- Help Jake buy a new Toyota Tacoma for $27,000.

- Calculate his monthly truck payment if he can get a loan with an interest rate of 2.5% over 72 months.

Calculate his other costs of buying the truck. If he buys the truck his auto insurance will increase to $135 per month, but his auto maintenance expenses will fall to approximately $220 per month. Can Jake afford to buy the truck with his current budget? Explain what he might have to sacrifice in order to afford the truck

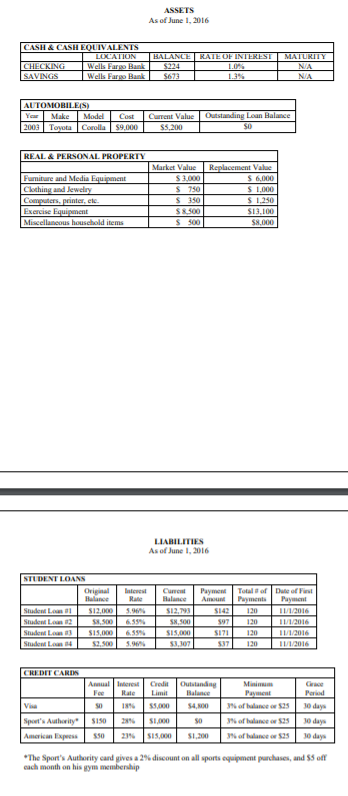

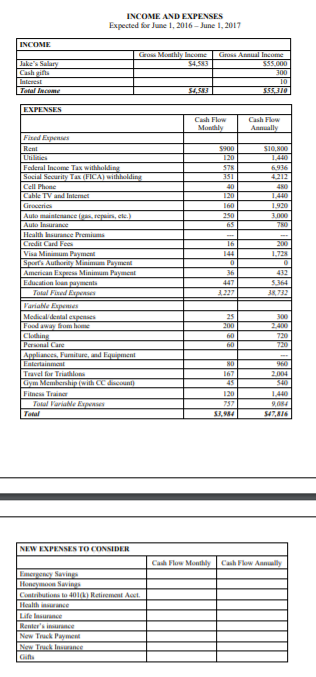

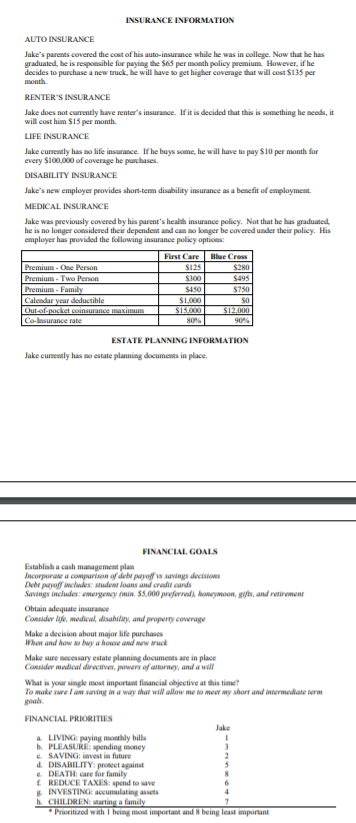

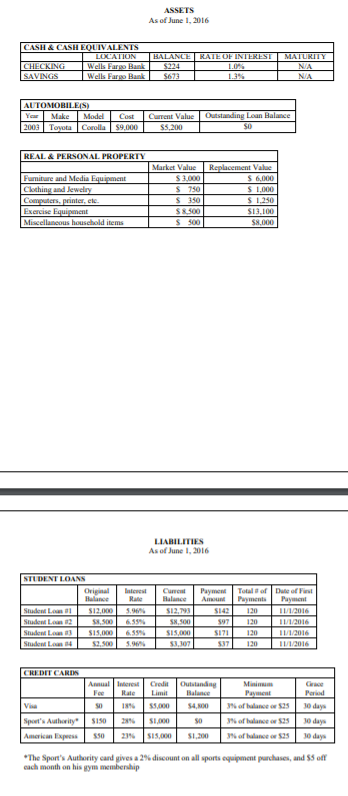

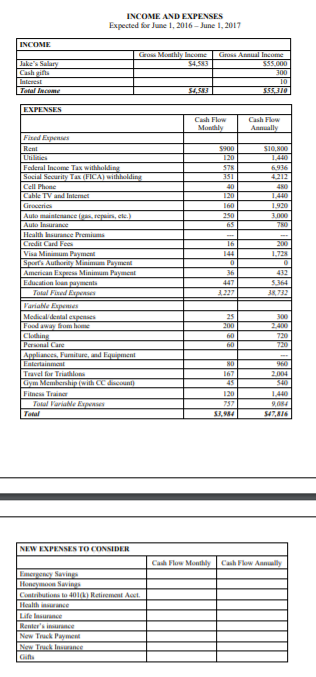

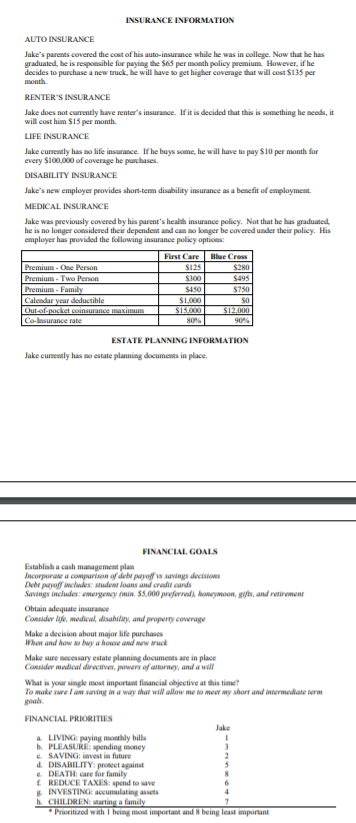

ASSETS As of June 1, 2016 CASH & CASH EQUIVALENTS LOCATION BALANCE CHECKING Wells Fargo Bank $224 SAVINGS Wells Fargo Bank $673 RATE OF INTEREST 1.09 1.3% MATURITY NA NA AUTOMOBILE(S) Make Model 2003 Toyota Corolla Cost $9.000 Current Value Outstanding Loan Balance $5,200 SO REAL & PERSONAL PROPERTY Market Value Fumiture and Media Equipment S3000 Clothing and jewelry $ 750 Computers, printer, etc. S 350 Exercise Equipment SR 500 Miscellaneous household items S 500 Replacement Value $ 6,000 $ 1.000 $ 1.250 $13.100 SH.000 LIABILITIES As of June 1, 2016 Care STUDENT LOANS Original Balance Student Low $12,000 Student Les 12 S8.500 Student Low $15.000 Sadew L4 $2.500 Interest Rate 3.66% 6.599 6.559 $12.793 SN,500 SIS,000 $3,307 Payment Total of Dute of Fust Amunt Payments Payment 5142 120 11/1/2016 597 120 11/1/2016 5171 11/1/2016 537 120 11/1/2016 Period CREDIT CARDS Amal Interest Credit Outstanding FoRate Limit Blue Vi 55,000 54.800 Sports Authority 510 51.000 SO American Express 550 21% 15,000 $1,200 Mis Pay of line 25 of hone of balance 525 30 days 30 days 10 days *The Sports Authority card gives a 2% discount on all sports equipment purchases, and $5 off cach month on his gym membership INCOME AND EXPENSES Expected for June 1, 2016 - June 1, 2017 INCOME Gross Monthly Income 54.383 Jake's Salary Cash is Interest Tonal Gross Anual Income $35.000 300 10 555310 54,53 EXPENSES Cash Flow Cash Flow Monthly rnally SINDO 1.440 6.936 5900 120 578 331 40 120 160 250 65 40 1.400 1.920 3.000 70 200 Fixed Expenses Reni Uns Federal Income Tax withholding Social Security Tax FILA) withholding Cell Phone Cable TV and Internet Groceries Automance, Auto Insurance Health Insurance Premium Credit Card Fees Visa Minimum Pyment Spoor's Authority Minimum Payment American Express Minimum Payment Ein a payments Towd ariales Medical dental cap Food away from home Clothing Personal Care Appliances, Fumiture, and Equipment Entertainment Travel for Triathlon Gym Membership with Cdiscount) Fitness Trainer Touare 16 144 0 36 447 3.227 432 5.364 3,732 25 200 60 300 2400 720 96 2004 NO 167 45 120 757 SI, 1.440 9,04 547,816 NEW EXPENSES TO CONSIDER Cash Flow Monthly Cash Flow Amy Eny Saving Honey Savines Contributions to 401(k) Retirement Act. Health ce Life insure Rener's New Truck Payment New Test ci INSURANCE INFORMATION AUTO INSURANCE Jake's parents covered the cost of his auto-insurance while he was in college. Now that he has graduated, he is responsible for paying the $65 per month policy premium However, if he decides to purchase a new truck, he will have to get higher coverage that will cost $135 per month. RENTER'S INSURANCE Jake does not currently have renter's insurance. If it is decided that this is something he needs, it will cost him $15 per month LIFE INSURANCE Jake currently has to life insurance. If he buys some, he will have to pay $10 per month for every $100,000 of coverage he purchases. DISABILITY INSURANCE Jake's new employer provides short-term disability insurance as a benefit of employment. MEDICAL INSURANCE Jake was previously covered by his parent's health insurance policy. Not that he has graduated he is no longer considered their dependent and can no longer be covered under their policy. His employer has provided the following insurance policy options: First Care Blue Cross Premium - One Person $125 S280 Premium - Two Person $300 $495 Premium - Family $450 $750 Calendar year deductible SI 000 Out-of-pocket coinsurance maximum $15.000 $12,000 Co Insurance rate 80% 909 SO ESTATE PLANNING INFORMATION Jake currently has no estatc planning documents in place. FINANCIAL GOALS Establish a cash management plan Incorporate a comparison of debt payoff savings decisions Dehe proff includes: student loans and credit cards Savings includes: emergency (n. 85.000 preferred honeymoon, sils, and retirement Obtain adequate insurance Consider medical disability, and property Make a decision about major life purchases Whers and how to buy a house and new truck Make sure necessary estate planning documents are in place Consider medical directives, powers of attorney, and a will What is your single most important financial objective at this time? To make sure I am sering in a way that will allow me to meet my short and intermediate im FINANCIAL PRIORITIES Jake LIVING paying monthly bills PLEASURI spending money SAVING: invest in future d. DISABILITY:protect against DEATHcare for family E REDUCE TAXES: spend to save INVESTING dating site h. CHILDREN starting a family Prioritized with being important and being lost important ASSETS As of June 1, 2016 CASH & CASH EQUIVALENTS LOCATION BALANCE CHECKING Wells Fargo Bank $224 SAVINGS Wells Fargo Bank $673 RATE OF INTEREST 1.09 1.3% MATURITY NA NA AUTOMOBILE(S) Make Model 2003 Toyota Corolla Cost $9.000 Current Value Outstanding Loan Balance $5,200 SO REAL & PERSONAL PROPERTY Market Value Fumiture and Media Equipment S3000 Clothing and jewelry $ 750 Computers, printer, etc. S 350 Exercise Equipment SR 500 Miscellaneous household items S 500 Replacement Value $ 6,000 $ 1.000 $ 1.250 $13.100 SH.000 LIABILITIES As of June 1, 2016 Care STUDENT LOANS Original Balance Student Low $12,000 Student Les 12 S8.500 Student Low $15.000 Sadew L4 $2.500 Interest Rate 3.66% 6.599 6.559 $12.793 SN,500 SIS,000 $3,307 Payment Total of Dute of Fust Amunt Payments Payment 5142 120 11/1/2016 597 120 11/1/2016 5171 11/1/2016 537 120 11/1/2016 Period CREDIT CARDS Amal Interest Credit Outstanding FoRate Limit Blue Vi 55,000 54.800 Sports Authority 510 51.000 SO American Express 550 21% 15,000 $1,200 Mis Pay of line 25 of hone of balance 525 30 days 30 days 10 days *The Sports Authority card gives a 2% discount on all sports equipment purchases, and $5 off cach month on his gym membership INCOME AND EXPENSES Expected for June 1, 2016 - June 1, 2017 INCOME Gross Monthly Income 54.383 Jake's Salary Cash is Interest Tonal Gross Anual Income $35.000 300 10 555310 54,53 EXPENSES Cash Flow Cash Flow Monthly rnally SINDO 1.440 6.936 5900 120 578 331 40 120 160 250 65 40 1.400 1.920 3.000 70 200 Fixed Expenses Reni Uns Federal Income Tax withholding Social Security Tax FILA) withholding Cell Phone Cable TV and Internet Groceries Automance, Auto Insurance Health Insurance Premium Credit Card Fees Visa Minimum Pyment Spoor's Authority Minimum Payment American Express Minimum Payment Ein a payments Towd ariales Medical dental cap Food away from home Clothing Personal Care Appliances, Fumiture, and Equipment Entertainment Travel for Triathlon Gym Membership with Cdiscount) Fitness Trainer Touare 16 144 0 36 447 3.227 432 5.364 3,732 25 200 60 300 2400 720 96 2004 NO 167 45 120 757 SI, 1.440 9,04 547,816 NEW EXPENSES TO CONSIDER Cash Flow Monthly Cash Flow Amy Eny Saving Honey Savines Contributions to 401(k) Retirement Act. Health ce Life insure Rener's New Truck Payment New Test ci INSURANCE INFORMATION AUTO INSURANCE Jake's parents covered the cost of his auto-insurance while he was in college. Now that he has graduated, he is responsible for paying the $65 per month policy premium However, if he decides to purchase a new truck, he will have to get higher coverage that will cost $135 per month. RENTER'S INSURANCE Jake does not currently have renter's insurance. If it is decided that this is something he needs, it will cost him $15 per month LIFE INSURANCE Jake currently has to life insurance. If he buys some, he will have to pay $10 per month for every $100,000 of coverage he purchases. DISABILITY INSURANCE Jake's new employer provides short-term disability insurance as a benefit of employment. MEDICAL INSURANCE Jake was previously covered by his parent's health insurance policy. Not that he has graduated he is no longer considered their dependent and can no longer be covered under their policy. His employer has provided the following insurance policy options: First Care Blue Cross Premium - One Person $125 S280 Premium - Two Person $300 $495 Premium - Family $450 $750 Calendar year deductible SI 000 Out-of-pocket coinsurance maximum $15.000 $12,000 Co Insurance rate 80% 909 SO ESTATE PLANNING INFORMATION Jake currently has no estatc planning documents in place. FINANCIAL GOALS Establish a cash management plan Incorporate a comparison of debt payoff savings decisions Dehe proff includes: student loans and credit cards Savings includes: emergency (n. 85.000 preferred honeymoon, sils, and retirement Obtain adequate insurance Consider medical disability, and property Make a decision about major life purchases Whers and how to buy a house and new truck Make sure necessary estate planning documents are in place Consider medical directives, powers of attorney, and a will What is your single most important financial objective at this time? To make sure I am sering in a way that will allow me to meet my short and intermediate im FINANCIAL PRIORITIES Jake LIVING paying monthly bills PLEASURI spending money SAVING: invest in future d. DISABILITY:protect against DEATHcare for family E REDUCE TAXES: spend to save INVESTING dating site h. CHILDREN starting a family Prioritized with being important and being lost important