Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help me asap I will rate on arrival, please type the answer,I need this in this in like 30mins please please. thank you That's the

Help me asap I will rate on arrival, please type the answer,I need this in this in like 30mins please please. thank you

That's the data , hope it's clear now, please solve it asap, thank you so much

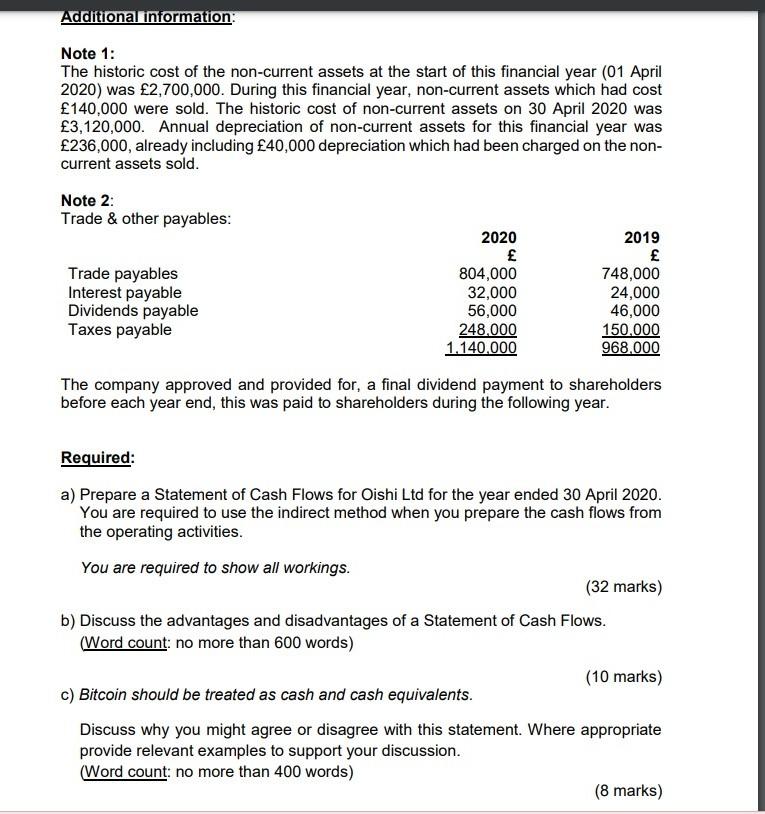

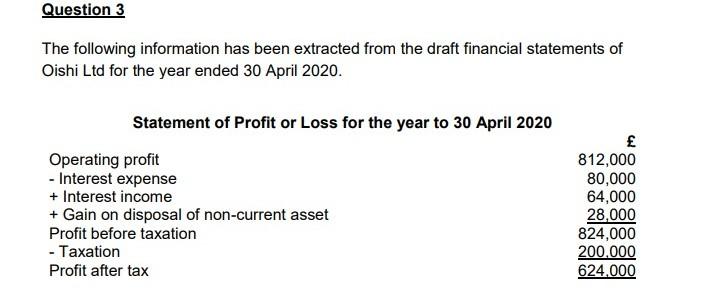

Additional information: Note 1: The historic cost of the non-current assets at the start of this financial year (01 April 2020) was 2,700,000. During this financial year, non-current assets which had cost 140,000 were sold. The historic cost of non-current assets on 30 April 2020 was 3,120,000. Annual depreciation of non-current assets for this financial year was 236,000, already including 40,000 depreciation which had been charged on the non- current assets sold. Note 2: Trade & other payables: 2020 2019 Trade payables 804,000 748,000 Interest payable 32,000 24,000 Dividends payable 56,000 46,000 Taxes payable 248.000 150.000 1.140,000 968,000 The company approved and provided for, a final dividend payment to shareholders before each year end, this was paid to shareholders during the following year. Required: a) Prepare a Statement of Cash Flows for Oishi Ltd for the year ended 30 April 2020. You are required to use the indirect method when you prepare the cash flows from the operating activities. You are required to show all workings. (32 marks) b) Discuss the advantages and disadvantages of a Statement of Cash Flows. (Word count: no more than 600 words) (10 marks) c) Bitcoin should be treated as cash and cash equivalents. Discuss why you might agree or disagree with this statement. Where appropriate provide relevant examples to support your discussion. (Word count: no more than 400 words) (8 marks) Additional information: Note 1: The historic cost of the non-current assets at the start of this financial year (01 April 2020) was 2,700,000. During this financial year, non-current assets which had cost 140,000 were sold. The historic cost of non-current assets on 30 April 2020 was 3,120,000. Annual depreciation of non-current assets for this financial year was 236,000, already including 40,000 depreciation which had been charged on the non- current assets sold. Note 2: Trade & other payables: 2020 2019 Trade payables 804,000 748,000 Interest payable 32,000 24,000 Dividends payable 56,000 46,000 Taxes payable 248.000 150.000 1.140,000 968,000 The company approved and provided for, a final dividend payment to shareholders before each year end, this was paid to shareholders during the following year. Required: a) Prepare a Statement of Cash Flows for Oishi Ltd for the year ended 30 April 2020. You are required to use the indirect method when you prepare the cash flows from the operating activities. You are required to show all workings. (32 marks) b) Discuss the advantages and disadvantages of a Statement of Cash Flows. (Word count: no more than 600 words) (10 marks) c) Bitcoin should be treated as cash and cash equivalents. Discuss why you might agree or disagree with this statement. Where appropriate provide relevant examples to support your discussion. (Word count: no more than 400 words) (8 marks) Additional information: Note 1: The historic cost of the non-current assets at the start of this financial year (01 April 2020) was 2,700,000. During this financial year, non-current assets which had cost 140,000 were sold. The historic cost of non-current assets on 30 April 2020 was 3,120,000. Annual depreciation of non-current assets for this financial year was 236,000, already including 40,000 depreciation which had been charged on the non- current assets sold. Note 2: Trade & other payables: 2020 2019 Trade payables 804,000 748,000 Interest payable 32,000 24,000 Dividends payable 56,000 46,000 Taxes payable 248.000 150.000 1.140,000 968,000 The company approved and provided for, a final dividend payment to shareholders before each year end, this was paid to shareholders during the following year. Required: a) Prepare a Statement of Cash Flows for Oishi Ltd for the year ended 30 April 2020. You are required to use the indirect method when you prepare the cash flows from the operating activities. You are required to show all workings. (32 marks) b) Discuss the advantages and disadvantages of a Statement of Cash Flows. (Word count: no more than 600 words) (10 marks) c) Bitcoin should be treated as cash and cash equivalents. Discuss why you might agree or disagree with this statement. Where appropriate provide relevant examples to support your discussion. (Word count: no more than 400 words) (8 marks) Question 3 The following information has been extracted from the draft financial statements of Oishi Ltd for the year ended 30 April 2020. Statement of Profit or Loss for the year to 30 April 2020 Operating profit 812,000 - Interest expense 80,000 + Interest income 64,000 + Gain on disposal of non-current asset 28,000 Profit before taxation 824,000 - Taxation 200,000 Profit after tax 624.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started