Answered step by step

Verified Expert Solution

Question

1 Approved Answer

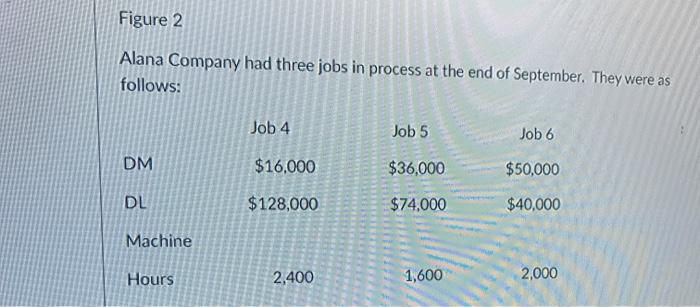

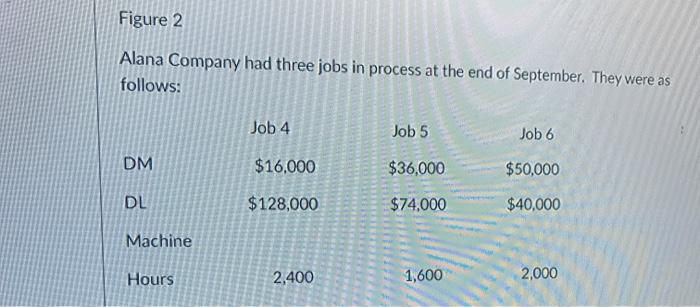

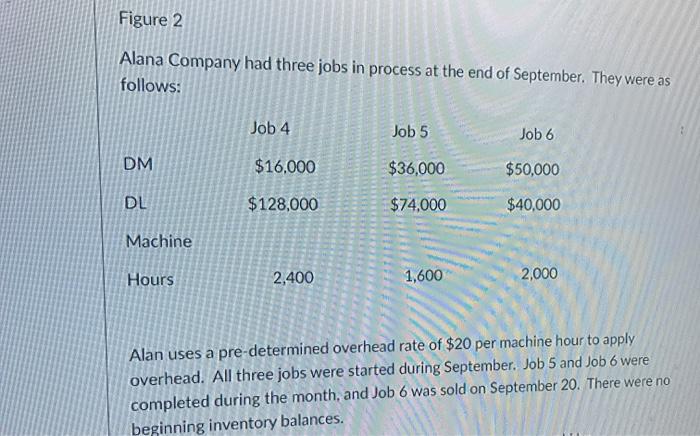

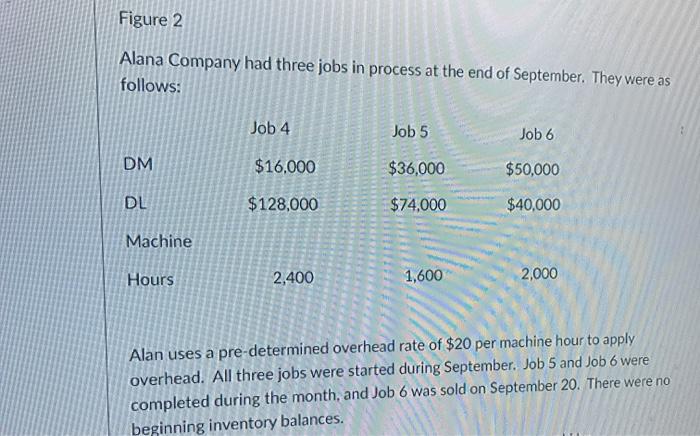

help? ia this what you need? or Figure 2 Alana Company had three jobs in process at the end of September. They were as follows:

help?

ia this what you need?

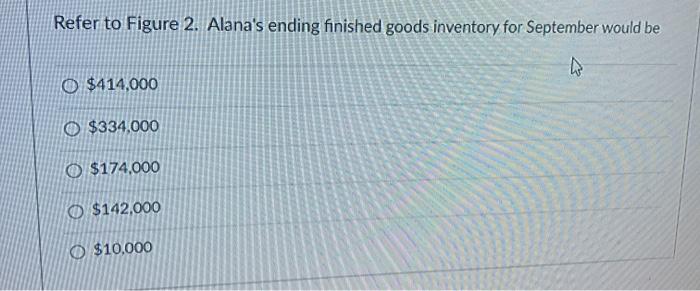

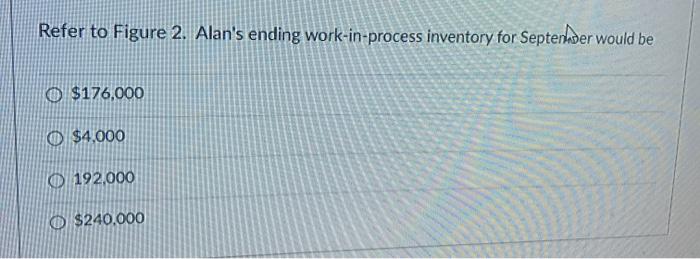

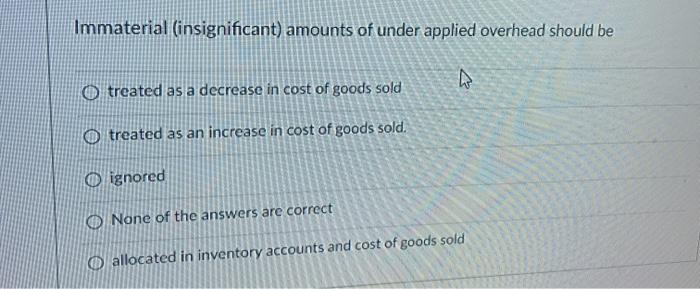

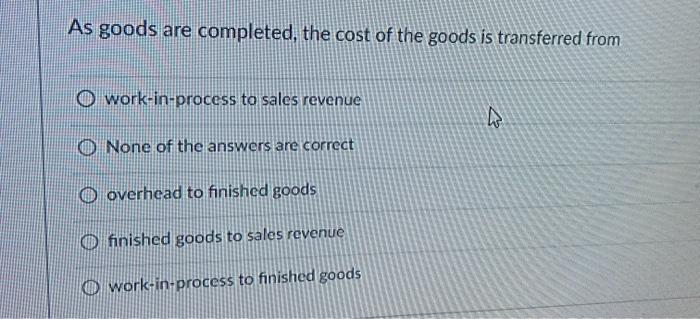

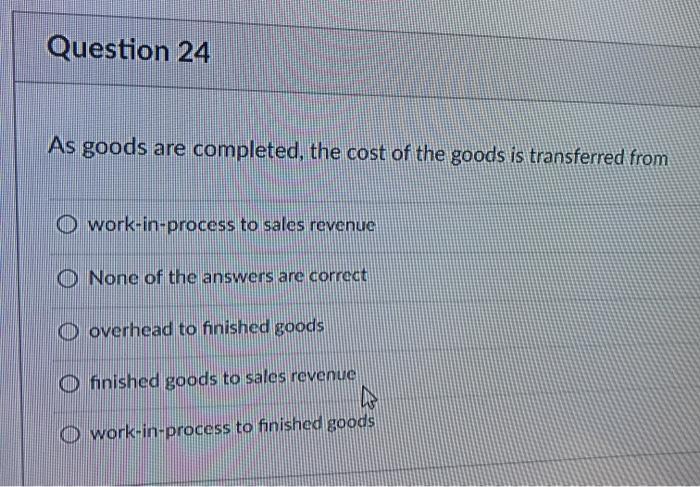

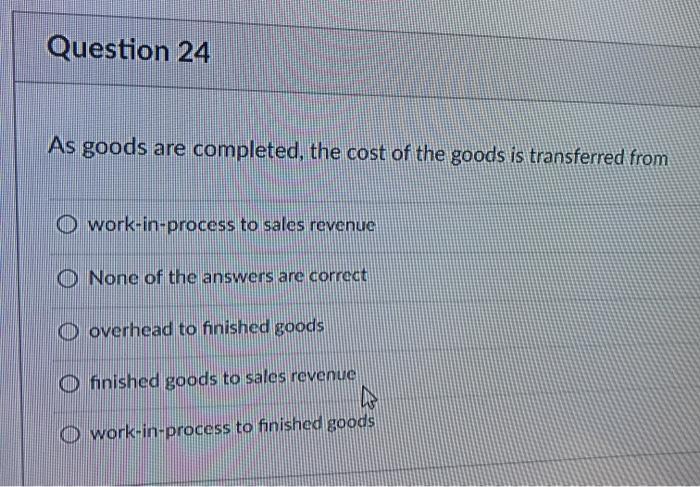

Figure 2 Alana Company had three jobs in process at the end of September. They were as follows: Job 4 Job 5 Job 6 DM $16.000 $36,000 $50,000 DL $128,000 $74.000 $40,000 Machine Hours 2,400 1,600 2,000 Refer to Figure 2. Alana's ending finished goods inventory for September would be O $414,000 O $334,000 $174,000 $142,000 O $10,000 Refer to Figure 2. Alan's ending work-in-process inventory for Septender would be O $176,000 $4,000 192,000 O $240.000 Immaterial (insignificant) amounts of under applied overhead should be treated as a decrease in cost of goods sold O treated as an increase in cost of goods sold. O ignored O None of the answers are correct O allocated in inventory accounts and cost of goods sold As goods are completed, the cost of the goods is transferred from O work-in-process to sales revenue 0 None of the answers are correct O overhead to finished goods O finished goods to sales revenue O work-in-process to finished goods Figure 2 Alana Company had three jobs in process at the end of September. They were as follows: Job 4 Job 5 Job 6 DM $16,000 $36,000 $50,000 DL $128,000 $74,000 $40,000 Machine Hours 2,400 1,600 2,000 Alan uses a pre-determined overhead rate of $20 per machine hour to apply overhead. All three jobs were started during September. Job 5 and Job 6 were completed during the month, and Job 6 was sold on September 20. There were no beginning inventory balances. Question 24 As goods are completed, the cost of the goods is transferred from O work-in-process to sales revenue O None of the answers are correct O overhead to finished goods o finished goods to sales revenue o work-in-process to finished goods

or

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started