Help me answer this question :)

The question is in english & malay

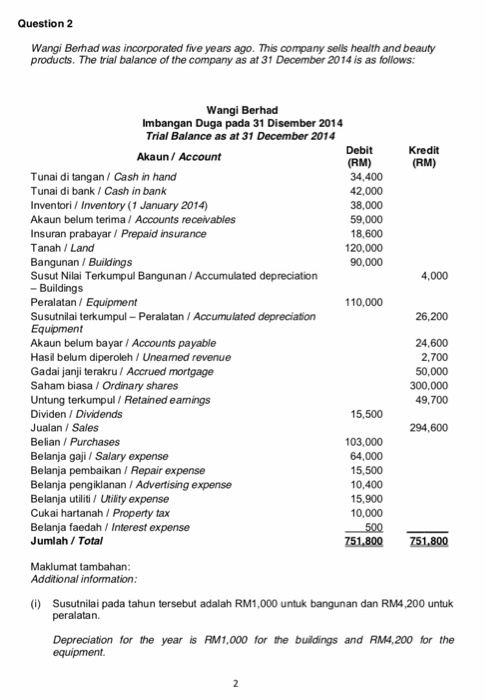

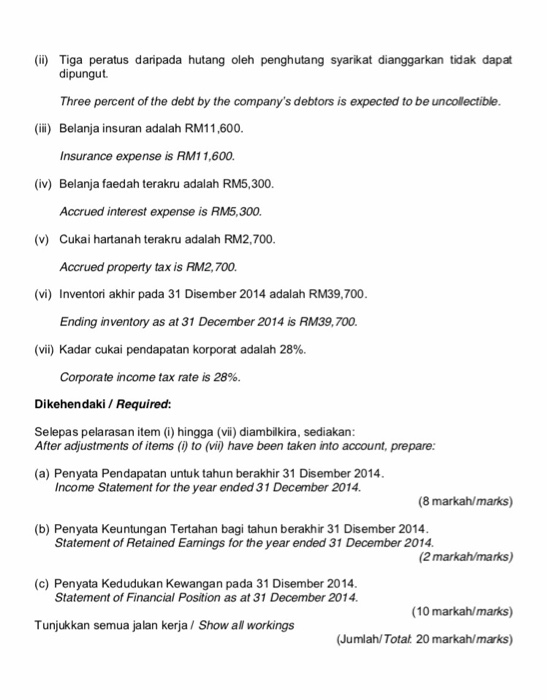

Question 2 Wangi Berhad was incorporated five years ago. This company sells health and beauty products. The trial balance of the company as at 31 December 2014 is as follows: Wangi Berhad Imbangan Duga pada 31 Disember 2014 Trial Balance as at 31 December 2014 Debit (RM) 34,400 42,000 38,000 59,000 18,600 Kredit (RM) Akaun/ Account Tunai di tangan Cash in hand Tunai di bank/ Cash in bank Inventori / Inventory (1 January 2014) Akaun belum terima / Accounts receivables nsuran prabayar Prepaid insurance Tanah/ Land 120,000 Bangunan Buildings Susut Nilai Terkumpul Bangunan /Accumulated depreciation - Buildings Peralatan Equipment Susutnilai terkumpul Peralatan / Accumulated depreciation Equipment Akaun belum bayar I Accounts payable Hasil belum diperoleh Uneamed revenue Gadai janji terakru/ Accrued mortgage Saham biasa / Ordinary shares Untung terkumpul Retained eamings Dividen I Dividends Jualan Sales Belian Purchases Belanja gaji I Salary expense Belanja pembaikan I Repair expense Belanja pengiklanan Advertising expense Belanja utiliti Utility expense Cukai hartanah Property tax Belanja faedah Interest expense Jumlah /Total 90,000 4,000 110,000 26,200 24,600 2,700 50,000 300,000 49,700 15,500 294,600 103,000 64,000 15,500 10,400 15,900 10,000 751,800 751,800 Maklumat tambahan Additional information (i) Susutnilai pada tahun tersebut adalah RM1,000 untuk bangunan dan RM4,200 untuk peralatan. Depreciation for the year is RM1,000 for the buildings and RM4,200 for the equipment. (i) Tiga peratus daripada hutang oleh penghutang syarikat dianggarkan tidak dapat dipungut Three percent of the debt by the company's debtors is expected to be uncollectible. (i) Belanja insuran adalah RM11,600. Insurance expense is RM11,600. (iv) Belanja faedah terakru adalah RM5,300. Accrued interest expense is RM5,300. Cukai hartanah terakru adalah RM2,700. Accrued property tax is RM2,700. (v) (vi) Inventori akhir pada 31 Disember 2014 adalah RM39,700. Ending inventory as at 31 December 2014 is RM39,700 (ii) Kadar cukai pendapatan korporat adalah 28%. Corporate income tax rate is 28%. Dikehendaki Required: Selepas pelarasan item (i) hingga (vi) diambilkira, sediakan: After adjustments of items () to (vii) have been taken into account, prepare: (a) Penyata Pendapatan untuk tahun berakhir 31 Disember 2014 Income Statement for the year ended 31 December 2014 (8 markah/marks) (b) Penyata Keuntungan Tertahan bagi tahun berakhir 31 Disember 2014. Statement of Retained Earnings for the year ended 31 December 2014 (2 markah/marks) (c) Penyata Kedudukan Kewangan pada 31 Disember 2014. Statement of Financial Position as at 31 December 2014. (10 markah/marks) Tunjukkan semua jalan kerja Show all workings (Jumlah/Totat 20 markah/marks)