help me!

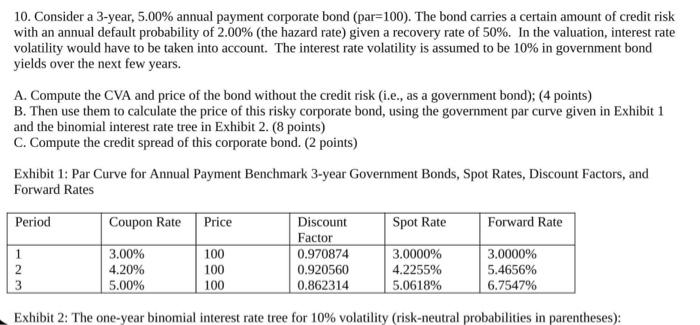

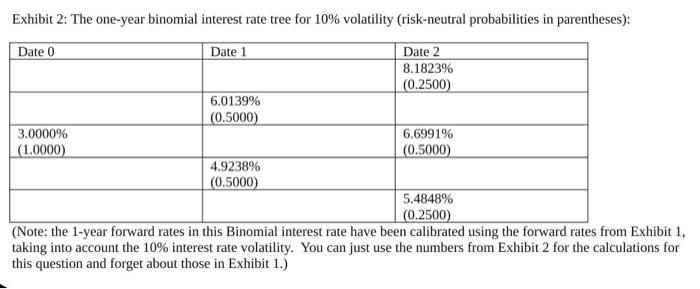

10. Consider a 3-year, 5.00% annual payment corporate bond (par=100). The bond carries a certain amount of credit risk with an annual default probability of 2.00% (the hazard rate) given a recovery rate of 50%. In the valuation, interest rate volatility would have to be taken into account. The interest rate volatility is assumed to be 10% in government bond yields over the next few years. A. Compute the CVA and price of the bond without the credit risk (i.e., as a government bond); (4 points) B. Then use them to calculate the price of this risky corporate bond, using the government par curve given in Exhibit 1 and the binomial interest rate tree in Exhibit 2. (8 points) C. Compute the credit spread of this corporate bond. ( 2 points) Exhibit 1: Par Curve for Annual Payment Benchmark 3-year Government Bonds, Spot Rates, Discount Factors, and Forward Rates Exhibit 2: The one-year binomial interest rate tree for 10% volatility (risk-neutral probabilities in parentheses): (Note: the 1-year forward rates in this Binomial interest rate have been calibrated using the forward rates from Exhibit 1, taking into account the 10% interest rate volatility. You can just use the numbers from Exhibit 2 for the calculations for this question and forget about those in Exhibit 1.) 10. Consider a 3-year, 5.00% annual payment corporate bond (par=100). The bond carries a certain amount of credit risk with an annual default probability of 2.00% (the hazard rate) given a recovery rate of 50%. In the valuation, interest rate volatility would have to be taken into account. The interest rate volatility is assumed to be 10% in government bond yields over the next few years. A. Compute the CVA and price of the bond without the credit risk (i.e., as a government bond); (4 points) B. Then use them to calculate the price of this risky corporate bond, using the government par curve given in Exhibit 1 and the binomial interest rate tree in Exhibit 2. (8 points) C. Compute the credit spread of this corporate bond. ( 2 points) Exhibit 1: Par Curve for Annual Payment Benchmark 3-year Government Bonds, Spot Rates, Discount Factors, and Forward Rates Exhibit 2: The one-year binomial interest rate tree for 10% volatility (risk-neutral probabilities in parentheses): (Note: the 1-year forward rates in this Binomial interest rate have been calibrated using the forward rates from Exhibit 1, taking into account the 10% interest rate volatility. You can just use the numbers from Exhibit 2 for the calculations for this question and forget about those in Exhibit 1.)