Answered step by step

Verified Expert Solution

Question

1 Approved Answer

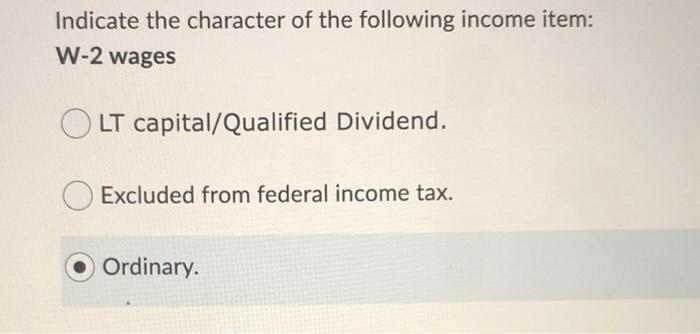

help! Indicate the character of the following income item: W-2 wages OLT capital/Qualified Dividend. Excluded from federal income tax. Ordinary. Indicate the character of the

help!

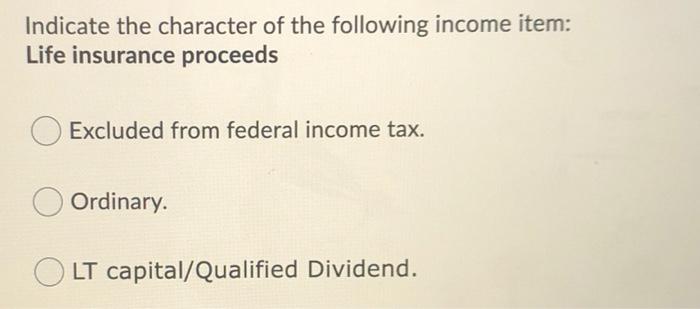

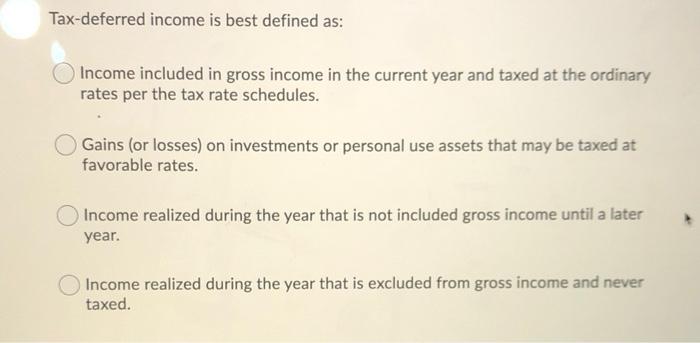

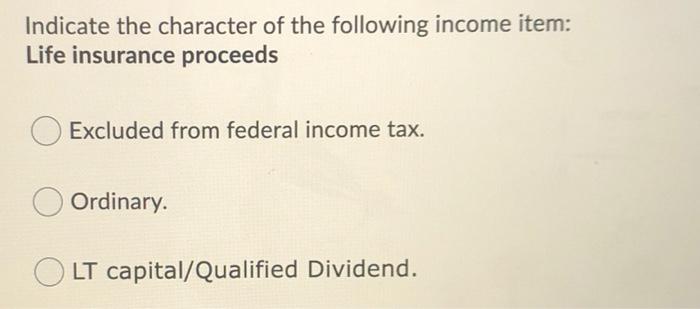

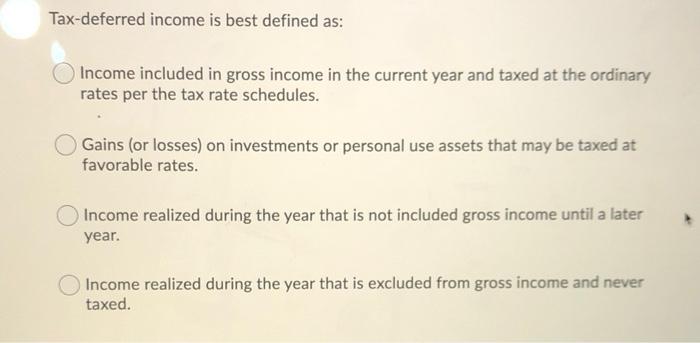

Indicate the character of the following income item: W-2 wages OLT capital/Qualified Dividend. Excluded from federal income tax. Ordinary. Indicate the character of the following income item: Life insurance proceeds Excluded from federal income tax. Ordinary. LT capital/Qualified Dividend. Tax-deferred income is best defined as: Income included in gross income in the current year and taxed at the ordinary rates per the tax rate schedules. Gains (or losses) on investments or personal use assets that may be taxed at favorable rates. Income realized during the year that is not included gross income until a later year. Income realized during the year that is excluded from gross income and never taxed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started