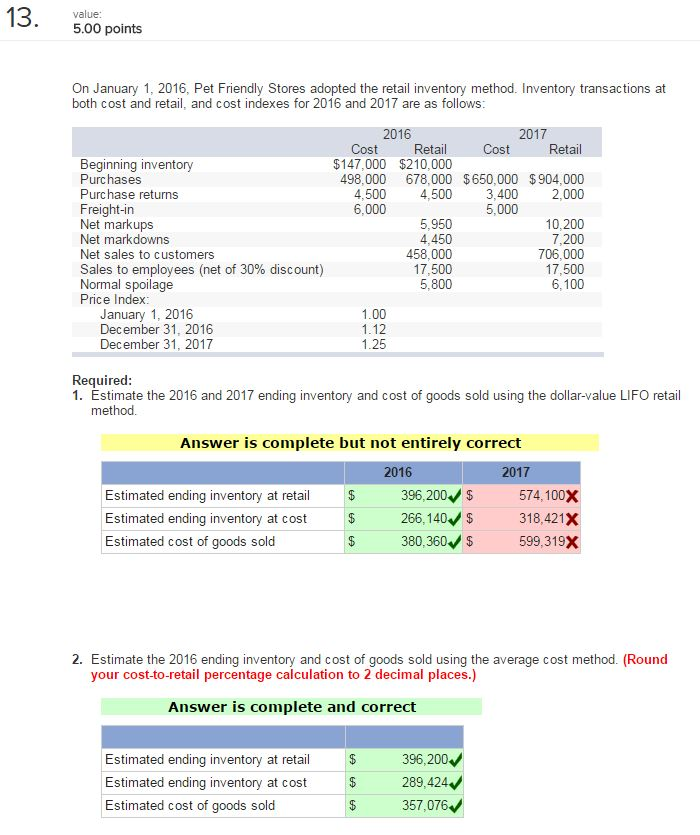

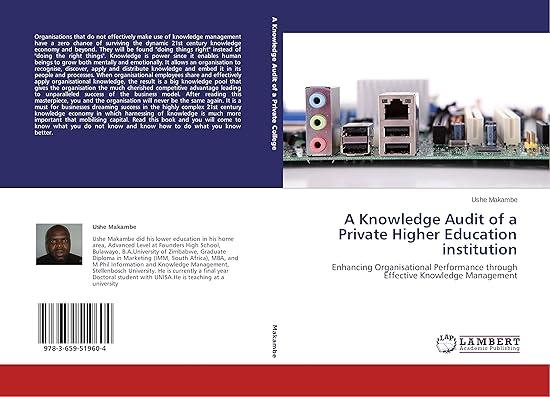

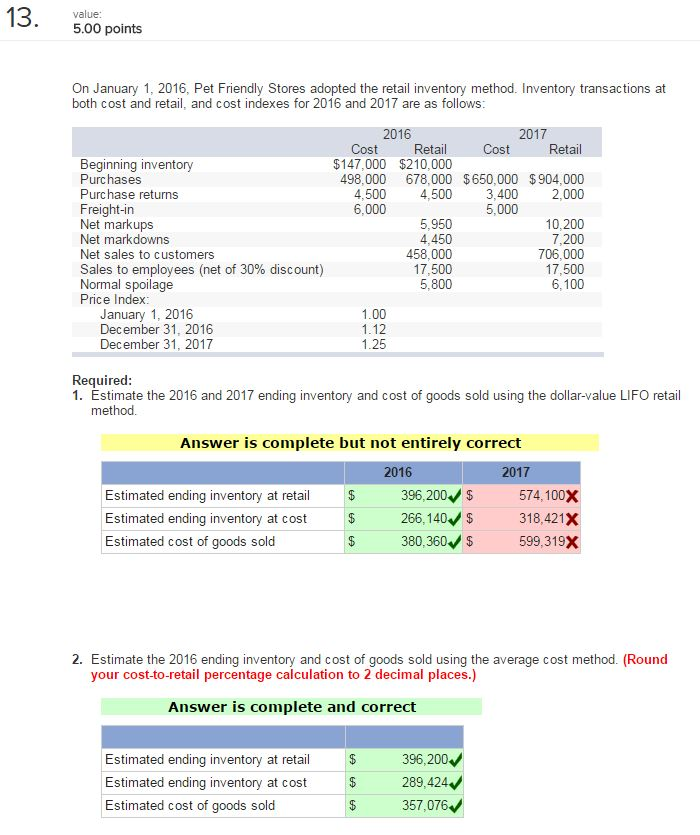

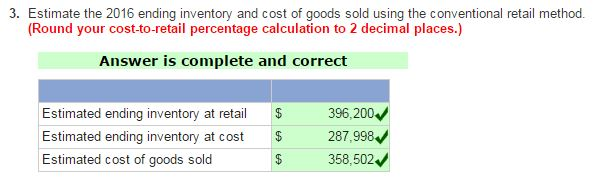

13 value: 5.00 points On January 1, 2016, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2016 and 2017 are as follows: 2016 2017 Cost Retail Cost Retai Beginning inventory $147,000 $210,000 498,000 678,000 $650,000 $904,000 Purchases Purchase returns 4,500 4.500 3,400 2.000 Freight-in 6.000 5.000 Net markups 5.950 10,200 Net markdowns 4.450 7,200 458,000 706,000 Net sales to customers Sales to employees (net of 30% discount) 17,500 17,500 Normal spoilage 5,800 6.100 Price Index January 1, 2016 1.00 December 31, 2016 1.12 December 31, 2017 1.25 Required e the 2016 and 2017 ending inventory and cost of goods sold using the dollar-value LlFO retail method Answer is complete but not entirely correct 2016 2017 Estimated ending inventory at retail 396,200 S 574,100X Estimated ending inventory at cost 266,140 318,421X 380,360V 599,319X Estimated cost of goods sold 2. Estimate the 2016 ending inventory and cost of goods sold using the average cost method. (Round your cost-to-retail percentage calculation to 2 decimal places.) Answer is complete and correct Estimated ending inventory at retail 396,200 289,424 Estimated ending inventory at cost 357,076 Estimated cost of goods sold 13 value: 5.00 points On January 1, 2016, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both cost and retail, and cost indexes for 2016 and 2017 are as follows: 2016 2017 Cost Retail Cost Retai Beginning inventory $147,000 $210,000 498,000 678,000 $650,000 $904,000 Purchases Purchase returns 4,500 4.500 3,400 2.000 Freight-in 6.000 5.000 Net markups 5.950 10,200 Net markdowns 4.450 7,200 458,000 706,000 Net sales to customers Sales to employees (net of 30% discount) 17,500 17,500 Normal spoilage 5,800 6.100 Price Index January 1, 2016 1.00 December 31, 2016 1.12 December 31, 2017 1.25 Required e the 2016 and 2017 ending inventory and cost of goods sold using the dollar-value LlFO retail method Answer is complete but not entirely correct 2016 2017 Estimated ending inventory at retail 396,200 S 574,100X Estimated ending inventory at cost 266,140 318,421X 380,360V 599,319X Estimated cost of goods sold 2. Estimate the 2016 ending inventory and cost of goods sold using the average cost method. (Round your cost-to-retail percentage calculation to 2 decimal places.) Answer is complete and correct Estimated ending inventory at retail 396,200 289,424 Estimated ending inventory at cost 357,076 Estimated cost of goods sold