Answered step by step

Verified Expert Solution

Question

1 Approved Answer

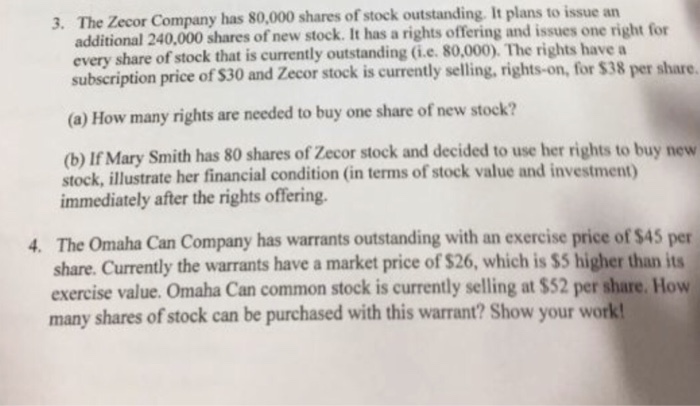

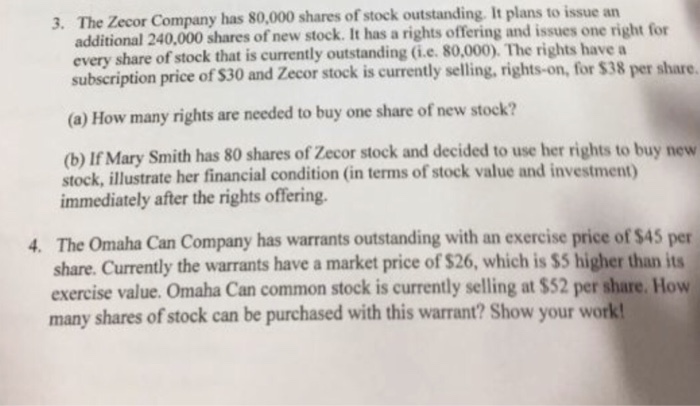

Help issue an 3. The Zecor Company has 80,000 shares of stock outstanding. It plans to ghts offering and issues one right for additional 240,000

Help

issue an 3. The Zecor Company has 80,000 shares of stock outstanding. It plans to ghts offering and issues one right for additional 240,000 shares of new stock. It has a ri every share of stock that is currently outstanding (i.e. 80,000). The rights have a subscription price of $30 and Zecor stock is currently selling, rights-on, for $38 per share. (a) How many rights are needed to buy one share of new stock? (b) If Mary Smith has 80 shares of Zecor stock and decided to use her rights to buy new stock, illustrate her financial condition (in terms of stock value and investment) immediately after the rights offering The Omaha Can Company has warrants outstanding with an exercise price of $45 per share. Currently the warrants have a market price of $26, which is $5 higher than its 4. exercise value. Omaha Can common stock is currently selling at $52 per share. How many shares of stock can be purchased with this warrant? Show your work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started