Answered step by step

Verified Expert Solution

Question

1 Approved Answer

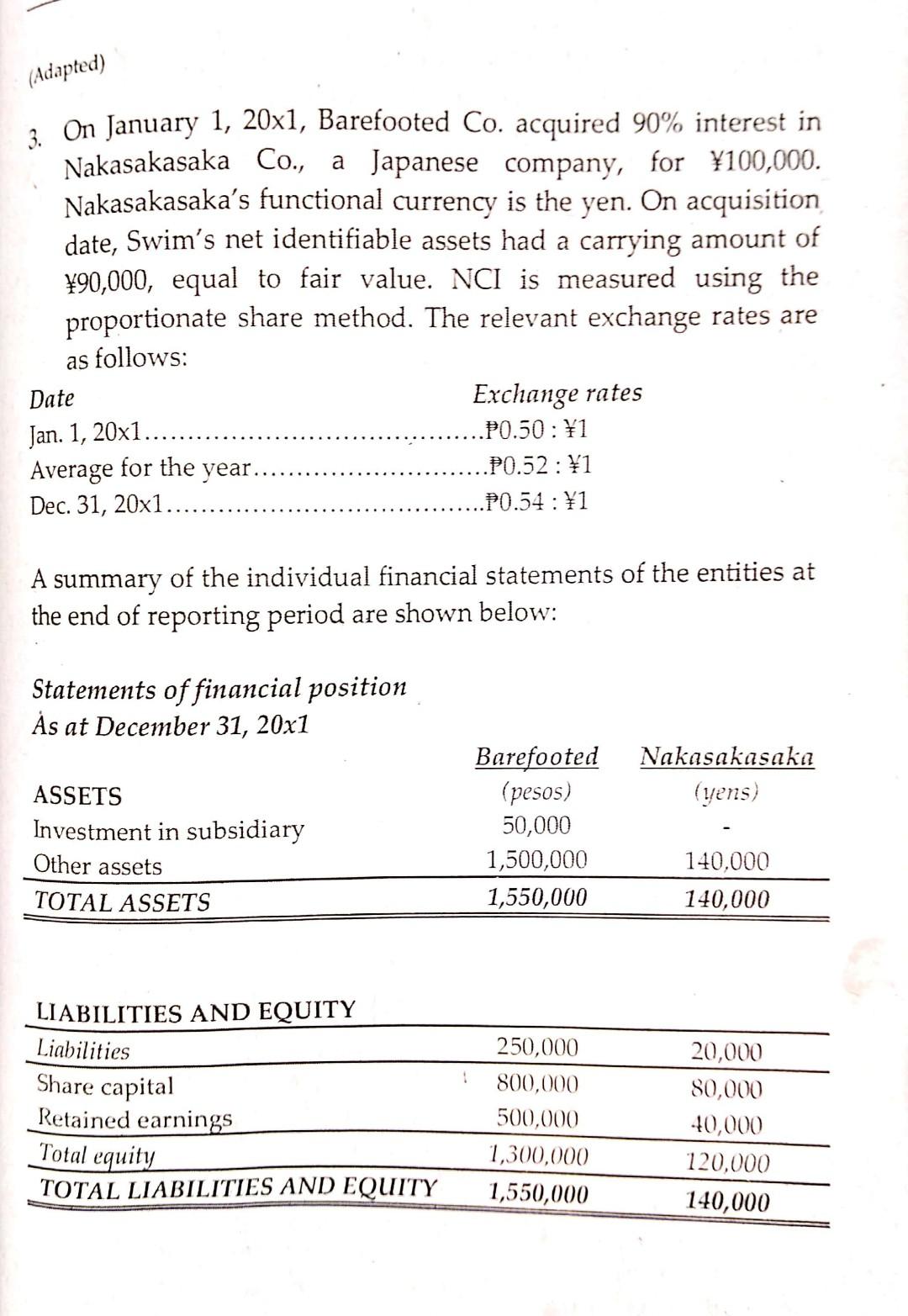

Help me. (Adapted) 3. On January 1, 20x1, Barefooted Co. acquired 90% interest in Nakasakasaka Co., a Japanese company, for 100,000. Nakasakasaka's functional currency is

Help me.

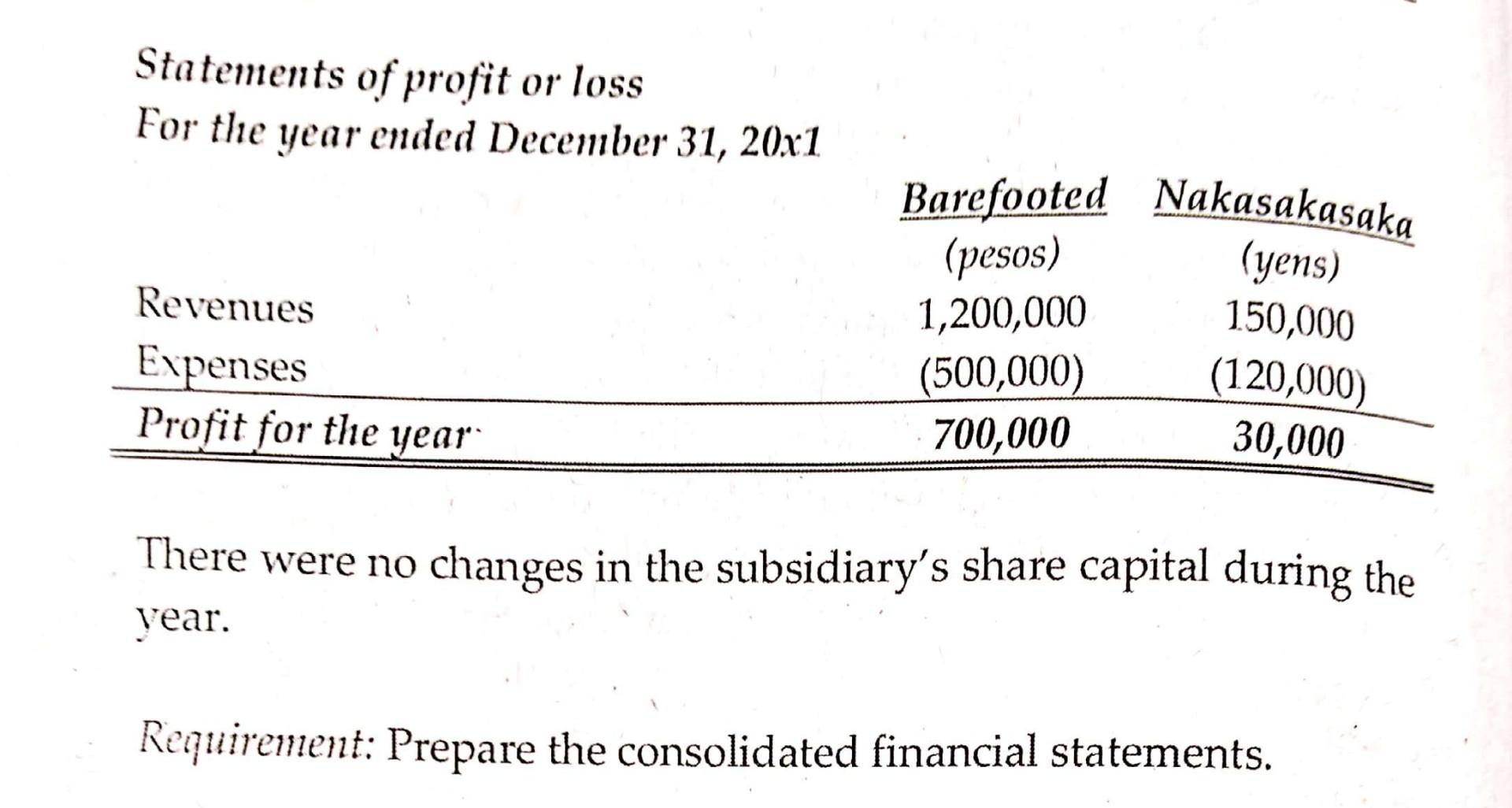

(Adapted) 3. On January 1, 20x1, Barefooted Co. acquired 90% interest in Nakasakasaka Co., a Japanese company, for 100,000. Nakasakasaka's functional currency is the yen. On acquisition date, Swim's net identifiable assets had a carrying amount of 90,000, equal to fair value. NCI is measured using the proportionate share method. The relevant exchange rates are as follows: Date Exchange rates Jan. 1, 20x1.. .P0.50 : 1 Average for the year. P0.52 : 1 Dec. 31, 20x1.. .P0.54 : 1 A summary of the individual financial statements of the entities at the end of reporting period are shown below: Statements of financial position As at December 31, 20x1 Nakasakasaka (yens) ASSETS Investment in subsidiary Other assets TOTAL ASSETS Barefooted (pesos) 50,000 1,500,000 1,550,000 140,000 140,000 1 LIABILITIES AND EQUITY Liabilities Share capital Retained earnings Total equity TOTAL LIABILITIES AND EQUITY 250,000 800,000 500,000 1,300,000 1,550,000 20,000 80,000 40,000 120,000 140,000 Statements of profit or loss For the year ended December 31, 20x1 Revenues Expenses Profit for the year Barefooted Nakasakasaka (pesos) 1,200,000 (500,000) 700,000 (yens) 150,000 (120,000) 30,000 There were no changes in the subsidiary's share capital during the year. Requirement: Prepare the consolidated financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started