Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP - is DUE @11:59PM The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent

HELP - is DUE @11:59PM

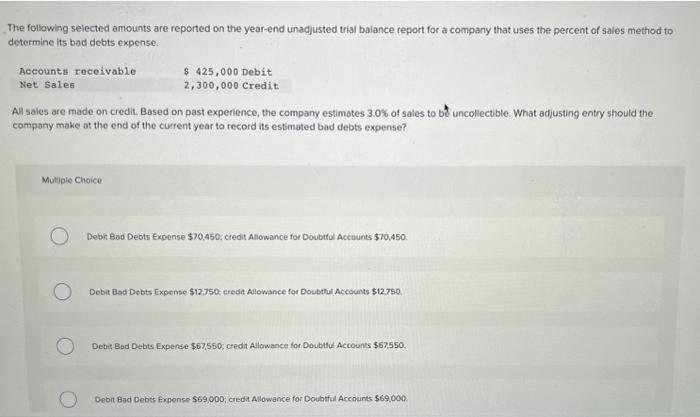

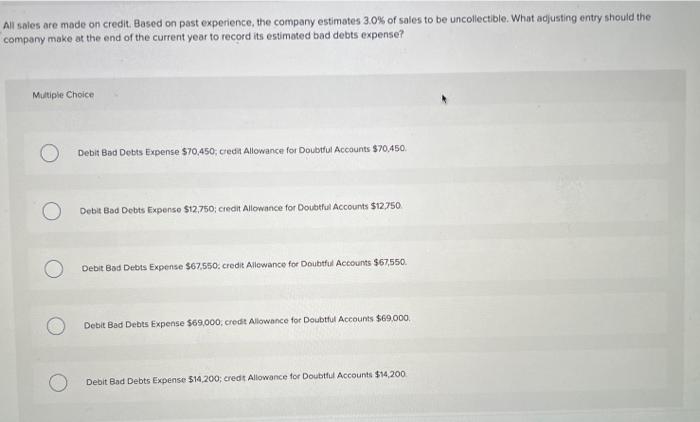

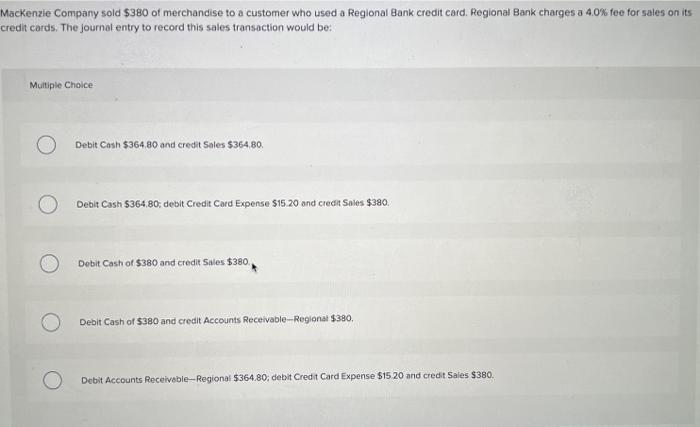

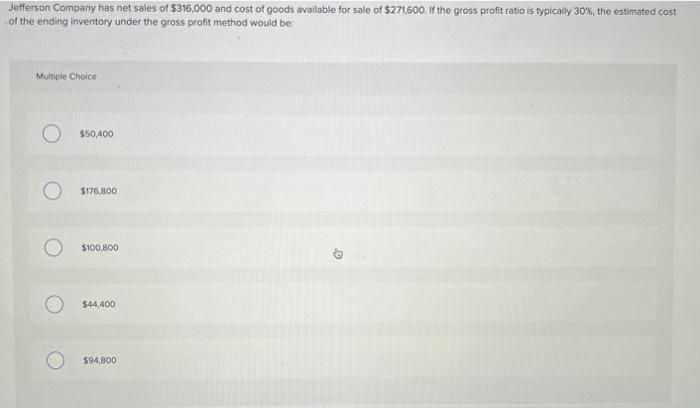

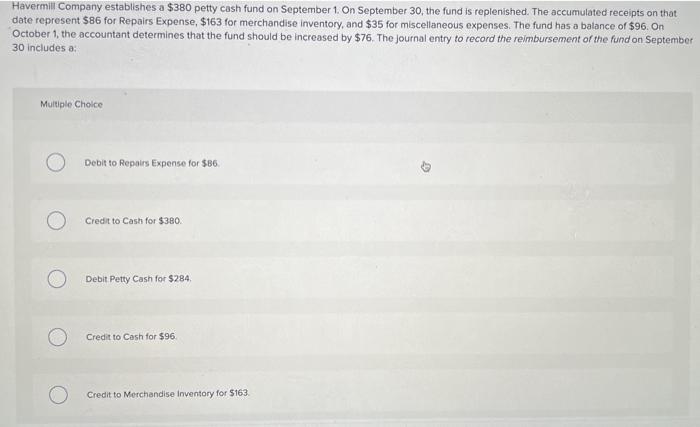

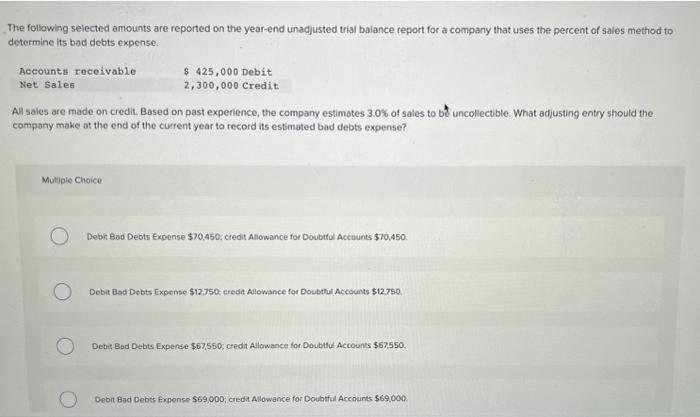

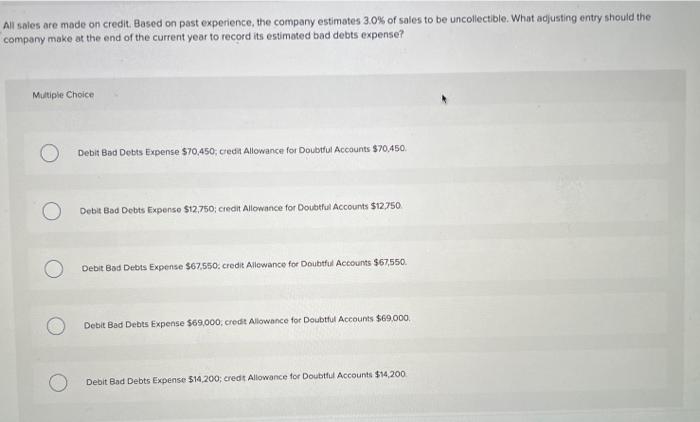

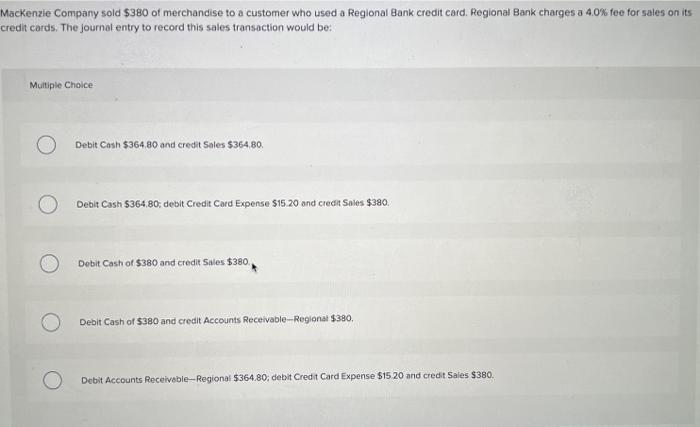

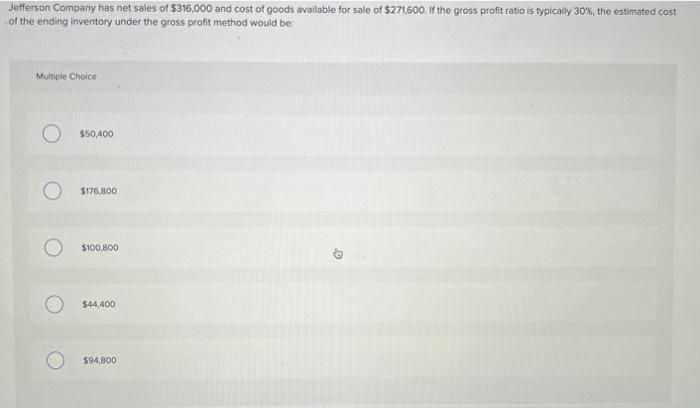

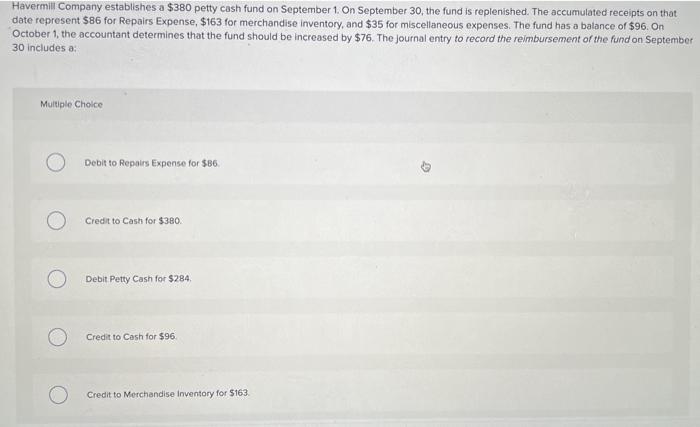

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bod debts expense. All sales are made on credit. Based on past experience, the company estimotes 3.0% of sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estmated bad debts expense? Mutiple Choice Debri Bad Debts Expense $70.450, credit Allowance for Doubtful Accounts $70,450. Debit Bad Debts Expense $12.750 - credit Allowance for Doubtul Accounts $12,750 Debit Bad Debts Experde $67,550; credn Allowance for Doubtful Accounts $67,550. Debit Bid Debts Expense 569,000 ; credit Allowance for Doubtfil Accounts $69.000. All saies are made on credit. Based on past experience, the company estimates 3.0% of sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense? Mutiple Choice Debit Bad Dobts Expense $70,450; cedt Allowance for Doubtful Accounts $70.450. Debit Bad Dobts Expense \$12.750; cedit Allowance for Doubthal Accounts $12.750 Debit Bad Debis Expense $67,550. credit Allewance for Doubtful Accounts $67,550. Debit Bed Debts Expense $69,000, credt Alowance for Doubttul Accounts $69,000. Debit Bad Debts Expense $14,200; credt Allowance tor Doubthi Accounts $14,200 Aackenzie Company sold $380 of merchandise to a customer who used a Regional Bank credit card. Regional Bank charges a 4.0% fee for sales on its redit cards. The journal entry to record this sales transaction would be: Muitiple Choice Debit Cash $364.80 and credit Sales $364,80. Debit Cash $364.80 - debit Credit Card Expense $15.20 and credit Sales $380. Debit Cash of $380 and credit 5 ales $380 Debit Cash of $380 and credit Accounts Receivable-Reglonat $380. Debit Accounts Receivsble-Regional $364.80, debit Credit Card Expense $15.20 and credit Sales $380. Jefferson Company has net sales of $316,000 and cost of goods available for sale of $271,600. If the gross profit ratio is typically 30%, the estimated cost of the ending inventory under the gross profit method would be: Multiple Choice 550,400 5176,800 5100,800 544,400 $94,100 Havermill Company establishes a $380 petty cash fund on September 1 . On September 30 , the fund is replenished. The accumulated receipts on that date represent $86 for Repairs Expense, $163 for merchandise inventory, and $35 for miscellaneous expenses. The fund has a balance of $96. On October 1, the accountant determines that the fund should be increased by $76. The journal entry to record the reimbursement of the fund on September 30 includes a: Muikiple Choice Debit to Repairs Expense for $86 Credit to Cash for $380 Debit Petty Cash for $284. Credit to Cesh for $96 Credit to Merchandise inventory for $163

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bod debts expense. All sales are made on credit. Based on past experience, the company estimotes 3.0% of sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estmated bad debts expense? Mutiple Choice Debri Bad Debts Expense $70.450, credit Allowance for Doubtful Accounts $70,450. Debit Bad Debts Expense $12.750 - credit Allowance for Doubtul Accounts $12,750 Debit Bad Debts Experde $67,550; credn Allowance for Doubtful Accounts $67,550. Debit Bid Debts Expense 569,000 ; credit Allowance for Doubtfil Accounts $69.000. All saies are made on credit. Based on past experience, the company estimates 3.0% of sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense? Mutiple Choice Debit Bad Dobts Expense $70,450; cedt Allowance for Doubtful Accounts $70.450. Debit Bad Dobts Expense \$12.750; cedit Allowance for Doubthal Accounts $12.750 Debit Bad Debis Expense $67,550. credit Allewance for Doubtful Accounts $67,550. Debit Bed Debts Expense $69,000, credt Alowance for Doubttul Accounts $69,000. Debit Bad Debts Expense $14,200; credt Allowance tor Doubthi Accounts $14,200 Aackenzie Company sold $380 of merchandise to a customer who used a Regional Bank credit card. Regional Bank charges a 4.0% fee for sales on its redit cards. The journal entry to record this sales transaction would be: Muitiple Choice Debit Cash $364.80 and credit Sales $364,80. Debit Cash $364.80 - debit Credit Card Expense $15.20 and credit Sales $380. Debit Cash of $380 and credit 5 ales $380 Debit Cash of $380 and credit Accounts Receivable-Reglonat $380. Debit Accounts Receivsble-Regional $364.80, debit Credit Card Expense $15.20 and credit Sales $380. Jefferson Company has net sales of $316,000 and cost of goods available for sale of $271,600. If the gross profit ratio is typically 30%, the estimated cost of the ending inventory under the gross profit method would be: Multiple Choice 550,400 5176,800 5100,800 544,400 $94,100 Havermill Company establishes a $380 petty cash fund on September 1 . On September 30 , the fund is replenished. The accumulated receipts on that date represent $86 for Repairs Expense, $163 for merchandise inventory, and $35 for miscellaneous expenses. The fund has a balance of $96. On October 1, the accountant determines that the fund should be increased by $76. The journal entry to record the reimbursement of the fund on September 30 includes a: Muikiple Choice Debit to Repairs Expense for $86 Credit to Cash for $380 Debit Petty Cash for $284. Credit to Cesh for $96 Credit to Merchandise inventory for $163

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started