Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help me ASAP 1. [3 points] UB's School of Engineering and Applied Sciences is considering investing in a new Enterprise Resource Planning (ERP) system to

help me ASAP

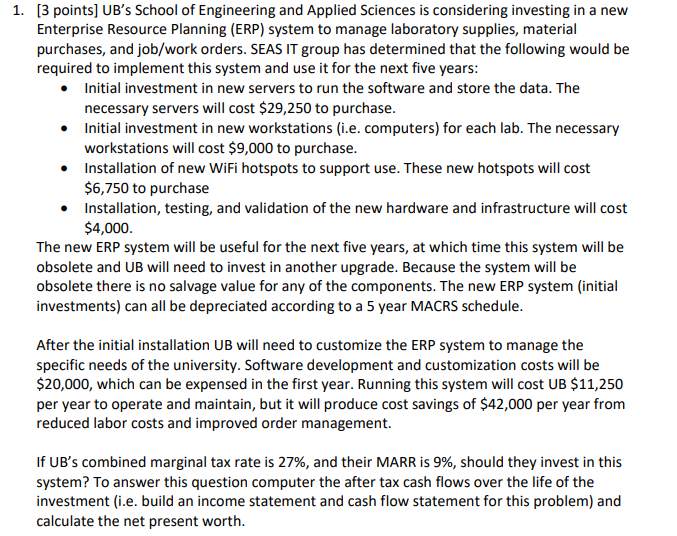

1. [3 points] UB's School of Engineering and Applied Sciences is considering investing in a new Enterprise Resource Planning (ERP) system to manage laboratory supplies, material purchases, and job/work orders. SEAS IT group has determined that the following would be required to implement this system and use it for the next five years: Initial investment in new servers to run the software and store the data. The necessary servers will cost $29,250 to purchase. Initial investment in new workstations (i.e. computers) for each lab. The necessary workstations will cost $9,000 to purchase. Installation of new WiFi hotspots to support use. These new hotspots will cost $6,750 to purchase Installation, testing, and validation of the new hardware and infrastructure will cost $4,000. The new ERP system will be useful for the next five years, at which time this system will be obsolete and UB will need to invest in another upgrade. Because the system will be obsolete there is no salvage value for any of the components. The new ERP system (initial investments) can all be depreciated according to a 5 year MACRS schedule. After the initial installation UB will need to customize the ERP system to manage the specific needs of the university. Software development and customization costs will be $20,000, which can be expensed in the first year. Running this system will cost UB $11,250 per year to operate and maintain, but it will produce cost savings of $42,000 per year from reduced labor costs and improved order management. If UB's combined marginal tax rate is 27%, and their MARR is 9%, should they invest in this system? To answer this question computer the after tax cash flows over the life of the investment (i.e. build an income statement and cash flow statement for this problem) and calculate the net present worthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started