Answered step by step

Verified Expert Solution

Question

1 Approved Answer

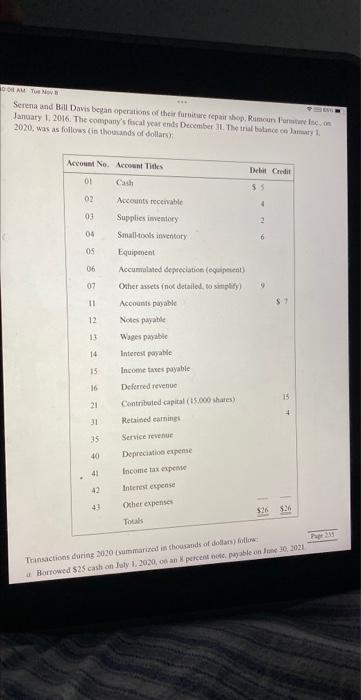

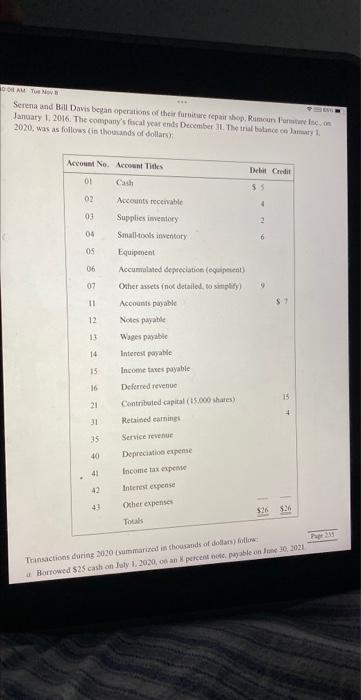

Help me 2020 , was as follows (in thourands of Sollars)? Trinsictions dorins 2020 (summarized in thousands of doliars) followe Transactions during 2020 (summarized in

Help me

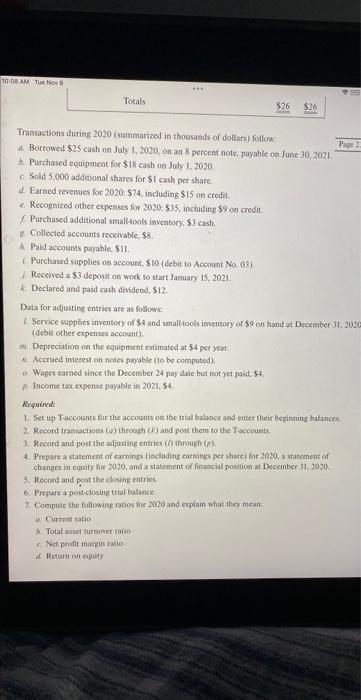

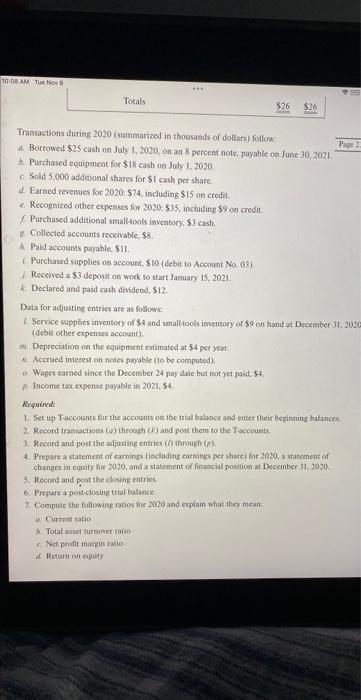

2020 , was as follows (in thourands of Sollars)? Trinsictions dorins 2020 (summarized in thousands of doliars) followe Transactions during 2020 (summarized in thousands of dollars) follow. a. Borrowed $25 cash on July 1, 2020 , on an 8 percent note, payable on June 30,2021 b. Purchased ecuipment for $18 eash on July 1. 2020. c. Sold 5.000 additional stares for $1 cash per share. 4. Earned revemies for 2020:$74, including $15 on credit. e. Recognized other expenses for 2020.$35, including $9 on credit. f. Purchased additional smaltools inventory, $3 cash. 8. Collected accounts receivable, 58 . h. Paid accounts payable, $1. 1. Parchased supplies on account, $10 (debit to Account No0,03 ). 1. Received a \$3 deposit on wock to start Jamuary 15. 2021. h. Declared and paid cash dividend, $12. Data for adjusting entries are as followi: 1. Service supplies inventory of $4 and umall-ook imentory of $9 on hand at December 31. 202 (debis other expenves account). mit. Depreciation on the equipment estimated at $4 per year. 12. Accrued interest on noter pagable (to be computed). a. Wabes earned sitice the December 24 pay dase but not yet paid, 54. A. income tax expense payable in 2021, 34. Required: 1. Set up Faccounts for the accounts on the trial babance and enter their beginning butmees 2. Record transictions (a) through (k) and post them to the Taccounte. 3. Record and post the adjusting entries (D) through (b). 4. Prepare a statement of carning (iscludetu earsines pet shate) for 2020, a statement of chunges in equity for 2020, and a statement of finascul porition at December 31, 2020 . 5. Recosd and post the closing entries. 6. Preparea posteclosing trial balance 7. Compule the followieg ritios for 2020 and eplain what they mean - 4. Current zatio 6. Total asset turnover matio c Net profit margin ratio of Return on equity 2020 , was as follows (in thourands of Sollars)? Trinsictions dorins 2020 (summarized in thousands of doliars) followe Transactions during 2020 (summarized in thousands of dollars) follow. a. Borrowed $25 cash on July 1, 2020 , on an 8 percent note, payable on June 30,2021 b. Purchased ecuipment for $18 eash on July 1. 2020. c. Sold 5.000 additional stares for $1 cash per share. 4. Earned revemies for 2020:$74, including $15 on credit. e. Recognized other expenses for 2020.$35, including $9 on credit. f. Purchased additional smaltools inventory, $3 cash. 8. Collected accounts receivable, 58 . h. Paid accounts payable, $1. 1. Parchased supplies on account, $10 (debit to Account No0,03 ). 1. Received a \$3 deposit on wock to start Jamuary 15. 2021. h. Declared and paid cash dividend, $12. Data for adjusting entries are as followi: 1. Service supplies inventory of $4 and umall-ook imentory of $9 on hand at December 31. 202 (debis other expenves account). mit. Depreciation on the equipment estimated at $4 per year. 12. Accrued interest on noter pagable (to be computed). a. Wabes earned sitice the December 24 pay dase but not yet paid, 54. A. income tax expense payable in 2021, 34. Required: 1. Set up Faccounts for the accounts on the trial babance and enter their beginning butmees 2. Record transictions (a) through (k) and post them to the Taccounte. 3. Record and post the adjusting entries (D) through (b). 4. Prepare a statement of carning (iscludetu earsines pet shate) for 2020, a statement of chunges in equity for 2020, and a statement of finascul porition at December 31, 2020 . 5. Recosd and post the closing entries. 6. Preparea posteclosing trial balance 7. Compule the followieg ritios for 2020 and eplain what they mean - 4. Current zatio 6. Total asset turnover matio c Net profit margin ratio of Return on equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started