Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP!!! I want to check my answers 4 8 points JKW Corporation has been selling plumbing supplies since 1981. In 2003, the company adopted the

HELP!!! I want to check my answers

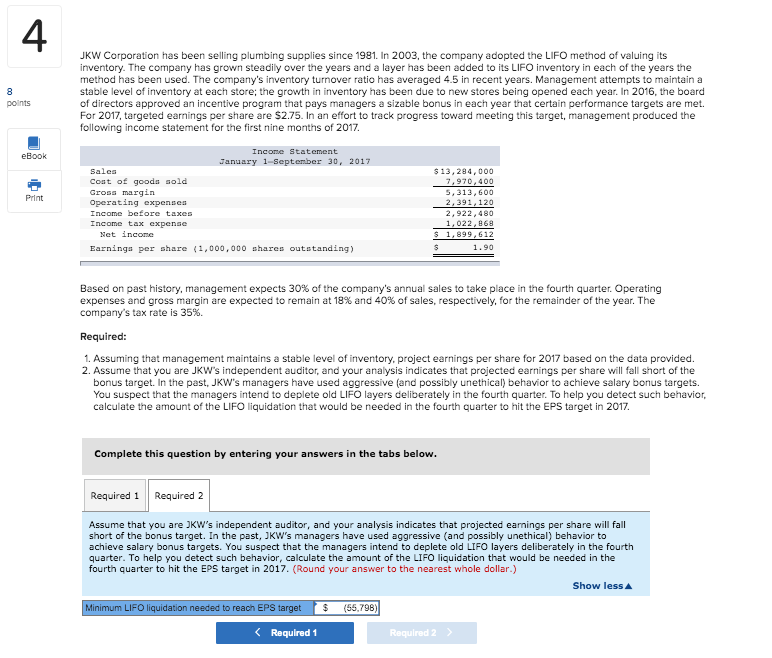

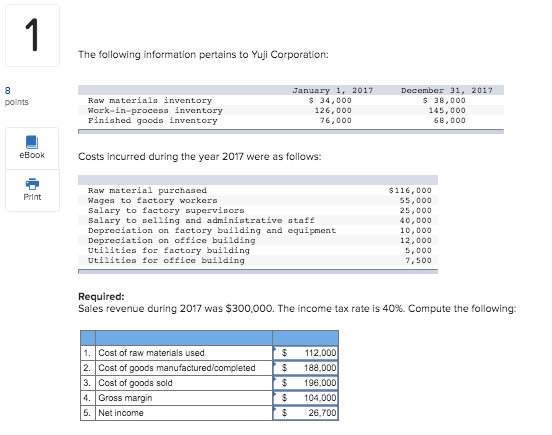

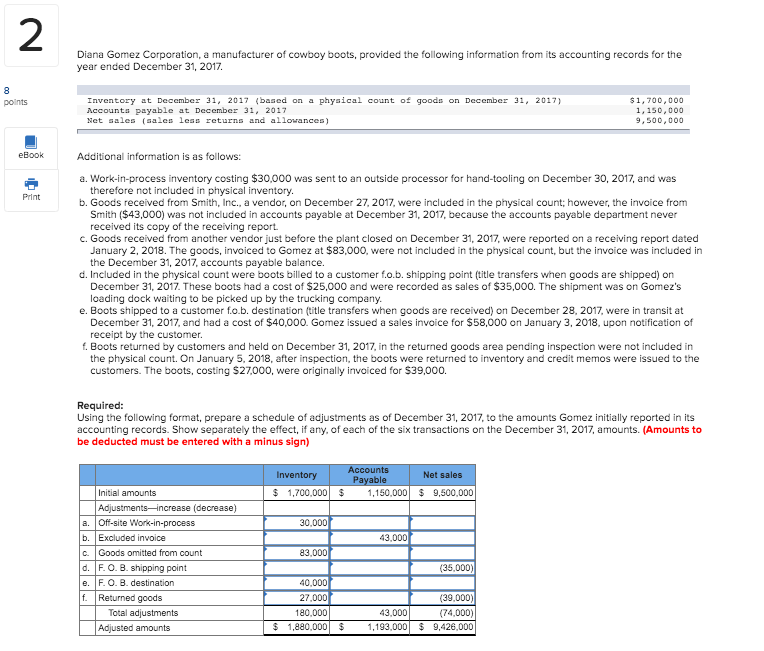

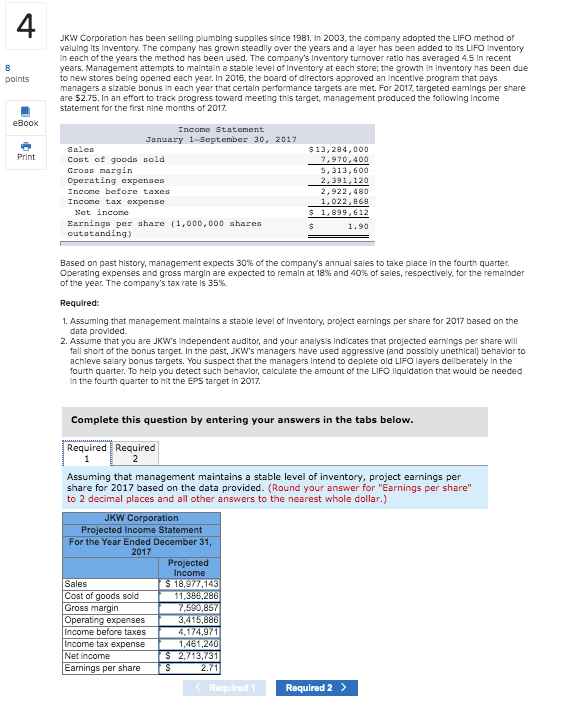

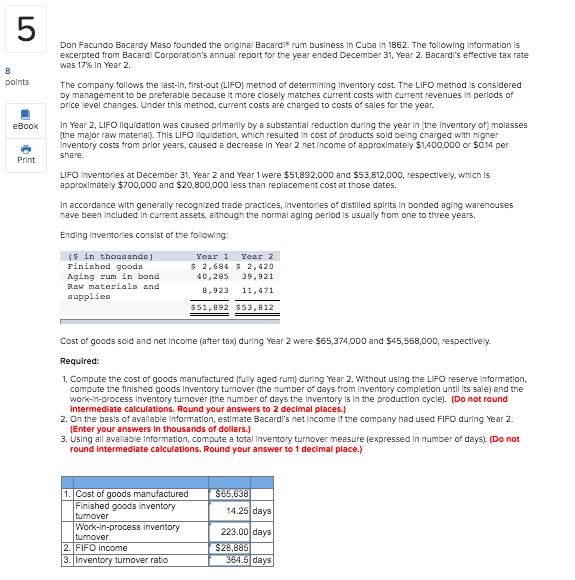

4 8 points JKW Corporation has been selling plumbing supplies since 1981. In 2003, the company adopted the LIFO method of valuing its inventory. The company has grown steadily over the years and a layer has been added to its LIFO inventory in each of the years the method has been used. The company's inventory turnover ratio has averaged 4.5 in recent years. Management attempts to maintain a stable level of inventory at each store; the growth in inventory has been due to new stores being opened each year. In 2016, the board of directors approved an incentive program that pays managers a sizable bonus in each year that certain performance targets are met. For 2017, targeted earnings per share are $2.75. In an effort to track progress toward meeting this target, management produced the following income statement for the first nine months of 2017 eBook Print Income Statement January 1 September 30, 2017 Sales Coat of goods sold Gross margin Operating expenses Income before taxes Income tax expense Net income Earnings per share (1,000,000 shares outstanding) $13,284,000 7,970, 400 5,313,600 2,391, 120 2,922,480 1,022,869 $ 1,899,612 $ 1.90 Based on past history, management expects 30% of the company's annual sales to take place in the fourth quarter. Operating expenses and gross margin are expected to remain at 18% and 40% of sales, respectively, for the remainder of the year. The company's tax rate is 35%. Required: 1. Assuming that management maintains a stable level of inventory project earnings per share for 2017 based on the data provided. 2. Assume that you are JKW's independent auditor, and your analysis indicates that projected earnings per share will fall short of the bonus target. In the past, JKW's managers have used aggressive and possibly unethical) behavior to achieve salary bonus targets. You suspect that the managers intend to deplete old LIFO layers deliberately in the fourth quarter. To help you detect such behavior, calculate the amount of the LIFO liquidation that would be needed in the fourth quarter to hit the EPS target in 2017. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that you are JKW's independent auditor, and your analysis indicates that projected earnings per share will fall short of the bonus target. In the past, JKW's managers have used aggressive and possibly unethical) behavior to achieve salary bonus targets. You suspect that the managers intend to deplete old LIFO layers deliberately in the fourth quarter. To help you detect such behavior, calculate the amount of the LIFO liquidation that would be needed in the fourth quarter to hit the EPS target in 2017. (Round your answer to the nearest whole dollar.) Show less Minimum LIFO liquidation needed to reach EPS target $ (55,796) 5 Don Facundo Bacardy Maso founded the original Bacardi rum business in Cuba in 1862. The following information is excerpted from Bacardi Corporation's annual report for the year ended December 31, Year 2. Bacardi's effective tax rate was 17% In Year 2 B points The company follows the last-in, first-out (LIFO) method of determining inventory cost. The LIFO method is considered by management to be preferable because it more closely matches current costs with current revenues in periods of price level changes. Under this method, current costs are charged to costs of sales for the year. In Year 2. LIFO liquidation was caused primarily by a substantial reduction during the year in the inventory of molasses (the major raw material). This LIFO liquidation, which resulted in cost of products sold being charged with higher inventory costs from prior years, caused a decrease in Year 2 net income of approximately $1,400,000 or $0.14 per share. eBook Print LIFO inventories at December 31, Year 2 and Year 1 were $51,892,000 and $53,812,000, respectively, which is approximately $700,000 and $20.800.000 less than replacement cost at those dates. In accordance with generally recognized trade practices, inventories of distilled spirits in bonded aging warehouses have been included in current assets, although the normal aging period is usually from one to three years. Ending inventories consist of the following: ($ in thousands) Finished goods nging rum in bond Raw materials and supplies Year 1 Year 2 $ 2,684 $ 2,420 40,285 39,921 8,923 11,471 $51,892 $53,812 Cost of goods sold and net income (after tax) during Year 2 were $65,374,000 and $45,568,000, respectively. Required: 1. Compute the cost of goods manufactured fully aged rum) during Year 2. Without using the LIFO reserve information, compute the finished goods Inventory tumover (the number of days from Inventory completion until its sale) and the work-in-process inventory turnover (the number of days the inventory is in the production cycle). (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2. On the basis of available information, estimate Bacardi's net income if the company had used FIFO during Year 2 (Enter your answers in thousands of dollars.) 3. Using all available information, compute a total inventory turnover measure (expressed in number of days). (Do not round intermediate calculations. Round your answer to 1 decimal place.) $65,638 14.25 days 1. Cost of goods manufactured Finished goods inventory turnover Work-in-process inventory turnover 2. FIFO income 3. Inventory turnover ratio 223.00 days $28,885 364.6 daysStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started