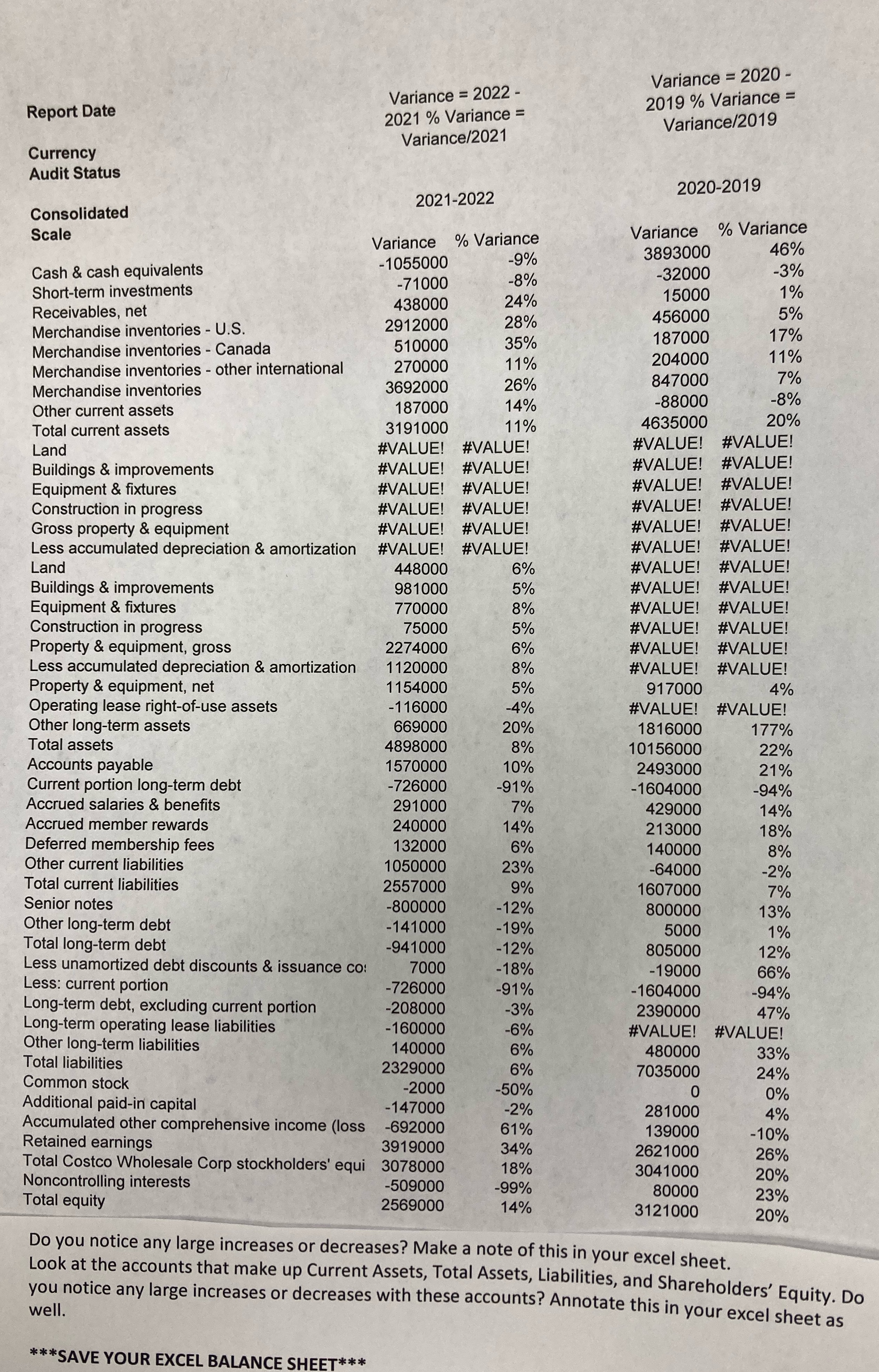

Help I need a summary answering the questions at bottom. The spots that say value were blank

Variance = 2020 - Variance = 2022 - 2019 % Variance = Report Date 2021 % Variance = Variance/2019 Variance/2021 Currency Audit Status 2020-2019 2021-2022 Consolidated Scale Variance % Variance Variance % Variance -1055000 9% 3893000 46% Cash & cash equivalents 32000 -3% -71000 -8% Short-term investments 15000 438000 24% 1% Receivables, net 2912000 28% 456000 5% Merchandise inventories - U.S. 35% 187000 17% Merchandise inventories - Canada 510000 204000 11% Merchandise inventories - other international 270000 11% 26% Merchandise inventories 3692000 847000 7% Other current assets 187000 14% 88000 8% Total current assets 3191000 11% 4635000 20% #VALUE! #VALUE! Land #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! Buildings & improvements #VALUE! #VALUE! #VALUE! Equipment & fixtures #VALUE! Construction in progress #VALUE! #VALUE! #VALUE! #VALUE! Gross property & equipment #VALUE! #VALUE! #VALUE! #VALUE! Less accumulated depreciation & amortization #VALUE! #VALUE! #VALUE! #VALUE! Land 448000 6% #VALUE! #VALUE! Buildings & improvements 981000 5% #VALUE! #VALUE! Equipment & fixtures 770000 8% #VALUE! #VALUE! Construction in progress 75000 5% #VALUE! #VALUE! Property & equipment, gross 2274000 6% #VALUE! #VALUE! Less accumulated depreciation & amortization 1120000 8% #VALUE! #VALUE! Property & equipment, net 1154000 5% 917000 4% Operating lease right-of-use assets 116000 4% #VALUE! #VALUE! Other long-term assets 66900 20% 1816000 177% Total assets 4898000 8% 10156000 22% Accounts payable 1570000 10% 2493000 21% Current portion long-term debt -726000 -91% -1604000 -94% Accrued salaries & benefits 291000 7% 429000 14% Accrued member rewards 240000 14% 213000 18% Deferred membership fees 132000 6% 140000 8% Other current liabilities 1050000 23% -64000 2% Total current liabilities 2557000 9% 1607000 7% Senior notes -800000 -12% 800000 13% Other long-term debt -141000 -19% 5000 1% Total long-term debt -941000 12% 805000 12% Less unamortized debt discounts & issuance co: 7000 18% -19000 66% Less: current portion 726000 -91% -1604000 -94% Long-term debt, excluding current portion -208000 -3% 2390000 47% Long-term operating lease liabilities -160000 6% #VALUE! #VALUE! Other long-term liabilities 140000 6% 480000 33% Total liabilities 2329000 6% 7035000 24% Common stock -2000 50% 0% Additional paid-in capital 147000 -2% 281000 4% Accumulated other comprehensive income (loss -692000 61% 139000 -10% Retained earnings 3919000 34% 2621000 26% Total Costco Wholesale Corp stockholders' equi 3078000 18% 3041000 20% Noncontrolling interests -509000 -99% 80000 23% Total equity 2569000 14% 3121000 20% Do you notice any large increases or decreases? Make a note of this in your excel sheet. Look at the accounts that make up Current Assets, Total Assets, Liabilities, and Shareholders' Equity. Do well. you notice any large increases or decreases with these accounts? Annotate this in your excel sheet as ***SAVE YOUR EXCEL BALANCE SHEET***